Let’s start today’s post with a little thought experiment.

To do that, I want you to meet Ryan.

Ryan is about to turn 40 years old and has a solid finance job that pays him $200k a year.

He lined up that gig about ten years ago, after completing a master’s degree and poking around a few lower-paid jobs for a while.

It took a bit of time, but once Ryan found his groove, you simply couldn’t stop him.

Ambitious and hard-working, he excelled at his job – and his personal finances.

Over the next ten years, Ryan saved 50% of his post-tax income (equating to $60k a year), and religiously invested the money into low-cost index funds.

As it turns out, those personal finance bloggers he’s been following didn’t lie.

Compounding works. And so, just a decade later, Ryan is about to enter that coveted millionaire territory:

Life is grand, isn’t it?

Well, perhaps not. And if Ryan was to be perfectly honest, he would tell you he is somewhat concerned about the journey ahead.

You see, Ryan is good with numbers. He can certainly forecast out the years ahead:

However, what looks like a finance blogger’s wet dream definition of nirvana does nothing for Ryan.

Zero. Absolute zilch.

As a matter of fact, it fills him with a sense of utter dread.

Beyond The Spreadsheet

You see, Ryan is tired.

On average, he works about 60 hours a week, but the workload can spike when he closes the quarters and the years. Also, the annual budgeting process is a royal pain in the backside.

Overall, the finance organization hasn’t grown as quickly as the company.

While Ryan is constantly getting better and faster at his job, there’s a never-ending stream of new responsibilities on his plate.

It was fine when Ryan was in his early 30s. But then he got married and now there are two little boys to look after.

Being a weekend dad is far from what Ryan had in mind when he was starting a family.

The other problem Ryan has is one of diminishing returns.

I mean, it’s not like he is doubling his net worth every year, like he did at the very start of the journey.

These days, the reward for yet another punishing year of work is just a slight uptick in “the number”.

So Ryan is doing a lot of soul-searching.

He’s not as fit as he used to be, but there just isn’t enough time to work out.

He’s not spending nearly as much time as he would like with his wife.

Most importantly, he’s not sure the grind is worth it.

Ryan stares at the spreadsheet and sees the price:

Two million dollars in exchange for what should be the best decade of his life.

No Exceptions

At this point, you can cut the argument a couple of ways.

You can tell Ryan to suck it up. I mean, the man will retire at 55 with five million in the bag. Give me a break – and put in those damn hours!

Alternatively, you can tell him to peace out.

Take a lower-paid, less demanding job. Even if Ryan doesn’t contribute another cent to his portfolio, he will end up with more than three million at 55. Not too shabby.

The challenge is that Ryan doesn’t like either option. And to be perfectly honest, I get it.

You see, Ryan isn’t alone. There are plenty of highly ambitious engineers, executives, lawyers, consultants, and yes – bankers – facing the same issue.

They want to build real wealth.

Not just a million – or a couple. No, these folks are angling for a much higher number, perhaps north of $10m.

At the same time, they don’t want to sacrifice their life and health in doing so.

You may say that their problem is unrealistic expectations.

But in fact, it’s something entirely different. It’s the fact that:

What Got You Here Won’t Get You There

If you’ve been reading this blog for a while, you’ll know that I am very skeptical of what I call entrepreneurship porn.

Nothing quite like those college dropouts “influencers” denigrating the 9-5 jobs (that they weren’t going to get in a million years in the first place) just to build a Twitter following and sell some Gumroad courses.

But the reality is that while a highly-paid career is one of the best ways to make that first million (or a couple), it will never make you truly wealthy.

The math is simple.

Over time, your annual savings account for an ever-smaller portion of your portfolio.

Pay rises are harder to come by. The cost of living is going up. And so are taxes.

As such, the increase in your net worth will eventually converge to whatever the market returns are.

History suggests that to be somewhere in the 8% range.

Unless you managed to reach escape velocity (which I define as a net worth of around $5m), you are pretty much guaranteed to stay on the hamster wheel, however plush it may be.

This is why you won’t find lawyers or bankers headlining any sort of a wealth list – but they sure headline many lists of unhappiest professions out there.

And the only way to get out is to get some skin in the game.

Next Level

The good news is that there’s a spectrum of options here, especially once you’ve got some capital saved up.

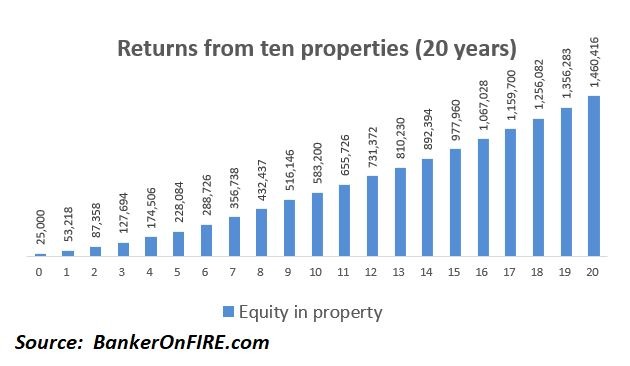

At the bottom end of the spectrum, you’ve got things like real estate investing.

