If you are truly focused on becoming wealthy, the best way to go about it is to look at what others have done to get there and follow their strategy.

In the case of UK’s wealthiest people, it seems that building up their pension pot was one of the key pillars of their strategy to grow rich.

That’s right – it isn’t property or stock market investments (though they are important in their own right). As the wealth data from ONS shows, growing your pension portfolio is the number one way to get rich.

Net Worth Distribution In The UK

The chart below summarizes the distribution of net worth in the UK. To be in the top half of UK’s population, you need to have a household net worth of c.£240k.

Having a household net worth of £1.4m will put you squarely in the top 10% of the UK. For those interested in being at the very top – it will take a household net worth of c.£2.3m to get there.

Where Does The Wealth Come From?

I wasn’t the least surprised to see that financial assets (i.e. stock market investments, ISAs and the like) and real estate (value of property less mortgage) represent a significant portion of net worth for the rich.

And while I am a massive fan of using pensions to build net worth, I was surprised to see just how much wealth the rich have in their pension pots.

If you are hovering in the middle of the distribution, your pension will hover at about 25% of your total net worth.

But for those who have really nailed it and and managed to get into the top 10% or 20% of households, pension assets represent more than 50% of their net worth.

What this means is that if you find yourself at the top of the distribution, you are likely to have almost £800k in your pension pot.

Put another way, it is imperative you focus on growing your pension if you want to get rich.

The good news is that investing in your pension not only instantly increases your wealth (see #3 below), but it is also one of the easiest things to do. Heck, there are even pensions for dummies guides out there.

I personally grew my pension from zero to £200k in just six years. I am confident you can do the same if you follow the advice below.

Top 10 Tips To Turbocharge Your Pension

1. Start Early

55 seems an eternity away when you are in your 20s. Then you hit your mid-30s (like me) and all of a sudden it isn’t that far away after all!

You now have a mortgage, a family and a whole bunch of expenses you never even knew existed. Don’t you wish you started contributing to your pension 10 years ago?

2. Maximize Your Regular Contribution

One of the best financial decisions I have made was to maximize the pension contributions for me and my wife when we moved to the UK.

When I saw the tax break and the employer matching, it was a no-brainer decision for me.

My wife took some convincing but joined me in making c.15% contributions to her pension. Six years later, I am sitting on a pension pot of about £140k while she has c.£60k in hers (I have detailed the growth of our pension at the bottom of the post).

Most importantly, after you set your contribution level you never feel like you are making a sacrifice because you don’t see the money in the first place.

3. Make Lump Sum Contributions

While it’s often overlooked, making lump sum contributions is a fantastic way to turbocharge your pension. It also has the advantage of instantly increasing your net worth.

Every time you get a bonus, a performance award, or any other one-off payment from your employer, try making a lump sum contribution into your pension. 50% is a good level to aim for.

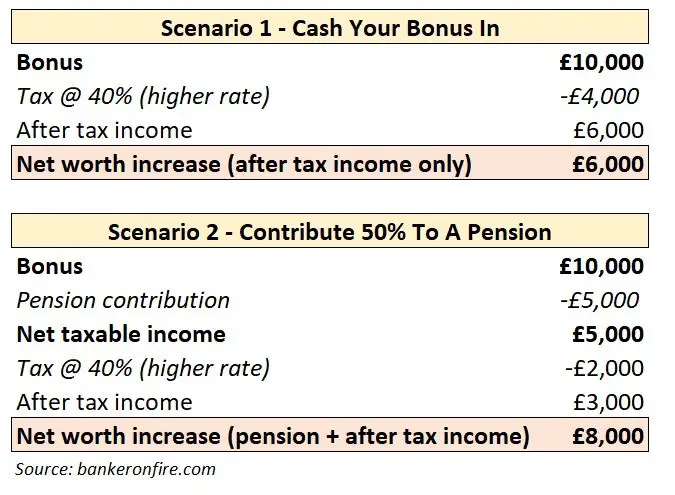

Let’s say you got a £10k bonus. Set 50% aside for a lump sum pension contribution. If you are a higher rate tax payer (40% marginal tax rate), this means that you will instantly increase your net worth by £2k because the government will give you a 40% break on your pension contribution.

