I am going to kick off today’s post with a couple of personal finance confessions.

First of all, I have no idea what my FIRE number is. That’s right, zero clue.

Now, to be very clear, I do have a range.

There’s a “base case” number – let’s just say it’s somewhere between $1m and $10m.

And then there’s the “stretch” target. This one is in double digits.

It’s a heck of a spread – but that’s okay. Because the second revelation of the day is that I have no idea when I am going to retire.

I mean, how could I if I don’t even know what my FIRE number is?

And so, somewhat unusually for a personal finance blog, you will find very few posts on early retirement here, other than my reflections on how it terrifies me.

Instead, I spend the vast majority of my time writing about the various ways to build wealth, as well as some reflections on designing an enjoyable life.

Some of it is down to personal preference. As it happens, I quite like the process of making money (amongst other things).

But the bigger issue is that I am always dumbfounded when I go on Twitter or another personal finance blog and see statements like:

“I am 27 and I will retire at 43 with a $1.75m portfolio”

The Great Unknown

Here’s the thing, I don’t consider planning to be a useless exercise. Far from it.

You definitely want to have a good grasp on how much money you are making, how much of it you are spending, and where the rest of it is going (hopefully mostly towards investments and not those friendly ladies hanging around Novikov on a Friday night).

However, anything beyond that is a total punt – because your savings rate is the only thing you have control over.

When it comes to investment returns, we are all just guessing.

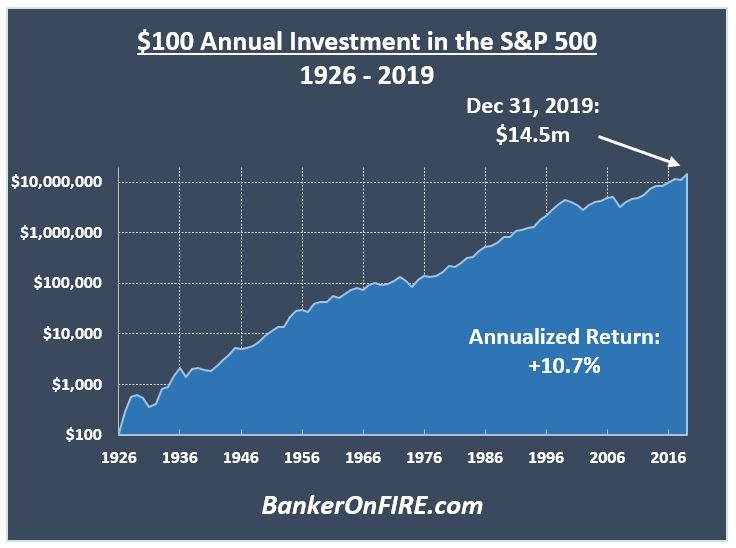

Sure, those guesses are rooted in history and math. Over the last 100 years, the S&P 500 has generated an extremely nice annualized return:

And so, looking at charts like the one above can be highly reassuring.

That being said, statistics is a funny science. I mean, your neighbour may be the one having two girls over on a Saturday night – but statistically speaking, you are also getting some action.

Similarly, returns do average out over time – but no one invests with a 100-year horizon in mind.

A person who started investing in 1928 or 1999 would have a drastically different experience from the one riding the incredible bull markets of the 1980s or 2010s.

Same stock market. Same strategy.

Wildly different outcomes.

Crystal Ball

Let’s suspend our disbelief for a moment and assume that by some act of clairvoyance, we are able to say with confidence that future returns will average precisely 8.371834% per year.

Do you think that solves your problem? Tough luck.

Sure, you can calibrate your investments in a way that will leave you with exactly $1.75m by the time you hit 43.

But how will you know what that $1.75m will actually buy you in 16 years’ time?

First of all, there’s inflation. It could be 2% – or 5%.

For all we know, inflation could actually get ahead of the stock market for a while, leaving you with a negative return in real terms. What do you do then?

Or you could end up with a massive cognitive dissonance where the “official” inflation is 3% but your experienced inflation is four times as much.

