Ask anyone who is worth their investing salt and they will be unequivocal about it:

The stock market is the most amazing money machine that has ever been invented.

No, it’s not intuitive or straightforward.

And in the short run, it certainly feels like it has no rhyme or reason.

Thus, it’s very easy to hate the stock market.

But whatever the shortcomings, it’s easy to forgive them when you are staring at results like these:

That being said, we are arguably in one of the weirdest (and wildest) market environments of all time – and it doesn’t just have to do with equities.

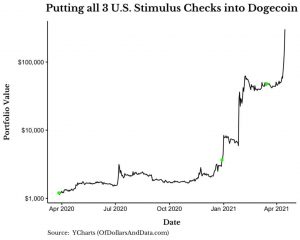

A joke crypto coin now has a larger market cap than Ford, Kraft Heinz, and possibly even Twitter.

Other cryptocurrencies, NFTs, and nearly defunct video game retailers are seeing similar price gains.

There’s apparently even a New Jersey deli that does $35k in sales and is valued at over $100m.

In an environment where everything has gone bonkers, just what is a rational investor supposed to do?

To be perfectly honest, I don’t know – and no one else does either.

In fact, anyone who tells you they’ve got a proven strategy to succeed in today’s market is lying (and probably has something they want to sell you).

However, that doesn’t mean you should throw in the towel. Far from it.

Instead, it’s worth reminding yourself of the number one rule of making money:

Not losing money in the first place.

When it comes to surviving today’s market conditions, knowing what not to do isn’t as good as having a crystal ball.

But short of pretending we live in a fairy tale, it’s the best thing we’ve got.

In today’s post, let’s cover off the biggest mistakes you need to avoid in order to survive the ongoing market frenzy.

Investor Mistake #1: Going All In On Speculative Assets

One of the biggest challenges in today’s market is simply keeping your cool.

It’s beyond frustrating to watch people much younger / dumber / lazier (sometimes all three combined!) than you, getting rich seemingly overnight.

All while you are (seemingly) standing still.

Now, there’s nothing wrong with taking a small (think 5%, maximum 10%) portion of your portfolio and plonking it down into one of these YOLO investments.

But the last thing you want to do is bet the farm here – because while no one knows when the party will end, everyone knows it will end.

When it happens, you don’t want to be the one holding the proverbial bag.

Warren Buffett once said:

“Never risk what you have and need for what you don’t have and don’t need”

So if you’ve got some play money you can afford to lose, by all means – go wild.

If things work out well, you might well be sitting on 10x gains in 12 months. And if they don’t – no real harm done.

But whatever you do, protect the downside.

Investor Mistake #2: Not Cashing In

They say it’s not a loss until you sold.

Well, guess what – it’s not a gain until you’ve sold either.

Assuming you have decided to take some high-risk gambles, you should think hard and long about your de-risking strategy.

Sure, you want to let your winners ride – but that’s for investing, not speculating on today’s equivalent of beanie babies.

If your speculative investment doubles in price, it’s not a bad idea to sell 50% of it, meaning you’ve at least broken even.

You can then let the “house money” ride – and cash in along the way.

Investor Mistake #3: Projecting Past Into The Future

Thanks to the recency bias, we have a tendency to expect that things that have just happened will continue happening going forward.

Sadly, capital markets don’t function that way.

No, a couple of great years in the market don’t necessarily imply that a crash is imminent.

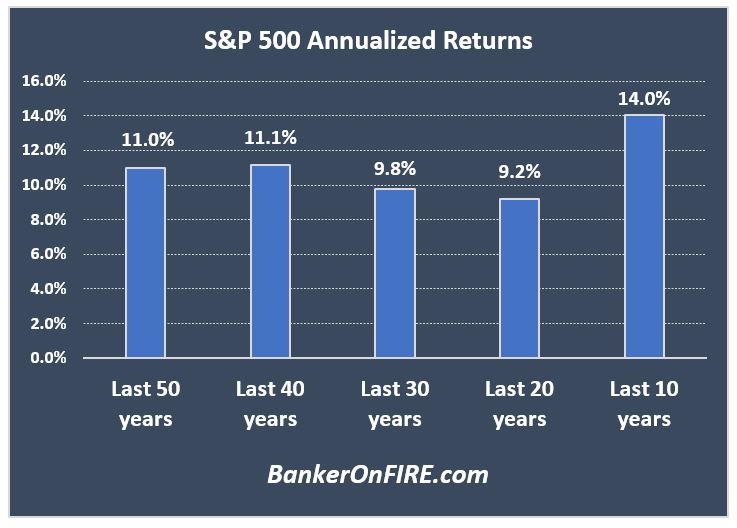

It is true, however, that over the long run, the stock market typically delivers nominal returns of 8-10% per year.