4. Manage Your Pensions At A Household Level

Thanks to the pension taper and the limit on contribution carry-forwards, my pension limit has been capped at £10k for about a year now.

My wife, however, hasn’t gotten there yet and probably won’t for a while. So the first thing that I did when I capped out on my pensions last year was to increase my wife’s contributions into her plan to make sure our total net contribution remains the same.

Yes, its counterintuitive to contribute 25% of one’s income into a pension. Yes, once again my wife raised her eyebrows when I initially made the suggestion.

And yes, it did feel like a big sacrifice when we increased her contribution level so significantly.

But guess what? Her paycheque is now lower. Mine is higher, though offset by a tax hit as I now get taxed on the payments my employer is making in lieu of pension.

It took us about two months to adjust our budget and spending. And now both pensions are on autopilot while my wife is pleasantly surprised every time she checks her pension and sees how rapidly it is growing.

5. Go Behavioural – Increase Your Contributions With Income

In a way, the Banker On FIRE blog is all about hacking your life in order to make the best possible decisions and enjoy the best lifestyle possible.

For the majority of us, hacking our life means hacking ourselves in the first place.

There are a number of practical and psychological reasons why we make bad financial decisions. If we want to make better ones (like building serious wealth in our pension accounts), then we need to be self aware and understand how to work around our limitations.

As proven by the Nobel Prize winner Richard Thaler, one of the best ways to save more is to time your savings increases to coincide with your earnings increases.

The concept is called Save More Tomorrow and I strongly encourage everyone to read about it here.

If you haven’t got the time, here’s a summary: if you start socking away more money at the same time you get a raise, then it won’t feel like a pay cut. Genius!

You can do the same with your pensions. Every time your pay goes up, and ideally before you even get your first paycheque, increase your pension contribution.

Ideally you do this by an amount that keeps your pay flat. You can also allow for a slight increase in your take home pay if you want to reward yourself.

Do this for a couple of years and all of a sudden you have serious money building up in your pension accounts every single month.

Do this long enough and you no longer need to increase your pension contributions, which is when you can start channelling your pay increases into something else. Like spending. Or more investing.

6. Utilize Your Carryover Allowance

You get to contribute up to £40k into your pension every year. If you contribute less than that, you can carry the rest forward for 3 years.

In theory, it means that if you haven’t contributed for three years, in the fourth year you can contribute a whopping £160k.

While the scenario above is obviously extreme, don’t lose sight of the bigger point here. If you have an unused carryover allowance and some extra cash to spare, putting it into your pension is yet another step towards building your wealth.

7. Make Use Of Employer Matching

Over and above the mandatory contributions all employers now have to make, you may also be eligible for employer matching.

The details are usually on your company’s benefits website. If you cannot find them, just email HR who should be able to direct you to the right person.

Very often, contributing another few percent to your pension will mean that your employer will do the same. All of a sudden, your 3.5% top-up snowballs into a 7% pension contribution.

8. Prioritize Your Pension Over ISAs and LISAs

I plan to do a detailed post on pensions vs. LISAs shortly. In the meantime, know this – 9 times out of 10, a pension will beat an ISA when it comes to wealth creation. This is mostly due to the combination of a tax break and employer matching.

You should always have some savings in an ISA for liquidity purposes (as you cannot touch your pension until you are 55).

Leaving those savings aside, the tax break and the employer matching make pension a clear winner. Even vis-à-vis the LISA and the government’s 25% bonus. Even after the tax on the 75% of your pension.

9. Centralize And Optimize Your SIPP

Don’t let your old pensions fall by the wayside when you move employers. Read my post on creating almost £300k of lifetime wealth by simply switching the pension provider. Do the same.

10. Don’t Get Too Smart With Your Pension Investments

Final tip: after you have done all of the above, please please please don’t go off and do something stupid. Like investing in a Total Managed Volatility Livestock Index Return Fund Ex Cows.

The reality is that there are only a handful (i.e. less than 5) ETFs you need to have in your stock portfolio. One of these days, I will describe them here.