Assuming you can put money to work at a 10-15% IRR, you are bound to end up far ahead of where the stock market alone would take you, especially once you compound it over 10+ years.

Taking things up a notch, you could consider angel/venture investments.

The past decade has seen massive democratization of private investing.

It will take a decent chunk of capital and many investments (the majority of which will go to zero), but there’s also a chance of stumbling onto the next Revolut or RobinHood.

Another path, beloved by many a banker and consultant, is to join a start-up in order to get your hands on some skyrocketing equity and stock options.

I personally know a former banker who left a very senior position (think European group head level) in order to join a tiny but fast-growing tech business as a CFO.

Five years later, he cleared well north of $100m after a successful IPO, much to the amazement and envy of his former colleagues.

Finally, you could try to take the swing at the grand prize.

Launch a business of your own, hold on to as much equity as possible, and walk away wealthy beyond your wildest dreams if things work out.

The big problem, of course, is that all of the options above are mutually exclusive with that highly paid job of yours.

It’s not just the lack of time.

The reality is that your employers don’t want anyone getting in the way while they get their pound of flesh. Hence all the restrictions on outside business activities, investments, and directorships.

The other problem is your own expiry date.

Sure, there are exceptions. But if you are on the wrong side of 40, make no mistake – you are almost out of time.

Your skills are becoming dated, and there’s no place for old geezers in the new economy. Revolut’s new CFO is 29 years old.

At the end of the day, there’s nothing wrong with a long and illustrious professional career. As a matter of fact, it’s still one of the best ways to get started.

But if you are setting your sights really high, you better be aware of the limitations.

Yes, a well-paid job will help you get much closer to your goal. But it will never take you to the finish line.

Thank you for reading!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Couldn’t agree with this post more. As the wrong side of 40 (nearly 50). Am glad am also north of the 5m but at 3% SWR still a way off where it needs to be to be truly passive.

Cheers.

So how are you thinking about next steps? Work for a while longer or take a step back now and let your investments do more of the heavy lifting?

$5m is a serious chunk but it ultimately comes down to expectations (and aspirations!)

Hi Bof,

Thanks for the article which really resonated with me. I am 32 and in a reasonably well paid consultancy role in London. I am hoping that one of the very small number of good things to come from the pandemic is more flexible working, so that that I don’t become a “weekend dad”.

Unfortunately, I agree that in order to make a decent living you are probably going to have to put in the hard work and long hours. I guess there’s no easy option eh!

All the best.

No, there isn’t. It’s either put in the hard work or take on far more risk than one typically does in a professional services career.

And the further you rise, the harder it gets to square up work and life, while the financial benefits get proportionately smaller.

That being said, you are in an excellent place. My 30s were probably the happiest / best decade of my life, notwithstanding all the work I’ve put in!

Totally accurate picture. I’m at 40, seeing the same thing you are. Incremental increases are all that is left unless serendipity happens. I just don’t know that it is worth grinding out another decade for a few hundred thousand or another million. It will probably just end up in the hands of a healthcare worker. At some point I think one needs to draw the line and evaluate whether the extra money will ultimately be theirs or some professional’s that is helping them stay on the hamster wheel.

Indeed, it’s a tough realization but very true.

Once you’ve cleared a certain baseline, working more doesn’t move the needle as much. If you are solving for a truly rich life, much better to look beyond the spreadsheet (or the bank account) and focus on health, relationships, and enjoying the fleeting days of life!

I left banking 7 years ago for consulting. So I spend 100% of salary and save bonus (much less than banking but still 1x). Am all invested in equities of various forms (etf, direct and unlisted PE and infra). Still doesn’t cut the mustard as expenses are pretty high with kids still at school and general life.

So I do what I want more or less but still answer somewhat to the man. If I get made redundant I think I am at a 3.4% swr so ok.

I think this is like the midway version of (nit full retirement but not full saving either) – and hence reinvesting small amounts (essentially investing 5% pa) to dollar cost average in and rebalance some average investing decisions from a few years ago that went up so avoiding capital gains by not selling those.

Realistically most of the funds now are to help the kids anyway whether while alive or dead.. and they need it given asset prices.. private housing in uk and Oz yielding 2.3% anywhere decent so 40x..

It doesn’t feel like that on a day to day basis. So l hope you can manage your mental state on this better than I am able to.

Interesting. I’m in a similar boat. Very decent net worth and so I don’t feel the sacrifice of IB is worth it anymore.

At the same time, I don’t want to leave work altogether – as a matter of fact, I’m perfectly content to work 60 hours a week, as long as I’ve got more control over my schedule.

I do have lofty net worth aspirations, which I would fulfill if I was to stay in my industry over the next 10 years or so. But I just don’t feel trading time for money is the optimal way to get there, both from an ROI and pure enjoyment/fulfillment perspective.

Thus, I plan to leave the industry to spend less time working for “the man” and more time on my own endeavors. It will be a step back (financially) but it’s a pre-requisite for taking two (or ten) steps forward.

Yes happy to discuss offline as I noticed from your posts I was in your position 5yrs ago. It’s all about control for me. Control over time. That’s all that matters.

