Back in February, when a very prescient colleague of mine was busy liquidating his equity portfolio, a good friend of mine was going in the opposite direction.

He and I had discussed investing in the past – and he had fully signed on to the gospel of not looking to beat the market, investing in low-cost index funds instead.

As the market continued to tank over the next five weeks, my friend was continuing to buy equities, exhibiting a great deal of self-control in the process.

The only problem?

He was putting his money into a FTSE 250 index tracker.

Taking Stock

In investing, the home country bias refers to the tendency to allocate more money to domestic equities than warranted by the weight of those equities in the global market.

It’s a psychological tendency to “buy what you know” (or what your financial advisor knows). By virtue of having smaller stock markets, countries like Canada and Australia tend to experience an outsized home country bias effect.

However, as the chart above illustrates, it holds across the board – and the UK is no exception.

In case you are wondering, indices like the S&P 500 or the FTSE 250 often include foreign companies – or companies with significant exposure to foreign markets. At last count, the S&P 500 constituents generated almost half of their revenues outside the US.

However, they are still considered to be “domestic” equities for classification purposes.

And notwithstanding any international exposure UK equities may have, their performance has been nothing short of disappointing this year. Instead of patting himself on the back for holding his nerve, my friend is still sitting on a paper loss and is some distance away from breaking even:

It’s not a temporary phenomenon, either. Over the past five years, the FTSE 250 has underperformed the S&P 500 by a whopping 62%.

And if you zoom out and look at performance over the past decade, the gap widens even more, a 221% rise in the S&P 500% vs a (relatively) paltry 107% gain in the FTSE 250.

Total (Lack Of) Return

What I often bang on about here at Banker on FIRE is the need to look at total return, not just price return (which is what the charts above show).

In other words, it’s the need to account for dividends paid out by constituents of the index that you hold. The chart below is a punchy illustration of how much impact dividends can make:

However, dividends hardly bridge the disparity in returns between the US and UK markets.

The dividend yield on the S&P 500 is around 1.8%. The FTSE 250 has a dividend yield of about 2.1%. That’s simply not enough to compound into a 116% difference over ten years.

So what gives?

The Credit Suisse Investment Returns Yearbook provides some helpful context.

The first and most obvious reason for the divergence of fortunes is technology.

As you can see from the pie chart below, technology comprised roughly a quarter of US equities in 2020.

US stock market industry weightings – 2020

In the UK, on the other hand, technology doesn’t even register, the likes of Softcat and IQE ignominiously categorized as “Other”.

UK stock market industry weightings – 2020

Missing out on the growth in large-cap tech stocks doesn’t bode well for anyone’s portfolio these days.

The other challenging sector is banks. As it happens, the UK stock market has a much larger proportion of financial institutions.

As the interest rates continue their long-term decline, the net interest margin (i.e. the spread between the rates at which banks borrow and lend money) continues to shrink.

No, it ain’t easy being a bank these days – and neither is owning one. In addition, European banks tend to be more strategically challenged than their US counterparts, due to a tougher macro backdrop and a series of missteps post the financial crisis.

The third nail in the proverbial coffin is oil & gas. Comprising about 15% of the UK equity market, the oil and gas majors are giving UK investors the proverbial kick below the belt.

In theory, the long-suffering UK investors should at some point see a turn of fortunes – and be rewarded for their patience. You know, reversion to the mean and all that good stuff.

But is that really the case?

A Hundred-Year View

A few pages down, the same yearbook provides some fascinating data on long-term real equity returns across various markets (denoted by the “geometric mean” column below):

The evidence is stark: UK equities have underperformed their US counterparts by a whopping 1% over the past 120 years.

Now, we all know that small differences can really add up over time, but the difference here is quite striking:

Of course, investors are typically happy to forgo (some) returns if they get compensated elsewhere, like with a commensurate reduction in risk.

Unfortunately, UK shareholders missed out on that one, too.

The volatility of returns, measured by the standard deviations on the two stock markets, is actually pretty much in line: 19.6% for UK investors and 19.9% for US investors.

In other words, you can bet on the FTSE recovering over the coming years – or decades. However, long-term data simply does not support that view.

Owning The World

If a reduction in volatility is your objective, you might as well have gone for the world equity index (had one existed back in 1900).