There are periods when earnings rise rapidly. Sometimes, that growth in earnings is accompanied by multiple expansion, which really turbocharges market returns.

Which is kind of what’s been happening over the past few years.

However, there are also periods when the stock market stagnates for years as companies “grow into” their earnings and multiples.

The decade starting in 1999 was one such stretch – and it arguably became one of the worst decades on record for US investors.

The good news is that there are proven strategies to offset such periods of below-average market returns – as long as you are prepared to act on them.

But whatever you do, don’t assume the good times will roll forever.

They won’t.

Investor Mistake #4: Confusing A Bull Market With Brains

In a bull market, everyone’s a genius.

It’s always fun to see someone two years out of community college strike it rich on Ethereum and quit their job to become a “crypto advisor” because they feel so confident in their investing prowess.

The thing about investing prowess, though, is that it’s proven over years and decades, not a couple of months in a frenzied market.

If you don’t believe me, just ask this guy.

Investor Mistake #5: Lifestyle Inflation

This one has less to do with investing and more with how you use the investing proceeds – but that doesn’t make it any less dangerous.

Sitting on some solid paper gains has a funny way of getting the imagination going.

“That Porsche sure looks nice”

“I could totally afford that designer bag now”

“Might as well fly business next time”

The thing is, if your investments have done well, you can certainly afford these things.

There are two issues here though.

First, you need to make sure you’ve actually cashed out enough of those investments to pay for whatever it is you want to buy, instead of buying it on credit (“I’d be crazy to sell my Tesla shares now!”).

That way, you won’t end up with a bunch of devalued investments AND a massive car loan hanging over your head.

Equally important, you don’t want to assume that the good times will last forever.

It’s one thing to take a dream, once-in-a-lifetime holiday. Quite another to sign up for a $2m mortgage assuming you can finance it by selling NFTs into eternity.

Investor Mistake #6: Running Out Of Liquidity

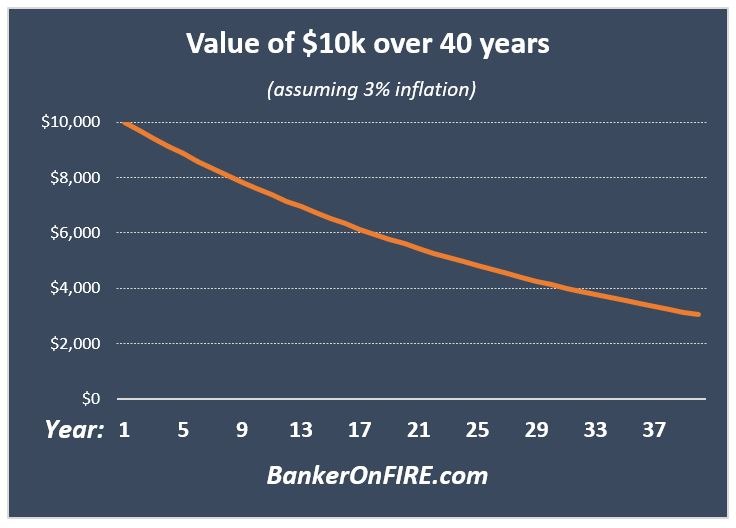

Cash is dead. Why would you want it sitting in your bank account, losing value by the day?

If there’s one thing I do enough on this blog it is to warn readers about the danger of inflation:

There is a flip side to this coin though.

While you never want to hold too much cash, it is critical you’ve got a sufficient cash buffer to help you survive as an investor.

As Morgan Housel puts it in the Psychology of Money, the real return on cash isn’t the 0% interest you get on it in the bank account.

Instead, the real return on cash is the fact that it allows you to avoid a fire sale of your investments – and ultimately generate those long-term returns that look so easy in hindsight.

Which brings me to the biggest investing mistake of them all:

Investor Mistake #7: Not Investing At All

I get it, it’s a silly market.

