Note: This post was first published in November 2019 and updated in February 2021

Every year, without exception, I see the exact same situation playing out at work.

Bright, motivated, and hard-working guys and girls begin their careers as investment banking analysts.

Almost immediately, the most ambitious and foresightful of the bunch start doing the rounds with the more senior members of the team, myself included.

In pre-Covid days, this meant getting lunches together, going out for coffees, and having other informal conversations.

(Suffice it to say that this generation made a far more seamless switch to Zoom than everyone else)

The key topic of such conversations? Soliciting advice on how to become a top-ranked analyst.

And who can blame them? After all, for the majority of their life, they followed a very simple formula for success:

Get top grades in school >> Get into a top university >> Get top grades at university >> Get a high-paying job. Boom!

Therefore, it’s not at all surprising that they would be looking to apply the same formula to extend their success in the workplace – and, by corollary, life.

Get a top ranking at work >> Get a great bonus >> Have a great life!

Right?

Unfortunately, the moment you graduate from university, the goalposts shift.

The magic formula that worked well for so long breaks down before your hat lands on the ground at the (virtual) graduation ceremony.

Being #1 is no longer the most important factor in determining your success.

Do you know what is? Simply staying in the game.

Burn Bright Or Burn Long?

Let’s go back to my junior colleagues for a minute.

Becoming a top-ranked junior banker certainly has its advantages.

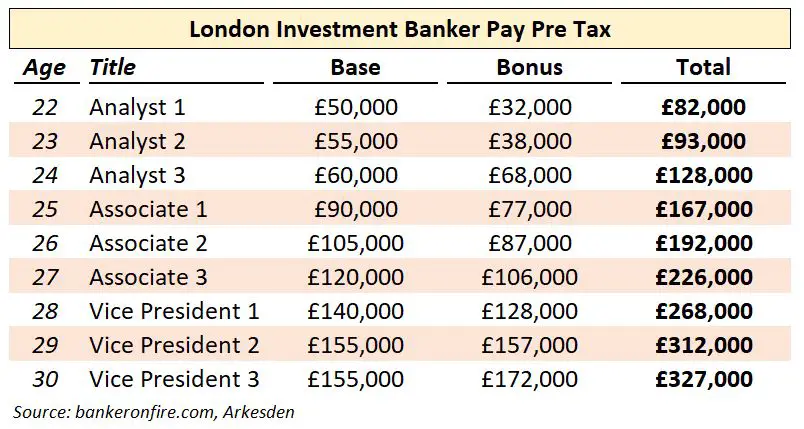

On average, first-year investment banking analysts get a year-end bonus of c.£32k.

The top performers can get paid significantly more, sometimes clearing bonuses of £40k or more.

And yes, that 25% increase in pay will come out of the bonus “bucket” of below-average analysts. Like many things in life, bonuses are a zero-sum game.

There is, however, a price to pay for the outsize compensation.

The top-ranked analysts typically work longer and harder than anyone else. They get staffed on the most challenging deals and pitches.

As a result, they typically work with more senior bankers. And guess what?

Those senior bankers tend to be much more demanding.

80-hour weeks can be the norm and it’s not unusual to clock 100+ hours for weeks on end.

And despite the portrayals in the media, you don’t spend any time doing this:

(Un)fortunately, this ain’t your life as a banker

No matter how young, energetic and motivated you are, sustaining that kind of lifestyle is nearly impossible.

Some form of burnout is commonplace and almost inevitable.

As a result, the top analysts usually depart the bank in a few years.

A select few will get hired away by private equity.

Others will leave for a corporate or pursue an MBA. And some will just take a career break and do nothing for a year while they ponder their next move.

In other words, they drop out of the game. And in doing so, forgo the financial rewards of just sticking it out.

Yes, a top-ranked analyst will have collected about £88k in bonuses by the time he burns out and leaves banking in two years.

His middle-ranked colleague would only get about £70k or so over the same time period.

Yet she would also get more sleep, more exercise and more social contact with her family and friends.

In other words, she would likely be happier.

The result? She probably stays put for another year or two. And in those two years, she will clear another £145k by making it to the associate ranks.

That leaves her far ahead of the high-flyer who knocked it out of the park – but only lasted two years.

Simply because she conserved her energy – and stayed in the game.

The 90% Rule

2021 was the first year in a long time when I didn’t dread January.

In pre-pandemic days, January meant that my gym suddenly filled up with more people than I’ve ever seen there before.

That 6:30 am HIIT class would be fully booked seven days in advance.

The line for the treadmills will be going out the door. And good luck trying to do some bench presses.

The gym would be full of people working out six days a week for two hours straight.

Yet magically, about four weeks later, the crowds would thin out, leaving me to enjoy my workouts again.

Because thankfully, 90% of people quit the gym within three months of joining.

