Earlier this month, I set out to cross off a few items on my 2021 money agenda.

As part of that (somewhat boring) exercise, I had to transfer roughly £150k from my wife’s workplace pension into Hargreaves Lansdown. Alongside Vanguard, Hargreaves is one of our go-to brokerages.

The move itself was simple enough.

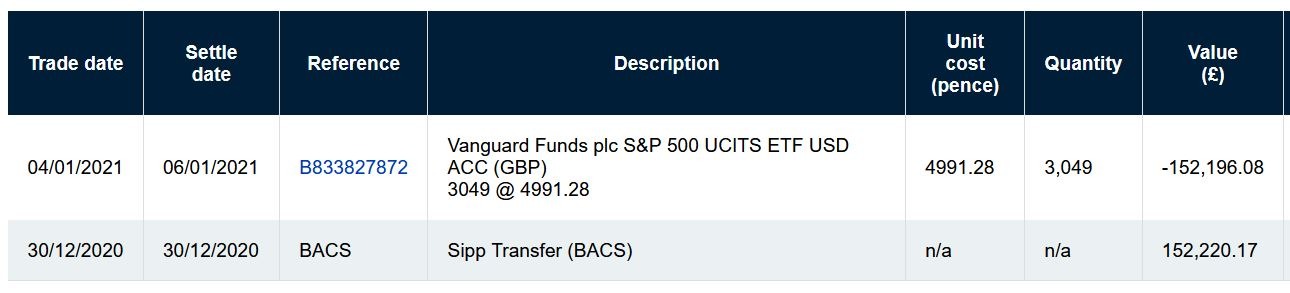

Fill out an online form. Wait a few days for the money to be transferred. Chuck it all into VUAG.

Prepare to save thousands of pounds.

In other words, this:

But as I hovered over the “Deal” button, I did catch myself hesitating, if just for a millisecond.

Should I really go all in? The market feels kind of frothy, doesn’t it?

Could it be better to slowly drip-feed all that cash instead of going all in?

Therein lies the inspiration for today’s post.

The Definitive Guide To Lump Sum Investing

The choice between lump sum investing (LSI) and dollar cost averaging (DCA) is one of the most frequent discussions in the personal finance community.

As such, there’s plenty of resources that will give you all the definitions and evidence you need to form an opinion.

No need to repeat things here. For what it’s worth, one of my personal favourites is this guide from the ever-excellent Nick Maggiulli.

If you have a few minutes, I recommend you read it. If you don’t – let me give you the punchline here:

Lump sum investing wins.

Hands down. No ifs and buts. Even if you adjusted for risk, asset classes, and valuations.

It makes total sense – given the market goes up over time, the sooner you get in, the better off you will be.

The evidence simply doesn’t lie – lump sum investing trumps DCA every single time.

Mathematically speaking.

But let’s pause for a moment as I ask you an unrelated, hypothetical question.

Where Theory Meets Reality

Assume I was going to offer you a game of Russian roulette.

For ease, let’s also assume the revolver we are going to use has 10 chambers, and I loaded up 9 of them with bullets.

You would clearly be nuts to accept an offer that has a 90% chance of you blowing your brains out.

As a matter of fact, that reasoning shouldn’t change regardless of how many bullets I remove from the revolver.

It’s just as bad of an idea if I leave only four bullets in, which gives you a 60% chance of “winning”. Should you play?

Hell no.

And even if the hypothetical revolver had a 100-chamber cylinder and just one bullet, you’d be well advised to stay away from this highly questionable bargain.

In other words, the risk of catastrophic loss clearly outweighs any potential upside I could possibly offer you.

Now, I am not drawing a parallel here between stock market investing and Russian roulette.

The reason this analogy is helpful, however, is because it clearly illustrates the way our lizard brain thinks about money and probabilities.

Sitting On The Sidelines

Assume you’ve come into a life-changing sum of money.

Empirical evidence suggests that the “right” thing to do is to invest all of it ASAP.

But as long as there is a non–zero chance of (temporarily) losing 40, 50, or even 60% of the capital in a market downturn, with possibly years to recover, is lump sum investing is the way to go?

You’ll have to answer that question for yourself. The answer will depend on things like the quantum of money involved, your risk appetite, preferences, and objectives.

What’s absolutely clear, however, is that being in the market beats not being in the market.

And if DCA is the way you dip your toes in the water, then so be it, all and any mathematical evidence be damned.

The alternative is to sit on the sidelines forever – because lump sum investing terrifies you.

In addition to dealing with sizeable chunks of money, here are a few other situations where DCA can be a way to get off the proverbial fence:

Perhaps you don’t know what you are doing. Not everyone has years and decades of investing experience.

If that’s the case, better to take things slow. Come up with a strategy. Put your money to work in 5-10% increments – and refine your approach along the way.

You might not maximize your gains – but you’re also unlikely to lose any sleep.