The last time we’ve had this kind of frenzy was in the late 90s.

I was still in my teens, but I do recall watching people around me literally betting the house on single-name stocks.

For the vast majority, it didn’t end well.

But as long as you don’t confuse short-term speculation with long-term investing, this is as good a time to start investing as ever.

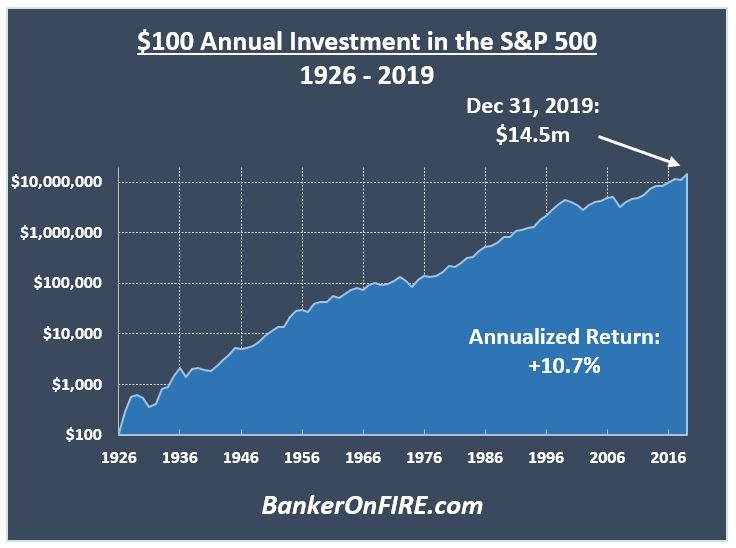

Whenever I worry about investment returns going forward, I like to look at this chart:

So don’t let the noise and frenzy distract you.

Continue spending less than you make.

Invest the difference.

Prosper.

Happy investing!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Well written article (as usual), highlights again that simplicity and process often trumps complexity

Thanks Magoo.

It’s easy to stick to systems and processes in a “normal” environment.

Where they usually break down is either in times of crisis (i.e. March 2020) or excessive exuberance (i.e. now)

Very timely and wise reminders. Thank you 🙂

Cheers.

All about keeping your eyes on the goal.

Thanks for another great article.

Whilst my ‘grown-up money’ (e.g. pensions) sits in index trackers, I’m a fan of gambling small amounts on speculative positions, all the better if they’re really volatile (it’s MVIS at the moment). I think of it as a hobby rather than investing, and the amounts in question wouldn’t impact my lifestyle if I lost it all.

My main takeaway though is just how much price movement can’t be rationally explained, there seems to be a significant amount of market ‘manipulation’ going on, certainly enough to ensure that I’m too scared to ever transfer my ‘grown up money’ out of their diversified positions!

Thanks Rob.

I think the current market environment provides lots of fertile soil for all sorts of dodgy behaviour.

People tend to become quite gullible when there is lots of money being made – and quite a bit of it sloshing around in the system.

As you say, no need to be scared of investing, and no harm playing with some “fun” money, as long as folks don’t get carried away.

I would also add, paying a Financial Advisor high fees that eat into your returns over time.

Yes, though that clearly applies at all times, not just in today’s feeding frenzy 🙂

Pingback: Thursday’s Top Three (TTT #001) – Money Savvy Ladies

Good article.

I think it’s absolutely vital as a passive investor to accept upfront that some people will outperform you by luck or ill-advised judgement. But you have to remember that these people are a tiny minority and you are just witnessing survivorship bias.

A huge advantage of passive investing which is rarely talked about is the almost zero cognitive and emotional load on you as an individual or family. You aren’t constantly worrying about whether to sell, whether you should hold, have I done enough research etc. It’s easy to explain to your partner what you are doing and it’s easy to formulate a strategy.

Investment mistake #8 – Letting movements in the stock market or individual companies affect your mood. If this is happening, you’re overexposed and not comfortable with the level of risk. You need to turn it down so it’s not affecting the rest of your life

I’ve been blogging for over two years now and I couldn’t have said it better.

It’s like riding a rollercoaster – but worrying all the time because this ride has a very high likelihood of NOT ending well.

And now you’ve taken your entire family along for the ride as well…

Pingback: The FIRE Insights Blogger Survey #1