It’s official.

We’ve gone from what seemed like a nasty, yet temporary wobble in the markets to a full-blown crisis.

The true scale of the damage to the world economy is unknown so far, but it’s clear the situation is more complex than it appeared at first – and will likely get worse before it gets better.

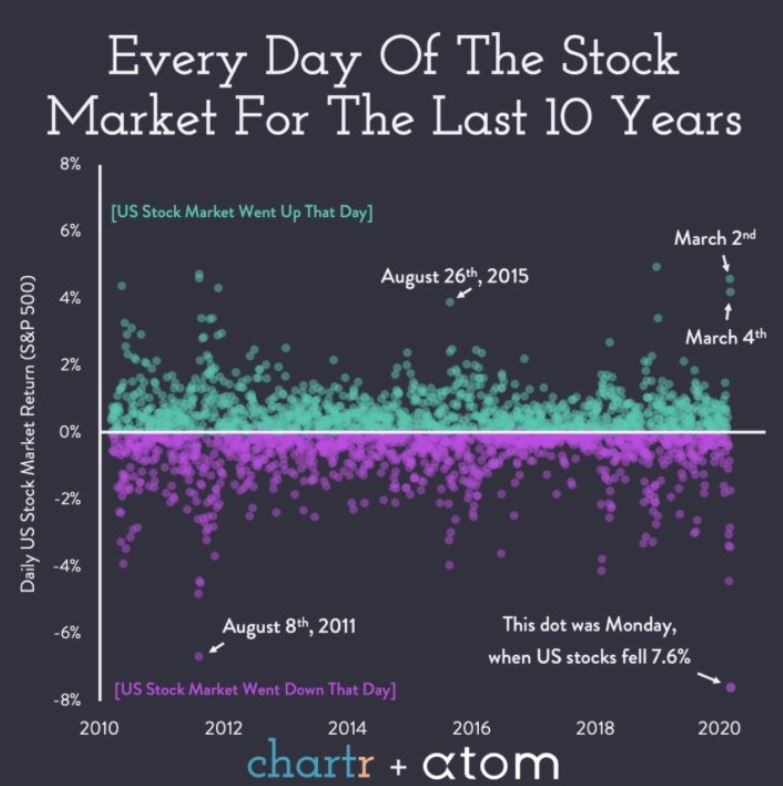

Last Wednesday I posted the below chart to my Twitter account:

The recent market volatility looked staggering to begin with – and this is before we had a 9.5% decline and a 9.3% surge that followed on Thursday and Friday.

Here are two more charts to contextualize the current market volatility, both courtesy of the Financial Times.

Friday’s move made it into the top 10 of the biggest one-day gains in the S&P 500 since 1928:

And if it wasn’t for that 9.3% increase, we would now be looking at the second-biggest weekly stock market decline since Word War II:

The market, as irrational it may be at times, doesn’t move this way for no reason. So just what the heck is going on here?

Sizing Up The Impact

Let’s put things in perspective. Yes, it is now clear that the coronavirus will have a significant impact on corporate earnings.

However, as I’ve written about here, a 20%, 30% or even a 100% temporary reduction in profits should not translate into an equivalent permanent reduction in a company’s value.

The problem, of course, is that we have now moved into a territory where the reduction in profits is becoming significant enough to potentially cause some businesses to collapse.

However, because it’s still very early days, the market participants simply haven’t got sufficient information to differentiate between the companies that will survive and the ones that don’t.

As a result, they are fleeing entire sectors, punishing weak and strong players alike.

Airlines are a prime example.

Norwegian Airlines, which has built its entire business around low-cost flights to the US, has moved quickly to temporarily lay off 50% of its staff. It’s a drastic move, but they were clearly out of options given Trump’s flight ban.

Other airlines have followed suit.

British Airways warned of an existential crisis and Virgin Atlantic’s chairman is expected to plead for a £7.5bn industry bailout to avoid bankruptcies.

Is the entire industry going to collapse? Of course not. But some airlines (hello Flybe) will – and that’s exactly the outcome the market is pricing in at the moment, in a very indiscriminate way.

And those airlines that do survive may have to be bailed out or taken over, crystallizing a loss for their shareholders.

Second-Order Effects

Aside from aviation, businesses in the hospitality, travel and tourism sectors will suffer the brunt of the initial damage.

