Note: This post was first published in January 2020 and updated in April 2021.

At some point, all stock market investors face the following question:

What is the right portfolio allocation between US and international equities?

As the data below shows, at the turn of the 20th century, the US stock market represented ~15% of the world’s total.

Fast forward a hundred or so years and the relative share has grown to ~52%.

And judging by the way the S&P has knocked it out of the park over the past decade (pandemics be damned!), I’d suspect the relative share is even higher today.

If you were to build a truly diversified global portfolio, you’d want it balanced according to the percentages in the second chart above.

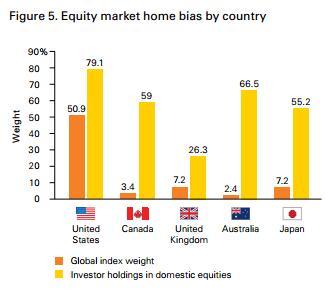

However, there is strong empirical evidence that investors tend to hold an outsized proportion of domestic stocks in their portfolios.

In the investing world, it is known as home equity bias. Have a look at the chart below:

Think about it: if you live in Canada, it simply makes no sense to have 59% of your portfolio invested in Canadian stocks. After all, they represent just 3.4% of the world’s total market capitalization.

And with governments around the world slowly lifting restrictions on international stock holdings, there no reason not to hold a globally diversified portfolio.

Or is there?

Today, I am going to make the case for concentrating your entire portfolio in US equities.

Is this edgy? Perhaps, though not as edgy as piling into a joke cryptocurrency or pinning your retirement hopes on Elon.

That being said, the vast majority of the Banker On FIRE stock portfolio consists of US equities – and below are the reasons why.

Higher Returns

At the end of the day, your stock market portfolio has one job and one job only:

Deliver the best possible risk-adjusted returns.

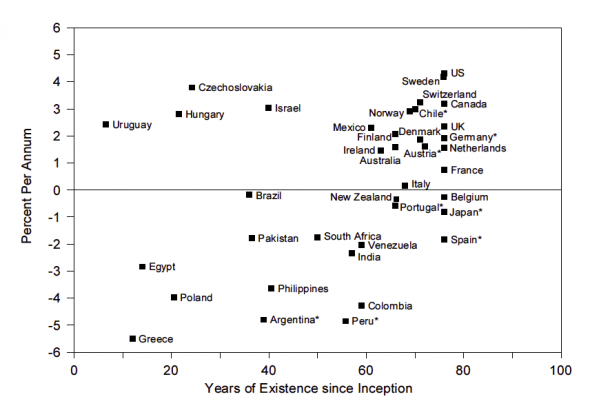

And as the data shows, US equities stand up to the task, with long-term returns that trump every other market:

The chart above plots long-term real (i.e. inflation-adjusted returns) across the world’s stock markets.

At c.4% over the past 80 years, US equities lead the pack.

Compounded over the long run, even minor reductions in returns make a massive difference to the value of your portfolio.

So while there is a case to be made for international diversification, it comes at a price. Are you ready to pay it?

Lower Costs

In addition to delivering higher returns, US equities are also cheaper to own.

Taking Vanguard as an example, the FTSE All-World ETF has an OCF of 0.22%. At the same time, the OCF for an S&P 500 ETF is only 0.07%.

Call me cheap but I’ll take a 0.15% reduction in fees any day of the year.

The good news is that the fee differential is shrinking with time. The bad news is that it’s still there.

As someone much smarter than me once said: “The returns come and go, but the fees are always there”.

Better Governance

No one is perfect and the next Enron could always be lurking just around the corner.

A lot of things are forgiven when a massive rising tide lifts all boats the way it has been recently.

That being said, US-listed companies are subject to much higher governance standards than those listed on other exchanges, particularly in the emerging markets.

Those of you old enough to remember BRICs remember the days when Brazil, Russia, India, and China were all the rage.

Two decades and more than a couple of scandals later, we know better.

As a stock market investor, you become a partial owner of the companies whose stock you own.

When the company stops acting in the interests of its shareholders, things usually don’t end well.

Just ask anyone unlucky enough to have invested in Petrobras or Gazprom.

Global Exposure

The usual argument for the world index is to secure exposure to as many economies as possible.

However, don’t overlook the fact that US companies, especially the biggest ones, already have a global presence.

For example, the S&P 500 constituents typically generate about 40 – 45% of their sales from foreign countries.

So even if your portfolio consists of 100% US equities, you will still get extensive global exposure.

Best Performing Companies Gravitate Towards The US

As an investment banker, I spend a lot of time with companies who are contemplating an IPO.

With very few exceptions, the most successful companies look to list on US stock exchanges.

The reasons for this are varied.