I mean, have you tried buying a used car recently – or sending your kids to a private school?

Finally, there’s the question of your actual spending patterns over time.

I have an extremely good grasp of how much I’ll spend next year – or the year after that. But in 16 years? You’ve got to be kidding me.

Thing is, life happens – and it doesn’t care about that nifty spreadsheet you typed up.

Kids, aging parents, emergencies and windfalls, medical problems – there’s an infinite list of curveballs life can and will throw at you. And when they do come, finances are the last thing on your mind.

Sure, you can spend as much time as you like refining your return, inflation, and spending projections.

If you are really good (or lucky), you might even be able to come up with a semi-accurate forecast.

But as ever, the biggest problems lie outside the spreadsheet.

Goals vs. Systems

Scott Adams, the creator of Dilbert, has a wonderful book called “How To Fail At Almost Everything And Still Win Big”.

In it, he spends quite a bit of time describing the difference between goals and systems.

Remember that statement I opened today’s post with?

“I am 27 and I will retire at 43 with a $1.75m portfolio”

What you see above is a goal. It’s an admirable goal, but it’s still a goal.

I will retire at 43. I will have a $1.75m portfolio.

A system is totally different. It could be:

“I will save 25% of my income – and 50% of all future raises”

Or

“I will invest 100% of my savings in low-cost, globally diversified index funds”

You see, the way Scott sees it (and I agree with him) is that goal-oriented people live in a continuous state of failure.

Most of the time, it’s what he calls “pre-success failure” – because they haven’t accomplished their goal yet.

But very often, that failure becomes a permanent failure – because their goal never works out.

You either don’t hit the mark, or you hit it too late, or you give up altogether.

Either way you cut it, it’s failure all around. It feels like a fight, causes stress, and makes folks feel like they want to give up.

This is especially true for people who take their goals seriously – like most readers of this blog.

Systems-oriented people, on the other hand, live in a perpetual state of success.

They succeed every time they save 25% of their income. They succeed every time they log on to Vanguard to buy those index funds.

And because they feel successful, they feel motivated and empowered to continue with their system.

Success begets success.

Wrong Questions

The other advantage of orienting your life around systems is that you are not pigeon-holing yourself by sticking to a goal you may have set many years ago, under very different circumstances.

Systems, by default, are flexible. Goals aren’t.

And so, a well-designed system provides enough flexibility to stop viewing life decisions through a financial prism – and to reflect the natural progression of life.

Perhaps you wake up one day and realize you want to start a business. Or write a book. Or simply take some time off to be with your kids.

In a goal-driven world, saying yes to any of the above implicitly means you are likely to fail at your goal of “retiring at 43”.

After all, that spreadsheet you built up didn’t account for a drastic reduction in income – with a non-existent (or a highly uncertain) offset.

Not so when you build your life around systems.

You can still continue saving 25% of your income and putting all the money into index funds.

Sure, you’ll contribute a far lower amount. But you will also end up living the life that’s right for you today, not ten years ago.

As it happens, I am coming in pretty close to my “base case” number.

That being said, I’m still far away from the “stretch” target. Unsurprisingly, the fastest way to get there is to continue doing exactly what I’ve been doing so far – maximizing my income and investing in real estate and equities.

But the thing is, getting there ASAP is not my goal. I am okay if I reach it when I’m 45. I will also be perfectly content if I get there at 60.

And if I never get there, courtesy of a nasty market correction, a nuclear war, or a terminal illness – that’s also okay.

Because while my system calls for maximizing my income, it doesn’t come at the expense of looking after my health, spending time with my children, and finding time for things I find enjoyable (i.e. this blog). Which, of course, leaves me with plenty of leeway as I think about the next episode.

In other words, there’s absolutely nothing wrong with setting goals and working towards them.

But as it happens, putting the right systems in place can take you even further ahead – all while making the journey far more enjoyable.

