One of the fundamental truths of being a personal finance blogger is that it invariably involves telling readers what you think.

The internet, however, is a funny, opaque place.

Things are not always what they seem. And for all you know, I could be just a random hobo sitting in the middle of nowhere, simply pretending to be an investment banker.

Of course, that would be an informational asymmetry of the highest order, and sadly I’ve got neither the writing skills nor the imagination (or the time) to pull something this complicated off.

But the informational asymmetry doesn’t end there, especially in the personal finance space.

Sometimes it’s intentionally misleading. Cue in that Twitter money bro trying to sell you a stock trading course. Guaranteed money maker, just $99, limited time only!

On other occasions, there are other, more benign reasons why one’s advice may differ from his or her actions.

And there’s nothing like observing revealed preferences to bridge the gap between imagination and reality.

Nassim Taleb once said: “Don’t tell me what you think, tell me what you have in your portfolio”.

Thus, in the spirit of full transparency (and also because some readers have asked), I’ve decided to do a post outlining my own asset allocation.

Am I really such a big believer in passive investing and real estate? Or have I been leading you down the garden path all along?

You’re about to find out.

Rules Of The Road

Some folks are more than happy to lift their personal finance kimono all the way up, for everyone on the internet to see.

I am not one of them. Hence, a few guiding principles/observations:

- For ease of reference, I have pro-rated all of my holdings to $1m

- Yes, I think in dollars. Tough to shake off the legacy of Uncle Sam having spent a big chunk of my life across the pond

- For confidentiality, I will not be disclosing my two individual stock holdings. Investment banking is not as big an industry as some might think

Portfolio Snapshot

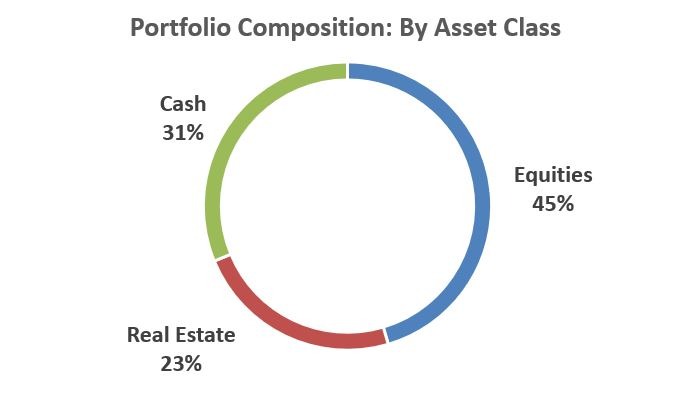

To start off with, here’s a snapshot of my portfolio by asset class, as of November 2020:

Nope, turns out I didn’t lie to you (not yet anyway).

Equities are the biggest component, accounting for 45% of my portfolio.

Real estate currently represents just under a quarter.

Note that this is property value net of mortgages – representing just our family’s equity stake in the properties that we own.

What this means is that the risk of loss on our property investments is higher than 23%.

Purely theoretically, if property values were to decline significantly, our equity stake would be wiped out – and I would still have the liability. It’s a remote outcome but it has happened before.

Cash Is… King?

You will also have noticed that I am sitting on far more cash at the moment than I should be, by any objective measure.

Currently, cash represents c.31% of our portfolio. It is my sincere hope that the cash pile gets even larger come Q1 2021 when the next batch of bonuses is due to be announced and paid.

This is despite the fact that over the past year, I’ve deployed a significant chunk of capital into both equities and real estate.

There are three reasons why our family’s cash holdings are at this level:

Reason #1: We are currently looking to acquire even more real estate

Ideally, we would look to buy another two commercial properties in 2021 and another one the following year.

As I have written about previously, the challenge with real estate investing is that you never know when the next deal will come along and how expensive it might be.

Thus, it invariably leads to a suboptimal asset allocation until you deploy your capital.

The implied opportunity cost is the one factor that many folks forget to account for when considering property investing.

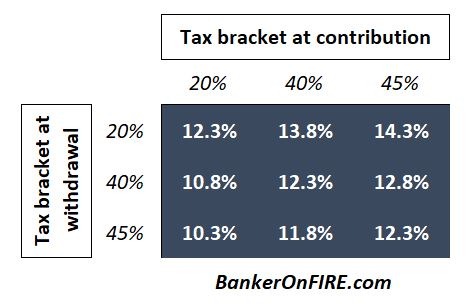

Reason #2: We are now at risk of hitting our pensions LTA

Over the years, we’ve been pretty aggressive about contributing to our pensions. Those attractive workplace pension returns may have something to do with it.

