The other day, I got a frantic call from the commercial tenant at one of our rental properties.

There was a pretty significant leak coming in from above which caused a mini-flood in the restaurant below.

Luckily, the place was closed to customers at the time – given Covid restrictions, they are only serving takeaway these days.

Normally, my property management would have taken care of a request like this.

However, the particular unit in question is not (yet) under a property management contract, which meant I had to work the phones for a bit to get a plumber to come in and try and figure out an issue.

Problem was, no one could figure out what’s going on. We’ve spent the next week or so collectively scratching our heads to pin down and resolve the issue.

A few days ago, as I recounted the situation to a friend of mine, he said:

“That’s really the problem with owning properties. There’s always a risk something like this may happen”

He was being quite genuine about it. Nonetheless, the comment made me pause.

Is that really the right way to look at risk? And speaking more broadly, do people have the right framework for dealing with risk in the first place?

Conventional Definitions

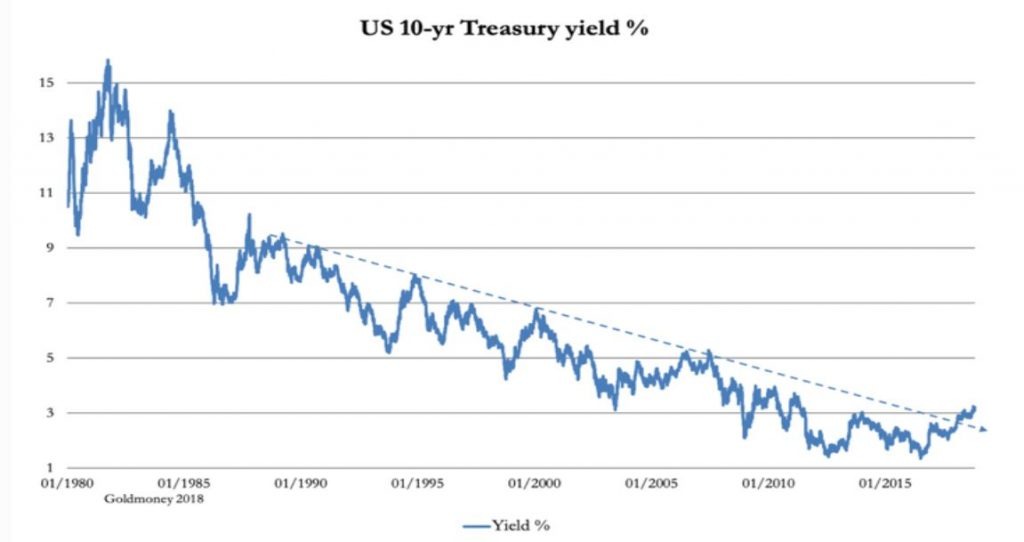

Dealing with persistently low interest rates has arguably been one of the biggest personal finance challenges of the past decade.

Notwithstanding the efforts countless central banks have put in, that pesky line just keeps creeping downwards:

In 2019, it seemed that their efforts have finally paid off. A global pandemic later, it’s clear – the near-zero interest rates are here to stay for a while longer.

Sadly, this means that if you don’t want to take on any financial risk, your returns will also be near zero.

Cue in a massive rush for progressively riskier investment strategies such as high-yield bonds (remember when they used to call them junk?), equities, options day trading, crypto, and a bunch of others I won’t even mention here.

At the same time, everyone is wistfully recalling those days when you could get a 4% risk-free interest rate on our savings account. Ahh, what a time to be alive!

What those same people fail to mention (or remember) is that back in those days, inflation was also running somewhere around 3%.

This, of course, means that back in those (supposedly) glory days, your realrisk-free return would also be near zero.

As it turns out, the world hasn’t changed that much after all. If you want to realize an attractive return on your investments, you’ve got to take on some risk.

It’s true today – just as it was at any point over the past one hundred years.

For some people, that means rebalancing their portfolio towards equities. For others, it’s investing in real estate – and dealing with those pesky maintenance issues.

Beyond Finance

If you look at things more broadly, a somewhat irrational approach to risk seems to pervade our lives outside of personal finance.

A large proportion of the population still smokes.

An even larger swath continues to drink more alcohol than can possibly be good for them (as we are about to experience again in the traditional lead-up to Christmas).

And judging by the line-up of dodgy individuals withdrawing cash from ATMs late in the evening, there are other, even more questionable habits at hand (after all, what do you really need cash for these days?)

Everyone knows there’s a proven relationship between smoking, excessive alcohol intake, and potentially life-threatening illnesses such as cancer and cirrhosis.