As always, thank you for reading.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

I enjoyed this one, a great articulation of the wisdom in selecting a direction of travel and then being flexible about how we will get there.

Thanks indeedably – always great to get a nod from one of my favourite bloggers!

Couldn’t have written it better myself.

Also no FI number (also have a range) – how could we when we don’t know if we’ll be living in Zambia, Spain, the UK or the US – with the cost of living so different in each.

Systems > Goals

Indeed.

Easy to spend countless hours finessing yet another spreadsheet.

Much harder (but much more effective) is to say: “I don’t know” and follow a set of guiding principles instead

Very well articulated BoF.

Same camp of not having an actual FI number. The only constant in life is change though have a broader direction of travel that I’m working to for a comfortable life for myself and the family.

Exactly.

Hopefully the “number” keeps ticking up while other important aspects of life (health, family, hobbies) are also in place

At the end of the day, enjoying the journey is the definition of a life well lived

It’s interesting, I have a exact opposite approach. When I was in my 20s, I told myself I will retire by 40. That is something else you have control over: at what age you will retire.

It was either retire by 40 or retire once I hit about a $3 million net worth, whichever came first. Given I was able to negotiate a severance that paid for 5 years of living expenses, I took the leap of faith at 34.

Planning is great because planning is free. Just throw up several scenarios.

Everything really is a leap of faith. And it is hard to let go of the money after a while. But I didn’t care too much anymore.

And sometimes, who knows. A bull market might make you much richer and you might find something new to do that will grow massive after you leave.

Sam

I agree

I know many incredibly accomplished people who zeroed in on a goal – and followed through with surgical precision.

Then again, many of those folks missed out on multiple even more lucrative opportunities along the way because they never paused to take stock and reconsider their direction of travel.

Surely goals are flexible too, since goalposts can always be moved and are not fixed?

Hmm, I’ve got a slightly different view on that

It may be just me, but when I do set a goal for myself, I pretty much stick to it no matter what. I.e. I am the kind of person who feels bad about not crossing all items off my daily to do list 🙂

So yes, you can (and sometimes should) move the goalposts but what’s the point of setting goals in the first place then?

You set the goal as something to aim for, to provide some focus for life.

However, due to the ‘unknowns’ (there is no crystal ball as you say), until you’re on the path to go for the goal, you don’t really know how viable or realistic that goal is.

Take your “I am 27 and I will retire at 43 with a $1.75m portfolio” goal.

A person sets this as their ambitious goal. Five years later, they will likely realise that life/views have changed, so they will perhaps move the goalposts to something which is more realistic and which more aligns to their life now so they continue to have something to aim for.

How does your portfolio investment income after costs compare to your spending requirements? You may have already achieved that crossover point where portfolio income exceeds spending. Then you have to consider how much more you want and how much more work you want to do. That’s how I considered it.

We are quite close.

That being said, a meaningful portion of our cash flow is from property and the way I release capital is by refinancing every 4-5 years, so it’s quite lumpy

Having just turned 40, I am just not in the mindset of “retiring” yet. More about figuring out what I want to do (work-wise) next. Clearly being in a good place financially helps expand the universe of available options!

Don’t confuse strategic goals with objectives.

Goals should be fixed broad outcomes where objectives have key results (aka OKRs) and lead to your goals.

“I will retire at 43. I will have a $1.75m portfolio“ although long term, like a goal is very specific with key results. It is a goal but has the properties of an objective = bad, it’s too specific and suffers from all the bad stuff you talk about. You’ve set yourself up for failure.

Your goal should something like “be financially independent by my 40s”, then you set yourself objectives to get there. Ie the system, save 25% of my income this year and spend 10% less this year. You then have full flexibility to achieve that goal whilst working towards a strategic desirable outcome. If FI turns out to be £1m or £3m your system (objectives) will adapt overtime as the future begins to reveal itself,

There is a reason in business we build strategies based on a vision, mission, goals/outcomes and objectives. Your life should be the same.