It’s the depth and liquidity of the markets. Ability to access a pool of experienced, sophisticated investors.

Or simply the prestige of being listed together with some of the world’s leading businesses.

This is why international companies like Alibaba, Spotify, Philip Morris, Lululemon, Shopify, and many others opted for a US listing.

Sometimes they also choose to list their stocks domestically (in what is known as a dual listing).

Still, make no mistake – the US stock market is the place to go if you want exposure to the best companies that are shaping the world.

Capital Trumps Labour

This is a contentious topic, but I’ll mention it anyway.

The two biggest factors of production are capital (provided by shareholders) and labour (provided by employees).

When it comes to capturing a piece of the value created by companies, US shareholders get a much better deal than employees.

I don’t want to get into a debate on the merits of things like two weeks of annual holiday, short maternity leaves, healthcare that’s tied to employment, and limited employment protections.

However, there’s no denying the fact that when employees work as hard as they do in the States, shareholders benefit.

FX Risk Is Overrated

One of the biggest reasons investors favour domestic equities has to do with FX risk.

The thinking usually goes like this: “If I invest in US stocks and the dollar depreciates vs. the pound, the value of my investments will decline”.

Sure it will – there’s no argument here.

But the bigger picture is that investing in lower-returning domestic equities can do much more damage to the value of your portfolio than FX ever will.

Let’s go back to the chart above.

Over the past 80 years, UK equities have underperformed the US by about 1.5% per year.

Forgoing 1.5% annual returns over a period of 30 years is equivalent to the US dollar depreciating from ~1.39 today to ~2.15 in 30 years.

Anything less than that, and you will have been better off in US equities.

Now don’t get me wrong – this has happened before and may well happen again.

However, if the GBP does appreciate this much by the time you retire, the following will also happen:

- You will continue to buy up US equities on the cheap as the USD depreciates, further boosting your returns

- You will benefit from a massive uplift in the value of your other UK assets (house value, cash holdings, etc.)

Bearing the above in mind, I’ll take my chances.

Worst case, I am more than happy to spend a few of my retirement years in the US until the exchange rates normalize.

More likely, I’ll be living it up somewhere nice and warm, taking advantage of the expensive pound.

Which brings me to my next and final point…

The Need To Hedge Existing UK Exposure

Whether we like it or not, but our exposure to the UK (or any other domestic market) goes way beyond our investment portfolio.

Our salaries, bonuses, and cost of living all depend on the success of this country.

Our job security is highly correlated with the UK economic cycle.

And the sterling-denominated values of our houses typically represent a sizeable component of our net worth.

Given the extent of the exposure, it is imperative to protect our finances against a UK economic downturn.

And when it comes to my family’s economic security, I can’t think of a better – or a simpler – way to hedge our fortunes than rebalance our portfolio to US stocks.

At the end of the day, you’ve got to come up with a sensible portfolio allocation that reflects your investment philosophy and objectives.

However, when it comes to long-term investing, every single basis point of returns makes a massive difference.

So before you dial back on US equity exposure, you need to make sure you are not leaving money on the table – all while getting nothing in return.

Have a good weekend – and happy (US) investing!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Pingback: More Important Than The Perfect Portfolio - It's Picking Something And Sticking With It - Financial Panther

This is an interesting article as you may remember I posted in the financial independence group that I was 100% us stocks. My only worry with the strategy was the currency risk. Your comparison with domestic investing is reassuring! Also to add to your point when the pound strengthens against the dollar the ftse 100 often falls so being 100% UK does not save you. As a UK investor wherever you invest there is always currency risk, the historical evidence suggest over the long run currency fluctuations cancel each other out. I like you will remain heavily invested in us equities

Neil, spot on – and yes I do recall that. We can pretend that currency risk doesn’t affect people only invested in the UK, but the reality is that it does. That’s why there was a FTSE rally post Brexit when the pound fell against the dollar, and the reverse is likely to happen at some point as you suggest.

I suppose there will always be a behavioural bias towards domestic stocks – people are naturally more comfortable with what they know.

Hello BOF, great article as always.

I have been pondering the mechanism of leveraged ETFs for some time (or using some form of leverage, borrowing to invest in general).

I came across SSO today which is an ETF tracking S&P 500 with 2x leverage. Essentially, buying $1000 of SSO is the same as buying $2000 of S&P 500.

Now, this is where my confusion starts. People shy away from leveraged investing in stocks but are comfortable leveraged investing in real estate because of 1 reason: margin call. Banks do not pull their loan on mortgage when the market crashes and homeowners have no equity left, but if an investor use 2x leverage on stocks in a CFD account, there wilk be a margin call to top up equity if market crashes 50%, forcing a fire sale if they cannot top up equity with outside cash.

