The period between 1999 and 2009 will likely go down as the “decade of pain” for US large-cap investors.

The S&P 500 followed the roaring 90s with a nasty, -2% annualized return over the subsequent ten years.

And yes, that does include reinvestment of dividends.

Source: Patton Funds

Now, what I usually remind readers of this blog is that very few people would see their portfolios perform in the same way as the line chart above.

That’s because few folks would make a lump sum investment and forget about it.

In reality, most investors put their money to work regularly, with every paycheck. One would also hope that the quantum of those investments goes up over time.

However, even that highly disciplined approach wouldn’t save the day here.

The Unluckiest Investor In The World

Last year, I spent a fair bit of time exploring the real path to wealth (hint – it’s certainly not linear).

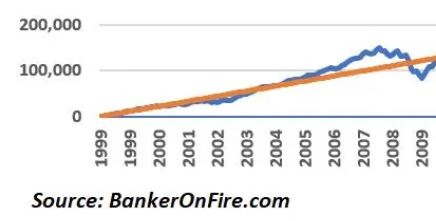

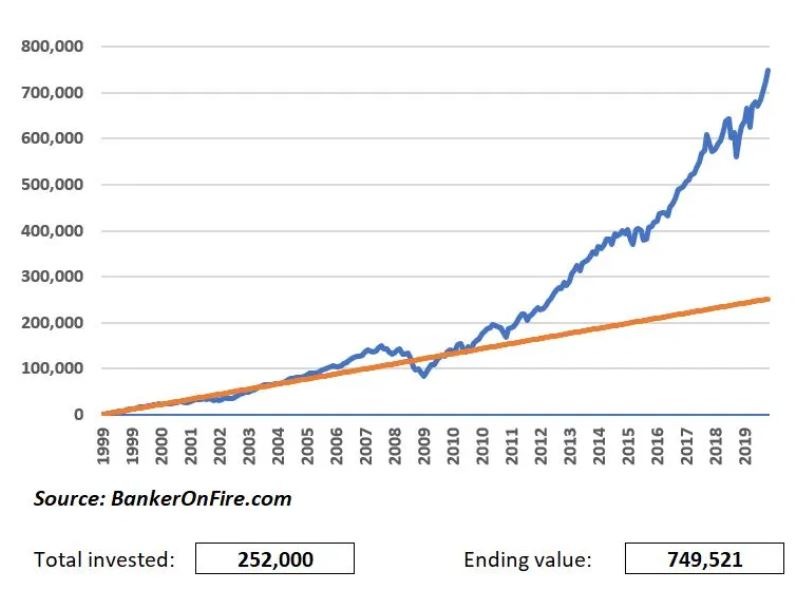

As part of it, I explored the case study on Sam, an investor who was unlucky enough to start his journey in 1999.

Have a look at those trials and tribulations:

The orange line denotes total cumulative contributions. The blue line – the actual value of the portfolio.

To state the blindingly obvious, having the blue line below the orange line is bad news.

What it means is that even Sam, possibly the best-behaved investor in the universe, had seen his portfolio decline below the value of his contributions.

Talk about tough luck.

Now, I have no idea whether we are in for another “lost” decade, either now or in the future.

That being said, I thought it might be interesting to brainstorm on various ways to hedge our portfolios against yet another painful experience of this magnitude.

Zooming Out

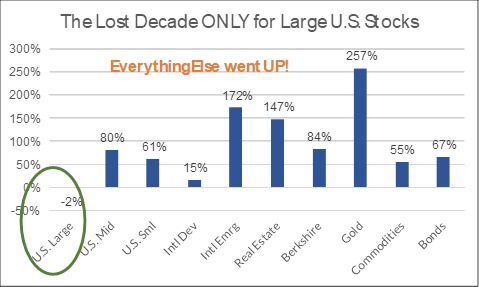

As it turns out, not everything was rotten in the kingdom of Demark stock markets in the noughties.

In fact, both mid-cap and small-cap stocks did quite well.

Ditto for emerging markets and real estate.

And the same applies to gold – notwithstanding what both me and the best investor in the world think about it.

Source: Patton Funds

Source: Patton Funds

So while “a lost decade” makes for a catchy headline, diversified investors walked away relatively unscathed.

The challenge, of course, is that there’s a price to be paid for diversification.