Bottom line set strategic long term goals based on your vision of who you want to be, your mission is to work out what you need to do to be that person, the goal are your broad outcomes to achieve your mission and use objectives that are more precise and in the present to get to your goals, continually set yourself objectives at least yearly.

It might sound a bit heavy but you probably do this already without realising this.

Agreed. I think you’ve articulated it very well, it’s good to approach it from a top-down, structured perspective

The reality is that all businesses have strategic planning sessions where they go through the process you outlined above

For most individuals, while it does happen implicitly, it’s rarely done in an organised way.

Fantastic post. It reminds me of the book Atomic Habits and you applied the system vs. goal concept brilliantly in the journey of financial freedom. Thinking about a goal is indeed like climbing a mountain – it could be motivating but also soul-destroying at times if you think about the long and arduous journey ahead. The system is the success in the every step of the way. Thanks for articulating this so wonderfully.

Applies to careers as well

Some folks start out in IB and think “Jeez, I’ve got to do this for 12 years before I make MD!”

While others just say “I’m going to do a good job, learn as much as I can, and try to maintain a work life balance. If things get unbearable, I will leave”

Interestingly enough, it’s the people in the second category that end up rising much higher

Two points in favour of goal setting.

One, the goal provides a yardstick against which you can measure progress. I found it useful in my 30’s for motivation if nothing else.

Two, it makes you face reality. With your goal reached, you have to decide what comes next. You can carry on as you were or make a dramatic change, but it will be you, not inertia, making the decision.

Goal setting worked for me, but I’m happy to acknowledge that it does not suit everyone.

Fair point. Too many folks reach their “number” only to move the goalpost even further

I do like goal setting, but I am the kind of person that REALLY hates not achieving my goals. Over time, I found switching to a systems-based approach works much better. But, at the end of the day it’s all individual

Not sure what your net worth currently is. But since you are in banking and are 40, I would shoot for $10+ million before retiring or switching gears. And if you are already past that goal, shoot for $23.4 million as that is the estate tax limit for couples here in the States.

$10+ million invested should be enough to equal investment returns similar to your current income. At this point, work really doesn’t matter much anymore.

Not quite up there yet. Think you can get to $10m by 40 if you start in IB out of uni.

I took a more circuitous route, though I am delighted to have spent my 20s outside the banking grind!

In reality what you are doing is giving you and your family some options. What you do with these options and when you choose to do that are both entirely up to you. Is this not a better approach to life than being on the receiving end of somebody else’s whim?

Of course. I guess the question is whether you use a goal-based or systems-based approach in order to establish that optionality.

Apologies for the obvious question – but does the label really matter that much? I would venture that the ends are somewhat more important than the means.

Really enjoyed this post, and agreed that system-based thinking can be very helpful, particularly for those of us who are prone to living too much in the future.

As a few people have mentioned, I think there is still some value in having a sense of roughly where you want to get to, even if it’s fuzzy around the edges and you expect that life will probably end up playing out differently (for better or worse).

There’s a phrase I came across in a book recently that summed this idea up nicely for me: “have a plan, but hold it lightly”. Easier said than done, but I’ve found it helpful.

“particularly for those of us who are prone to living too much in the future.”

That kind of hits the nail on the head. Folks who somehow feel like they cannot be happy until they reach a specific goal stand to realize the biggest benefit from shifting towards a systems-based approach.

One reason I prefer systems is that I used to find myself in that camp quite often…

I am glad that this article did not say that planning is worthless. It is unimaginable to me to live my day-to-day life without doing so. I do not know if this is nature or nurture, but I am just so used to having a sense of control on what is going on, especially with my finances.

I am in total agreement that some things and events are outside of my control, that continually obsessing to take control will only end with failure. The idea that you wrote about goals and systems made me think and to me it seemed that with systems you always succeed because of the flexibility, as opposed to the rigidity that a specific goal brings.

I do have a FI number, because I want to know, but it continuously evolves as our family and our circumstances change. Like us it is a living being that I make sure adapts to any situation it is in.

Not at all. Like you, I consider planning to be very important.

