Even in normal times, a big chunk of my days is spent in conversations with what is sometimes known as “smart money”.

On the asset management side, this includes active money managers like Fidelity, Legal & General, Invesco, and many other household names.

They often hold large positions in companies that we represent, so an ongoing dialogue is crucial to understanding their views on company management and performance.

Then there’s private equity, which encompasses both the large buyout shops as well as the sovereign wealth funds.

Their investing activities mostly lie on the other side of the spectrum – private companies operating out of the daily spotlight of the stock market.

To say that both of these investor groups have been spending immense amounts of time analysing the current situation would be an understatement. Their world is one where a single number on the screen can make and break careers.

As such, crises like the current one present an existential threat – and a tremendous opportunity. And while my personal views on active money management are well-defined, these conversations can nonetheless be very helpful.

At worst, they provide an insight into the thought process of some very smart people most of whom honestly believe they can do better than the market.

And at best, they help establish an investing framework in a very choppy market environment.

Here are some key takeaways from the conversations I’ve had over the past few weeks.

It’s Still Early Days

The biggest theme coming through at the moment is that it’s still very early.

Yes, we’ve seen the markets rally for three days in a row last week before they finally choked on Friday.

Yes, the government stimulus measures are unprecedented.

And yes, in a perverse way the magnitude and speed of the decline should be reassuring. Only five of the last 19 bear markets have resulted in a decline more severe than the one we are seeing today.

All of the above should provide some comfort in that we will find a bottom soon.

At the same time, there are still way too many open questions – and nearly not enough answers.

When do we flatten the curve? What happens once we do? Do we lift the lockdowns, risking yet another wave of infections? Or do we remain in limbo, hampering economic activity for much longer than anyone expects?

With no conclusive evidence on effective treatments and a vaccine still a long time away, the mood music doesn’t exactly point to a near-term resolution, notwithstanding anything Donald Trump has to say.

And for every day the world remains in various stages of lockdown, the economic impact becomes more and more pronounced.

History doesn’t have to repeat itself. That being said, the current evidence doesn’t exactly point to Covid being the shortest bear market on record.

Further Downside In Multiples

One of the interesting aspects of the Covid bear market is that the multiples haven’t come down nearly as much as they have in the aftermath of the past two crises.

When the dot-com bubble burst, the S&P S&P 500 P/E (price to earnings) multiple has declined over 50%, from 46x to 22x. What this means is that investors went from paying $46 for every dollar of earnings to just $22.

In the financial crisis, the multiple tanked by almost 70%, from 42x to 13x.

How about now?

Before the current decline started, the S&P 500 P/E multiple stood at about 23x. It is now about 16x. But there’s more to it than just the headline numbers.

Because the share prices have come off so quickly, they’ve moved way ahead of earnings estimates. Not even management teams have a true grasp of the implications for their business at the moment.

What is likely to happen over the coming weeks is a substantial reduction in earnings forecasts. As the denominator of the P/E formula declines, the multiples increase. This means that multiples are still high – and suggests even more risk to the downside.

False Rallies Galore

The stock market is a nasty animal. It has the habit of surprising investors with some of the most gut-wrenching falls immediately followed by gravity-defying rises. The range of moves in the past two weeks alone is a good example.

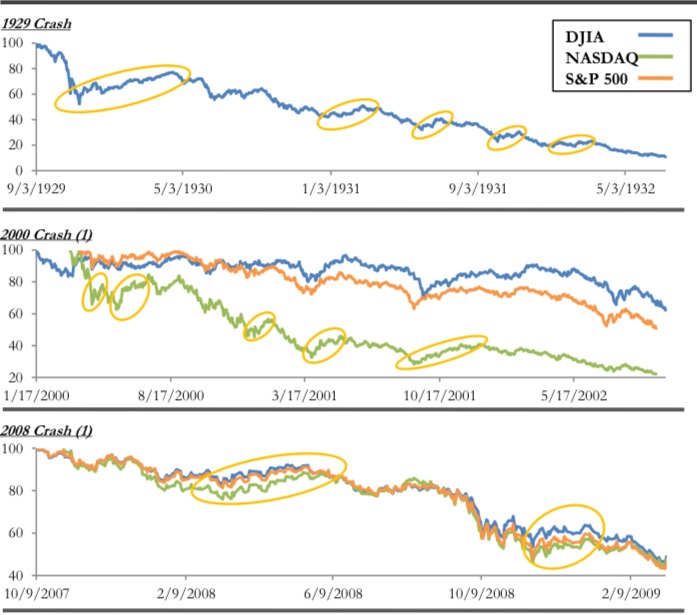

No one can predict what comes next. That being said, historical bear markets have a rich track record of false rallies.

Fool me once… fool me again?

Take a look at the charts above.

In the financial crisis, the S&P 500 managed a 24% rally in 2008 before the ultimate trough in February 2009.