Rate of return on your workplace pension:

As my earnings grew, I ended up being tapered down to £4k. In order to tame the taper, we’ve started overcontributing to my wife’s pension.

We are now at a point where the prospect of exceeding the LTA is becoming more likely by the day.

Thus, we have reduced my wife’s contributions as well and are now switching from pension to ISAs. As such, there’s a bit of a lag until we can make use of next year’s ISA allowance.

Reason #3: My job

Sad but true. I am acutely aware of how unpredictable my job is. Thus, we keep an emergency fund equal to 12+ months of our spending.

The opportunity cost is pretty meaningful – but the ability to sleep well at night is priceless.

To sum it up, I am planning to take our cash holdings to c.5-10% of our portfolio, but I won’t plunge into a bad real estate deal in order to do that.

Breakdown Of Equity Holdings

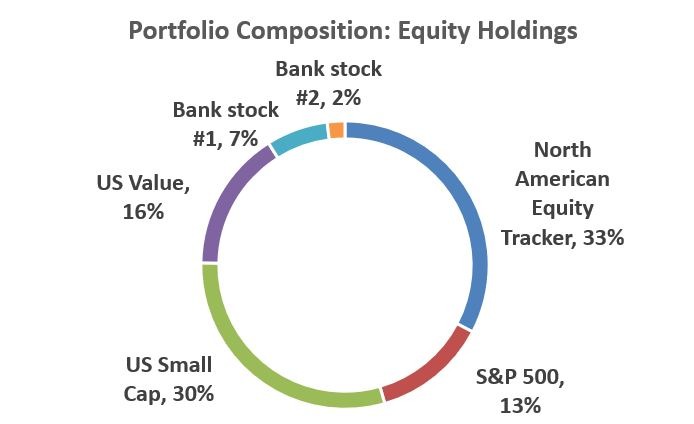

Let’s now have a look at what’s inside my equity portfolio to see if I actually practice what I preach.

North American Equity Tracker: 33%

This comprises mine and my wife’s workplace pension plans, or rather, the portion not yet transferred to a SIPP.

Sadly, I’m on one of those crappy plans with high fees. But given a £4k annual contribution (and a transfer out every 12 months), it’s not so bad.

On the contrary, my wife’s pension provider is actually quite straight up and provides a good range of low-cost index trackers.

Either way, both are about to be transferred out to a third-party pension provider shortly after Christmas, most likely Hargreaves Lansdown.

S&P 500 Index Tracker: 15%

This one speaks for itself. Held in our ISAs, VUSA is the Vanguard S&P 500 ETF.

At a 0.07% ongoing charge, what’s not to like?

The difference between VUSA and the North American equities above is that the latter holds a broad universe of US stocks beyond those in the S&P 500.

US Small Cap Equities: 30%

I’ve previously written about my dangerous liaison with value stocks.

As it happens, I’ve gotten even friskier with small-cap stocks. At roughly a third of my equity portfolio, small caps (I hold them through the IJR ETF) represent a pretty concentrated bet on a specific sector.

Why do I do this to myself?

Well, for one, I’ve made up my mind on the Fama-French theory. Having taken a view, I intend to stick to it for at least a few decades.

The second reason is that the small caps are quite complementary to my S&P 500 holdings. If you add the two up, I basically end up holding the entire US index.

And the third reason is that when I was buying up equities earlier this year, the S&P 500 had already recovered most of its losses.

On the contrary, small caps and value stocks were still relatively underpriced back then.

US Value Stocks: 16%

See above. Incidentally, right after I’ve reflected on the destruction of value, we’ve seen a monster rally in both value AND small-cap stocks.

Given I’ve got a 20+ investment horizon, I’ve ignored the recent moves. Only time will tell how successful my strategy has been.

My US value stocks are held through the IWN index.

Bank Stock #1 & #2: 9% combined

These are the shares me and my wife have been awarded in our respective employers.

Normally, my policy is to liquidate my share awards as soon as they vest. However, this year I’ve made an exception.

Bank stocks have plummeted back in March and stayed there for most of the year.

It simply didn’t make sense to sell our holdings at a 50% discount just to buy the S&P which by that point had almost recovered its losses.

On the back of brighter macro prospects, our employers’ share prices are up meaningfully as I write these words. Come spring next year, I will likely monetize our entire holdings (another portion will have vested by then).

True Lies?

To sum it up, I probably didn’t do too bad on the polygraph test.

My strong preference for US equities and real estate (but only outside the UK) is reflected in my holdings.

Perhaps I’ve got a bit more of an active streak in me than I like to admit, as evidenced by my bias towards small-cap and value stocks.