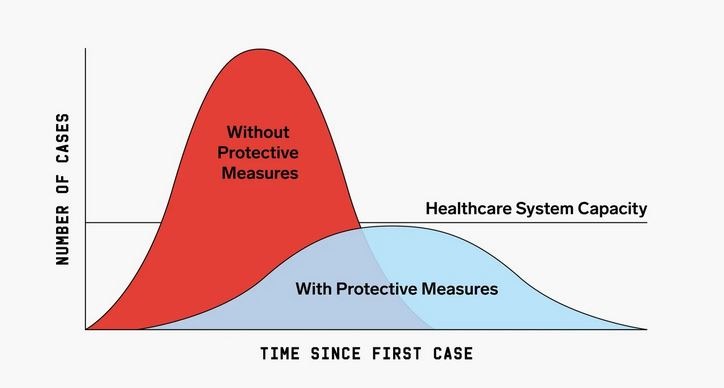

It is now clear that governments are defining success as mitigating the immediate impact on the healthcare system to allow it to treat the people who have been infected.

What we are solving for at the moment

That being said, we know that the vaccine is still about 18 months away. The younger, healthy folks will likely feel more confident about their chances of fighting out an infection.

Their lifestyles will go back to normal relatively quickly – as soon as the lockdowns are lifted.

However, large swathes of the population – whether the elderly or those with underlying health issues – will have to meaningfully change their behavioural patterns in order to minimize the chances of infection until they can get vaccinated.

Less travel. No cruises. Fewer meals out. Less shopping in crowded places. Yes, there will be some offsets in the form of online shopping or food delivery, but the bottom-line economic impact is unlikely to be positive.

Combine this with the impact of layoffs and spending reductions in the travel and hospitality industries and you’ve got yourself a proven recipe for a solid recession.

The outcome could be even more disastrous if there’s a large corporate bankruptcy, especially one in the financial sector. It’s unlikely, but there’s a handful of names that come to mind (Boeing? smaller European banks?) as being relatively flat-footed at the moment.

Nothing like mass layoffs or a malfunction in the banking system to strike fear into the heart of consumers, causing them to put hard brakes on spending money.

Cause For Optimism

The good news, of course, is that we’ve been down this path before.

The underlying reason may be different from the financial crisis, but the weapons to fight it are the same. And those weapons have been used, honed and refined many times over the past decade.

Zero rates, hundreds of billions of asset purchases, repo operations, swap lines and credit facilities – the central banks have already demonstrated they are prepared to use whatever they’ve got in order to avoid a meltdown.

This isn’t to say that the stock markets won’t tank again today – or that we won’t see persistent volatility in the days and weeks to come.

In a perverted way, considerable policy action sometimes causes investors to think things are even worse than they seem.

But it does provide some comfort that we are not going to sleepwalk into a massive meltdown which is what almost happened back in 2008.

And while it may not look like this over the next few months, both supply-side and demand-side recessions tend to be shallower and shorter than the ones caused by excessive leverage.

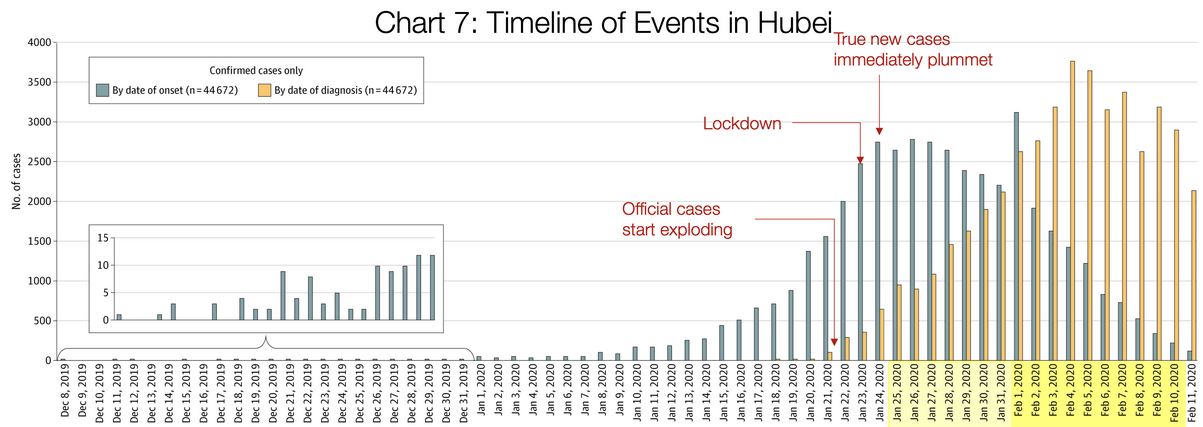

What makes this one particularly nasty is the obvious fact that there are human lives at stake. But once again, one reason to be optimistic is to look at the way China has handled the crisis so far.

