This year has not been an easy one for investors.

In fact, I would argue that we have already exceeded the threshold of pain experienced during March 2020.

Back then, it was a heart-wrenching drop followed by a lightning-quick recovery.

And while I wouldn’t yet compare this year’s market performance to a death by a thousand cuts, I can also understand how the relentless downward churn is wearing people out:

Counting Your Losses

Let’s make one thing very clear:

If you are trying to build wealth and yet you haven’t lost money over the past few months, you are doing it wrong.

Bonds are down. Stocks are down.

And whether you like it or not, the true value of real estate is also down, courtesy of rising interest rates.

It may take some time for the sellers to adjust their pricing, but it will happen – and is already happening in places like Canada.

And so, if you haven’t lost money, that means one of the following things:

- You are sitting in cash (not a good idea)

- You are concentrated in one particular sector like energy (never a good idea)

- You have your wealth tied up in a well-performing private business or an esoteric investment (not applicable to most people)

If you find yourself in one of the first two categories above, feel free to pat yourself on the back.

And then, please go out and build yourself a real portfolio – because you probably certainly won’t get as lucky next time.

Mental Adjustments

Here’s the most important thing you’ve got to remember about the equity markets:

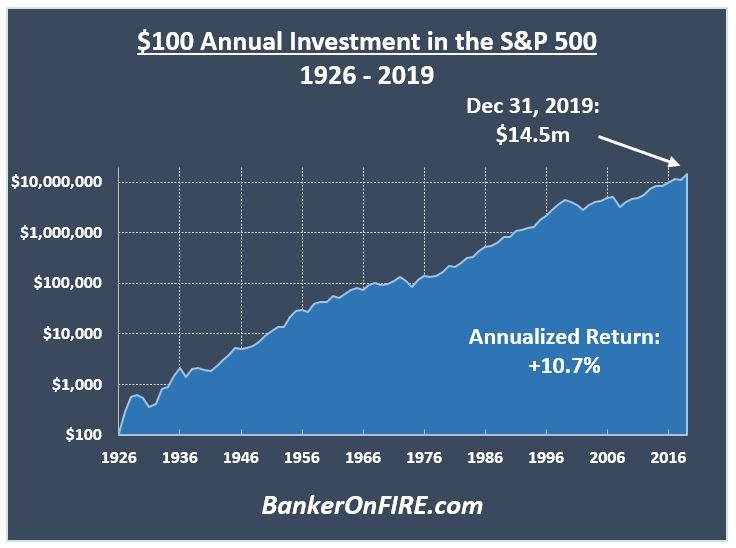

Market volatility is a feature, not a bug. It is the very reason we get those 10%+ long term returns in the first place:

In other words, investors demand a 10% return to compensate them for that heart-wrenching volatility every once in a while.

If there was no volatility, everyone would get 2% annualized and go home. Have fun staying poor trying to retire on that!

So in a very perverted way, every time someone capitulates and sells in a downturn, their loss is your gain – as long as you remain a net buyer.

Keep that in mind next time you see some red on your stock app – and stay the course.

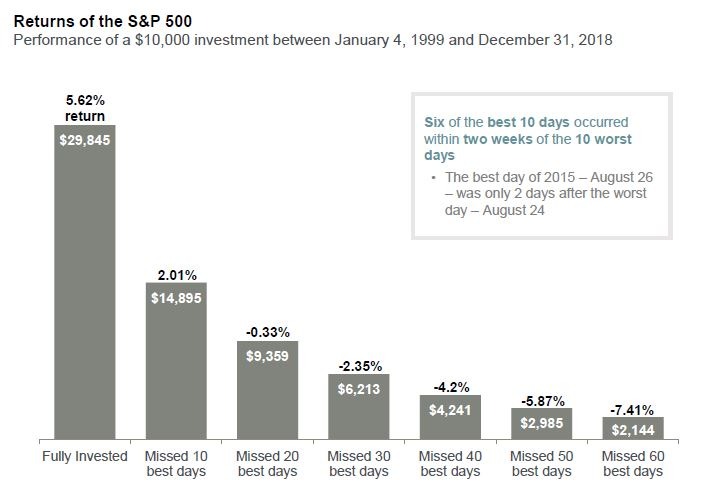

In fact, the ONLY adjustment you should consider making right now is tweaking your risk exposure if you feel the volatility is getting too much to bear.

The data is clear: it is much, much better to own a lower-risk, lower-return portfolio for the next 40 years than to go 100% equities but capitulate every time the market wobbles on you.

And once you are done with that rebalancing, just let go.

Let the market do its thing, and you keep doing yours – which is continuing those regular, automatic contributions to your brokerage account.

As always, the more you can contribute, the better off you will be.

Speaking of which…

Delivering Alpha

The one observation that held true over my 10+ years in investment banking is that times of market turmoil are actually the best times for professional outperformance.

Think about it. When everything is going well, it’s business as usual.

Everyone sticks to their plans, strategies, and yes, advisory line-ups. If it isn’t broken, why fix it?

But that math changes drastically once people feel the sands shifting below their feet.

All of sudden, businesses need new playbooks to adjust to the new economic realities. And in that context, executives become much more open-minded, presenting an opportunity for employees and external advisors alike.

This is why, every single time the markets wobble, there’s a battle cry going out across all the investment banks:

“GET IN FRONT OF YOUR CLIENTS”

This newly inflationary world we are living in is no exception – and you don’t need to be a banker to take advantage of the disruption.

Check your company’s strategy decks. Dial into the earnings call. Actually listen in during the next townhall instead of multitasking or scrolling through social media on your phone.

Then, go out and do the same for your competitors if you can.

Speak to your contacts in the sector, ask a friendly banker or consultant to send you a few good industry reports (we always have those lying around).

If you are working at a privately funded start-up, try and speak to a few investors in the space (as an aside, they would be EXTREMELY interested in talking to you as well).

It’s basic stuff, but the reality is that barely anyone out there actually does it. Which is why those who do put in the effort automatically end up miles ahead of their peers.

Then, once you have a decent grasp of your company’s new strategy, put it to work.

Understand the implications for your division and department. Try and figure out the biggest pain points for your manager (or ideally, your manager’s manager).

Heck, you could even ask them what their biggest priorities are in this new environment. At worst, you’ll get some incremental face time.

At best, you’ll come across as a strategic thinker who stays on top of latest developments and can help them move the business forward.

And once you’ve figured out what keeps your managers up at night, try your best to fix their problems.

No, you don’t need to do this all on your own. But helping drive a big strategic project can and will give you loads of attention and internal visibility – in perfect time for the upcoming performance review.#

Combine that with the red-hot job market and an intense war for talent, and you are suddenly in the driver’s seat when it comes to negotiating a proper pay increase.

At the end of the day, there are only three levers you can pull to succeed as an investor.

One is to maximize risk-adjusted returns, which you accomplish by investing in low-cost, diversified index funds.

The other one is to maximize your investing horizon. As long as you are already investing, this is kind of out of your hands.

The last, and most important one, is to maximize your contributions. And as it happens, this is where you’ve got the biggest ability to move the needle – especially in today’s environment.

Don’t squander it.

Thank you for reading – and good luck!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Pingback: Weekend reading: a fairy tale ending - Monevator

Pingback: The Sunday Best (05/29/2022) - Physician on FIRE