Talking about cash/ time usage :-

Actually the first 5hrs a week I would work for negative $/hr. Ie if I didn’t have a job I would be calling people to chat over lunch etc about the market, then the marginal dollar per hour ramps up and there are jumps at around 35hrs a week (when harder to do kid pickups), 50hrs a week (average non professional services).

The door only revolves one way and if you Eg expect to earn only 10% of your total comp, I would urge you to suck it up for your kids for another year or two – honestly it’s not that bad and in pandemic the impact is less from what I hear with less travelling. From this side of the fence I would go back for 3x or more my comp (not that my wife would let me).

Lastly I can also give one piece of advice that I learnt slowly. Investing across multiple entity names is a massive after tax cashflow improvement. So many ways to shift gains between people, trusts, kids, company as equities go up and down. Keeps tax down so for a lower income your cashflow is significantly higher.

Yep, control is ultimately what it boils down to.

Don’t think I would take a 90% pay cut. That being said, it could be a 50% pay cut, even if I go to a relatively senior corporate role.

It’s a high-quality problem to have as primarily a function of having a couple of knockout years at work and being paid commensurately, but… the pay cut will still bite.

Appreciate your perspectives, very helpful as I ponder my next steps!

I got to say some really good points.

Haha this could literally be written for me (did you have this planned anyway or was my slack message the catalyst?) and my current position. Really hard decision to know what to do next

It doesn’t get easier with time, does it? Especially if you happen to have high aspirations.

What’s interesting is that it’s a pretty universal problem anywhere between $1m and $5m+, so captures a very wide swath of people.

This is a great article! I’m sure there are a lot of folks in their mid 30s and early 40s who were aiming towards giant net worths only to realize the reality of their situation.

Real estate is an option, and another option is to settle for more time with your family and let your net worth compound while you work less hours to cover your expenses.

Sure you’ll never afford to own 3 properties and $100k vacations, but you can still live a good life if you can manage lifestyle creep.

I can tell you that joining a startup isn’t going to solve your hours problem. It’ll only make it worse.

Thanks AR! And agree, that’s the opportunity set. Work less and let savings compound is a great option.

And yes re: startup, if anything the hours may even be worse! But, getting proper equity does have the upside potential that paid employment will never bring.

i am one of the dummies who think you can get better than market returns by selecting your own equity investments and holding them. get up near a 15% average and you can get pretty wealthy.

we’re too old (in our 50’s) to get filthy rich but my conundrum now is to start spending now or keep it all in play just to get a few more million. we don’t really want for anything so any extra spending now would just be vanity.

I agree that moving your returns from 8% to 15% is the financial equivalent of jumping on a rocket ship

That being said, it’s an unlikely path for the vast majority of people….

And yes, you certainly don’t want to spend money just for the sake of it – many better ways to deploy capital (children, charities etc.)

Awesome content as usual. Being in my late 20s, it’s interesting to see the various potential paths that can be taken, and the required risk for each one.

Assume it happens quite often, but I wonder if the senior banker who exited to a CFO position might be my ex-group head… German start-up by any chance?

Glad you found it helpful!

It’s great to be a (relatively) junior professional making good bank (and putting that money away) but it’s equally important to have enough foresight to know what challenges one can expect down the road.

On your question – I think the sheer magnitude of that home run implies we are probably talking about the same person.

Small world I guess 🙂

very interesting article and good follow up comments by everyone.

It seems likely that on his deathbed, Ryan will have wished (if he didn’t make this choice) that he had made a career change such that he continued working on a reduced salary to cover his monthly expenses and perhaps then save a small portion of his salary, which enabled him to see his family and children on a daily basis. In the meantime his savings, will probably (but not certainly – slight disagree with that part of your article!) continue to compound to enable a comfortable retirement. I believe this is known as coast fire. He doesn’t have enough money to pull the plug now imo and it seems on balance staying in the same role is unlikely to lead to happiness.

The problem though is in order to get to where he is now, Ryan has had to demonstrate the characteristics – competitiveness, tendency for hard work, probably ruthlessness and even a bit of corporate backstabbing even if done with a smile. So that moving roles now and watching his ‘friends’ continue to climb the greasy pole and drop disguised hints about how well they are doing next time they catch up for drinks requires strength of character. When was the last time people asked so how many bed time stories / kick around in the park have you had recently etc etc? It’s all about what you achieve at work. Particularly as people move to middle age and start to grab hold of reasons to believe their life is a success. So very tough to implement.

I’ve got a not particularly close friend who is CEO of a start-up and his stake on exit currently seems to be worth around £10 million. Incredible outcome but he’s certainly working for it.

Ryan can do anything he wants – he just can’t do everything he wants.

I actually don’t think $5m in the UK gets you escape velocity per your comment in your early 40’s. I’ve read a lot of the esi millionaire interviews and I’m struck by how many of the people have high incomes alongside houses that are comparatively low value – $<500k. But in the UK those high incomes, which I feel don't exist as much in the US are pretty much in London (not all I know) and we all know how expensive London housing is. On the flip side I also think people in the US have more faith in the equity markets than the UK, which is understandable and probably right. But I've gone through a decade suck out so even at roughly £5m n/w I don't feel at escape velocity. Honestly I think at £7m I would be at escape velocity on our lifestyle but I am also very conscious that psychologically it's always just a little bit more. I'm obviously at least at able to take the foot off the gas if I want and do something different that continues to pay.