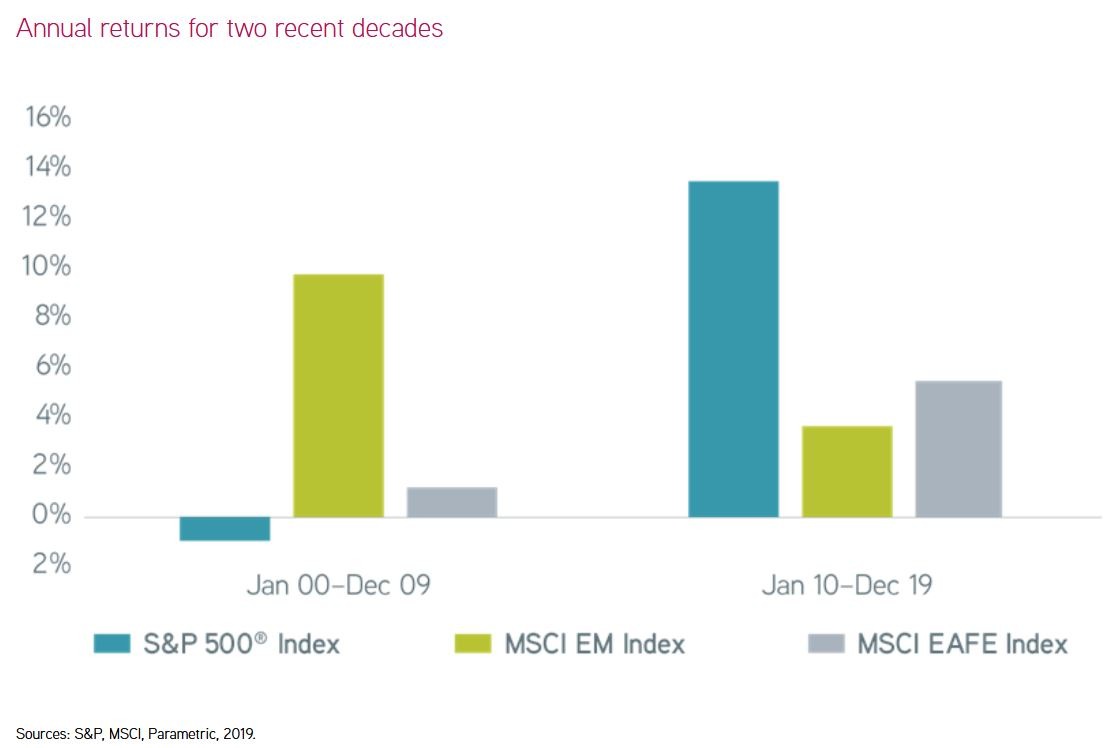

Emerging market equities have basically gone MIA from 2010 onwards:

And you can trust yours truly when I say that anyone invested in small-cap and value stocks did not enjoy the ride either (until the massive recovery over the past 4 months).

In other words, it’s this:

If you want the diversification that comes with “owning the world”, you need to be prepared for meaningfully lower long-term returns.

Beyond The Wall Stock Market

Of course, you could also look to spread your bets beyond the stock market.

At least in theory, real estate is supposed uncorrelated with equity returns (though as we all know, all correlations go to 1 when the sh$t hits the fan).

Historically, investors had two key options when it came to real estate investing.

The first one is REITs (watch out for tax implications with this one).

The second one is making direct property investments.

For full disclosure, this is my preferred route – but it’s certainly not without its challenges.

Most recently, we’ve also seen a rise in the popularity of real estate crowdfunding.

As far as investor involvement goes, crowdfunding sits somewhere between REITs and direct investments. It also requires a certain level of income to play the game.

Most importantly, however, one could argue that the crowdfunding market is only sufficiently developed in the US, essentially putting it off-limits to international investors.

Theoretically, you could hire a lawyer and accountant who will establish an LLC for you and do all the paperwork but that would be a stretch for most people.

Non-Productive Assets

Bitcoin? Art? Wine?

Despite all the recent hype around all three asset classes, I’m really struggling with this category.

The first hint is in the name. As none of the above produce a regular stream of cash flows, you are reliant on price appreciation alone to drive your returns.

Now, I accept that Bitcoin and gold could well have their uses within a well-diversified portfolio.

In fact, much smarter people than me have illustrated the benefits of some exposure to the assets above.

