It’s going to happen.

It could happen tomorrow – or many years from now.

Perhaps it’s a sharp drawdown – or a painfully long journey that resembles death by a thousand cuts.

It could end quickly, like the March 2020 or the October 1987 crash. Alternatively, recovery could take years.

But the only thing that’s certain is that at some point, there will be a stock market crash.

I’m not saying this just because of all the madness that’s out there at the moment, though when I see WallStreetBets crushing hedge funds on GME or Robinhood traders discovering momentum trading it certainly makes me feel like 1999 all over again (and not in a good, youthful way).

Quoting a fellow finance blogger, stock market crashes are a feature, not a bug. Thus, if you are serious about your finances, you better have a plan to deal with a crash when it comes.

Today, let’s talk about some things you can do to prepare.

#1: Assess Your Exposure

While the stock market crash of 1929 set off the Great Depression, it certainly didn’t end that year.

As a matter of fact, the S&P 500 was only down 8% that year. It ultimately bottomed out in 1932, with a nasty peak-to-trough decline of 84%.

During the 1970s crisis, investors have seen a maximum drawdown of about 48%. The dot com bust had a similar decline of 49%.

Finally, the financial crisis was another whopper, with a 56% peak-to-trough decline.

It’s fair to say that we probably won’t have a repeat of the Great Depression. The governments and the central banks have learned a lesson or two in the past century.

That being said, you should probably assume the next stock market crash could temporarily wipe out as much as 50%-60% of your equity portfolio.

You should let that number sink in. Ideally, use it to update your net worth file. Stare at it for a while.

How does that picture make you feel? Importantly, how would your significant other feel about it?

If you are able to keep it together, well done to you.

But if the mere prospect makes you sick to your stomach, you should re-evaluate your asset allocation pronto.

And even more importantly, …

#2: Don’t Forget About Correlations

That is, the fact that the stock market typically doesn’t crash in isolation.

The decline is typically caused by an exogenous factor (pandemic, anyone?) – and is pretty much guaranteed to cause price declines across a range of other assets, from commodities to real estate to equity derivatives.

If you run a business, you may see a sharp drop off in client activity and revenues.

If you are employed, your company could fall on hard times – and decide to lay off folks and cut pay for those who remain.

You’ll need to form your own judgment here but remember – bad news never comes alone.

Be prepared.

#3: Calibrate Your Spending

At times of market volatility, reducing your spending is one of the biggest levers you can pull to keep your finances on track.

Doing so immediately increases the “life span” of your emergency fund, offsets any reductions in your pay, and enables you to take advantage of depressed asset prices.

Most importantly, being able to flex your “cost base” downwards gives you peace of mind – because you know you’ve got options in case markets hit a rough patch.

Have a look at your budget (and if you don’t have one, start keeping one ASAP).

What are the “discretionary” costs you can temporarily do away with?

Can you chuck that expensive gym membership?

Find a replacement solution for your nanny/nursery (time to give granny a call?)

Skip that next holiday in favor of a staycation? (this one should be easy)

Identify your top 5 “emergency measures” and see how much of a difference that makes.

It will depend on your current spending patterns, but I know that for me, a 25% reduction is well within reach.

This is also one of the biggest reasons why spending on experiences trumps physical purchases.

Much easier to stop eating out for a while than to take that expensive BMW back to the dealership.

#4: Protect Your Earnings

On this blog, I cover a lot of ground writing about strategies for maximizing your earnings.

I am also a big believer in changing jobs as a tool for accelerating your pay and career progression.

No need to cover any of those topics again. Just remember – stock market crashes typically tend to catalyze changes that have been long in the making.

One could argue that changing jobs just before a crash can be dangerous. Last in, first out, and all that.

Perhaps. What’s even more dangerous is being stuck in a job that is slowly disappearing, courtesy of technological disruption or simply being tied to a shrinking industry.

In a downturn, these are the riskiest jobs to be in. They are the first on the cutting block when management is looking to revitalize and reposition their businesses.

