Note: This post was first published in April 2020 and updated in June 2021

It took me more than a year since starting this blog to get around to the topic of investing in bonds.

There are good reasons for it.

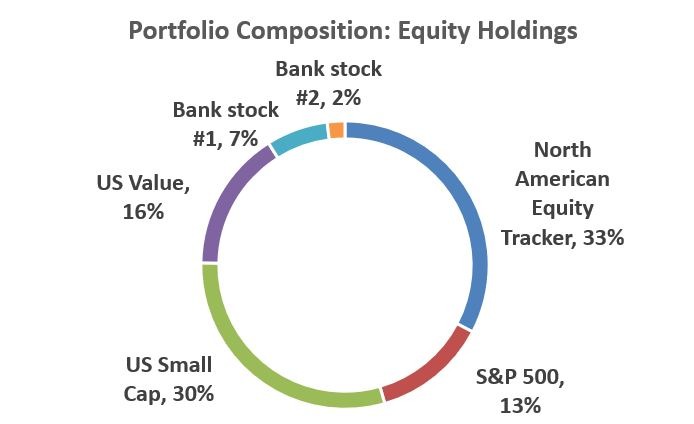

First of all, my own portfolio consists of 100% US equities at the moment.

Look Mom: no bonds!

Retirement is still a long way off. As a result, I am more than happy to take on more risk in order to generate a higher long-term return.

Secondly, investing in bonds (or debt securities more broadly) is very different from investing in equities. It involves a very different approach and mindset.

Suffice it to say that in my day job, working on a debt offering is drastically different from working on an IPO.

Debt investors are far more conservative and focus on protecting the downside. In contrast, equity investors are all about growth and upside.

And finally, I just hadn’t had the time. The rabbit hole of investing can go really deep really fast – so I just hadn’t gotten around to the topic of investing in bonds.

So what has changed now? A few things, really.

Wind Of Change

In the past, I have written about the best ways to build wealth in one’s twenties and thirties.

I have since extended this mini-series with posts on what to do if you happen to be in your 40s and 50s.

It’s never too late to start pursuing financial independence – but if you start late, bonds may have a bigger role to play.

Then there’s last year’s Covid crisis, and all the talk about the way bonds have performed in the market meltdown.

It’s a no-brainer that adding bonds to your portfolio significantly reduces the risk – but has an associated impact on returns:

However, in order to understand the chart above, you need to understand the actual basics of investing in bonds.

Finally, there’s the shameless self-serving reason. The times, they are a-changing.

As much as I hate to admit it, each passing day brings me closer to the big 4-0. Can I go through another big downturn with an equity-heavy portfolio?

Sure, but I wouldn’t want to do it more than once.

I don’t often turn 40, but when I do – I write about investing in bonds

Alas, it’s time to dust off the good old bond playbook and cover off the basics of investing in bonds.

Today’s post is intended to do just that.

The Difference Between Equities And Bonds

Let’s start with a textbook definition of a bond.

Unfortunately, explaining bonds using textbook definitions isn’t always straightforward – so if that didn’t hit the spot then here’s an analogy that might be helpful.

Imagine you buy a rental property. If you choose to go with an interest-only mortgage, you can think of it as a bond.

Your interest payments are non-negotiable and at the end of the term, you’ve got to either repay the balance outstanding or take out another mortgage.

In this case, you are the borrower and the bank “owns” the bond.

As the beneficial owner of the property, you own all the equity in it. All of the excess cash flow after mortgage payments and other expenses goes to you, the equity holder.

And so if the rent – or the value of the property – goes up, the bank doesn’t get any of that benefit. It all accrues to you.

So far, so good.

But ask yourself this – is the bank really worse off in this situation, on account for missing out on all the upside?

Not quite.

Investing In Bonds: Risk and Return

Sure, the bank is sitting pretty in the example above.

It takes on very little risk – because it knows you will do your absolute best to make the mortgage payments.

If you don’t, the bank will send some friendly repo men over, repossess your property and sell it to make themselves whole.

That relationship may seem unfair until you consider that the bank’s returns on the mortgage are far lower than yours.