But what about this leveraged ETF? The leverage is already embedded into the ETF so even in case the market crashes more than 50%, there won’t be any margin call, right?

The cost of leverage is very reasonable as well, SSO has an expense ratio of 0.9%, higher than 0.07% of Vanguard S&P 500, but this really just equates to 0.83% interest rate, isn’t it. Very cheap in my opinion.

The way I understand it right now, if I have $10,000 and I can borrow another $10,000 to invest in S&P 500 at 0.83% interest rate, and there will be no requirement for me to top up my equity if S&P 500 drops 60% tomorrow, I will take it. That’s basically what I think leveraged ETF like SSO allows me to do.

But is my understanding correct? It will be great to have a real finance professional like you to review it.

Thank you very much!!

You bring up a great point.

To make a long story short, you DO NOT want to invest in a leveraged ETF. They are not long-term investment vehicles due to something known as return decay.

Have a look at the article below for a good explanation – and stay away from them 🙂

https://www.investopedia.com/articles/financial-advisors/082515/why-leveraged-etfs-are-not-longterm-bet.asp

Great article BoF, i’m interested to know your thoughts on this compared to a global tracker. For instance, China is loosening it’s rules on capital markets and is encouraging growth in that area to, as always, compete with the US (but i could be wrong). Is it not wise to pound cost and invest now in a global tracker, which would involve US stocks, and presumably Chinese stocks at a low price compared to the future, then as China grows you would have bought them cheap as part of your global tracker. Then in ten or twenty years time, China’s stock market may have caught up somewhat with the size of the US stock market?

Thanks Chris.

Notwithstanding my preference for US equities, I think a global tracker is an excellent choice and should be the default choice.

The reason I am very bullish on US equities is that I think they are a great play on global GDP growth (in addition to all the other reasons in the post).

That being said, there could well be a long period in which European or emerging market equities outperform US stocks. A global tracker will give you balanced exposure.

What global tracker would you recommend Damian?

I have a lot of easy access savings I want to invest, but will need to take some out over time.

I intended to put most in an S & P 500 ETF, but am sitting back to see what happens with Biden/Tech/ taxes etc, to see if the market drops and I get a better entry point, or lose less due to this.

Who know whether it’s “priced in” already, I hate that expression, thrown around far too often without justification.

I remember time out of the market is proven to be negative whatever the circumstances, so should just get on with it!

Let me start with your last question about “getting on with it”. I think you may find the post below helpful:

https://bankeronfire.com/lump-sum-investing

You may not want to chuck everything in right now, but you may want to consider DCA’ing and starting to put money to work ASAP. As you correctly point out, sitting on cash is a suboptimal strategy.

As far as trackers go, I think either of the below will do a job just fine:

https://www.vanguardinvestor.co.uk/investments/vanguard-ftse-all-world-ucits-etf-usd-distributing?intcmpgn=equityglobal_ftseallworlducitsetf_fund_link

https://www.vanguardinvestor.co.uk/investments/vanguard-ftse-global-all-cap-index-fund-gbp-acc

Hope this helps!

Hi Damian, I’m enjoying the blog. It seems that most fire blogs are from people on more moderate incomes so your high earner perspective is a change, and somewhat more relevant to my situation.

On the US shares discussion I agree whole-heartedly with your point about capital vs labour. The US seems to be such a viciously capitalist society, even under the new administration. It is easy to be confident that over the long term, policy and culture will allow the value of businesses to grow and benefit investors, certainly compared to more left-leaning Europe.

I even mused about the ethics of investing in the US and whether I wanted to be part of businesses which benefit from such inequitable labour laws. Still debating that one.

For the record I am a UK resident, assets predominantly invested in US stocks and REITs, some world equities and an overweight to UK stocks (at least compared to the 7.1% on your graph).

Thanks for the comment Jo. Glad you are finding the blog helpful!

Yes, thinking very much aligned here.

My wife isn’t American but spent a few years working in the US for one of the Big 4 shops.

At the end of her stint, she told me she’d like her entire portfolio rebalanced towards US equities because she has never in her career seen employees working as hard, partially because of intrinsic motivation, but partially because of the fear of losing their job / health insurance.

I’m a big believer in the US economy over the long run, but it’s definitely one where employees get the shorter end of the stick.

Pingback: Saturday Linkage: – 39 Months

Love your blog. When I look at long term performance graphs of UK and US equities they seem to follow the same path till the mid to late 1990s and it is only since then that the US outperforms. However I do take your point, and as we longer actually make anything what you say makes sense. I have money going into investments regularly but have an amount sitting on the side waiting for the ‘market crash’ so I will now go and read your article on lump sum investing (perhaps a bit late in the day).

Thank you.