Equally I watched a BBC video yesterday on the terrible problems in Lebanon with the short interview with the man living in a slum with his wife and three children having lost his job as a cabbie and thinking christ I'm lucky, thank my lucky lucky stars.

The best part of having some wealth is the options it provides

Insightful observations as always, there is proper guest post potential here BnF.

Interesting to compare notes. I do agree with you re: escape velocity. $5m is a number I had with my hat on, as I do have the option of moving back across the pond – and that’s part of the longer-term plan.

That being said, an immigrant like me feels far more uncomfortable venturing out beyond South Ken than someone who grew up in the UK and has friends outside London. Am sure plenty of nice places to live once you leave the metropolis.

And you really hit the nail on the head here:

“When was the last time people asked so how many bed time stories / kick around in the park have you had recently etc etc? It’s all about what you achieve at work. Particularly as people move to middle age and start to grab hold of reasons to believe their life is a success.”

Surely better to consider moving to a lower cost of living location rather than spending your time in a rat race to make $5m-$50m to get a lifestyle you could get somewhere else for far less.

To me, diminishing returns rapidly set in so I’m amazed people chase large sums.

Good observation, and a valid point.

To be honest, I’ve yet to observe many folks with meaningful net worth using geo-arbitrage to retire early.

That being said, may be just a small sample size.

Couldn’t not comment. A brilliant post and am not surprised so many of us found this timely. Here I am at 42, doing lifetime cash flows with income ending by 45 or so. Although I have an easier grind, a 2.5 day a week flexi day job, a recruitment business on the side and over £2m net worth – most days I dream of retiring – some days I imagine a full scale career change. It’s so agonising that I am seeing a coach next week.

Cheers AK.

Amazing how many folks are in the same boat. Move the age up or down a few years. Move the net worth up by a few million (going down doesn’t really work). And yet, the fundamental issues remain the same.

A question back at you though. Clearly, you don’t get to a £2m net worth, a business you own, and a well-designed schedule by accident. Takes a certain personality. Do you think that personality is suited to retiring at 42 (or 45?)

Or is it more a longing for change and possibly more adventure?

Thanks BoF. I can see your point. At some level I know I couldn’t be idle – consuming stuff when I have been a producer most of my life. Might do something related to the law – but as you allude to as well with your link, no one seems to provide any encouragement.

I have yet to meet a happy lawyer!

Then again, it may well be different when you do law on your own terms, as opposed to having yet another SPAC shoved down your throat so that you can bill 3,000 hours a year…

Best of luck with next steps, would love to know how things pan out.

Also found this very timely! I’m actually about to step up a gear or two into my highest paying role so far (I’m 42) after 1.5 years taking it easy. We’re not quite FI yet, but getting there and this role will give us a nice boost. While this is a dream role, I’m very conscious of how long the hours will be. On the one hand I’m keen to see what I can achieve before my career ‘peaks’ but equally don’t want my health, relationships etc to suffer. I’m planning on putting in place some serious boundaries, but maybe that’s just wishful thinking.

In my experience, the folks who manage it best are the ones who have a “good enough” approach as opposed to being perfectionists.

They are the ones who find the best balance, stress less, and survive longest.

The irony, of course, is that it’s the perfectionists who typically rise highest – and subsequently crash and burn when they can no longer physically control 100% of their jobs.

There are plenty of places in the UK, that are cheaper (than London) and very enjoyable to live in. I live in Scotland, in 2019 my wife and I spent around £35,000 and invested a similar amount. That £35,000 included plenty of nice holidays, such as 2 climbing trips for me to Norway and the Alps, a ski trip and a holiday to Japan.

Our expenses are going to increase in the next couple of years as we’d like to buy a house (currently in a flat) and we’ve a little one on the way, but for full FIRE I estimate we need a max of £50,000 per year. Which should be achievable from our early to mid 40s. Plan is to get £750,000 in our S&S ISAs then run them down (although not empty them to leave a buffer) to get to pension age at which point my pension should have compounded to the lifetime allowance. Then live off my pension and the remaining ISA balances, with a top up when my wife’s pension comes in later (public sector pension).

Sounds like I’m in the minority here, but to me after the first million time becomes so much more important than money. The only use for money for me is freedom and control. If I had £1,000,000 today I’d go part time immediately, and look at my full time retirement options. I could happily spend all my time with my family, rock climbing and learning new skills, that I may or may not decide to monetise depending on needs/wants.

Finally I actually think spending too long working full time in the same job actually deskills you for the future work market as it doesn’t allow enough free time to learn the skills of tomorrow. I also think the argument for lower SWR going forward is flawed. This article explains it far better than I could: https://portfoliocharts.com/2021/07/20/what-vanguard-gets-right-and-wrong-about-the-4-rule/

Calum.

I also feel the argument for a lower SWR going forward might be flawed but I also think the arguments for a 4% SWR are flawed as well in real life. How to balance two conflicting statements? As you no doubt know the data is based off historical precedents and not the future and secondly the 4% masks very substantial volatility.