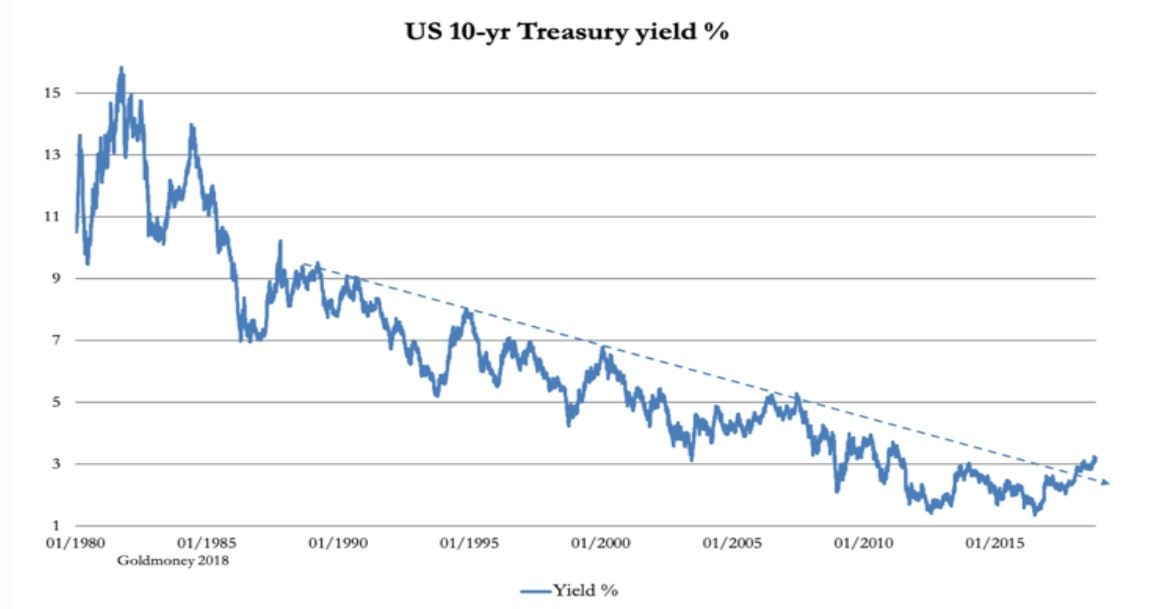

With interest rates at record lows at the moment, the bank will at best generate a 1-2% return on its investment.

The long-term direction of interest rates

You, the equity holder, stand to do much better provided you don’t totally muck it up and buy a property with a yield that’s higher than the mortgage interest rate.

(If this confused you, click here for an explanation).

If for whatever reason the price of the property quadruples, the bank won’t be any better off.

But you, the equity holder, will be sitting pretty – in compensation for all the risk that you have taken on and for making those pesky interest payments on time.

As a bond investor, you essentially take on the role of the bank. However, you won’t be funding retail mortgages (though that’s also possible).

Instead, you will be acting as a lender to large and small corporations that decided to issue debt as part of their financing strategy.

Your chance of loss is lower than that of equity holders – because if a corporation defaults on its debt, its assets will be repossessed and sold to pay the bondholders.

At the same time, your returns will also be lower.

This is why in times of economic expansions, the bonds don’t perform as well as equities. They simply don’t get to share in any of the upside.

But bring on a market downturn – and bonds hold their value pretty well.

Equity holders would need to get wiped out before bond investors lose any of their principal.

In other words, lower risk – lower return.

Different strokes for different folks

Bond Denominations

In theory, corporate bond denominations typically start at $1,000. In practice, typical corporate bond issuances have denominations of $100k.

The amount is a whopper in absolute terms but remember that the target investors are the institutional fixed-income investors who rarely cut tickets below $1m.

As a result, retail investors typically invest in the bond market through an intermediary, such as a bond fund or ETF.

Similar to stocks, an active bond fund will have a portfolio manager that will look to buy bonds with a better risk-return profile versus peers.

Passive bond funds just acquire a broad universe of bonds across geographies, issuers, and maturities and pass on the savings to investors.

For example, Vanguard’s Global Bond Index Fund invests in over 12,000 individual bonds and has an expense ratio of 0.15%.

Investing In Bonds Isn’t Without Its Risks…

While the risk profile of corporate bonds is typically safer than that of equities, they are not risk-free.

Listed below are some of the most common risks you take on when adding bonds to your portfolio.

Default risk is the risk of a bond issuer is not being able to make coupon or principal payments to bondholders.

Kind of like you missing those interest payments on your mortgage because you lost your job.

Now imagine you bought a bond with a 3% coupon and interest rates went up to 5% the following day.

You would be quite upset as every £100 invested would generate a return of only £3 per year instead of £5. This is an example of interest rate risk.

Duration risk (also known as term risk) is the risk of having your money tied up for a long period of time.

If you buy a bond with a 3% coupon and inflation rises above 3%, the value of your investment in real terms ends up being eroded.

The longer the term of the bond, the higher the likelihood of that happening.