And yet, the very same people who are supposedly “worried about risk” during the day are the ones you see at the pub that very evening.

What gives?

Some folks will argue the cause-and-effect relationship. Others will make use of the “everything is okay in moderation” argument.

The most philosophical ones will tell you that life is risky by definition.

A shoddy piece of scaffolding may hit you over the head on your next lunchtime walk. And sadly, many folks who lead healthy lifestyles still draw the short stick when it comes to health outcomes.

In other words, we don’t get to choose. There’s a degree of risk related to just getting out of bed in the morning. If you want to enjoy life, you just need to accept this risk and get on with living.

Glass Half Full

It is when viewing things through that prism that one realizes how lucky we actually are when it comes to financial risk.

Whether it’s bonds, equities, or real estate, proper diversification, and a long-term investment horizon can help you eliminate most of the risk related to your investments.

The only risk you will be left with is systematic risk, which pretty much means the risk of the human race failing to continue progressing the way we have been for the last ten thousand years.

In other words, provided you’ve taken the right precautions, worrying about your investments should be the last thing on your list.

There are many other things that should be top of your agenda. Many of them you have zero control over – and yet you don’t find the prospect of WW3 keeping you up at night, do you?

And as for that pesky leak? Turns out a mouse had eaten through a drainage pipe.

Cost me a hundred bucks to get it sorted – and I’m still coming in below my maintenance budget for the year.

In other words, nothing to worry about.

Thank you for reading!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

The financial services industry and their well meaning but flawed warnings around ‘risk of capital loss’ have alot to answer for here.

I remember talking my friend through s and s isas and her immediate reaction being ‘oooo too risky!’ when I asked her to expand she said I could lose my money. But when I asked if she paid into her work pension she looked at me like I was an idiot and said of course I do

The look on her face when I said ‘so where exactly do you think that moneys going’ was priceless. And I confess I didn’t quite make the link myself until about 8 years ago which is mad considering I live and breathe this stuff and have an interest in it. What hope for the rest of the population

Very true. One of the biggest questions I grapple on this blog is calibrating my content to be helpful to as broad an audience as possible.

On one hand, you kind of want to explore some of the more complex issues around asset allocation, SWRs, risk management etc.

On the other, going in that direction quickly becomes unhelpful to the majority of people who haven’t got as much background in finance and need more help around basic issues.

I understand that you’re talking to a rapidly diminishing audience the more complex your content becomes. I’m not really sure its possible to mix the levels of complexity and maintain the overall coherence of the blog?

I feel people such as yourself operate at a level of financial understanding that few outside of the industry are able to relate to. So there’s a huge opportunity to push the boundary’s of FI understanding within those complex areas. I’m thinking Early Retirement Now but I can’t really think of anyone else particularly in the UK. Are you aware of any?

Not really to be honest, I think it becomes a highly niche topic after a while and so the very “advanced” blogs are probably not as well known.

To me, it’s figuring out what makes the most impact – getting a broad base of folks educated about the basics or a smaller group of folks advance their (already extensive) knowledge. Quite likely it’s the former given declining marginal benefits of advanced investing.

Then again, I also like to write about some of the more advanced topics, hence a slight bifurcation in posts on this blog!

Some great risk arguments there, which I may try on my non-investing friends, who happily regularly risk liver-cirrosis yet won’t touch investing with a barge pole!

I think we’ll see this contradiction playing out regularly in pubs across the country over the next few weeks 🙂

A bit of a rant, BoF: I like it! ?

As you say, literally nothing is without risk and one could argue there is a correlation between risk and reward (e.g. skiing is statistically speaking one of the most dangerous activities your average person will ever practice).

No one owes you a return on your cash. Cash is super-abundant and banks can procure it at negative real rates these days. As Ray Dalit says, cash is trash.

*Ray Dalio

Gotta love Ray and his radical transparency! ?

You’re spot on. We take on tons of (often unwarranted) risk every single day.

And yet, broach the suspect of financial risk and everyone is instantly horrified.

What are your thoughts on insuring against personal risk: disaster insurance like life insurance, critical illness & income protection? Currently grappling with how much of my net pay to cover me and the family. 1-2% seems like a no brainer.

I think it’s a no brainer. Given I’m the primary breadwinner (and I wouldn’t want my wife to work in the event something happened to me), I’m insured to the hilt.

A ~£1.5m life insurance policy, personal accident, disability, critical illness. The peace of mind it gives me is alone worth the premiums.

Useful. Thanks for sharing.