Personally I don’t think I could handle that level of 4% volatility in drawdown with a circa 60 year retirement. Volatility is not reduced materially if you reduce the WR to say 3%, which pre costs is effectively a PWR based on historical data assuming US equities and no other frictional costs. It takes a person with a strong character to pull the plug in their mid 40’s and – in a realistic worse case scenario – 10 years later their portfolio is worth in real terms say 50% of what is was when they started (see 1970 – 1980) and still look at their partner and dependents and go well yeah, it was fine historically so, hey should be ok, don’t worry.

I’m not saying it won’t be fine – I’m saying I don’t know, no one knows and that lack of knowing, coupled with the fact that by the time you think you might be in trouble your prospects or returning to the career that got you to the place where you can pull the trigger is, in all probability, diminished materially. Ok not everyone and yes you can retrain etc etc, I get it.

On the other hand annuity rates at circa 1.5% index linked for a 55 year old are quite a substantial warning sign, which doesn’t, I don’t think, have much historical precedent. So worth being aware.

That aside – your plan, ethos and attitude looks pretty good with one proviso how you feel now can alter materially once you have children.

Personally, I am increasingly of the view for me that the answer is moving to a coast fire type route as I articulated above.

good luck

Yes, perhaps my attitude will change once our child arrives, however I work in an industry with a huge amount of uncertainty so I’m kind of used to it, so perhaps not.

The above points you make are good ones, could you go into more detail about the annuity rates , about how this is a warning sign?

Currently I’m of the opinion that I’d rather pull the trigger on my current career sooner rather than later. If markets were to take a tumble in the first “danger decade” I’d be more than happy to cut back on discretionary spending or get any menial job part time to weather the storm. I don’t think getting my old job back would be necessary to cut the withdrawal rate from 4 to 3 or even 2% for example. I’d rather the above scenario than waste more years working full time in a higher stress career when I didn’t need too.

Calum

The blog by Finumus explains it better than I. And the comments are useful reading as well.

https://www.finumus.com/blog/low-interest-rates-and-the-safe-withdrawal-rate-swr

I am not saying i buy in to this entirely. No one knows the future. But I feel it wouldn’t be prudent to discount this completely.

There’s a wealth of research that indicates humans continue throughout life to seek to satisfy the following core needs security, status, achievement, autonomy, purpose, belonging or some derivation thereof.

Financial Independence gives you the opportunity to mould your future to satisfy these needs and in practice for me it will probably continue to be gainful employment, notwithstanding that I am fairly financially independent. The key being that it will be more on less on your terms.

A brilliant article BoF and very much food for thought. Can i seek a quick clarification. Presumably Ryan’s NW here is liquid NW i.e. doesn’t include his primary residence / equity in primary residence. Thank you.

Correct.

But that doesn’t really matter, does it? You can have him in a paid-off house – or with a slightly higher net worth ($2m or $3m) and the existential questions would still remain, as evidenced by some of the comments…

Glad you enjoyed it!

Possibly hedonic treadmill / people get stuck on treadmill – wife likes London life etc…

Also if you are going somewhere cheap and can leave with $500k-$2m. why would you make more, depending on how much is meaningful for you.

Possibly

But the reality is that moving to a lower-cost location is easier said than done.

Tough to uproot children / move away from family and friends / sever your social connections.

Incidentally, much easier if you are originally from a LCOL area and are simply coming back home…

Pingback: The Sunday Ride #5 – Updated 4% Rule – Bankeronwheels.com

BoF just wanted to say I’m a lawyer and I really enjoy my job. It’s difficult and at times stressful but I get an interesting and varied array of work and get to work with some really smart people.

This is timely for me too. My net worth earnings and age are similar to Ryan ( slightly older and higher earnings) and deciding what to do next is difficult. I probably don’t need to work anymore but the job is interesting and I have some degree of control over hours. I’d be bored not working and seems a waste to have spent 20 years to become really good at something to stop doing it.

I suspect I’ll do another 5 or so years full time and reduce days and pay for a few years in my early 50s

Hi Lou

Glad you enjoyed the post. To be absolutely clear, what I didn’t want to do is generalize the happiness levels of lawyers. I’ve got quite a few good friends who are plowing that field and like you, are really good at what they do.

That being said, I think lawyers (especially corporate lawyers) have an even tougher job than bankers. It never ceases to amaze me how intense that career is.

To be honest, if I could do what I do – but for 40-50 hours a week and with proper structure, I would never look for another job. I suspect you are in the same boat.

Best of luck with your next steps!

Hi BOF great post, arguably your most thought provoking yet, so much so I have felt compelled to comment! Ryan’s situation that you describe is almost identical to my own, certainly in terms of net worth, income, and age. Bizarrely I was modelling this exact scenario out for myself approx. 6 months ago, and came to the same dilemma as Ryan. Obviously there is no universal right answer, even though people’s financial situation may be the same, personalities, life values, and family situations are completely different, and as such individuals can only make a decision that is right for them.

For anyone interested I thought I would just document how I solved this issue (well think I have solved it! Perspectives, opinions and values often change with time and experiences!)