Alternatively, you may want to use tax-advantaged accounts.

Depending on the specifics, it might be worthwhile sitting on cash for just a bit longer – but shield your investment gains from taxes forever.

If you do end up going with DCA, you better remember to automate your investments.

Naturally, DCA outperforms in falling markets – which is exactly when you may be reluctant to top up your portfolio. Better to take the emotion out of the equation.

Going All In

Having said all of the above, let’s go back to the original premise of the article.

In case you feel like lump sum investing is the right way to go, but just can’t pull the trigger, it may be worthwhile asking the questions below:

Where was the money sitting previously?

In my situation, the money was already invested in equities. I simply cashed out the portfolio to transfer it to a new broker.

As such, I wasn’t really “lump-sum investing” it in the first place.

On the contrary, choosing to drip-feeding would be the equivalent of cashing out my portfolio.

Does the amount really move the needle?

Everyone will have a different answer here. That being said, 20% of your net worth can be a helpful reference point here.

Assume your net worth is £100k and you chuck £20k into equities in one go. The next day, the market declines by 50%.

As a result, your net worth is down by £10k, or 10%. Unpleasant, but far from terminal.

Are you really investing a “lump sum”?

For most of us, money events like inheritances, lottery winnings, and divorce settlements will be genuine one-offs.

Many others may feel like one-offs, but they actually aren’t. The best example here is an annual bonus.

The amount and timing might vary, but if you’ve been receiving one for years, it hardly qualifies as a true “lump sum”. If that’s the case, might as well chuck it all in and forget about it.

Squaring up theory with emotion is one of the biggest challenges in personal finance.

An answer that makes 100% sense mathematically can make zero sense emotionally. Fighting your lizard brain is rarely a good idea.

Instead, much better to strike a compromise and move on.

Your portfolio will thank you for it.

Happy investing!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

I realise that lump sum investing is better, but as you say, it can feel very scary. Because I have an unstable income, I have a small pot of ‘investing money’, which I draw from to top up my contributions in months I didn’t earn so much, or months in which I took a holiday. It would likely be better to just invest all this right now, but I prefer to even things out, just in case. Plus, it makes more sense with the tax-sheltered accounts such as ISA/LISA – if I have a bit of a buffer, I can max those out even in a bad earnings year.

Exactly. Much better to do something that’s suboptimal from a theoretical finance perspective but actually works from a practical standpoint.

The issue I have with theoretical advice is that it often leads to people staying out of the market for far too long.

Currently looking to sell £16k of SMT from a H&L Stocks account (Transferred when BG closed its own offering) to then buy the same stock in an X-O ISA at the start of next tax year. SMT was my first ever monthly investment, not in a tax shelter, I was still learning.

I’ve been a Pound Cost Averaging guy up to now. But this will change my approach. Filling up £16k of next years ISA allowance in one go will only let me save the remaining £4K into my lifetime ISA (£333.33 a month through HL). This means any excess funds, rather than going as a monthly payment into my Vanguard ISA will have to be saved up as cash an then deposited into the Vanguard ISA at the start of the 2022 tax year. Feels strange moving from the safety of monthly investments but at the same time it needs to be done in order to get my investments into a tax free environment as i’ve just hit the 40K mark with my total investments to date and £12k of that is in none tax sheltered work share schemes. Only £10.5K is currently in an ISA or LISA and I need to change that which means a change in approach.

I do something very similar – fill up all tax-advantaged accounts in April and know I’m done for the tax year.

Even after years of dropping £40k (for me and my wife) in equities in one go, it still feels a bit unnatural. Was even more so last year when the market had just collapsed.

Tough to fight the lizard brain…

I do this, in a sense this is DCA it’s just that your frequency is annual, as opposed to monthly etc.

Agreed – that’s a good way of looking at it actually.

When I was pulling together my wife’s workplace pensions last year into a Vanguard SIPP, I did it in smaller batches due to time-out-of-the-market risk.

Given markets are meant to rise more than they fall, I thought it prudent to try to take the average and only lose a bit of money in the transfer.

In the end, I think we “won” more than we “lost” with the time out of the market.

Interesting. I didn’t do the math but given how the market has performed recently, I may have missed out on a couple of good days.

That being said, HL was quite quick in processing the request.

Surely one would invest according to risk appetite, say 70% VUAG 30% VAGS.

Yes – but for most people it’s still very hard to chuck a meaningful amount (let’s say 40%+ of your net worth) into VUAG in one go.

A timely post as I’m in the process of transferring a SIPP (though far less than £150k!).

Of course, lump sum investing wins but I’ve only ever invested monthly and I’m not sure I will sleep easy whacking the whole lot on investments in one go.

So I’m just going to invest in smaller batches, which in my mind is better than waiting on the sidelines for the ‘right’ opportunity.

The way I got comfortable with it is reminding myself that the money was already in the market in my wife’s workplace SIPP.