But as far as art and wine goes, I find it a bridge too far.

Unless you have some differentiated expertise in either category (no, boxed wine doesn’t count), you are really taking a punt here.

As they say, hope is not an (investing) strategy.

The Unpopular Answer

Let us go back and check in on Sam, the unluckiest investor in the world.

Unless you’ve been living under the rock, you won’t be surprised to hear that after going through a world of pain in the noughties, Sam has pretty much knocked it out of the park ever since:

Now, it all seems easy in hindsight, but could the answer simply be… stay the course?

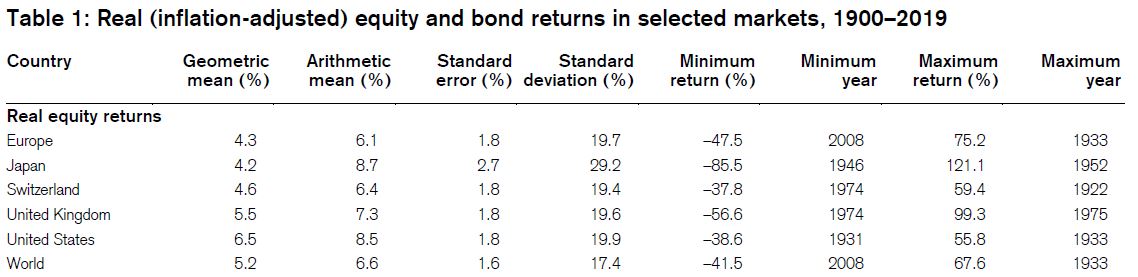

The biggest lesson one can take from historical investing data is that most assets have their day in the sun – eventually.

Yes, US large caps have had a horrible beginning – but have been on an absolute tear since 2010.

On the other hand, emerging market equities performed in pretty much the opposite manner.

All the while those capricious small-cap and value stocks posted more fits and starts than I can count.

Sure, they’ve notched up an impressive run over the past few months, but who is to say that will continue?

What is true, however, is that investors who chased the latest and greatest performance could well have ended trading in and out of asset classes above at worst possible times.

On the contrary, it’s the ones who stuck to their investing strategy (like Sam) through thick and thin that ended up doing well for themselves.

Thus, the unpopular answer may be that once you’ve diversified your portfolio, you simply can’t hedge yourself – other than picking a strategy, sitting tight, and having a 20+ investing horizon in mind.

And if that means nursing those recent losses on your growth portfolio, then so be it.

Thank you for reading!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Another good one.

The biggest battle here is behavioural.

The “trusting the process”.

In being able to ignore all the noise and immediate evidence that things are going horribly wrong (or just slowly and steadily suboptimal), and let your money ride. Sam’s journey in your story contains a fairy tale happy ending, though we seldom hear from those who backed the also rans.

Sam gets lauded as patient and determined. The others dismissed as stubborn or foolhardy. Same action, different outcome.

We celebrate the early investors in the “Unicorns”, or who bough Berkshire Hathaway back way in the day. Investors with foresight and fortitude. Nobody much talks about those who faithfully followed the same process, but backed different horses. Those who invested in Yahoo! or Nokia or Kodak a couple of decades ago and gamely held on in the belief things would eventually come good.

Ultimately all investing is a gamble. It is these behavioural aspects that make it so fascinating!

I completely agree with what you have said – except that all investing is gambling. Yes, stock trading or even picking individual stocks without knowing what you are doing is close to gambling.

However, passive index investing is not gambling at all. You can control your risk and you can make reasonable decisions based on decades of information. Of course it doesn’t mean that it’s risk-free, but definitely not gambling in my opinion.

Curious to hear your arguments on why you think it’s gambling.

Don’t get me wrong, I don’t believe it is a bad gamble.

When I say gamble, I do so with the meaning that the outcome is uncertain. Which it is, even with passive index trackers. Will it experience capital growth or capital losses within my time scales?

As the charts in this post illustrate, while the direction of travel may trend positive overall, the lived experience varies considerably. Which is academic while you don’t immediately need the money for other things, but it starts to matter if you were banking on it to pay for your groceries this week or to fund your pension over the next decade.

Even single market index trackers are somewhat of a gamble. The recent Credit Suisse Global Investment Returns Yearbook had an excellent discussion about the experiences of those investing in Russia, China, and Austria in the early part of last century, where investors lost their entire stake. They probably thought it “couldn’t happen here”, just as we do today.