In the dot-com bubble, there were two such head fakes.

And if you go back to the Great Depression, it had five episodes of the Dow Jones moving up 20%+ before it ended in 1932.

Good money managers tend to be astute students of history. They’ve seen the patterns above. Hence it is really no wonder you haven’t yet seen smart money doorcrashing the market on the way in.

A House On Fire

When Jamie Dimon was taking heat for the knockdown price at which JP Morgan acquired Bear Stearns back in the financial crisis, he used the following allegory to explain his thought process:

Imagine you are looking to buy a house. At some point, you need to assign a value to it. Pretty easy, isn’t it? Now, imagine you are buying another house – but this one happens to be on fire. How do you assign a value to an asset where the situation changes every single second?

That’s the conundrum money managers find themselves in today. Make no mistake – the recent volatility is as heart-wrenching for them as it is for you.

Investing decisions aren’t easy at best of times – and least so when share prices move by 20%+ a day and it takes just one discrete event to wipe out a year’s worth of earnings estimates.

There are many other things that come up in our conversations, such as oil prices, inverted yield curves and constant GDP revisions. But it’s fair to say the topics above bubble to the top in every single conversation.

So what does this mean for retail investors like you and me?

The Disadvantages Of Being “Smart”

It might not seem that way from the outside, but for all their advantages professional money managers also suffer from a couple of major handicaps.

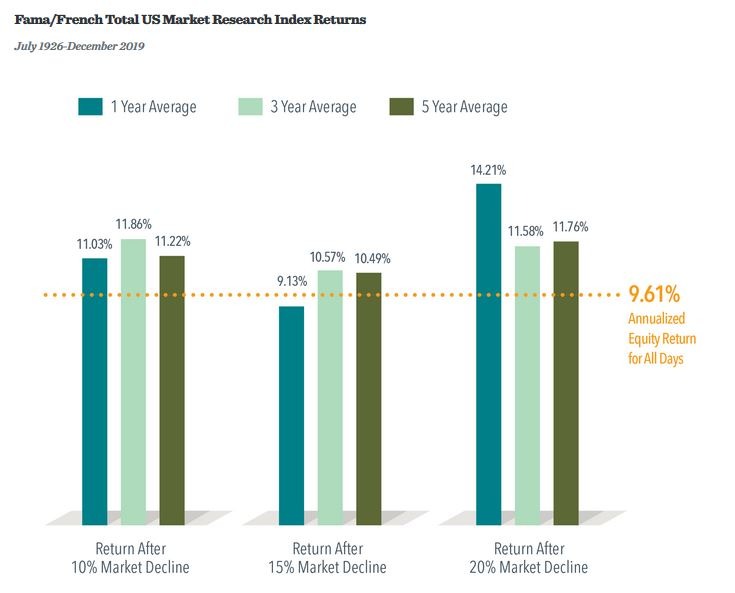

The first one is neatly summarized in the chart below.

The data never lies

Unlike you and I, active money managers simply do not have the option of following the market. Doing so is equivalent to admitting defeat versus passive investing – and finding yourself unemployed in relatively short order.

If they buy now, they will be chastised for jumping in when the crisis was still in full swing. If they sit on the fence and miss out a rally, they will underperform their benchmark index. I have zero envy for their conundrum.

The one thing they have done well so far is they haven’t been selling. But hindsight is always 20/20 – so gear up for some very uncomfortable conversations when companies in their portfolios start going bankrupt, as some inevitably will.

“It was clear XYZ was going bust! Why didn’t you sell while you could?”

Trust me, many a finger will hover over a “sell” button if the crisis persists.

The second problem is dealing with redemptions. Investors have held tight for now, but should the crisis persist that behaviour might change.

Those active managers that haven’t got a significant enough cash cushions will likely be forced to liquidate their positions at depressed prices in order to fund redemptions.

Making the problem even worse, the lack of cash means they won’t be able to step in and provide much-needed liquidity to their portfolio companies by supporting rights issues.

Worst case, this means these companies will go bust. Best case, they survive – but the active money managers get diluted by new investors stepping up to the plate.

All this results in an unwillingness to deploy cash until the worst is over – and potentially missing out on much of the upside.

Finally, there’s the eternal principal-agent problem.

When you are managing someone else’s money (as opposed to yours), your compensation is typically tied to assets under management. This often leads to suboptimal investment decisions.

For example, a private equity investor may be tempted to buy an asset just to put money to work. It might not be the best investment but hey – bring on the 2% fee for “managing” the money.

Alternatively, they may be reluctant to sell an asset that’s declining in value – because not only it crystallizes a loss, it also reduces assets under management.

Both decisions lead to reduced investment returns – but they are entirely rational (at least in the short-term) from the money manager’s perspective.

Best Of Both Worlds

As retail investors, we are uniquely placed in being able to leverage the market intelligence coming our way – all while avoiding being hamstrung by short-term thinking and the weight of expectations.