My background is I work as a GP. Because of my job I have had the privilege to speak with a large number of people in the last days and weeks of their life, not always but often they will talk about life regrets, without question the vast majority cite working too much, and not spending enough quality time with family.

Warren Buffet is famously quoted as saying he has enough money to buy anything he wants in the world apart from time. In my opinion this is such an important concept to grasp in the wealth building journey. Essentially at some point a decision about how much ‘enough’ is, has to be made. The extra £10-20m that you may accumulate beyond what is ‘enough’ is absolutely no good to you at the end. If this has come at the expense of time with family (or something else as equally important) it is just pointless.

I asked myself would I be any happier with £30m compared with £3m. For me I concluded that I would be just as happy with the £3m, both ultimately give me what I want, which is complete autonomy over my time. Only the £3m is a lot easier to get in terms of both time and effort! I accept not everyone will agree, but I think the danger for people trying to build wealth is that they lose sight of what they are trying to achieve, surely happiness/freedom has to be the ultimate goal.

As an interesting thought, if just accumulating wealth to one’s dying day is what makes someone happy, might I suggest longevity as a strategy! If someone has accumulated £1m in there 30s then they can reasonably expect to live 50 more years and possibly 60, particularly if they take the coast FI route, have a stress-free job, and live a healthy lifestyle. £1m compounding at 8% for 50 years gives you a nominal (approx) £53m, for 60 years just short of £120m surely that has to be ‘enough!?’

In any case thanks again for a great post, please keep writing, brilliant to read your thoughts each week.

Neil.

Thanks for the comment Neil, very interesting and clearly you’ve got a unique perspective based on where you sit.

My personal opinion is quite aligned with your point of view. Past a certain amount ($5m in my case), control and time matters far more than the incremental dollar (or a million)

If I can figure out a way to continue growing my net worth in a way that’s not detrimental to spending time with my family, my health, and my values, all while allowing me to achieve personal and professional realization, I will continue doing so.

But unless I tick those boxes, there’s really no deal where I can justify continuing to spend my most precious resource (time) on work.

Cheers

BoF

I would love see the logic / maths behind why $5m is the magic number.

My situation isn’t far away from Ryan’s. I’m hitting 40 this year and about to move up from FD to CFO. I agree with the diagnosis of the problem. However some of the options suggested seem more like mistakes to avoid. Is it really a good idea to swap an investment strategy that is working (even if boring) for highly speculative venture capital investments. Even worse to jack in a successful career for a punt on a single start up company. Real estate is a load of hassle and also has plenty of potential to go wrong.

Aha – you hit the nail on the head here.

Thing is, if you are happy with your work-life balance AND the way your net worth is evolving, there really isn’t a problem to solve.

And if you are not, one of those aspects may have to take a hit. Otherwise, you need to change your investment strategy to one that carries higher risk (as you correctly point out re: venture capital) but offers a correspondingly higher return.

There’s really no other way around it, unless you believe in free lunches (which I as a finance professional don’t)

What I will say, however, is that joining a pre-IPO business as a CFO and monetizing your 1% stake in a successful float is a far cry from joining a one-man shop looking to “disrupt email”. So there’s definitely a spectrum of options there.

As far as $5m goes, the math is simple. At that point in time, your net worth grows by about $350k a year (assuming a 7% return). Assuming your day job covers the bills, you are on track to cross into $10m+ just a decade later.

Hope this helps – and best of luck with the move to a CFO role. Exciting times ahead!

Good morning BOF, hope you had a good weekend. There are a few issues with Finimus’ analysis in that article. Two of which he concedes in the comments. One the profit margin of the annuity company (sounds like a minor issue) and two the portfolio make up of the annuity i.e. they tend to hold a significant portion of an annuity portfolio in bonds. If I was to hit FIRE and plan for a long 40-50 year retirement I’d definitely hold most of my portfolio in equities. Finimus seems argue that many FIRE proponents aren’t prepared for the risk of selling off during a market crash. Maybe he’s right about that, but knowing how happy my wife can be on relatively little in the short term (we’d have no issue just going on camping holidays in Scotland for the average time it takes to get through a market crash for example).

The other issue with SWR is that it is fixed on the downside (with good reason), but with no view on the upside. For example in the original study a SWR of 4% had a 5% of failure, but the average portfolio increased by 89%. These are good odds especially as the downside can be mitigated, by earning some form of income and/or being flexible with spending.

Lastly I wonder if annuity rates are a decent measure of SWR, or if they are a better measure of perpetual withdrawal rates, where the balance of the portfolio isn’t depleted at the end of the retirement time period.

Overall though I do agree that FI is less about retirement per say and more about the freedom to work on your own terms.

I think you may have been addressing BnF, not BoF 🙂

That being said, I do agree with you.

Being able to (i) invest in equities and real estate vs just bonds; (ii) flex your spending to reflect market conditions; (iii) eliminate the insurance company’s profit margin and most importantly (iv) being able to go back to work if things go south (even if not at the same pay) all contribute to de-risking your SWR.

So I am pretty aligned with what BnF is saying above, which is somewhere in the middle between blindly relying on a 4% SWR while not taking the pessimistic view that 1.5% is where we are for the next 50 years.

This post might also be helpful: https://bankeronfire.com/a-million-is-not-enough

no problem at all on the mis-identification!