Yes, it took some draconian measures – but they’ve got the situation under control in about two months.

I don’t expect the developed world to be able to act with the same speed or coordination.

However, with Italy and Spain instituting total lockdowns, multiple countries closing their borders and the fact that social distancing has proven to be massively effective in China, I am optimistic.

Lockdowns work – click on the picture above for an excellent summary

Lockdowns work – click on the picture above for an excellent summary

It might take longer than two months – but it will happen. In the meantime, things are likely to get worse before they get better.

Strap Yourself In

Just like it does in every crisis, the market will test your resolve with some a steady flow of bad news, heart-wrenching falls and short-lived rallies.

You may be tempted to time the market. Don’t.

If you think you can anticipate the development of a global pandemic AND policy decisions of multiple central banks around the world, might as well skip the whole stock market thing and play the lottery instead.

It may also be tempting to cash out and sit out the volatility. I can’t blame you. But rest assured – when we declare victory against the coronavirus, it will be far too late to “get back into” the stock market. That ship will have sailed.

No one rang the bell at the top of the market a few weeks ago. They won’t ring it at the bottom either.

So keep the faith. Stay invested. Keep up your regular stock market contributions. And most importantly – stay healthy. Everything else will fall into place.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

I’ve been pleased with the way I’ve handled these drops so far with no real concerns beyond the sensible ones like redundancies and concern for loved ones

My biggest concern is the way my pensioner father is stressing about this. 12 months ago I agreed to go on my stepsisters mortgage to help her keep her house after a break up, I’m not paying but am named and was done on the strict understanding he would underwrite any losses . She’s a personal trainer so likely to be impacted so I’m hoping my dad’s agreement to underwrite the mortgage holds water despite his worries. It’s only to get to the end of 5he fixed rate next year when we’ll sell

I said to him again on the weekend it will come back. He said if there’s anything left to come back. I said if your well diversified global portfolio doesn’t come back we’ve all got bigger issues! He’s checking it daily (which I am to be honest but more from an interest point of view)

And my dad has just cashed out!

Ouch. Ultimately he needs to do whatever helps him sleep at night, but it is absolutely the wrong time to do it. Bummer.

I wonder how many others are doing the same thing right now.

Btw, I still haven’t checked my portfolio. Will likely do so when I do the update at the end of March but cannot be bothered until then. No upside so I refuse to waste time logging into the various accounts.

Yes from his pov he’s got plenty and if he misses out on growth so be it. I guess it could be worth.

I may use my interest only mortgage to build a bit more cash for a bit but leave my current monthly investment unchanged. Its either that or just sell my 40/60 fund but I’m going to hold off for now I have 5 months money so enough to get through the first bit of a large dip or redundancy but this has made me feel like I should carry more cash than I am. But no plans to cash out

Stimulus announced. Your view? Mine is the system isn’t broken. Won’t stave off a deep recession. Will mean the bounce when it comes in asset prices will be unbelievable

The biggest comfort I take from the various stimulus packages is that governments seem to be ready to do whatever it takes to mitigate economic damage.

Unlike a decade ago when everyone was outraged at bank bailouts, you don’t really lose political capital by uniting to fight the virus.

So yes, I do think asset prices will rebound but equally the valuation environment may be more conservative for a while. Very tough to say at the moment.

Edit on dad. He hasn’t cashed out just adjusted to more cash and 48 % equities from 65%.kind of like hedging his bets crystallising a bit of loss but he’s much happier and ultimately that’s the best thing

Okay that doesn’t seem too bad. Ideally you rebealance the other way but times like these change people’s risk tolerance so better to have a portfolio that lets one sleep at night!

Can someone more intelligent than me (ie you) explain where the money for the government intervention announced today is coming from. And what the implications are?

The government has clearly decided that it’s worth running a considerable deficit in order to prevent a near-term economic meltdown. You can debate the specifics but it’s a move in the right direction.

The flip side is that government debt levels will go up and will ultimately need to be repaid by increasing the tax base on both individuals and corporations.

Gear up for a period of even higher taxes once the current crisis is over.

Helpfully the US Fed Reserve explained it very clearly where the money comes from.

https://twitter.com/Ben__Rickert/status/1238203981458890754

My guess is an endless amount of newly printed £££ will eventually drive up the price of assets. My guess is a price of yellow shiney metal will start going up even more.