Reinventing yourself is never easy – don’t make it any harder by trying to do so at times of severe market dislocations.

In other words, fix the roof while the sun is shining.

#5: Keep Investing

Everyone talks about it. Few people actually do it.

On the face of it, the FI community accepts the wisdom of continuing to put money to work in a crisis.

You take advantage of depressed prices, buying stocks on “fire sale”. When the market inevitably rebounds, it is these purchases that will give your portfolio a nitro boost.

And yet, as the experience has shown, very few people actually do it. When the world seems to be collapsing around you, you don’t need to go far to find an excuse.

This time is REALLY different!

But we’ve never had a pandemic / terrorist attack / [insert your own] before!

This is just the beginning – it’s all going to come down like a house of cards!

In other words, this:

What will YOU do in a stock market crash?

To make matters worse, people don’t just pause their investments. They also make the biggest mistake a stock market investor could ever commit.

As Morgan Housel says in his excellent book*, your success as an investor isn’t determined by what you do when the times are good.

Instead, it’s determined by your behavior in those rare moments when things are bad.

Other than simply holding your nerve, there are multiple ways to force yourself to stay the course in a crisis.

Automating investments is one.

The other one is to put a commitment device in place.

You can even hire a fee-only investment adviser who can steer your portfolio through turbulent times.

It doesn’t matter what it is. Just make sure you have a plan in place.

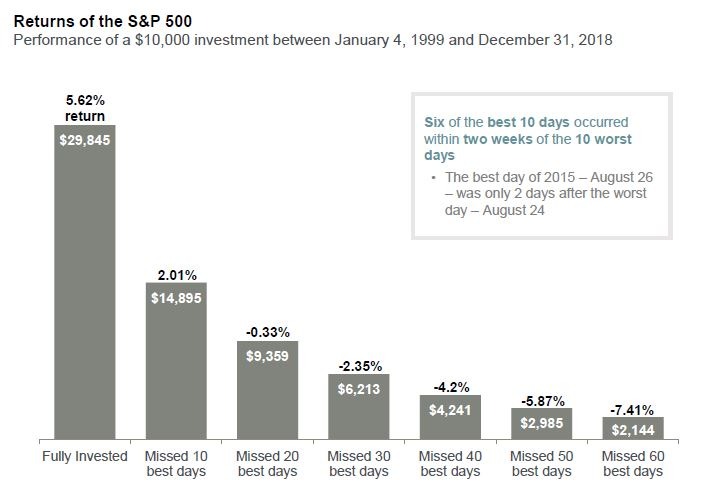

#6: Don’t Try To Time It

The threat of a market crash has been hanging over our heads for the better part of the past decade.