I agree the rebuttal to the good finumus article is to hold risky assets in your portfolio, which historically has achieved that SWR – the point being the issue with the word safe I guess. A further rebuttal to that hypothesis is also this article that also references the finumus article within the comments and is well worth a read. https://earlyretirementnow.com/2020/08/31/the-half-percent-safe-withdrawal-rate/

On profit margin – you can also argue that annuity providers benefit from pooling longevity risk – some people die earlier / some die longer so they can fairly confidently predict they just need to provide assets to last to the average life span of the annuity holders – whereas you are unlikely to be average – you need to think about longevity risk (is that bad…?!). If you are reading this blog it’s an indicator you’ll live longer than the average btw.

I’m not going to make future asset returns predictions and it doesn’t guide my planning beyond being aware that the future may not turn out to be within the parameters of the past although it’s a good guide or the best we have.

If you retire at 40 and are married (m/f) then you currently have a circa 10% chance of one of you making 100 in the UK. So I feel I need to budget for a circa 60 year time period. I find it useful to look back 60 years (1961) and think just how much the world has changed since then to give an idea of just how much it may change over the next 60 years. Again this is not to say 4% rule won’t work just to be aware of how its impossible to even consider understanding the outcome.

Some additional complications to think of though with the 4% rule or any withdrawal rate. (a) exchange rates seem to have an impact – https://portfoliocharts.com/2017/06/09/your-home-country-is-inseparable-from-your-withdrawal-rate/ (b) there’s a school of thought that historically (apart from the last decade) standards of living have improved as earnings > CPI and therefore if you want to account for that you would need to reduce your withdrawal rate further.

The main issue for me and I believe almost everyone remains the volatility combined with the future outcome for risk assets, which will be a single path that may not reflect historical averages (may be better or worse).

I listened to a pod-cast in which a well known blogger said if you’d got through March 2020 without selling down you had passed the test and could therefore handle holding your equities throughout any withdrawal period. I really disagree. A few months of volatility is not that bad really. 2008 wasn’t much of a better test. Holders of assets have an advantage currently in that monetary authorities are on their side and have been for the last couple of decades. Try holding equities in 1929 and witness a circa 7%% drawdown with no complete recovery until the mid 1940’s when monetary authorities view was to liquidate, liquidate and purge the system! Or the late 1970’s in which an equity / bond portfolio was hammered in real terms over that decade. If you had held through that then you can call yourself as good as bomb proof!

And yet if you are holding equities, which you need to do if you have a 40 – 60 year withdrawal rate you have to accept, need and indeed want that volatility. Because it’s that volatility that delivers an equity risk premium which then underpins that SWR.

I’m just making the point that proponents of the SWR underplay the associated volatility that is inescapable from the required portfolio and it’s easy to do as the last decade has been so easy relatively speaking.

FWIW – I am very heavy equities and real estate in my portfolio……

If you buy into that thinking – ‘Coast Fire’ has quite a lot going for it. The portfolio hopefully compounds up whilst you are not having to save any more. A slightly more aggressive route would be to withdraw a little say anything between 1 – 3.5% ish (which is probably the max PWR) and then cover any delta with work on your own terms. If someone is aggressively saving 50% + of their net salary (I am currently doing 70 / 75%) it shouldn’t hopefully be an impossible ask. When you finally retire the portfolio should hopefully have held its own in real terms at the very least. You increase the probability of that the less you withdraw of course. It might also have grown a heck of a lot as well at which point you have a very nice problem.

Oops, mixing up my bankers there ?, sorry guys. Really enjoyed that ERN article, thanks BNF.

You make an interesting point about life expectancy, I actually think that the FIRE community is likely to have an even higher life expectancy than average, because if you retire early you’ve got more time to keep in good shape, which will pay dividends as you get older.

Fully agree that the March 2020 hiccup was no test at all. I went into it with delight as I bought cheap equities, then disappointment as markets rallied faster than expected and the sale ended sooner than I’d have liked. I imagine I’d have felt differently if it had gone on for a decade or if I was in the drawdown instead of accumulation stage.

Also agree that the 4% rule should be blindly followed, I used the tools on portfolio charts to figure out a SWR more tailored to living in the UK and for my portfolio, which for transparency is mostly equities, barely any bonds, a bit of gold and recently a splash of bitcoin (thanks BOF for the push to research that by the way). Interestingly did you notice that the PWR actually increases with longer retirements? Counter intuitive, but makes sense when you think about it.

Wow, Ryan is me. This thread really hit things home.

For the longest time this was me plodding along doing my job, climbing up the greasy career pole and actually just saving (not even investing).

As a professional I can tell you we are great at our jobs, but that can end up being our life. We are very poor understanding the need to invest. A lot in my profession make millions a year, but also probably spend just as much a year, so are never even saving (let along investing and growing their money). This is partly because they want to live the good life now.

But the sacrifice to living the good life now is frankly crappy hours and dealing with frankly demanding and unreasonable clients.

Yes, I also come across a lot of folks like that in IB.

Very smart and hard-working, good at what they do and therefore well-remunerated.

