What always suprises me about propety investments is how many people put significant chunks of their net worth into real estate without having a fundamental understanding of real estate investing. Sure, you can sometimes get lucky and make money. After all, many people got rich on Bitcoin without a first idea of how cryptocurrencies really work. However, failing to grasp the key concepts of any investment you are making is likely to end badly. If you are lucky, you’ll get away with suboptimal returns on your investments. For those less fortunate, it can be a path to financial ruin.

One of the key objectives of BankerOnFire is to help my readers build wealth faster. That’s why I decided to take the time to outline the two most important factors that will determine whether you will make or lose money on your real estate investments. Not only it will help you avoid money-losing investments but it will also enable you to screen real estate opportunities much faster and filter out the ones not worth pursuing. But first, let’s cover off some fundamental concepts.

Debt Versus Equity Investment

The one key concept everyone needs to understand is the difference between debt and equity investments. This should be intuitive for everyone, but in case it is not, here it is: when you buy a property, you are the equity investor. You contribute the down payment and your bank / credit union / private lender / neighbourhood loan shark contributes the balance of cash required to purchase the property. That makes them the debt investor. So far, so good.

The bit that some people fail to grasp is the fact that equity investors need to receive a higher return on their investment than debt investors. The reason for it is that debt investors take on less risk than equity investors, such as:

- Mortgage interest is paid to debt investors before equity investors can get their hands on any cash

- If the property declines in value and the equity investor goes bust, the debt investors can take posession of the property and sell it to recover their investment. Assuming the percentage decline in property is less than the down payment (in percentage terms), the debt investor will not lose money

- Debt investments do not require any work once the loan has been originated. Equity investors are responsible for managing the property, finding tenants, repairs etc.

Now, onto the good stuff.

Important note: For simplicity, I assume no transaction fees and taxes in the examples below. I am also using an example with an interest only mortgage to keep things simple. The concepts discussed would still hold if you were to reflect fees, taxes and capital repayment in the analysis.

The Importance Of Leverage

The number one concept to understand in real estate investment is how leverage, when used wisely, amplifies your returns. Please note the caveat – you should never, ever, overextend yourself so that you are risking foreclosure. At the same time, you should absolutely take advantage of leverage as a way to amplify your real estate returns.

Example: Investment Property With A 10% Cash Yield And No Appreciation

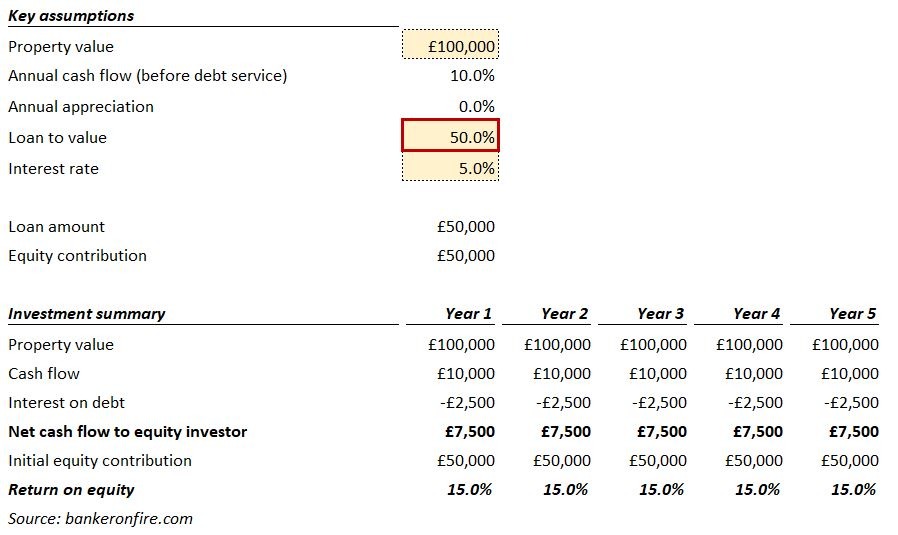

Assume you find a property that costs £100,000, generates a cash flow of £10,000 per year and does not appreciate in price. Also assume you can find a lender who is willing to give you an interest-only, 50% LTV mortgage on it at a 5% interest rate.

Below is a simple summary of the returns this property would yield to you, the equity investor.

Scenario 1: Acquire property with 50% LTV mortgage

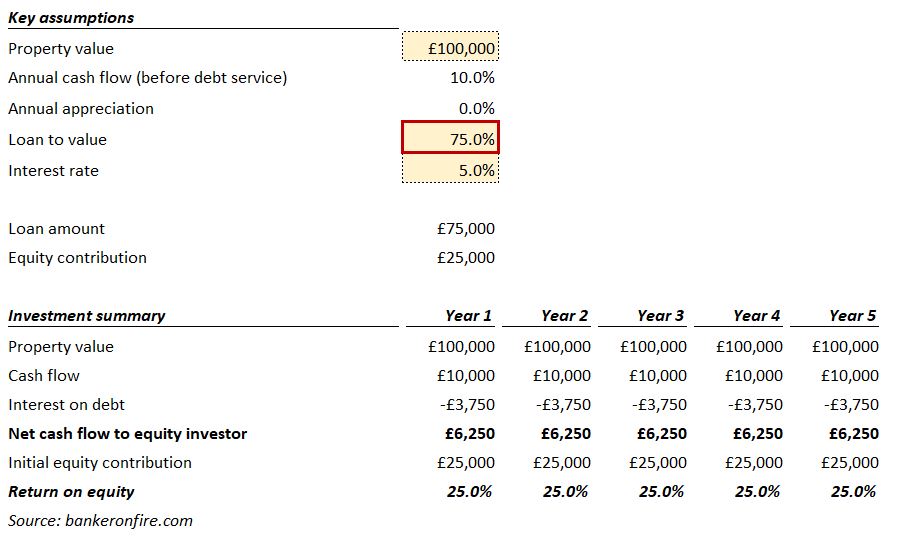

Scenario 2: Acquire property with 75% LTV mortgage

But what if you could convince your bank to give you a 75% mortgage? It shouldn’t come as a surprise that your net cash flow would decline to £6,250 per year – after all, you have a bigger mortgage and therefore your interest payments are higher.