Unlike “smart money”, there’s no reason for you to sell. DON’T DO IT. Don’t sell today. And definitely don’t sell if things get much worse. It’s the guaranteed way to lose money.

If you are worried about running out of cash, now is the time to build up your reserves if you still can. A quarantine isn’t exactly unhelpful as it certainly presents tons of opportunities to save money and augment your emergency reserve (or your investment cash pile).

Make some drastic decisions today – so that you don’t have to make even more drastic ones down the road.

More importantly, don’t be afraid to buy.

The numbers don’t lie. If your time horizon is longer than three years, you will exceed the market’s long-term return.

Too nervous to make a lump sum investment? Totally understandable. Humans aren’t machines and it makes complete sense to be reluctant.

If that’s the case, drip-feed money into the market. Yes, the math says dollar-cost averaging is suboptimal to lump-sum investing. Do you know what else is suboptimal? Staying out of the market altogether.

When you buy, don’t do anything stupid like trying to stock pick in the current environment.

Professional money managers with armies of smart employees, leading technology and an informational advantage don’t feel like they can properly price stocks at the moment. What makes you think you can do better?

So please don’t go out there and start buying Boeing on a hunch. If you want to blow your money, there are much better ways to do it. In the stock market, stick to low-cost, diversified index trackers.

Most importantly, go easy on yourself.

If history is any indication, the situation might well take some time to play out. Don’t kick yourself for missing the rallies – or putting a chunk of money to work just before another downturn.

All you need is to stay in the game – and you will outperform the vast majority of “smart money” along the way.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Thanks for bringing us the insights from the war front Mr Banker 🙂 That’s something you don’t easily find in most personal finance blogs.

Another advantage individuals have over the “smart money” is that they don’t have to compare themselves to a benchmark. Therefore, if we can achieve our goals with the least amount of risk, that’s still a big win.

Thanks Michael. You’re spot on – can’t overestimate the advantage of not having to look over your shoulder. Nothing like being able to move at your own pace and in line with your own risk appetite.

PS: Great blog – and always good to come across another Londoner

Can I ask your opinion (note not advice!)

I have what seems to be a stable job no movement in pay etc yet and no sign that won’t continue. They’ve publicly guaranteed jobs so that should be secure at least. I have 6 month buffer cash wise. The bit I’m wrestling with is do I a) build cash to 12 or even 24 months b) invest monthly as normal in the knowledge I have plenty I can pull out even if markets are down or even c) sell a bit of my portfolio to make myself more secure immediately and then go hell for leather with a more secure emergency fund

I have just gone interest only on my mortgage (timing is impeccable so should be increasing the amount I pay into shares by the bit I’m not paying on my mortgage. To hoard as cash seems to actually do myself a disservice but I’m just conscious 6 months may not be sufficient

Good question. The situation you really want to avoid is becoming a forced seller because if that happens you are probably selling at a significant discount.

Does the 6-month buffer cover the regular level of expenditures or does it just cover the essentials? My 12-month buffer covers what I call a “downside” case. I.e. if I was let go we wouldn’t have our nanny, we would defer all discretionary spending, etc.

2 years may be a bit overkill but I would try to have one year’s worth of buffer to help you sleep at night

So you would basically build more cash monthly rather than invest and take advantage

Basically I have about 10k to 12k in cash. Interest only mortgage is now 670 council tax 234. Gas leccy maybe 100. Phone 14. 120 credit card repayment (have 13k on a credit card interest free left over from my kitchen which will be paid next December from my Saye) sky 72 car insurance I pay in full but about 80 a month for both cars. Food about 400 (can be trimmed) home is about 25 a month

Take home pay is about 4200 (the rest I put in my pension so Ill be buying the dip anyway just trying to capitalise in my isa as well. I generally save about 500 in a s and a isa a month and looking to up that to 1000 now I’m interest only. About 1800 a month goes in my pension as I’m trying to maximise that before reducing in a few years

Just the essentials mortgage bills utility council tax. Basically the bits that keep the lights on and roof over my head

Obviously petrol say 250 month (not alot at the moment!)

Ultimately I could call on my dad but he’s helping my sister at the moment and being a personal trainer she needs it far more than me. Plus I’m massively independent lol

You are already putting quite a bit of money to work through pension and your regular contributions so yes – I’d say protect the downside a bit more before doubling down.

From where I sit one potential risk factor is relying on your SAYE to repay the credit card loan. If the underlying securities in SAYE decline in value, you may be exposed.

As they say – “protect the downside and the upside will take care of itself”

The Saye is a guaranteed amount I. E I mean my contributions alone will clear the credit card without any growth. Thanks for your comment and agreed I think I need more of a buffer

Got it re: SAYE. In that event just build up a bit more of a buffer and then you can start putting more money to work. Judging by the latest developments, there’s still plenty of time!