There are four key levers that determine how wealthy you will ultimately get.

The most obvious one is how much money you make.

However, as this guy has shown, that’s just the starting point.

If you want to build wealth, you’ve also got to put some of that hard-earned money away.

This is where your savings rate comes in.

I don’t want to belabor the point here. Instead, let me point you to this instant classic from Mr. Money Mustache that shows the impact of your savings rate on your retirement prospects.

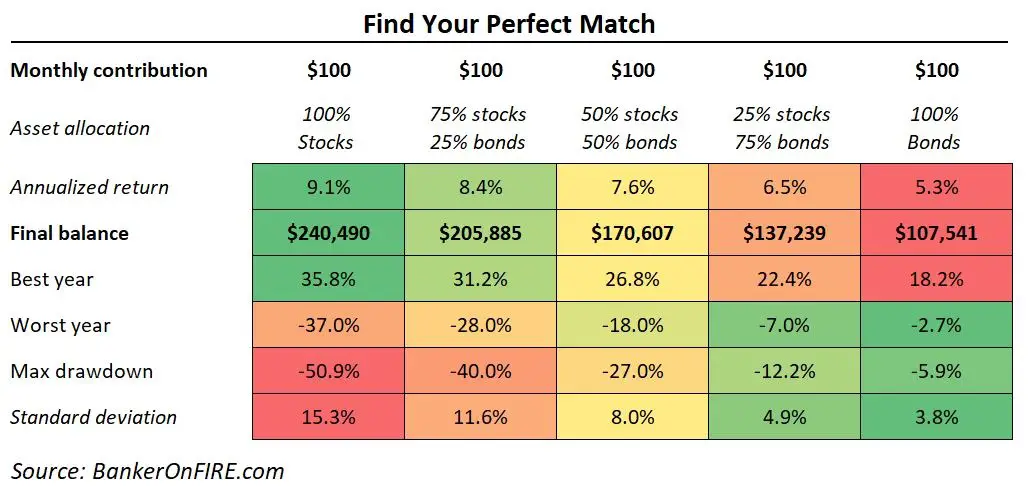

Once you’ve put some money away, you can start playing with your asset allocation.

The higher your risk tolerance, the higher the returns (up to a limit) that your portfolio can achieve:

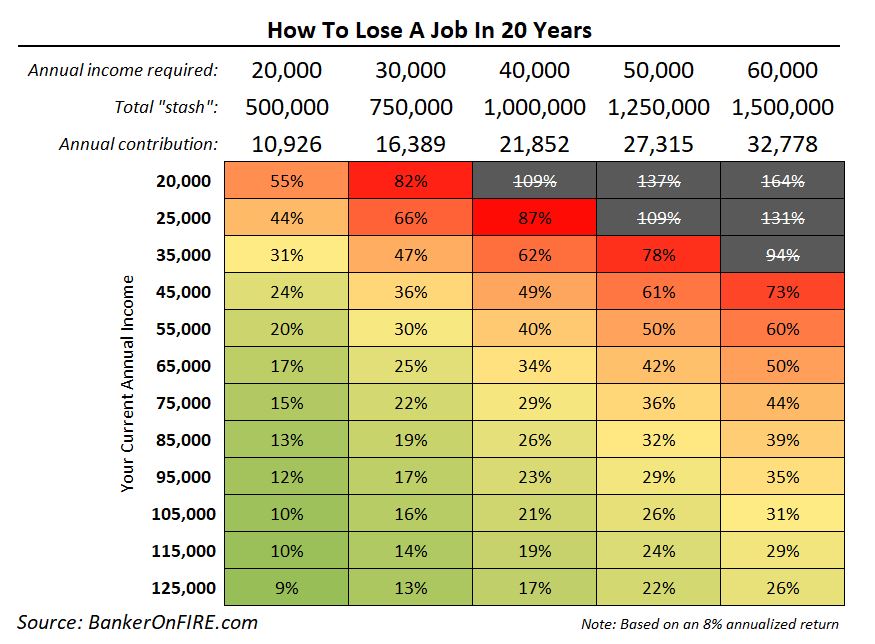

And finally, there’s your time horizon.

It’s tough to lose a job in 10 years.

But extend that time horizon by a decade, and the path to retiring at 45 is lined with some easily achievable savings rates:

Now, the reality is that in order to build real wealth, you need to combine all four components.

No point making millions if you squander all the money that comes in on questionable habits and alimony payments.

Equally, even a 99% savings rate won’t get you there if you aren’t making enough.

Some folks start their investing journey in their teens. Others might not get there until much later in life.

Some prefer and slow and steady approach to building wealth.

Others have the tenacity (and audacity) to take repeated outsized shots – until they ultimately succeed.

In other words, everyone has a unique set of skills, attitudes, and opportunities.

But if you are serious about building wealth, you need to look in the mirror and ask yourself:

What exactly is my edge?

And if you think this only applies to building wealth, you may want to think again.

Running Around

When I was growing up back in the 90s, I loved watching tennis.

Pete Sampras was my favourite player. But if I had to pick another one, Michael Chang would be a close second.

Now, if there’s one thing you’ve got to know about Michael Chang it’s that he had a massive handicap when it came to tennis.

At just 5’9’’, he was one of the shortest players on tour, in a game where height provides an enormous competitive advantage.

What he did have, however, was speed.

Michael parlayed that edge into a mega-successful tennis career, becoming the youngest player ever to win a Grand Slam and reaching a career-high of world #2.

Look around and you will find these stories playing out all around us.

Anyone familiar with the rise of Arnold Schwarzenegger knows that he certainly wasn’t a shoo-in for an action movie hero and the governor of California.

A poor kid from an Austrian village, with a horrible accent and an impossibly long last name.