At the same time, they don’t really pause and ask themselves – is working such crazy hours until I’m 60 or 65 really the best way to spend our relatively short lives?

Or perhaps they do – but the answer is drastically different to the one you and I give ourselves. Let’s not forget that the FIRE movement is very much a fringe one. It’s also one that is skewed towards millennials, so perhaps the overall mood music will change over time.

Thanks for another great post BoF, and great to read the comments too.

I was interested in your proposed options to reach escape velocity: (i) real estate; (ii) angel investing; (iii) join a start up; or (iv) start your own business. Those options are, as you say, increasingly risky with increasing (potential) reward.

I think a couple of important points are lurking but haven’t been made totally explicit:

The first is that all of those options themselves require quite high levels of time. They are therefore not obvious ‘solutions’ to the problem of running out of time.

The second is that all of those options require capital (even if as the safety net in the event of failure). By the time Ryan is 40 he may well not have enough time left to start a business. However, Ryan does have more capital than ever (indeed, that is what he has spent his time acquiring). He cannot use his capital to buy time (as on your hypothesis, he does not yet have ‘enough’). But he can use some of his capital to buy increased risk (and therefore, the potential for increased reward). If he gains that reward then ultimately he may be able to retire earlier, and in that sense, to buy time.

That idea is perhaps most clearly seen in option (ii), angel investing. But wouldn’t a more accessible option be to invest in individual stocks? Ryan doesn’t need to allocate his whole portfolio to that strategy. But making a few outsized bets (even for 30% annually, these don’t need to be 10-baggers) with, say, 10% of his net wealth would after a few years cause an appreciable increase in his net wealth. Or why not use some leverage to invest?

The other attraction of simply investing in a few individual stocks is that it carries a much lower time commitment (although I accept there is some time involved in researching).

Given the risk/disruption involved with options (iii) and (iv), I don’t think its a surprise that more people don’t do this. But my suggestion is that more HNW (or future HNW) individuals should take on higher equity risks from relatively early stage. It seems to me to be a sensible middle ground between taking average levels of risk (index funds) and huge levels of risk (starting your own business) without expending much time.

Just my thoughts from reflecting on my own situation and trying to rationalise (ex post) what I do!

Thanks William, agree with everything you are saying. The time point is particularly prescient, take it from someone who is trying to balance a reasonably sized property portfolio on top of a demanding career, kids, plus this blog.

On leveraged investing, however, it’s not something I would recommend – here are some thoughts I penciled down on this topic earlier: https://bankeronfire.com/leveraged-investing

And as far as active investing goes – perhaps, though I would look at it through a slightly different prism:

(i) Go overweight on higher risk, higher return sectors (i.e. technology) or

(ii) Focus on small caps and international equities, where the probability of outperforming seems to be higher: https://bankeronfire.com/the-not-so-silly-things-active-investors-say

As you say, just need to be cognizant that there’s no free lunch here, and those higher returns come with higher risk (i.e. volatility)

If Ryan is only spending 60k net he can generate that from his portfolio of 1.5m at age 43. Assuming any lived in property is paid off and the 1.5m of investments is all or mostly tax sheltered and sufficiently accessible, that approach could work based on SWR or natural yield.

Alternatively being in that position at age 43 gives you the option of some kind of career change as discussed above. I think you need to be both financially ready to FIRE, but also ready to walk away from the challenges of work. At age 43 that would have been too early for me.

I agree.

Definitely a ton of benefits in leaving a stressful, all-consuming job behind. But I could never see myself not working at all, not for a very long time still.

Pingback: Weekend reading: Many managers can't manage much longer

Pingback: DIY Investor - The Do-It-Yourself Investing Blog

Yeah I agree with the sentiment of this.

I’d like my net worth to be $5m+ to take the edge off, but I most definitely require a lot more to be “satisfied” (personally, I’d like 100m+)

And doing the math earlier on, 100m+ is not feasible whatsoever even if you get very lucky in the market + a job. Ergo, entrepreneurship is a requirement, even if there’s very low chance of success.

My strategy nowadays is to do entrepreneurship on the side (to build up the 5m) while minimizing my time doing my “9-5” work so I get a highly hourly rate effectively. My job isn’t that stressful “if I follow the rules” — but unfortunately, I’m quite the rebellious one and it’s hard to reign that in. It pays well and doesn’t take much time, which for a lot of people is great – but 1) I sincerely do not enjoy the people I interact with there, 2) even if they pay me for doing 0 work, I still wouldn’t ever be able to reach the 100m+ goal, and would take quite a while to reach 5m.

Once I reach the 5m (W-2 + investments + entrepreneurship) then I can take more time risks to build up software startups that has some probability of doing the 100m+ I envisioned.

In conclusion: yes, the first milly is easy. But life can be hard depending on how much you want. And each person’s ambition is sort of a personal preference.

If you don’t mind me asking, what is it that you do for the 9-5?

I agree with you, clearing $100m is only possible with entrepreneurship. Think you can get to $10m – $30m with a successful and long (this is crucial) career in banking and private equity. Anything else requires either rising to stratospheric levels (i.e. Steve Ballmer who became a billionaire working for Microsoft), having a job with a very unique compensation structure (hedge funds), or starting your own advisory or private equity shop.