Uncertainty doesn’t mean we don’t invest, just that we do so conscious of the fact that the outcome is not guaranteed within our timescales.

I agree. While the long-term odds are definitely in our favour, you cannot discount the tail events that could lead to a complete loss of principal.

Now, that doesn’t mean we shouldn’t invest in the first place. For all I know, I could get hit by collapsing scaffolding the next time I go for a walk.

Unlikely, but could happen. Still, no reason to stay indoors all the time.

Same for index investing. Has a (small) chance of catastrophic loss, as indeedably correctly points out. Still much better than the alternative…

Thanks for the clarification indeedably – fully agree with you!

BoF – agree with you as well. By now, I am comfortable with all the ups and downs of the market, recessions etc, however, this this tail risk (or “small chance of a catastrophic loss”) is what keeps me awake every now and then. In other words, ending up in a situation like Sam for potentially 20-30 years.

Now I understand that there are not really other alternatives (if you don’t do anything, you are guaranteed to lose money to inflation). Still, are there any other arguments why I should not worry about this?

Sadly no real arguments. But as I said, tail risk is everywhere. Illnesses, accidents, etc – none of that keeps you up at night, does it?

Neither should the stock market.

By a world index, maybe a bond index too, invest regularly and stay the course. All will be good.

Great post. That’s why I continue to up my international market exposure. And part of my alternative strategy includes some bitcoin, but not too much. But well thought out and put as usual long-term strategy is the best strategy. period.

Will be interesting to see how the markets play out over the next 10 years or so.

I continue to be 100% US equities but equally, I’ve got about 20 years to go before I start the drawdown phase, so can ride out long periods of underperformance in the meantime.

So this is great analysis if you are in the accumulation phase and would have served me well back then. It’s particularly relevant to me as I did start investing in 1999, I didn’t understand the above and I didn’t really understand passive investing, which also wasn’t so available and so I didn’t achieve the results in the first decade that I should have done more the pity me. It’s important to be aware, markets owe you nothing and there has been one period where bonds have out performed equities for circa 60 years (unbelievably so). But if you are saving aggressively over a long period of time then equities are the place to be and this analysis is great to help you say the course. Next time there’s a decade suck out remember this!

But….what would be really good is for you to run this in reverse and then make this a blog post for discussion. Assume you’ve FIRE’d / Retired in 1999 you are in global equities / S&P 500 (pick your poison) and you’ve £/$1m in savings. Now withdraw 4% each year, adjust annually for inflation and see where you are in 2009. It’s a scary place if you are not earning would require fortitude to then stay the course. Of course the next decade was then a ripper, which will probably mean the 4% rule is still valid but you didn’t know that at the time. In fact you’d have been reading it’s the end of capitalism at the time – I know because i was. What’s the chances you’d have stayed the course? That’s the real challenge of FIRE imho and I don’t believe many people focus on it as they have limited experience and haven’t seen a decade bear market. Sure people say you’d adjust etc etc – but that’s not what the 4% rule is based on. My critique of the 4% rule is the volatility is such that the majority of people can’t cope with it.

That is why for me, having saved aggressively for a couple of decades, I’m increasingly of the view there’s limited chance of me pulling the plug entirely. Rather I will look to adjust the work life balance.

Just to question your last sentence to understand – you said you’ve about 20 years to go before you start the drawdown phase? Have you had a change of heart in terms of checking out of banking? How does that fit with your private schooling plans – maybe the last bonus round was super kind….

Good article

Thanks BnF – you may be interested to know that this post was inspired by one of your earlier comments on this blog.

I think what’s interesting is that a well-diversified portfolio actually did reasonably well in the noughties, as evidenced by the performance of small / mid-caps, as well as international equities.

Backtesting my own portfolio, my small-cap / value allocation would help but certainly not my 100% allocation to US equities.

As far as the 20-year comment goes – I’ve got a somewhat peculiar plan. I do intend to dial back over the next 12 – 24 months, potentially moving into a corp dev role for a few years, or directly into uni-level lecturing.

That being said, my wife and I expect to continue making enough money to sustain our lifestyle. This would be through a combination of earnings (from hopefully much more manageable jobs) and cash flows from our real estate holdings.