I’m actually not in the “chuck everything in ASAP” camp (as you’ll see in the article) but there’s a ton of merit of starting to deploy cash sooner rather than later.

Let us know how you get on!

I’ve had this discussion several times with UK, Canadian and Australian investors. Many of them claimed a tax advantage on how dividends and capital gains were treated for domestic shares. I’d still be nervous to have investments that don’t mirror capitalization.

Agree on both counts.

On taxes specifically I know that it used to be the case but I think the favourable treatment is slowly going away.

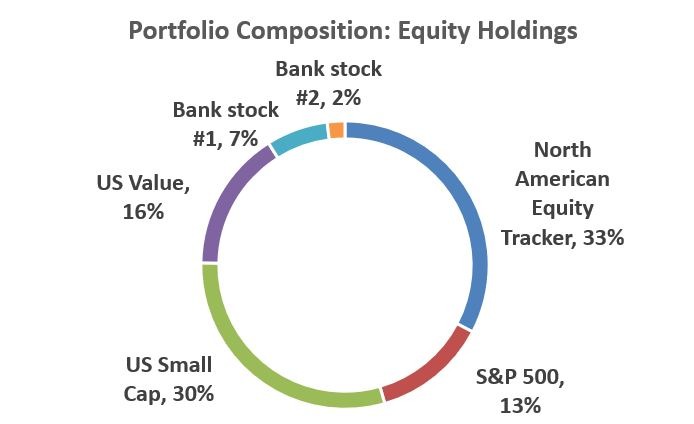

Hi BoF. Could you elaborate a little on which US small cap tracker you might recommend please ?

Many thanks

Sure. I use IJR stateside and ISP6 here in the UK.

Hope it helps!

Many thanks. I think I will use a split of ISP6 and R2SC for my US small cap exposure.

It’s a shame that capital DOES trump labor. Labor is the one who are actually providing the physical service. I would think that labor is way more important than capital but nope. The laws are designed to favor the one who hold capital rather than the one who are physically spending the hours it takes to produce goods and provide services.

I think I’ll stay at a 100% equity exposure rate for the rest of my life, no matter which stage of my life I’m in, ha.

Both are important. You need someone to build plants, design machinery, and invest in IP if you want the economy to prosper.

But there needs to be a balance. If returns on labour are decimated, the long-term outcome is suboptimal for everyone involved.

One other reason to invest in US – look at the DJ index – how many existed 50 years ago? Do the same for Europe.

Creative destruction is pretty much zero in Europe.

I never looked at the data that way but you are right.

Challenge is that while Europe does create great companies (Spotify a great example here), they often choose to list in the US.

That trend has been slowing down lately with the likes of Adyen and The Hut Group choosing to list here, but will be a long time until we reach critical mass.

Good Morning, apologies for tagging on this thread, but a quick question related to this. You mention that companies choose to list in the US, but looking, for example at the Vanguard US Equity Index Fund, which has over 3,700 stocks included within in, none of them are foreign companies? For example Spotify will not be included in the US index? Likewise the large chinese companies that are listed in the US? To have exposure to these companies, you still have to buy an index that tracks Europe, or China?

You are right, Spotify wouldn’t be included in the S&P 500 – but it would be in the Russell 1000 for example (if my memory serves me right)

Point I was making is slightly broader – many companies “migrate” to the US over time, moving their management teams and HQ stateside before ultimately listing there.

As a result, investing in US indices gives you access to higher quality opportunities.

Hi Damian,

I am wondering, where you say Inflation-adjusted in the returns example above, is it really applicable for investors who do not live in the country ? For Eg, If one lives in UK and invests in India, does the high-inflation rate in India really have an impact ? I can understand it having an impact in terms of living in the country – Goods become dearer et al. But from an investment perspective, is the impact owing to lesser money left over for Indians to invest ?

The analogy is the FIRE concept of earning/investing in a different country and then retiring to a different country. Personally you would be impacted on a day-to-day basis only by the inflation in the country of retirement while your investments in a different country could still prosper ?

For like-like comparison purposes, Inflation-adjusted real returns does make sense.

Hey Sundar,

The point is that the returns in this chart are local currency returns.

Thus, if your US investments return 10% but inflation is 5%, you still end up with a 5% real return.

There’s an additional currency risk if you live in a different country, but that’s specific to your individual circumstances.

Hope that makes sense!

Hi BoF

When you invest in America, do you full replication or synthetic ETFs. Do you think one type is better than the other.

Also, all ETFs have an ongoing charge. Could Berkshire Hathaway be a better option than a S&P 500 ETF.

Best wishes

Metro

I’m not sure to be honest. The one I use is VUAG in case that helps

Berkshire is a very different beast from the S&P 500

Pingback: Investing Without An Edge: The Stress Free Way To Invest