In my defense, I do hold them through widely diversified ETFs.

And the reason I don’t recommend other readers get into these subsectors is that I think there is probably an easier (and cheaper) way to get an adrenaline shot out there.

Either way, I’ll keep you posted.

Thank you for reading!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Good to see you practice what you preach BoF.

Initially I was surprised by the level of cash you are holding but once you explained the reasoning I understood why you take that position.

The only question I’d have would be where are you holding what I imagine is a fairly sizable amount of cash?

Thanks Rosario.

Having taken an objective look, I realized I’m more of an active investor than I’d like to admit (to myself at least), but still pretty close to the passive end of the spectrum. I suppose everyone has their weaknesses 🙂

For cash, it’s split relatively evenly between bank accounts here in the UK and stateside. Sadly all of them pay near-zero interest, hence I’ll make a big push to buy the two properties early in 2021.

You’re right, there are several shades of active investing I’d say you’re certainly towards the passive side.

The question on where you hold your cash was driven not just by interest in the returns, which I guessed would be minimal, but also how you hold such figures safely.

I feel you’re level of cash is a function of both your property investment strategy and income.

If you were to categorise the cash, and I’m sure on some level you do, into emergency fund, property investment pot, future ISA contributions etc that may be a little more telling.

The post prompted me to look at my own split again. Its very straightforward by comparison. I’m 96% Equity (all in global index trackers), 2% Bonds and 2% Cash. Without factoring in any equity in my house.

On the face of it I feel it seems light in cash, the 2% is effectively 6 months emergency fund. Having been through an income squeeze for a few months this year and still feeling relatively comfortable with this level I don’t see that changing. It does however highlight just how concentrated I am in global equities. Perhaps that’s something for me to reflect on.

Got it. I split up my cash amongst three institutions here (HSBC, Barclays, Oaknorth) and two across the pond.

Am painfully cognizant I wouldn’t qualify for full deposit protection in the event of default but consider the risk relatively low (and it will be solved once I pull the trigger on the next property).

Would say about 20% of cash is earmarked for property purchases, the rest is an emergency fund. ISAs will usually (hopefully!) come out of next year’s bonus so not allocating anything to that bucket for the time being.

I think your own allocation makes a lot of sense? Unless you were contemplating retiring over the next decade / getting friskier with subsegments like tech or US equities?

I agree on the risk of default, minimal but still could be prohibitive if 30%+ of your net worth is wiped out. Single figure percentages much less so.

8-10 years I might be looking for a slight change of pace perhaps, with a favourable tail wind. My high level plan was to keep pretty much as is for the next 5 or so and then start increasing cash, perhaps overpaying mortgage as a hedge etc. If markets were to take a dip during that time I’d be happy to keep working and investing in equities.

The way I think about it is between five banks we are talking 6% or so of my net worth per bank.

Assuming one was to go bust (I’m discounting a chain reaction scenario), I’d probably get covered for half of my holding or so (depending on jurisdiction and amounts held) as the first tranche would be covered by deposit protection.

Don’t get me wrong, it would still bite but it’s a low enough weighted probability outcome that I can be sanguine about it.

Thanks for this! Very interesting.

I imagined more people might be holding VUSA given the low fees but I never actually saw anyone call it out explicitly, so that’s nice. If other posts ~1 year ago hadn’t already been enough to show me that a well researched portfolio can actually be pretty simple, this would’ve done it.

I’m personally holding almost everything in VUSA (most), VEVE and pension in Blackrock World Ex UK. Vested and yet unsold company stock is also a temporary portion at all times. Going forward I’m probably going to have a crypto allocation of ~3%.

Lately I’ve been looking to buy some EQQQ as I’m long on tech but the sector feels a bit overpriced, which is why I haven’t taken the plunge yet (also VUSA is inherently tilted a bit towards tech).

A potentially interesting discussion is: what is the allocation that got you here? Are you now in the phase of accumulating or protecting capital? I’ve often seen it said that concentration builds wealth and diversification guards it.

With a couple more years until 30, I’d be tempted to take some more risky concentrated bets than dumping all in diversified ETFs – for example not having diversified my company stock too early or buying some growth stocks would’ve been quite a bit more beneficial over the past year. But hindsight is 20/20.

It’s a tough one. I consider myself to be still very much in accumulation phase, not least because I’ve set a very aggressive net worth target for myself.

At the same time, I am reluctant to pick subsectors (other than small cap / value as illustrated above) as I just haven’t got the evidence or the differentiated thesis to support taking a strong view over the next decade or two.