Let’s face it – if the last time you got some exercise was in the playground, you are not going to look like these guys anytime soon.

Not going to happen

Not even if you go to the gym for three hours a day, seven days a week. You simply won’t get there.

But you know who will?

The people who start small. The ones who start off by going twice a week for 30 minutes – and not necessarily in January.

A few months later, that twice-weekly, simple workout has become an entrenched habit. At that point in time, they add a class or two – and drop the Saturday night burger and chips.

When you bump into them in September, they’ve lost 15 pounds of fat and bench press their bodyweight ten times.

Unlike the quitters back in January, they never burned out.

They stayed in the game.

And they are just getting started.

Defying The Odds In Order To Lose

Let me give you another example.

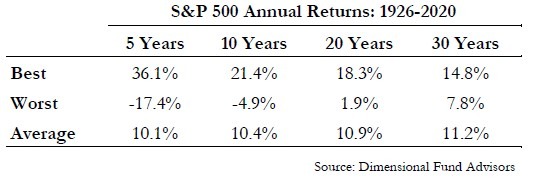

It is a hard fact supported by historical data that losing money investing in the stock market over long periods of time is nearly impossible.

Here’s what happens if you stay in the market for 20 years:

And have a look at how the worst-case outcomes change the longer you stay in the market:

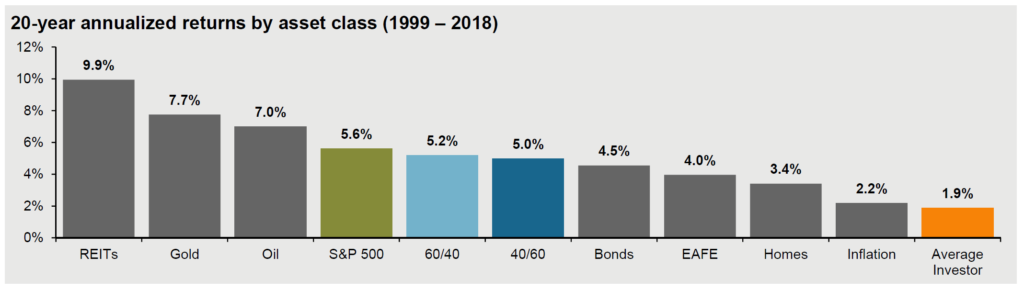

And yet, year after year, millions of people defy the odds and walk away with painful losses. Their returns, instead of looking like the ones above, look like this instead:

Yes, it’s that bad

The reasons are simple. They try to time the market. They pile in at the top. Then they run for the hills at the bottom.

In other words, they don’t stay in the game.

It doesn’t matter whether it’s writing, playing an instrument, learning a language, cooking – or (gasp!) reaching financial independence.

The reality is that it is nearly impossible NOT to achieve your goals – provided you let your efforts compound.

Compounding requires time. And time implies staying in the game.

In one of my favourite books, Morgan Housel writes about Warren Buffett’s investing success:

As I write this, Buffett’s net woth is $84.5 billion. Of that, $84.2 billion was accumulated after his 50th birthday.

His skill is investing, but his secret is time.

None of the 2,000 books picking apart Buffett’s success are titled “This Guy Has Been Investing Consistently for Three-Quarters of a Century”

So I will leave you with the same message I give to my junior colleagues when they angle for a top ranking:

Many will start fast. Few will finish strong.

Choose who you want to be.

Happy investing!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Brilliant post Banker on Fire. A real insight into the world of Investment Banking but more importantly good sound life advise.

Funny how often it comes down to just hanging on and the rest takes care of itself!

Interesting quote about buffet. I didn’t know that.

He was also lucky that his investing time frame coincided with the beginning of a massive debt fuelled spending spree by governments.

If the Governments continue spending like they did for the past 40 years then yes asserts will continue to rise. People will access to the money will continue to chase the returns.

Follow the money but watch it like a hawk.

The other phrase was something like

The markets can stay irrational longer than you can stay solvent.

I suspect that if anything, the pace of government spending will accelerate.

The pandemic was the first time ever when governments around the world have literally sent money to the population at large.

Now, I don’t necessarily disagree with that response as the alternative was letting the economy collapse. But for any future government, refusing to do so in the next crisis is political suicide.

Brilliant post – thank you for sharing!

Cheers AoF. I don’t know what it’s like in the big 4, but in banking, it’s often not the smartest or hardest working people who rise to the top.

Instead, it’s the most resilient bunch of folks who end up surviving and thriving.

Have recently started reading your blog (found it over on Monevator). Just wanted to say thanks a lot for the helpful (and motivating) insights – I know it’s a massive effort to continue posting on top of work and family commitments so thank you for that.

All the best.

Thanks for the kind words Matt, means a lot.

Have a great weekend!

Yep. Showing up and putting in consistent effort are about all you need in life to make it.