No, you wouldn’t have knocked it out of the park, with an annualized real return of just 5.2%.

A big reason for it is that entire markets have gotten wiped out over this period of time. Russia. Pre-war Germany. And there’s a whole bunch of proverbial dogs in the mix, delivering negative real returns over that time period:

Still, owning the world is a good idea, especially if you are concerned about a Japan-like scenario playing out in the US.

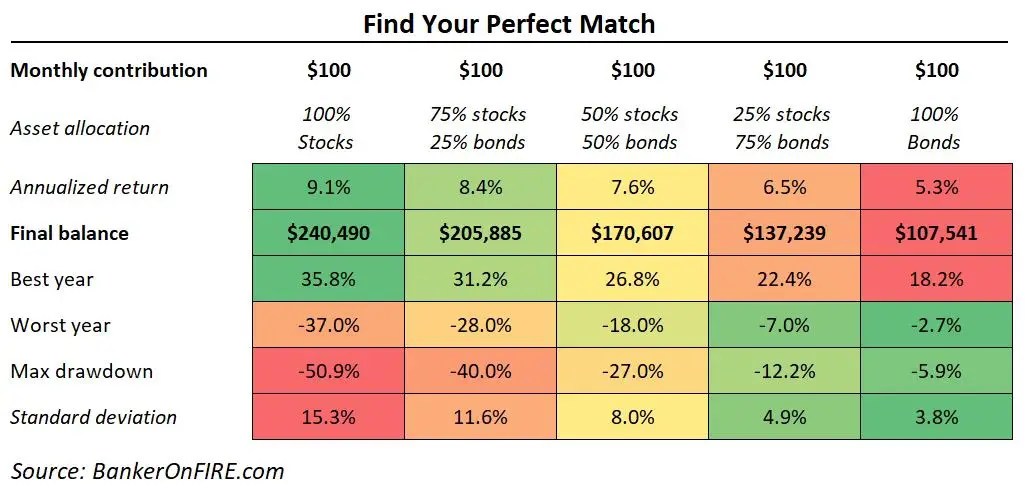

Alternatively, you could just construct a portfolio of US stocks and bonds, finding your perfect match on the spectrum of risk-return profiles:

Ultimately, you need to pick your own stock market investing strategy – and stick to it. But if you are looking to maximize your risk-adjusted returns, investing in the FTSE is probably not the way to go.

Thank you for reading!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

What’s the timescale in that last table please?

Since 1987. This post has the juicy details behind the analysis:

https://bankeronfire.com/bonds-vs-stocks-what-30-years-of-performance-means-for-your-portfolio

Fascinating performance difference. I like the chart on home country bias. I thought everybody owns mainly the S&P 500? It’s like owning the NBA, where the best play instead of just owning the Spanish league basketball team 🙂

Conversely, it’s like owning the English Premier league instead of the MLS in America.

Sam

Indeed. In a way, much easier to be a US investor – you get to hold the majority of your portfolio in domestic assets and are thus insulated from FX movements.

In other words, home country bias works to your advantage.

I also find the long term performance differentials striking. A 1%+ return is a hell of a lot to give up, with no corresponding reduction in volatility.

There’s also the question of taxation. Home based equities get a sweet tax deal.

Do they? I’m not aware to be honest, at least not here in the UK.

Very possible it’s about to get worse here in the UK too…

You mean given Brexit? Quite possible, though I would hope that entire mess is now priced in…

I was thinking more the CGT changes looming on the horizon, including a possible a reduction in the personal allowance. Nothing set in stone as of yet but watch this space. Could make an already bitter tax deal a little more sour.

Ahh, yes. Monevator had a good post on it this weekend.

Ultimately, you’ve got to hold your investments within an ISA but let’s see how long those generous allowances last.

Even though the UK have performed badly compared to international markets, its nothing as bad as how the HK markets have done in the past decade. They are very heavily Bank and real estate dominated. There is a push towards Chinese tech stocks recently so it will be interesting to see how that shakes up the markets in HK.

Yes. Bad news for those whose behavioural bias (“buy what you know!”) or financial advisors streered them towards home country equities.

The Ant debacle last week obviously didn’t help either.