What Arnie figured out very early on, however, is that he had a body that responded incredibly well to weight training (and steroids, which were legal back then).

He then used that advantage to embark on one of the most inspiring rags-to-riches journeys of all time.

Sometimes, you don’t even need to be better than anyone else in a specific area. Rather, it’s a combination of traits that becomes your edge.

For example, Scott Adams isn’t the best cartoonist, writer, or businessman.

But it’s a combination of those things – in addition to his sense of humour and risk tolerance – that made him one of the most successful artists of modern time.

Making Bank

The argument goes beyond reaching movie stardom or becoming a cultural phenomenon of your time.

Take investment banking as an example.

Day in and day out, I see folks deploying their individual edge to reach the pinnacle of an ultra-competitive profession.

Those with superior technical skills and an ability to drive a tough negotiation rise through the ranks in M&A.

Bankers who love becoming absolute industry experts thrive in sector roles, such as healthcare or technology.

And the gregarious, charming types become country coverage officers (also known as relationship bankers).

Sure, you need to possess some measure of all characteristics in order to be a successful banker.

And it is also true that those bankers who can excel in each of the aspects above become real superstars.

But take a closer look at their careers, and you will find that they “majored” in one of the areas above as they ascended to the top.

In real estate, every property needs to have a unique selling point.

It may be the neighbourhood, the lot size, the proximity to transport links, the curb appeal – anything that will stand out and appeal to prospective buyers (or tenants).

Properties that have this special component will continue rising in (or holding) their value. Others are unlikely to make for successful investments.

This even applies to dating.

Some people capitalize on their natural good looks. Others use their sense of humor.

And yet others simply whip out the credit card and try to impress their date by spending inordinate amounts of money.

Warren Buffett once said:

How do you beat Bobby Fischer? You play him at any game but chess.

I try to stay in games where I have an edge.

The process of discovering your edge isn’t straightforward.

It requires experimentation, iteration – and a whole lot of time.

But in today’s hyper-competitive world, it might well be the most crucial building block of a wealthy and fulfilling life.

Do you know what yours is?

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Hi BOF,

Currently i am 25, running my own business in the UK and thinking about making a switch to investment banks, not for the money but for the knowledge in finance, deal making, deal analysis.

I had always been placed in the top 3 in any number-related subjects throughout my education, be it maths at school or finance class at university. After graduating in 2018, I wanted to establish a salon business of my own because i hated the whole “sucking up to bosses” idea, and all the lies I have to say in interviews to get a job, feeling like they were doing me a favour for letting me do the job and make money for them in exchange for peanuts compensation. 2 years in to running the business, it was not a failure, in fact it was quite a profitable shop although not making huge money (net profit roughly 35k/year), i am facing a dead end.

I want to expand the business but any project i have in mind, i don’t know how to do an analysis on it to figure out its R.O.I. For example, let say I want to buy a competitor’s shop, I don’t know how much is a good bid price, how much I can make in return etc. Let say I want to open another shop in a different city, I don’t know how to research the market there, how many potential customers i will get, their age, their taste, their disposable income, their willingess to buy my product etc.

Because of all this, I am sitting here thinking maybe if i work for a year or two at an investment bank or big 3 consultants, I will learn the skills of analysing businesses, reading balance sheet, market research and all the skills necessary to expand a business, then go back to my venture. So please could you offer some advice.

-Will I learn all those skills in your job?

-Could I learn those skills in any other way if I don’t work in that kind of job? (Classroom teaching seems very out of touch with real world businesses so I prefer learning in a more practical environment)

-Did you already have those skills before you joined investment banking?

Thank you

I’m not sure IB is the best way to proceed here.

As a junior banker, you’ll do some of it, but you may end up doing very few projects that will be relevant to what you are trying to achieve.

Also, it’s a helluva hard way to learn all of these topics. You also need to figure out what to do with your business in the meantime.

If I were you, I would consider continued education (believe it or not, but GOOD (emphasis intentional) MBA programs actually give you these skill sets. Otherwise it’s a combination of online courses / mentoring / books / self-learning.

Best of luck!

I think my “edge” is optimism plus grit. I tend to always believe that sooner or later, something good will happen if I stick to it. Nothing is ever as bad or as good as it seems. So when the bad times come, I don’t get bogged down by it.

Did you know that I helped popularize this fire movement in 2009 and let Mr. MMM guest post on my site two years later to help get him going? I don’t think many people do, probably because I don’t self promote as well as him, partly because I’m a minority and not a white man.

But that’s just the way things are in America and most places. Just got to keep fighting!

Cheers

Sam

Sam,

That is very interesting. For every Mr. MMM in any industry there are always 10 others who are quietly chipping away at things. This was my experience growing my company as well.

I think for any bootstrapped entrepreneurial venture you need that optimism and grit combo. Growth is always two steps forward one step back. You have to have faith that it will just keep coming together one day at a time.

I would also add showing up and being consistent as other underrated skills in general.

Fully agree with both of you.

My biggest payoff has come from sticking through the tough IB years as an associate.

Most of my friends and colleagues have peaced out due to a combination of hard work and no balance. Those who perservered are the ones who get to reap the spoils of much more interesting work, better work life balance, and significantly higher comp.

But it does take about a decade to get to that place.

I like the Bobby Fischer comment. I ran my first marathon at age 46. Also running his first marathon was a professional golfer, one of the best at the time, named Justin Leonard who was 29. I’m a terrible golfer but at the age of 46 I smoked his 29 year old self at the marathon. So I already knew how you beat a professional athlete, you pick your game, not his! I’m pretty sure I could have beat him at tennis or chess too.

Pingback: Wednesday Reads: Budget 2021; USS Valuation Update. - Dr FIRE