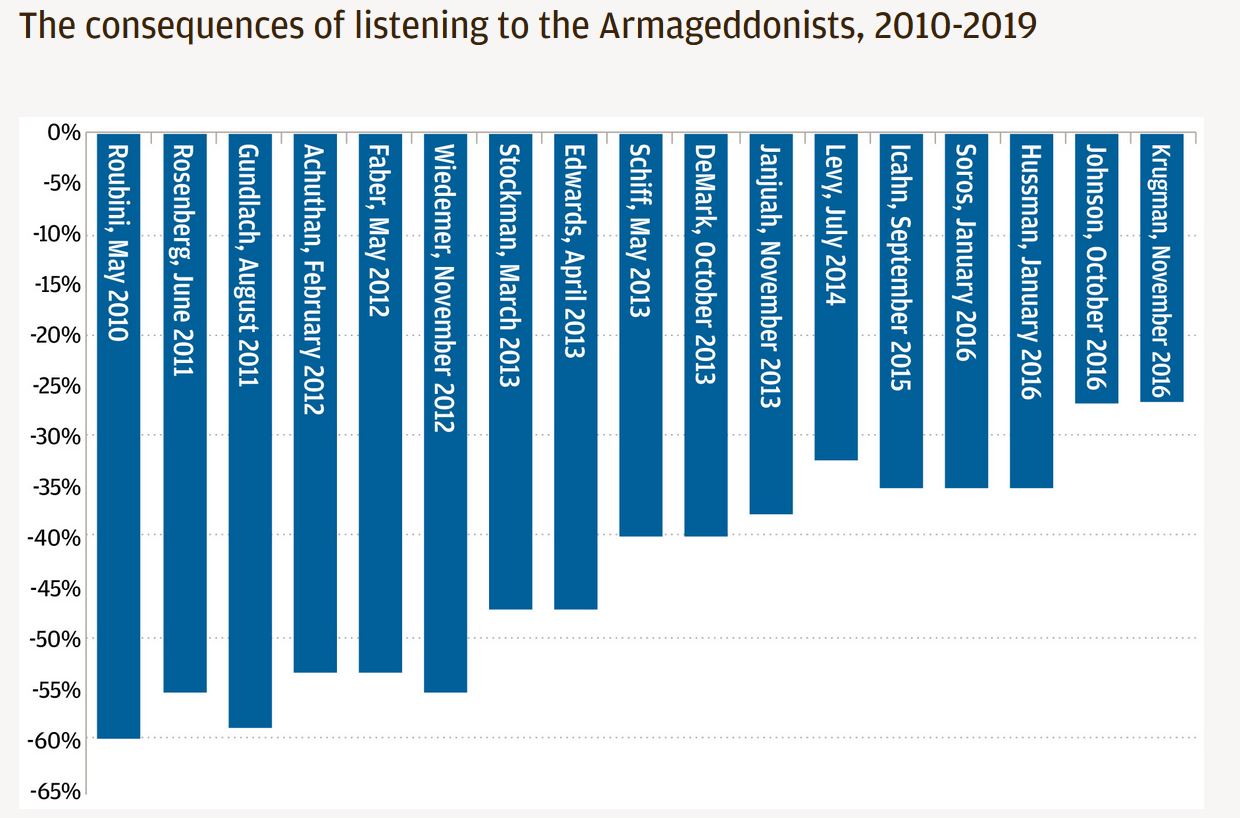

Below is a graphical summary of all the doomsday predictions made by famous economists and investors starting in 2010:

The vertical axis plots the absolute loss you would have experienced if you had taken their advice at the time and cashed out of the market.

Given this chart was prepared in 2019, you can increase the losses by another 10-15%.

Remember – no one can time the market. Not you, not me, not the smartest person in the world.

We all know the crash is coming – at some point. But investing like a correction is just around the corner is the worst thing you can do.

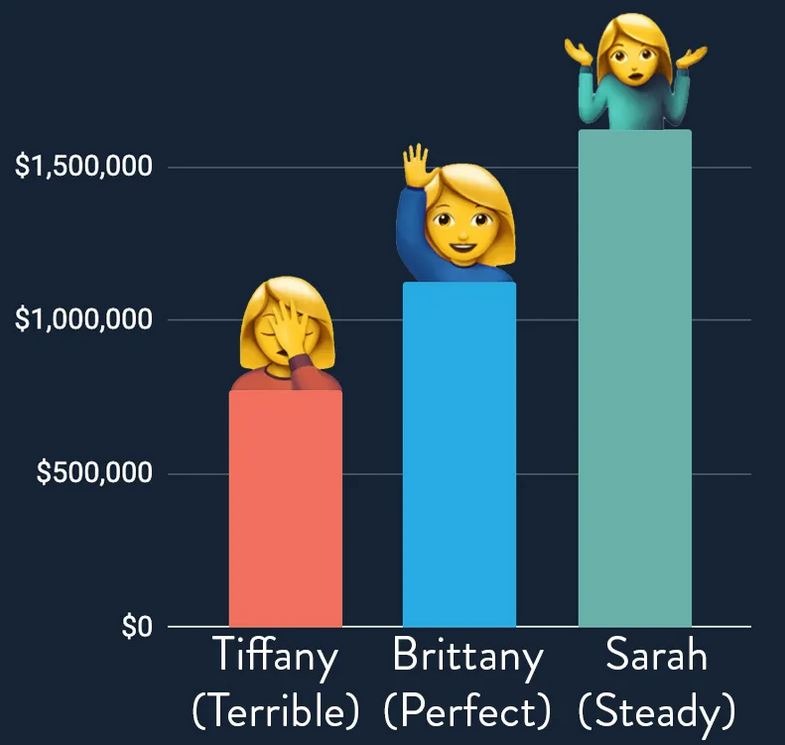

If you still don’t believe me, I encourage you to read this wonderful post from Personal Finance Club. It proves that steady investors end up ahead of perfect timers:

Staying Optimistic

Yes, it may seem more than a little depressing to engage in a thought exercise alongside the above lines.

I mean, why in the world would you want to envisage scenarios that may have a catastrophic impact on your finances – and possibly your employment as well?

I’ve got a diametrically opposite perspective – because planning for a crash gives me comfort.

The comfort of having a decent sense of what the impact on my portfolio is going to be.

The comfort of knowing that I can flex my spending to ride out any volatility.

The comfort of knowing that I’ve done all I could to de-risk my employment.

Most of all, the comfort of knowing that I will take advantage of the depressed prices – and ultimately end up miles ahead of where I would be otherwise.

It’s a pretty good feeling. Give it a shot and see for yourself.

Happy investing!

*Affiliate link. Read more about our affiliate policy here

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Great post thanks! One additional measure, if you are getting on a bit (!), is to make sure you have several years living expenses (2 for me) in cash or near-cash. E.g. premium bonds. That way you can sleep at night knowing the markets can do as they please for a while.

Massive difference between the younger accumulators who can invest through a crash or recession and old farts like me who don’t have that luxury!! I’m 55 and recently took redundancy/ cashed in my DB pension btw ??

Very true. I’ve also got a very meaningful emergency fund.

Sure, it has an opportunity cost but with two young kids, I value the ability to sleep tight.

Great post Damian!

Interesting that you note the ‘87 crash as a quick one … globally yes, but for a tiny island at the bottom of the world not so much (could put an argument forward that the effects are still felt). Take a read if you’re interested ?

https://www.nzherald.co.nz/indepth/business/1987-stock-market-crash/

Wow, I had no idea NZ was hit that hard. I suppose reinforces the importance of investing in a globally diversified tracker.

Looks like a fascinating read – have bookmarked for my weekend downtime 🙂 Thanks Sarah.

As I read this the markets are opening in negative territory. I’m keeping some extra cash in my SIPP, as well as monthly investing, to pick up any bargains in the coming months. If the market doesn’t crash then i’ll just invest the excess in some bigger monthly drips.

Ultimately it’s very tough to time it, though having an extra cash reserve never hurts (I am sitting on a big emergency fund simply because it gives me peace of mind).

Key is to make sure you can continue investing if / when the market does come off.

But the evidence says this is the wrong strategy so why would you risk it. If it doesn’t dip and you can’t time it (you won’t) then everything will be more expensive and slow and steady will beat you hands down.

Trust me, I’ve been there and made the mistakes. The simple set and forget is the smartest move you can make for the long term.

I agree that a large enough cash allocation is key as well. Mine is (only) 6 months at the moment, but if I were to significantly reduce my work in a semi-FIRE way, I would definitely increase this.

In terms of spending, I am quite minimalistic so I can’t cut back much unless I move home, but spending only 40-50% of what I earn is good enough for me. Back in March, about half of my clients didn’t immediately do the switch to online classes, but I was still able to cover all my expenses and even save a bit with only half of my income. This could be the same with a couple where both people work: if one loses the job and they only spend half of their income, they would still be fine.

I think having that kind of spending flexibility is the best kind of market protection you can get.

Sadly I expect very few people to be in this position…

A market crash as occurred in March last year, or in 87 isn’t really the major concern as long as you have the fortitude not to sell at unreasonably low prices. The issue is dealing with a decade of low returns, or a period of forty years when equities underperform bonds, which has occurred previously – think about it…you’ll be 80 when that happens. Probably if that occurred, there would be one heck of a bull market in the next couple of decades. But that’s not much use when you are 80 years old.