We probably won’t be setting anything aside from retirement, but equally, we won’t be drawing down either, giving our equity portfolio another 15 – 20 years to compound. That gives us quite a bit of runway still.

I’m certainly not complaining about the bonus round (no reasonable person would), but still quite a bit of work to do!

By the way, did you see Monevator’s triptych on his upcoming early retirement and the associated financial plan? Very worthwhile reading.

Thanks good to know my comments aren’t that wayward. I don’t think your plan is peculiar, everyone has their own path but in any event that path from IB to Corporate Development is well trodden and a sensible progression. I guess less people go into teaching but some surely do. My position is likely to be something similar – it feels unlikely I will be able to stop working fully although by many blogger measures I clearly could as I don’t believe I can manage the risks inherent in fire. Being in a position where income = expenditure through a sustainable job / business and having a portfolio growing (or otherwise) in the background is a good position to be in both mentally and financially and that’s where I would hope to be and sounds like yourself as well. The trick is timing and the right opportunity etc etc. I commend it to anyone in a similar position.

Monevators three part series is as usual excellent and also insightful to me as what works for the TA will not work for me and does not work for so called fat fires imho. The state pension doesn’t touch the sides / once you are out of your high paying industry it’s very hard to get back in / the back up plans aren’t that actionable. You generally can’t do something to counter balance the volatility in your portfolio. For FIRES looking to draw down say £20k a year you can generally get a job that will pay that if needed. The only options are to (a) reduce spending dramatically to a low SWR (b) stay in a role in which income roughly = expenditure for a number of years but you don’t need to worry about saving anything (c) be able to live with the volatility (d) have a ridiculously large portfolio. I increasingly think (b) is where I will be per the above but ideally in a less demanding role. Regardless one thing I don’t really do any more is stress about money, think about it a lot….but don’t stress.

Interesting article. I’ve always been afraid of going through a lost decade cycle where we not only lose money but we lose time as well. That’s my greatest fear even as a long term investor, it’s just frustrating to neither lose nor win.

Maybe I should just stop stressing out over it. I’ve been holding for the past five years and even if there’s a lost decade for the next 10 years, I am still actually at a positive place from when I first started investing. Haven’t seen it from this angle and you made me think of a different perspective.

There’s always that risk. In my mind, it’s key to make investing part of your life, but not a critical component.

The last thing you want is to suspend all enjoyment waiting for that portfolio to compound.

Damian – interesting to hear your stepwise plan prior to commencing drawdown. I kind of went this way – albeit that I initially took a “gap year” at the conventionally wrong end of my career before starting in the step down role. As it turned out this pause was a really good move – think decompression, etc. My plan was to stay for only a few years in the step down role. But actually I stuck at that role for longer than strictly necessary as in some ways it was far more enjoyable than I had imagined. In other ways it was at times rather frustrating too! The first year or so in the step down role was the worst, but once I got over that hump I found some very personally rewarding ways to use skills developed years earlier. Finally I jumped ship with no regrets and was paid extra to do so too!

As I think I may have mentioned elsewhere previously you should have realistic expectations of the demands likely to be made on you in the step-down role, which on paper may seem easier etc. But please bear in mind that you may well be coming at such a role anew so, at least initially, that may well bring its own pressures and demands!

I think the “glide path” to retirement can be one of the most challenging pieces of the equation. Far less straightforward and “linear” than the finance bit, isn’t it?

Given I am still south (though not very far south) of 40, I’m acutely aware that even in 2-3 years I’ll be far too young to pack it all in. Just seems strange to pull the plug after building up so much knowledge, skills, and contacts over the past 20 years.

I’m also cognizant that stepping from a 70-hour workweek to a zero-hour one is probably not a great idea. Sure, I need a holiday and would love to get a few months off (which I will probably get as part of garden leave anyway).

But in terms of intensity, I’d be quite content with working 50 hours a week, but gaining back control over my evenings, weekends, and (crucially) holidays.

Would love to do that for a couple of years, then take stock and figure out next steps.

“But in terms of intensity, I’d be quite content with working 50 hours a week, but gaining back control over my evenings, weekends, and (crucially) holidays”

100% agree.

Only you can judge your situation.

Please note that if you do need to decompress, lots of folks who have gone through this have observed that it takes much longer than you initially think it will. Fear is a very powerful emotion – but ultimately I would imagine your well-being is probably more important.