The one allocation I am considering making is crypto. Probably 1-2% of my portfolio. This is a good post from Finumus that got me thinking:

https://www.finumus.com/blog/crypto-assets-in-your-portfolio-what-the-world-is-waiting-for

Tech is interesting but had a fantastic run and as you rightly point out, VUSA gives us about 25% exposure to tech as it is.

Very interesting to see – thanks for sharing, BoF.

It appears you are very US centric equity and don’t want to put much money in UK equity – any specific reasons? I guess partly because you have a lot of stakes in UK already (career, real estate, etc) and if the last decade is the guide FTSE100 has gone nowhere…

I’m putting most of my equity in FTSE Global All Cap i.e.. buying the world. Then, some one-off investments are in FTSE All share as things look comparatively cheap, with the higher dividends if things do not work out well on the capital appreciation.

Matching you 1:1 on the All Cap, our SIPPs & ISAs are 100% Global All Cap, my workplace pension is whatever the closest thing to All Cap was on the Scottish Widows platform. From all the reading I’ve done over the last 2 years when I discovered this entire subject, at 30 years old, I see no reason not to given my time horizon.

@BoF, I also hold a sizable EF in cash, roughly 12m expenditure, because I am the main earner in my household with 2 young ones. Not having to worry about random stuff breaking in the house or what would happen should my employer go bang is a good thing!

That’s exactly how I think about my EF.

Sure, I am missing out on some investment returns but also have 2 kids at home and don’t need the stress of keeping a roof over our heads should things get choppy at work.

There are three primary reasons I’m not keen on UK equities:

1. Historical (over the past 100 years) underperformance:

2. It doesn’t represent a meaningful share of the global equities market (unlike the US stocks which account for 50%+)

3. As you correctly point out, my existing exposure through my job. As it happens, all of my property investments are outside the UK, so less concerned on that front.

If helpful, here is my latest post on this topic: https://bankeronfire.com/tale-of-two-markets

Hello BoF – hopefully you will be please to know you have a very interested US-based follower here. Can you clear up a few of the UK retirement investment vehicles for me please? Workplace Pension in Uk – is that same as an employer 401(k) plan in US? ISA in UK – is that similar to an IRA in US? Thanks

Thanks Ken, glad to hear!

Yes, a workplace pension is like a 401(k) but FAR more generous and less restrictive. Your employer is required to make mandatory contributions and there’s no vesting.

And yes, an ISA is just like an IRA. Not sure what the limits are in the US these days, but here they are very generous to the tune of £20k/year.

thank you for the article. I think you are wise to hold Cash, not only is it good in case of a job loss disaster, but UKCPI is at 0.3% so the cost of carry is very low at present. UK Commercial Property wise it is tricky to get the tax right, holding in a SIPP has a lot of advantages. Have you looked at hedge funds – there are a number of UK listed funds trading on large discounts that could outperform if we have a bear market. I like the idea of getting the smartest traders in the market for less than the value of their assets.

Glad you enjoyed it!

I’m not really into hedge funds to be honest. I haven’t seen compelling evidence hedge funds can consistently outperform the market (net of fees). On the other hand, there’s quite a bit of evidence suggesting they underperform.

Most importantly, the folks who have really figured out how to make money in the stock market usually don’t let outside capital in:

https://bankeronfire.com/the-people-who-beat-the-stock-market

Is there a reason to go VUSA rather than the US accumulation?

Which one of the accumulation funds did you have in mind?

Are you intending to be 100% stocks in perpetuity or will you dial the risk back I the future?

I aim to get to my mortgage value in equities in my isa in the next few years by which time il have about 400k to 500k in a pension at she 43. The pension will def stay 100% but wondering what to do on the isa front?

I plan to aggressively pay my mortgage down to about 100k from 3 to 5 years time from salary and the odd lump withdrawal from my isa. Sub optimal maybe I should logically continue investing but I like the idea of being mostly mortgage free before leaving work. Leaving a bit of mortgage for flexibility but not so much that I can’t pay it off if need be

Once I start living off the isa until pension age I will keep 2 years in cash but quite like the idea of splitting the rest into thirds. A third in a lower equity passive fund and third in a 60/40 fund and the rest in 100% equities (might be different %s but that’s the Gist) . Might be over complicating but a ladder in retirement seems like not a bad idea for shorter term investment pots

It really depends on what our employment situation is at that point and how much cash our properties spin off.

For now, the thinking is 2-3 years’ worth of expenditures in cash and rest in equities upon retirement. But if there’s one thing I know, it’s that preferences (and risk appetitle) evolve over time so I may end up changing the approach!

this was also going to be my question. Why not (for example) – VUAG the accumulating class?