For now, remember this: ETFs were invented because it has been proven, many times over, that it is nearly impossible to beat the market on a consistent basis.

Please don’t try to become a closet active manager by investing in a highly specific, esoteric fund. Just buy a low-fee, broad-based index tracker.

The Banker On FIRE Pension Value Evolution

Saving for pension should be one of the most basic and easiest decisions you will ever make.

Sure, my wife and I had to force ourselves to increase our pension contributions are few times since we started saving into one.

But only six years after starting to save into the pension, we now have c.£200k in our pension pots.

I cannot begin to tell you how amazing it feels to know we have made the tough choices when it comes to our pension.

And even though we always knew it was the right thing to do, seeing our strategy validated in the numbers is one of the most rewarding aspects of it.

Even if we stop all pension contributions now (unlikely but could happen), our pension is on track to grow to about £700k by the time we retire. Hopefully this also means we are firmly in the top decile when it comes to net worth!

Please Invest In Your Pension Now

There you go, I said it.

If you really want to be rich, then please get off your backside and go top up that pension of yours now.

Trust me, fast forward a couple of years and you’ll be thanking yourself every single day.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

The only thing I’d say to this is I kind of wish I’d split my savings between isas and pensions for the liquidity for a few years. I’m 39 and only started earning good money maybe 10 years ago (as in paying higher rate tax) I’m only just touching 6figures as of this year. Nevertheless I have about 215000 in my pension but until recently I never really had alot other than equity in my house. I contribute about 12% and my employer 6 so about 1400 a month (this should start to go up to mirror our parent companies contribution of 12% over the next few years) but for me now I want maybe 200k in isas for liquidity. I’m still paying mortgage off over 30 years but will then use dividends from my isas to take lumps out of the mortgage. Thats the plan anyway. Seems more sensible than paying anymore off the house directly now and tying it up. Mortgage is 275k at about 58% ltv

Hindsight is always 20/20 but I think you’ve done the right thing. You never know how pension regulations will change so good to take advantage of it now.

I have a lot of high earning friends who didn’t utilize the tax breaks when they could. Now they’ve been hit with the maximum taper, which means they can only contribute 10k/year into the pension. It’s a massive missed opportunity.

A penny for your thoughts, Banker.

I’m maxing out my pension at the moment and I’m not sure if I should start scaling back based on the amounts accumulated so far. I’m 40 and have £165,000 in my pension. If I stop constributions today, and we assume a 10% return for the next 19 years, then the pot will hit £1m. Based on this it would make some sense to stop contributions fairly soon, however, this scenario doesn’t take sequences of returns risk into consideration. What would you do if you were in my position?

My wife has a pension pot just shy of £100k.

We both have combined ISAs and GIAs of £450k.

Hi there.

I would say 10% is punchy. It’s what the US market has delivered over the long run, but I am modeling 7 – 8% in my personal projections.

You can try to reallocate some of “your” contributions to your wife’s pension? Alternatively, you could hold some lower-risk, lower-return assets in your pension and the riskier assets in your ISAs.

Most importantly, do you want to / are you able to retire early? If so, it might make sense to start topping up ISAs / GIAs anyway.

Thanks for your thoughts.

10% does sound a little high but I’ve achieved an annualised return of 12.5% pa since 2005. I guess there will be a reversion to the mean so maybe 8% is a better figure to go with.

My wife has lost her job as a result of COVID so until she finds a new role her contributions will be fairly limited.

I think maxing out the pension for another couple of years may be the best option here. We may lose the tax relief before then anyway.

I’m interested in the FI part of FIRE but not really the RE.

Got it. I’ll admit I’m in the same boat (cannot imagine not working, though I can imagine working for myself and not a corporate at some point).

In your situation, if you were to hold some bonds in your portfolio (as part of reallocation towards retirement), your pension may be the right place for that to help keep you under the LTA while accomplishing your overall portfolio objectives.

On a separate note, Monevator did an excellent piece on pensions vs ISAs – did you see that one? Might be helpful reading to help refine the thinking: https://monevator.com/how-much-wealth-do-i-need-in-my-isa-versus-my-sipp-to-achieve-financial-independence/

Either way, it’s quite a high-quality problem to have!