Just need to acknowledge the limitations of planning – which is why it always surprises me how prescriptive people become when they take a historical market return, plug it into their spreadsheet, and say with 100% certainty: “I will hit my FI goal in 2043”

In the same boat as you re: FI number. Have a directional idea but equally acknowledge that spending patterns can and do change, especially on a 10+ year horizon!

Interesting perspective. I tend to agree that setting very specific goals can be counterproductive.

I like to approach the topic with military analogies – which I think is very similar to the process you describe. One way to put it is to define your strategy, meaning what “winning” would be for you: quitting your current job, going part-time, focusing on family/hobbies, etc.

Then work your way back and define the tactics to get there: train yourself or change position to increase income, improve savings rate, invest in real estate or index funds… And keep an open mind to adjust to exogenous factors along the way, with your winning goal always in sight.

P.S.: I have been following your blog for a while and wanted to say I have always found the content very insightful. I can relate to a lot of the posts as I have done my own stint in IB a few years ago… I started my own blog a few weeks ago and hope I can one day have as much great content as you do!

Thanks for the kind words about my blog – and the apt analogy which I quite like 🙂

Congrats on starting your blog – it’s hard to believe I’ve been running this one for 2.5 years. Time flies with these things.

Pls ping me an email once you’ve been at it for a few months – I often feature new bloggers in my biweekly Greatest Hits roundups to give folks a traffic boost.

For these folks, more money isn’t the goal once you have enough.

It really isn’t. From working in finance, I know it’s hard to get away from money. But it really is like the Matrix where once you leave, you will see things in a different light.

I promise you this!

Interesting. Maybe instead of shooting for an age target, I should work towards a system target where if I just save the target amount, then it’ll all work out in the end and I’ll have achieved my goal.

Off topic comment. I have no idea how you work in M&A investment banking, have children, AND still have time to crank out meaningful blog posts that highlights important life topics. Much respect from here. Also, I don’t doubt you’ll reach the 8 figure+ mark if you continue to work in investment banking, too.

I just think it’s impossible to shoot for an age target because market returns are outside of our control.

Much easier to say “I will save x% of my earnings and will retire once my investment / drawdown income matches my living expenses”.

And thanks for the other comment. I hope to hit eight digits without necessarily working in IB for much longer!

TBH I think *both* are required. I used to be a lot more process oriented and found that the process never gave me the outcomes I want. Then, I became very outcome-oriented and that caused a ton of frustration and anger like you said.

Nowadays, I find that a balance between both focusing on outcome *and* process works for me. The process helps put me in a state of ‘continual success,’ while a reality check periodically to see if my outcomes are hit tells me whether or not my process is just wrong. For example:

* I want to work out 3 times a week with XYZ program. My diet will have some macro distribution. I will hit a squat of 315lb in 9 months.

* By month 3, I might realize that I am not even on track despite following my regimen religiously. Ergo, I come up with some hypothesis, do more research, and make tweaks.

* Same for month 6.

* And on month 9, 2 things can happen: I can hit 315 or I don’t. If it’s the former, I win because I have accomplished a very far-fetched goal and the win is exhilarating even if the journey going there is hell. If it’s the latter, I’m likely way more adept than when I first started and constant focus on the outcome would have forced me to learn a lot more than if I just followed the process.

So for me, both methods feed into each other and aren’t mutually exclusive. The outcome helps me feel *bad* and use that chip on my shoulder to improve my processes. My processes and building atomic habits help drive to keep my on track and feel like I’m taking good, small wins everyday without ever losing site of the big-picture outcome.

After all, what’s a process without the outcome?

That’s very well articulated and I agree with you.

I think the problem is that if the journey is tough, most people will peace out as they probably don’t have the same level of willpower (or spend that willpower on different things, as it’s a limited resource).

So the idea is to enjoy and internalize the process (working out) first, which subsequently goes a long way in helping achieve the goals.

Very impressive squat by the way!

Pingback: The FIRE Insights Survey #4