Thus, I wasn’t really lump-sum investing, I was just putting the cash back where it came from in the first place!

Otherwise you are essentially cashing out – only to DCA back in.

I hear what you’re saying – now my ears need to convince my brain! 😀

Assuming we’re going for a lump sum trade… would investing £150k into a liquid, large fund-size ETF like VWRL in a single online trade on your retail platform get the best possible price (not withstanding Best Execution rules) ? Let’s say you’re limited to ‘At Best’ rather than a limit order too. Is there any way to access the primary market directly with this size of trade?

I’ve done lump sum investing twice in my life. 1 an inheritance of about 47k in December I think it was 2017? When the markets tanked about 15% almost immediately. The other with a retention bonus of about 27k in February 2020 lol. My timing is impeccable

My rationale was helped in both cases by a high savings rate which also incidentally helped me continue to invest monthly. The ‘lost’ money would be made up in less than 2 years

I’ve found my appetite for risk has increased with the increase in my networth. That 40k was a little over 10%. The 27k less than 5% Like you say if it had been 50% I’m not sure I would have been quite so sanguine but I’d like to think I would

Hah yes I remember that December – think it was 2018 if I’m not mistaken. We’ve barely touched bear market territory but it was an uncomfortable few weeks!

Good thing you are well above your in price on both investments.

I think for that size of trade, the cost of accessing the primary market would outweigh the advantages of getting a marginally lower bid-ask spread.

As you say, funds like VWRL have tons of liquidity so doubt the broker is skimming much off the top there (though I supppose depends on the broker too).

I resonate with this article completely.

I used DCA (or pound cost!) to drop in my DB lump sum into a SIPP. I rationalised, like your article, that lump sum investing was theoretically the best way forward… however…

I could not justify at the start of that process the threat of losing a large proportion of my capital in one go. Emotionally I wouldn’t have coped with the ‘loss’ so dripped it in to inoculate myself against market fluctuations, get comfortable with the movements and let my appetite to risk ‘mature’ as such.

Pleased to say this worked for me over a period of 12-18 months. My lizard brain and fear of risk won initially but I battled through it

Great site, incredibly informative – well done

Thanks for the kind words David.

This is exactly it. You are dealing with life-changing amounts of money. Yes, the theory is great, but… at the end of the day theory won’t help you sleep at night, will it?

So if it takes DCA’ing to get ourselves over the hump, then so be it – even if there is some opportunity cost in terms of forgone upside.

Pingback: Wednesday Reads: Just the links - Dr FIRE

I dont think this issue is quite as straightforward as is made out. It being better to invest a lump sum as opposed to DCA relies on the market rising in that future period. Yes history tells us that the future is very likely to follow the past but to say this means that an individual will be better off investing say a lump sum from say a pension transfer in one go as opposed to say making 12 monthly DCA purchases over a year is a logical error of applying the statistics of the many to an individual situation. Granted history tells us it’s probably better because most years the market rises, but in any one year theres a decent probability that the DCA would have been better. It’s all in the average price of the units you buy and you wont know which would have been best until hindsight tells you. The lizard brain some mention isn’t completely daft 🙂

No, it’s not. The lizard brain is the reason why we’ve survived for so long 🙂

You are spot on – it’s all fine and dandy that things have a high probability of working out in our favour. But if there’s a non-zero risk of a catastrophic outcome, that changes the equation completely, which is why our instincts kick in.

Lots of interesting chatter, but surely what you are really doing (as you acknowledge above) is a transfer. The only real issue I can see with this is to minimise time out of the market.

This risk (which could be either -ve or +ve) can/could be [partially] ameliorated if you had some cash (£150k?) to hand and used it to time your buy to coincide with your sell. Then, in due course, use the sell proceeds to replenish the cash holdings.

Indeed. It’s how I move assets from GIA to ISA each year. Challenging to do that within a pension wrapper, however.

@Alistair @Genghis

Correct on both points. What I find fascinating (and what ultimately inspired the post) is that even though I knew I wasn’t really “investing”, I still had to fight the urge to DCA as opposed to lump sum.

As ever, the real challenge isn’t about figuring out what’s the right thing to do – it’s about forcing yourself to act on it while that monkey brain continues to scream and shout.

@Hopeful Firer, good point.

It’s also worth reminding ourselves that the probability of positive returns over a long term time horizon (ie. one or more decades) varies across markets. Both the US and UK markets have been enormously lucky in that respect. Contrast that to some countries that have witnessed one or more permanent losses of capital – good summary here: https://klementoninvesting.substack.com/p/stocks-in-the-long-run-are-still

Great point. There’s an excellent chart at the link below that shows how many countries have posted a negative real return over the long run:

https://bankeronfire.com/the-case-for-a-100-us-equity-portfolio

For what it’s worth, the only way to avoid this outcome is to load up on that world tracker.