Every morning, I try to be in the car at 7:05.

Our temporary accommodation, while comfortable and spacious, is far from being centrally located.

And so, I need to drive about 30 minutes to the train station, where I have exactly 5 minutes to park the car and hop on the 7:40 train to take me downtown.

I try pretty hard not to miss the train as there isn’t another one for 40 minutes. Thus, on days when I’m running behind, I do everything I can to shorten the 30-minute commute.

I drive at, or just above the speed limit. I stay in the left lane in order to avoid getting stuck behind trucks or slower-moving vehicles. And I keep my Google Maps on all the time in order to follow a route that helps me avoid traffic jams.

On average, doing all of the above can help me shorten the commute by about three to four minutes. I can also save a couple of minutes by sprinting through the station.

But if I get in the car any later than 7:12, it’s more likely than not I’m missing my train.

Of course, there are still things I could do to make it.

I could drive way above the speed limit. Heck, I could even drive on the shoulder of the highway to bypass some of the traffic.

And once I’m off the highway, I could certainly run a couple of those pesky red lights that always seem to slow things down.

Except, as most people would hopefully agree, doing so is just not a great idea.

In fact, it would be a HORRIBLE idea.

Running Out Of Runway

By this point in time, I think we all know where the analogy is going.

We all have about 30 years or so to figure out our finances.

Of course, it doesn’t have to take that long. In fact, that’s what the financial independence movement is all about – doing things that help you shorten the journey.

The good news is there are plenty of such things.

You can grow your income (a personal favourite of mine). Bonus points if you manage to increase your savings rate at the same time.

You can also invest through tax-efficient vehicles like 401(k) plans or UK workplace pensions to help juice your returns all the way into mid-teens:

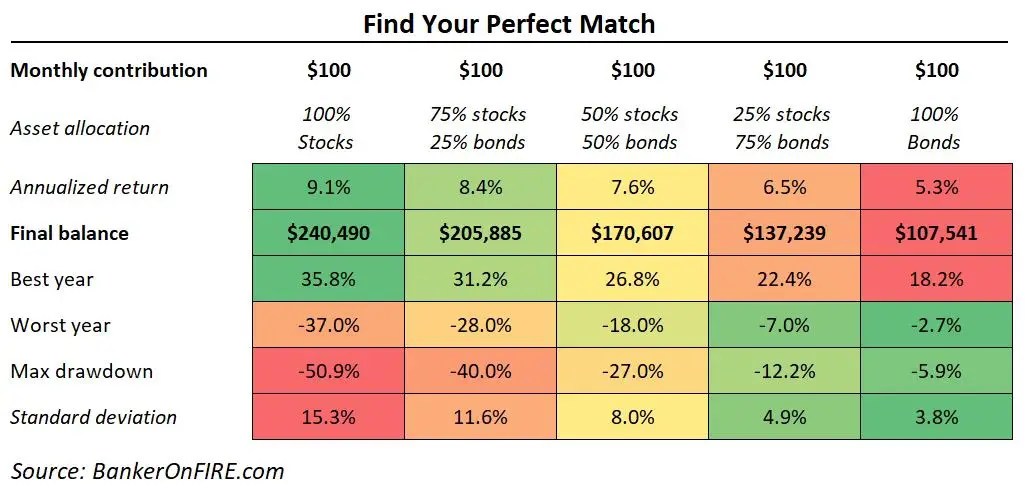

If you can bear some extra volatility in your portfolio, you could change your stock vs bond allocation:

Finally, you could try andget rich with real estate – but only if you are fully comfortable with the risks and challenges involved.

But as much as I hate to be the bearer of bad news here, this is probably where we all cap out in terms of levers to shorten our journey to financial independence.

There will always be people who disagree. Oftentimes, these same people will try to pitch you a variety of creative investment “ideas”.

Some will be on the relatively benign (yet still dangerous) end of the spectrum. Remember the folks who suggested going all in on FAANG or ARK over the past few years?

Some others will really push the limits, pitching you on “the one stock that delivered consistent 50%+ returns over the past 30 years” or some highly structured instruments with all the upside and “protected downside”.

(As an aside, they aren’t really lying. The sellers do get all of the upside and none of the downside!)

The less runway you have ahead of you, the more compelling some of those ideas begin to sound. But make no mistake – when it comes to investing, they are the absolute equivalents of dangerous driving.

You may be able to get away with it for a while. Heck, some folks will even manage to collect their chips and walk away before the inevitable disaster strikes.

But at some point, luck will run out.

Drive on the shoulder often enough – and cops will pull you over and hand you a whopper of a ticket.

Run too many red lights – and you will get T-boned by an 18-wheeler at some point.

And when you do, missing the 7:40 train will be the least of your worries.

At the end of the day, the absolute best thing we can all do, is to start our investing journey as early as possible.

It’s the equivalent of getting in the car at 7:05, even though you don’t feel 100% prepared – perhaps because you didn’t finish your breakfast or shine your shoes.

Having said that, there will always be people who didn’t start early enough.

If you are one of those people, the important thing to remember is that it’s not the end of the world – and certainly not a reason to undertake risky manoeuvres that will most likely lead to a disaster.

Much better to face up to reality and aim for the 8:20 train instead.

No, you won’t finish your journey as early as you wished. But you will definitely end up in a much better place – and enjoy the ride along the way.

As always, thank you for reading – and happy investing.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

And if you ask any investor, the number one regret is that they didn’t start sooner. So if you are sitting on the sidelines or nervous about putting more in the market right now, it is best to jump right in. Like you said, better to start early and learn along the way, than wait until it’s too late to catch the train!

Couldn’t have said it better myself

The only regret investors tend to have is not getting on with it much earlier.

It’s been tough for us FAANG folks here in San Francisco. The decline of Facebook and Amazon this year is particular spectacular. Then of course FTX and crypto.

But the show must go on! Whatever happened to your new opportunity? Sorry if I missed the post. But didn’t you say you were thinking about joining another firm?

Check out this post I have in the URL field about the most bullish economic indicator yet. I published it on November 2, and curiously, nobody discussed this theory or connected the dots at all. I wonder why?

Sam

Just catching up on comments now

To be frank, if someone told me a year ago interest rates will go up 5x but S&P will only come off 20% with Nasdaq not far behind, I’d laugh them out of the room

And yet, look where we are today…

Pingback: Surprises, Next Steps, Word Silliness, And Flying Santas – Physician In Numbers