I imagine Investment Banking is tiring as heck though. Most of the Bankers I know are non stop. I can’t personally live that life, but your overarching point is spot on!

You are right, signing up for IB is like riding a bull in a rodeo. You’re either in it 100% or you’re out.

The two most important qualities that help you survive are the ability to compartmentalize and emotional detachment. Without a healthy dose of each, folks crash and burn in just a few years.

Incidentally, this also explains the character of the many investment bankers out there!

I will say though that the IBs I worked with were incredibly valuable in assisting us to sell our business. Plus they know all the good spots to eat!

I am an MD in IB and one of the wisest bits of advice I was given earlier in my career is exactly this. “90% of success in IB comes just turning up to work everyday”. The point being stay in the game and as well as the money accumulating so will your knowledge.

The other way I explain it to my new starters is that IB is all about the area under the curve. If you draw a chart of annual earnings through an IB career, there is no point pushing to be promoted early in the hope of earning slightly more in say year 5 but then getting cut later as you don’t have the knowledge or contacts of your peers and missing out on years 10 to 30 when you make real money.

Having just gone through the analyst year-end rating / comp cycle, I am reminded that this never changes.

Everyone wants to be top bucket. Those who aren’t in the top bucket (even if objectively well rated) want to know how to get there. Those who do get a top bucket rating are angling for ways to get an early promo.

I keep trying to remind these kids that it’s about longevity and enjoying what you do, not compressing a decade’s worth of career into eight years. They nod politely but am sure they tell themselves that I am full of cr@p.

Thing is, I was exactly the same way when I was in their shoes. Always well ranked, consistently well paid – but it was never enough…

As always thank you for your articles. I have recently re-read(during the week) a part in the book by Nassim Nicholas Taleb “Skin in the game”, the chapter is “Chapter 3 how to legally own another person”. The dog Vs Wolf dilemma in the Chapter in sub chapter 3 called “freedom is never free”. The fable story is the dog tells the wolf how great everything is with all the luxury and comfort he has. The wolf asks “What is the collar on your neck”. When the dog explains he runs away “Of all your meals, I want nothing”. Question is do you want to be the dog or wolf? At this moment in time I want to be both the dog and wolf. I want to continue working in my full time job and have a side hustle I want to build my own infrastructure. This week I have completed a Business Startup course and exploring the side hustle. I am excited and in deep thought and need to take action have a minimal viable product. I am in search of the seed to success and will be taking small steps, left right, left right. What I got out of your article is to measure my effort and discipline. With discipline I can do it. I can build my own infrastructure. I can invest in myself. The balance of home and work life is important and to work out what is enough. I want to make it to the other side.

Of course if the side hustle does better then the full time work I will be investing less time into the full time job.

Best of luck with your side hustle! I agree you want to try it in parallel to your day job as I’ve never signed up to the whole “burning the ships” mentality.

And thanks for reminding me of Taleb’s book. It’s been on my reading list forever, but I’ve finally downloaded it on Kindle last night.

Nice one.

See also: https://pratt.duke.edu/about/news/tortoise-hare#:~:text=In%20the%20iconic%20parable%2C%20Aesop,%2C%20they%20shouldn%27t%20be.

Hah, love the analogy.

Also think it’s fascinating there are folks publishing research on these kinds of topics!

Couldn’t have said it better. What matters is that you stay in the game instead of going 100 miles per hour for 1 day and quitting the next day. It’s a marathon, not a sprint.

Filled with money isn’t my first blog that I started. My first blog I wrote 3x a week and was absolutely burned out. At my highest mark I had 10,000 views but I just couldn’t continue writing 3x a week and writing 1x a week made me feel like a failure. Instead, I gave it all up!

Giving 10% effort over 20 years is still more than giving 100% effort over 1 year and completely giving up after. It makes a huge difference.

Yeah, spot on. Like the way you bring it back to blogging – may even be more applicable given search engines prioritize sites that have been around for a long time, instead of those who pop up, get 100 posts up in three months, and then disappear for good.

How’s the new blog coming along?

Great post.

I suspect law (litigation) is similar. Feeling burnt out already at 35 having gone flat out for 10 years. Trying to keep my fixed costs low to be able to walk away at a time of my choosing.

Sounds like you’ve got a long and intense stretch behind you.

The good news is that it’s much easier to put in that sort of effort between 25 – 35 than between 35 – 45. By that point, people have less energy and more commitments (i.e. kids) and so it can become a real slog.

Best of luck as you look to scale back!

Great insights on what it takes. Hustle and consistency compound which enables you to achieve your goals.

At the end of the day, it’s a pretty simple recipe!

That last bar chart looks straights out of JPM’s Guide to the Markets

Good reminders

Thanks David. And yes, that’s where it is – I obviously forgot to source this one.