Welcome to the next installment in your Wealth Building Toolkit.

A Share Incentive Plan (SIP) is yet another scheme that can boost your net worth through a combination of generous tax breaks from the government and share awards from your employer.

Put simply, a SIP involves using pre-tax earnings to buy shares in your employer. Your employer can also choose to award you additional shares at no cost to you.

While not as waterproof as SAYE (because you can actually lose your entire principal), a SIP could nonetheless be a great way to boost your savings and investments.

However, before signing up, you need to carefully consider the details to determine whether your employer’s SIP scheme is right for you.

Share Incentive Plans – An Overview

The baseline principle underlying share incentive plans is providing employees with a way to share (no pun intended) in their employers’ fortunes.

There could be up to four types of shares in a SIP:

1. Partnership shares

These are shares you buy with your gross earnings. The limit is £1,800/year or 10% of your annual pay, whichever is lower.

2. Matching shares

For each partnership share you buy, your employer can grant you up to two matching shares. They will have vesting conditions (see below).

3. Free shares

If your employer is particularly benevolent (mine wasn’t), they can also give you up to £3,600 of free shares every tax year. Once again, vesting conditions will likely apply.

4. Dividend shares

If the shares you hold in a SIP pay a dividend, it can be used to buy additional shares. Otherwise, the dividend will be paid to you directly and may form part of your taxable income.

If you participate in a SIP and your company is taken over, then your shares will be transferred into a new share plan. If the acquirer isn’t publicly listed or does not have a SIP, they will need to put in place a compensation scheme for all participants.

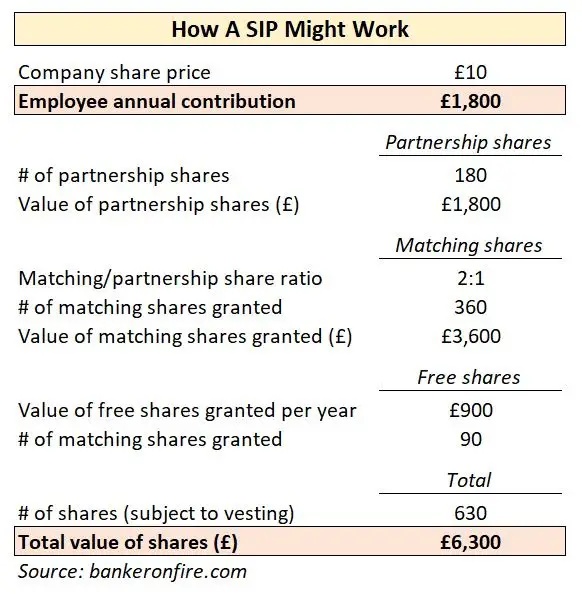

An Example Of How A SIP Might Work

In this plan, an employee subscribes to the full SIP contribution amount of £1,800/year. At £10/share, he buys 180 partnership shares/year.

The company then matches each partnership share with two additional shares. It grants the employee 360 matching shares (180 x 2) with a value of £3,600.

The company also grants £900 worth of free shares every year.

In total, the employee gets 630 shares/year, a value of £6,300.

Worth noting this is an unusually generous SIP plan. These days, companies typically stick to granting one or two matching shares and leave it at that.

How A SIP Lifts Your Net Worth

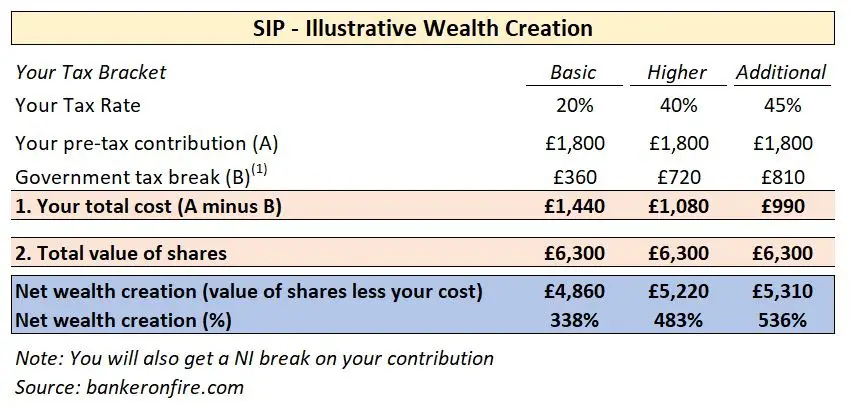

Continuing on with the example above, let’s look at how much wealth you can build if you were to participate in such a SIP.

Depending on your tax bracket, the total cost of your SIP contribution would range between £990 and £1,440. This is the result of your SIP contributions going out of your pre-tax earnings.

The total value of shares you actually receive is £6,300. Therefore, your net worth gets a boost of anywhere between 338% and 536%.

Note that you would also get NI relief on your SIP contributions, lifting your net worth even more – and that’s before you take any share appreciation into account.

Assuming the shares don’t decline in value, participating in this particular SIP would be a no-brainer.

Key Advantages Of Share Incentive Plans

As described above, the biggest advantage of a SIP from an employee perspective is the ability to get free shares in their company.

Even before taking any tax benefits into account, a participant in the scheme would get 450 shares valued at £4,500 every year.

The second advantage is a break on your income tax and NI contributions. When a £1,800 contribution only costs you between £990 and £1,440 (potentially lower once you take NI into account), it’s hard to pass up on the offer.

This tax benefit can be clawed back and takes five years to “vest”. Therefore, if you withdraw shares from the SIP within five years, you will be liable for both income tax and NI contributions (your liability will be slightly lower if you manage to keep your shares there for three years).

If you do, however, keep the shares in the SIP plan for five years, all the tax savings are yours to keep.

If you retire or go on a long-term sickness leave while participating in a SIP, you would typically not incur any income tax liability on the free or matched shares. This is because you would be classified as a “good leaver” by your employer.

The third advantage is the capital gains tax kicker.

Any shares acquired through a SIP are exempt from CGT. All you need to do is to make sure you sell the shares out of the SIP. If you take them out and sell them later on, you may be liable for CGT on the gain between the time you took them out of the SIP and sold them.

Few things in life are entirely free of drawbacks. While SIPs can be very attractive for the reasons above, they can also be less advantageous depending on your circumstances and risk profile.

The Two Key Shortcomings of SIPs

Participating in a SIP puts your capital at risk on day one. While this is typical of any stock market transaction, it makes a SIP less favourable then a workplace investment scheme like a SAYE.

If your employer’s shares decline in value, you will feel the impact in your investment portfolio. In some cases, it may more than offset the value of any matching and free shares you get.

And the impact will be much more pronounced if you aren’t well-diversified and your SIP holdings represent a big portion of your portfolio.

Furthermore, when it comes to free, matching and dividend shares, you will not be able to take them out of the plan for the first three years. Some employers extend that “vesting period” to five years. This is typical of any share award schemes and benefits your employer by reducing employee churn and hiring expenses.

If you are planning to change jobs in the next three years, you may want to hold off investing in your company’s SIP.

So Should You Say Yes To A SIP?

As with any stock market investment, participating in the right SIP at the right time can be extremely lucrative. For example, employees of Sky have done very well out of their SIPs after Comcast struck a deal to acquire the broadcaster in 2018.

If you do, however, bump into a Royal Mail or a Deutsche Bank employee, you probably want to pick a different conversation topic.

The bottom line is that if you have a well-diversified stock portfolio, your company’s SIP terms are attractive and you can bear a little extra idiosyncratic risk, using a SIP can be a good way to boost your net worth and accelerate your journey to financial independence.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com