That being said, you only had to put £25,000 of equity down, so the £6,250 represents a 25% return on your investment. Put another way, if you had £50,000 to invest, you could buy two of these properties and make £12,500 per year as opposed to just £7,500 in the example above. So far so good?

Maybe. While you are likely to be able to secure a mortgage with an LTV of at least 50%+, sometimes the lenders aren’t as forthcoming. What happens then?

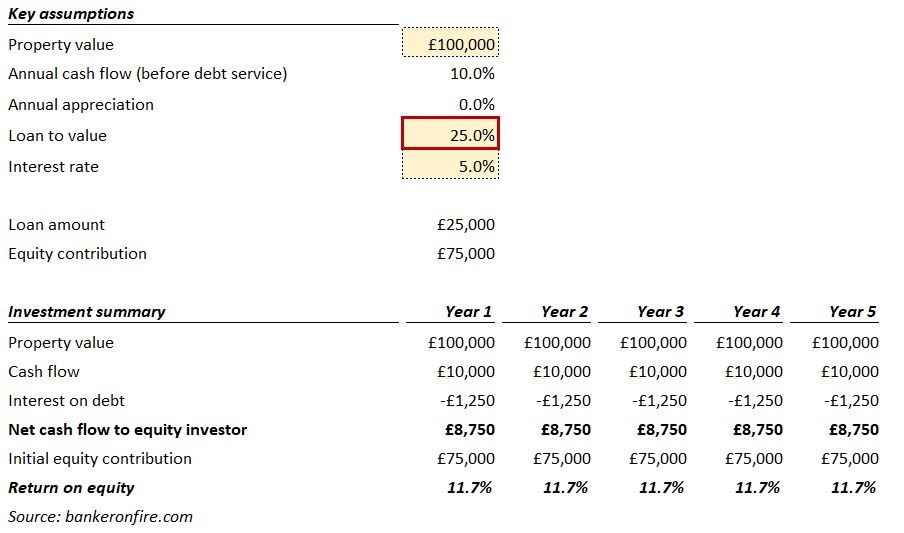

Scenario 3: Acquire property with 25% LTV mortgage

Example below illustrates what happens if you only get a 25% LTV mortgage. Your net cash flow goes up to £8,750 but because you had to put £75,000 down, it works out to a return of only 11.7%. Not so great after all as you are now making 3.3% less per year than in a 50% LTV scenario.

This brings us to real estate invesment rule number 1: Leverage, when used appropriately, can have an outsized impact on your returns. When looking at properties to invest in, you should always consider their LTV potential.

The Importance Of Cash Yield

It goes without saying that if you buy the wrong property, you will lose money irrespective of the LTV your bank may extend. So how can you tell whether a given property can make you, the equity investor, money? And is there a simple way to be able to tell how much money the property will make you? The answer to both of these questions is yes. All you need to do is follow the steps below.

- Calculate the cash yield on the investment (before any mortgage principal and interest payments). The way to do this is to take total rental income, subtract all of your expenses and divide the residual number by the property value. In the examples above, the cash yield on the property was 10%.

- Compare the cash yield to the interest rate you will likely have to pay on the mortgage. Once again, in the examples above, the interest rate we assumed was 5%, which means the cash yield was 5% above the interest rate.

- If the cash yield is above the interest rate, you will make money. If not, ignore the property and move on. Unsurprisingly, our analysis above had us making money!

What it boils down to is the fact that the 10% cash yield of the property has to be divided between the debt investor (i.e. the bank) and the equity investor (i.e. yourself). Because the debt investors get paid first, the equity investors get what’s left over. If the debt investor doesn’t get to keep all of the cash the property is generating, you will make money. But if they take a disproportionate amount, you will lose.

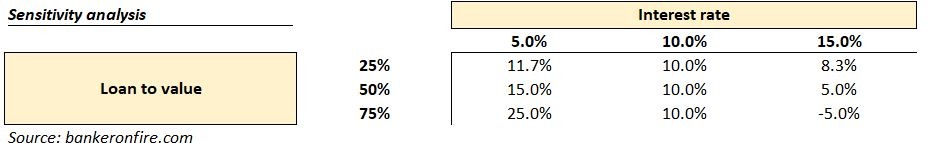

Take a look at the table below for an illustration of how the equity investor returns are impacted by the LTV and the interest rate on debt:

The first column recaps the examples above. Because your cash yield of 10% is higher than the 5% interest rate, you get to make money.

In the second column, the cash yield is equal to the interest rate. You still make money, but you only make as much as the debt investor. As summarized above, you should always look to make a higher return than your lender, therefore you should not be investing on these terms.

The third column is most striking. It assumes that your debt cost is 5% higher than your cash yield. Unsurprisingly, you are now in a situation where you make less money than the lender – and are even losing money in a high LTV scenario. If you see this situation on the horizon, walk away as fast as you can.

There you have it – you are now armed with the two most important concepts in real estate investing! In future posts, I will explore situations where you have price appreciation on top of the cash yield. For now, feel free to download the spreadsheet here. Play around with the assumptions to get a better understanding of the concepts.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com