Perhaps I’m just blind, but for whatever reason, I don’t see VUAG in my Vanguard UK dashboard, though I know it is offered by Hargreaves for example.

That’s the only reason, agree the accumulating version would be a better option.

Let me know if you’re also here in the UK and are able to invest in VUAG.

Hi BoF – yes I am in the UK. VUAG for some bizarre reason isn’t offered on the vanguard platform. However I use interactive investor and bought it via that, it has the same 0.07% Total expense ratio. Maybe worth noting that VUAG is a relatively new product – inception was earlier this yr if im not mistaken.

Glad to hear I wasn’t missing a beat!

VUAG is the one I’ll go with in January when I’m investing a transfer from my workplace pension into a Hargreaves SIPP.

Thanks BoF, interesting read. Im curious about the large cash holding. Are you planning on paying for your future property investments in full rather than using a mortgage?

I guess I’m curious as to the thinking behind the these two trade offs:

1. Hold a large enough amount of cash to purchase a property in full with minimal to zero mortgage. During that time there is an opportunity cost with not having that cash invested elsewhere.

2. Invest your cash in the mean time since you’re willing to wait until a good property deal comes along. Use a mortgage for the property and a much smaller deposit while either keeping that initial money invested or perhaps withdrawing it at that point in time to contribute towards the property purchase.

Thanks.

Hey Brendon – see my response to Simon below. I do take out mortgages, but still need a good chunk of cash to cover the down payment, closing costs, and working capital reserve.

I wouldn’t invest the money I earmark for a property purchase as when a property does come along, I like to move quickly. Being at the mercy of the market at that point in time doesn’t work, plus there are logistical issues to think of.

Sadly, even in this day and age, moving $500k between investment / bank accounts is far from instant.

Thanks for sharing. Very interesting reading and provokes thought about my own choices.

One reflection: given the name of the blog & your chosen profession I was surprised at the proportion of real estate (& cash that is about to be turned into real estate).

Is this RE UK focused and if so does it not pose correlation risk?

Thanks again

Cheers Simon, glad you found it helpful!

As a matter of fact, all of our properties are outside the UK. First of all, I am already exposed to the UK economy to a greater extent than I’d like to be.

Secondly, the UK government seems to be bent on making buy-to-let as painful as possible which dissuades me from putting my money to work.

As far as the quantum of cash, I target properties in the $1m – $2m price range. Between a 30-35% down payment, closing costs, and working capital (need to have cash on hand on ride out any near term cash flow issues), the cash requirement really adds up.

Sounds like a good plan! Happy Christmas.

As I recall you are based in the UK but have spent time in the US. I note you have a lot of your assets that are US based. Are you doing this through UK listed Irish domiciled ETFs or directly through US holdings?

That’s right. I hold some through my legacy investment accounts I opened when I lived there.

Now that I’m in London, I’m precluded from topping those up – so all new investments are made through local brokers / UK listed ETFs.

Nice cash holding!

Can you share why you have a majority of investments in US equities when you are in England?

Sam

To me it’s either US or world equities. UK stock market represents only c.6% of the world so not about to make a concentrated investment bet like that (and that’s before Brexit and a slew of other local issues).

Given US equities have outperformed the world to the tune of about 1% over the past 100 years (6% vs 5% real return), I’m all in US.

Hey BonF,

Great blog, long time admirer from the sidelines here

Out of interest, when considering your pension lifetime allowance what long term rate of return and inflation (CPI) do you factor in?

Hi there.

Great to hear you are enjoying the blog!

To answer your question – I use an 8% return and a 1% inflation assumption. Not because I think that’s where the inflation will end up (likely to be higher) but because I’d rather err on the conservative side.

The reality is that for a dual-income household, exceeding the LTA (so having roughly £2.1m in pensions as of today) means you could probably retire much earlier than the pension age – as long as you put some of that money into ISAs.

Interesting, as you say, would expect that to be on the conservative side. Was expecting more like 1.50% and 6%. Are you really that adverse to breaching the LTA? Or just moving away from making extra contributions – over and above any employer matched contributions?

I just feel that breaching the LTA is very inefficient. For a simplified example:

– when I’m 55 and have £900k in my pension and £100k in my ISA I am arguably in a position to pull the plug early and use my ISA funds to “bridge the gap”

– when I’m 55 and have £1m in my pension and zero in my ISA, I cannot retire early – and I will pay a 55% penalty on the excess when I get there (given there will be a few more years to go so the £1m will grow considerably)

Yes, you want to maximize the match but I feel that once you’ve got a pot of that size, optimizing for time becomes far more important than optimizing for money

Fair points. Let’s just hope it’s all academic as the lifetime allowance gets scrapped soon!