Finally, there’s a host of other risks such as credit downgrade risk (which increases the probability of default), liquidity risk (not being able to sell the bond at a tight enough bid-ask spread), and redemption risk (which is when the bond is redeemed by the issuer).

All of the above are helpful reminders of why a passive bond investing strategy tends to be highly effective for bonds as it does for equities.

…But It Also Has A Rewarding Side To It

Having bonds in your portfolio doesn’t sound very exciting… until it does.

Typically, that happens in times of market volatility such as the one we are seeing today.

While equities plunge, bonds typically hold up in value – because they get the first claim on the assets of the borrower.

More importantly, unlike dividend payments, the coupon payments on bonds are actually non-negotiable. You get to protect the principal – and benefit from an income stream along the way.

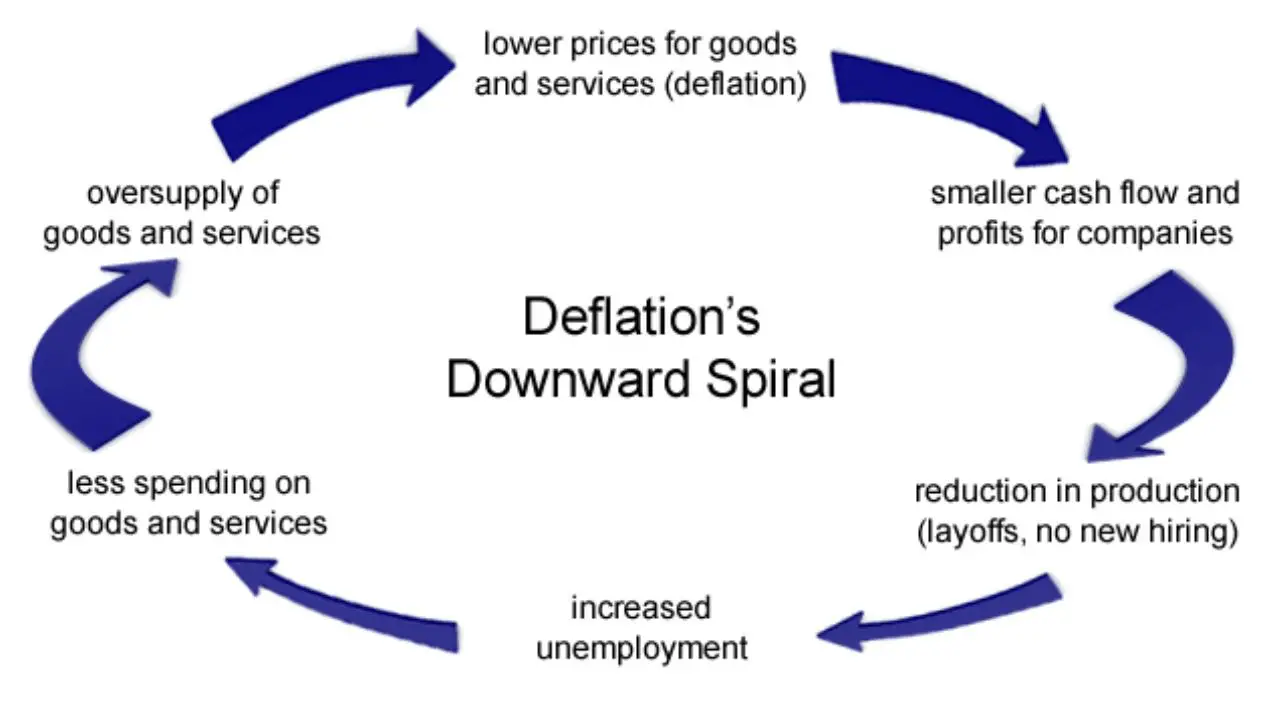

The other, often overseen advantage of bonds is the ability to hedge against deflation.

Most of us are familiar with inflation. Well, deflation is also a thing – one that happens when the price of goods and services declines with time.

It’s a nasty one because a deflationary environment typically causes people to postpone their purchases.

Why buy a car today for £1,000 if you can get it for £950 in twelve months?

As consumer demand slows, the economy grinds to a halt, depressing equity prices… cue in Japan for the past 30 years.

In a deflationary environment, the value of your money goes up with time – and so does the value of the coupon and principal payments on the bonds that you own.

Should You Be Investing In Bonds?

For all their advantages, you may now be wondering: why invest a meaningful portion of your portfolio in instruments with a lower return profile? Has the Banker On FIRE lost a few of his marbles as he approaches old age?

Not quite (or not yet anyway).