This sustained period of underperformance is what occurred to me in my first decade of investing from 1999 – 2009 and my response was sub-optimal. Now that I continue to accumulate wealth and I am more experienced I expect my response would be significantly better. In retirement? Not clear…Holding a few years of cash reserves will be no panacea in that scenario. After several years of down performance, the true believers in the SWR become the waverers…is this time, the first time it’s really different? Does the 4% SWR still work? That’s when FIRE will truly be tested and without experience for many people I suspect it will be failure in the purest sense in the form of a return to work or selling into depressed markets.

I’m fairly sure I couldn’t pull 4% from my portfolio on a sustained basis through decades of sub-optimal market performance. FWIW I am heavily invested in equities and I have no view whether they will go up or down near term.

You bring up an interesting point. Given levels and speed of central bank / government intervention these days, they are bound to react to a sharp sell-off.

A prolonged, death by a thousand cuts decline where earnings multiples slowly normalize in line with historical levels? That’s a tougher one.

That being said, I’m relaxed about relative underperformance. Missing out on an unprecedented bull run in fixed income (or another asset class) is unpleasant, but not terminal as long as your own portfolio is chugging along just fine.

It’s the other scenario that you higlight that will be the killer here. Investing for years on end, just to keep your head above water in absolute terms.

This is exactly why my retirement planning is highly reliant on (1) staying employed in a light-touch (i.e. 20 – 30 hours a week) capacity and (2) cash flowing real estate. The equity portfolio becomes an important third pillar, but it cannot be the only one.

Then again, I’ve still got plenty of time and energy and actually don’t mind working as long as I have the balance. Others might not be in that position.

I lived through a bunch of crashes, corrections and bubbles. Stayed 100% in stock every time and never sold a share. Now that I’ve won the FI game I don’t take as much risk because I don’t need that much gain. I stay 50-55% equities . My safe withdrawal rate is going to be less than a percent.

Unless we unlock the key to immortality, having 100 years of living expenses (in nominal terms, at least) will keep you pretty safe financially 🙂

Great article – doing what ifs / stress tests is IMO a prudent way to plan.

It may be worth pointing out the dependence between salary, employer stock [options] and pensions too. For some reason lots of folks often overlook this scenario until it is too late!

I suspect Steveark may mean his actual W/D rate – i.e. he is rather over-funded!

Perhaps he will clarify in due course.

Thanks Al Cam.

I have once read an academic study that suggested that to account for the correlation between your salary and stock holdings in the employer, you would need to receive employer shares at a 50% discount.

To be fair, that’s how many ESOP plans are structured. Still best, to sell them as soon as the shares vest.

And one should never have employer shares in their pension, not if they can help it.

Agree.

May be hard to entirely avoid employer shares in pension if using index trackers.

I must say 50% discount for ESOP plans seems high to me – but this might be something to do with the sector?

Another point might be a troubled employers ability to pay pension (DB) and/or pension contributions (DB & DC) too.

In short, your risk concentration wrt your employer may be quite high – even if on average [at least] it works out well/OK. Personally, I have experienced both excellent and not so great outcomes.

Great post!

I have over the past 4 months gradually divested from 100% US equities and allocated around 25% to bonds and been increasing exposure to international developed markets, emerging markets and value stocks.

I previously held an increasingly large part of my portfolio in US technology stocks which have gone up astronomically since when I bought them back in October 2019. I have taken profits from these investments and re invested as per my investment strategy.

Target allocations are looking at;

25% Fixed income

50% US Stock Market

10% Emerging Markets

15% Developed Markets

I try not to time markets, but where some of the assets I own become ridiculously overvalued I feel it makes sense to take profits and re invest.

All the best!

Josh

Cheers Josh, great to see you on here again!

All about finding the right asset allocation – and having the discipline to stick to it through good times and bad.

FYI,

Re Steveark comment above:

see comment #35 at https://monevator.com/back-up-plans-for-living-off-a-portfolio/ for more details