There are three reasons you may want to sprinkle some bonds over your equity portfolio.

The first situation where it may make sense is if you are approaching retirement.

After all, you really don’t want to let the market gyrations determine when you can kiss your cubicle goodbye.

Should have added bonds to the portfolio…

Slowly increasing your allocation to bonds can smooth out the ride – and give you the peace of mind to retire even when the equity market is tanking, because your portfolio won’t be impacted as badly.

The second reason which is often overlooked is the ability to sleep well at night.

As many people discovered in March 2020, perceived and actual risk tolerance are two different concepts.

You may think you’ll be fine with a 30% reduction in the value of your portfolio.

Then a downturn hits, you lose your job, your significant other is put at risk and your tenant stops paying rent.

Wowza! Can’t blame you for being tempted to go to the mattresses 100% cash in that environment.

The best portfolio in the world won’t help you if you waver in times of crisis and sell it at the worst possible moment.

If you think there’s a chance of that happening, you may want to take a position in bonds in order to cushion the inevitable blow, even if retirement is a long way off.

The third, and most important reason, is the ability to get a free lunch.

As it turns out, it may well be possible to construct a portfolio of equities and bonds that will outperform a 100% equity portfolio.

But more on that in upcoming posts. This (soon to be old) man needs a break.

Happy investing!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Very interesting

I’m also approaching the big 40

I hold a nominal amount in bonds (a small amount of my portfolio in a 40 60 equity bond fund as a safeguard for shorter term spending in the next 2 to 5 years)

I plan to hold this in my Isa and pension for another 5 years at least to max growth. I’ll probably move my isa down to 60 40 but may not decrease risk on my pension until I’m 50

That’s where I am coming out as well – slowly increase my exposure to bonds over the next 10 years. That being said, I’ve got a decent risk appetite and don’t mind riding the rollercoaster for a bit longer!

I’m thinking the same way too. Approaching 40 with a rough target of retiring by 50 if not slightly before. I’m planning on continuing almost 100% equities for another 4-5 years and then rebalancing in my ISA only through contributions for the following 4-5 years.

If that time line rings true I’ll then look to rebalance my pension annually at a percent or two a year as I move closer drawing down from that pot.

Yes, that’s along the lines of what we are thinking as well.

There may be a change in strategy if we line up more relaxing jobs (i.e. a few days a week) that we can see doing into our 50s. That stream of income can become our “bond”, enabling us to stay 100% equities for a while longer.

I struggle to see myself retiring completely at 45 or even 50. That being said, I struggled to imagine many things about being 40 when I was younger!

Nice intro to bonds here. Thanks! I must be getting old because I’m actually looking to increase my exposure to bonds 🙂

We are in the same boat!

I think that corporate bonds are under-rated generally as part of an investment portfolio, particularly during a stock market crash.

Over the recent “Covid-Crash” the gross redemption yields of the bonds of some major companies went above 20% with less than 2 years to maturity. Accepted that there is some risk but bond holders are in front of equity holders in the event of a company paying creditors and coupon payments can’t be cut in the same way as dividends. I’m not saying they should be 100% of a portfolio but a 20% return with less risk than equities seems like a pretty good deal to me!

Any chance you could write about this type of strategy? (or I’d be happy to provide a guest post on the subject)

You are right. When everyone panicked in early March, bonds declined in price much more than one would expect them to (hence the yields shot up as you say).

It may have been the biggest reason for the unprecedented speed and quantum of the Fed intervention.

I haven’t done guest posts before but think this would make a great subject for an inaugural one. Let’s get in touch over email to hash out the logistics? I’m at bankeronfire at gmail dot com.

Sure, I’ll drop you a line.

I stayed 100% equities until maybe four or five years prior to retirement. After that I went 55/45 equity/bond. I never did sell during any of the corrections or bear markets of the past but it did feel nice to only see half the chaos in my portfolio when Covid happened. I don’t see the higher returns I used to get, but I don’t need them.

Nothing quite like being able to sleep well at night!

Wow, you are spot on. An equity investor’s incentive is to have as much upside as possible while a bond investor’s incentive is to protect their downside as much as possible.

I’ve learned about bonds in school but got so confused every time. Can retail investors invest in these bonds or can only institutional investors do? I mean, with equities, all you have to do is go on Robinhood, look up GME, and buy! (just kidding).

But with bonds, I just had no idea where I can go to buy it, that isn’t an index.

Tough to invest in individual bonds given large face values (and probably don’t want to either given diversification)

Got to be an index fund, but you are probably a few years away from needing them in your portfolio!