By the time you are reading this post, I will have finished packing for our summer beach holiday.

In a family tradition, we always take two weeks off at some point in August. A time to recover from the first half of the year – and reflect on the path forward.

And in a break from tradition, today’s post has nothing to do with money, investing, or financial independence.

Instead, it is about life, and dealing with the curveballs that it will inevitably throw your way.

As a matter of fact, it’s a post I published exactly a year ago.

The reason I have decided to repost it today is that the questions it raises are existential ones.

The kinds of questions we sometimes contemplate as we enjoy that beautiful sunrise or sunset, away from the pressures of work and responsibilities.

Imagine for a moment that you are young, healthy, have a loving family, and have scaled the pinnacle of business success.

As you enter the next chapter in your life, you are looking forward to everything that comes with the territory.

Except, the next chapter is one that you didn’t expect. One horrible day, you wake up to a battle you are going to lose.

The horrible, dreaded C-word.

This is exactly the situation Peter Barton found himself in.

A proverbial self-made man, he had just retired from a stellar career at Liberty Global, where he had helped John Malone stitch up one of the most formidable cable empires in the world. (UK readers of this blog may recognize Liberty Global as the former owners of Virgin Media.)

At the age of 46, having banked millions in just over a decade, Peter left his job behind.

He was looking to spend more time with his family as he geared up for the next challenge.

Cancer was not the challenge he had in mind. Unfortunately for Peter, while cancer certainly didn’t define him, it did defeat him.

But as he battled the disease, he found the strength and inspiration to write a book about his experience.

When it comes to a manual to design a life, this is as good a read as it gets.

No, I don’t mean to say that Peter had an exemplary life. I certainly would have made a few different decisions along the way.

But it is his reflections on those decisions that can help us map out our own path forward, one that builds on his good choices – and avoids some of the pitfalls he has experienced.

Looking Back

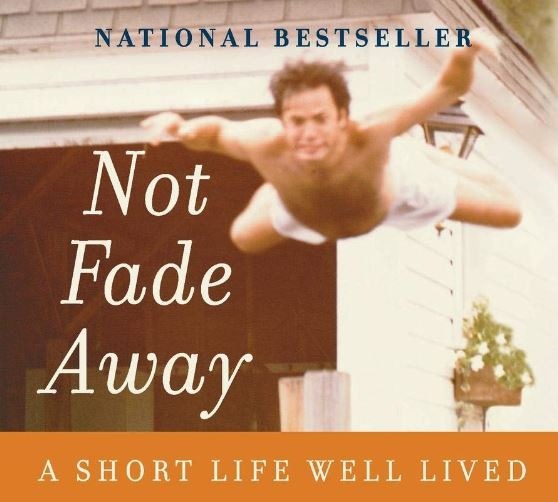

I have first come across Not Fade Away on a chance recommendation by Khe Hy over from Rad Reads.

In one of his newsletters, Khe referenced the passage below which caught my attention.

A few months before he passed away, with his body breaking down, and a backpack with his IV and oxygen equipment on his back, Peter took his daughter on a jet ski ride in the Caribbean.

This is how he describes the experience:

We zipped and bounced along. Kate held on to my back; her cheek was against my shoulder. It was like she was a little girl again, and I was a young and healthy and protecting father.

We explored a bunch of little coves around the resort. The water was a hundred shades of blue and green; sunlight glinted off it so brightly that it almost hurt. Everything amazed us; we just pointed at things and giggled.

I choke up when I recall this story. But not because I’m sad. Because there’s more joy in the recollection that I can hold. There was a lifetime worth of pleasure in that single day.

By definition, a big part of the financial independence journey is about looking forward and delaying gratification.

But what happens when there’s nothing else to look forward to? When delaying gratification just doesn’t make sense?

How will we look back at our lives when that moment comes?

It’s fair to say that facing up to a challenge that Peter faced is the most powerful way to examine one’s life.

To reset some of the priorities that may have fallen by the wayside over the years.

And while I hope that none of us will ever experience what Peter and his family had to go through, reading his book is a great way to reflect on, and recalibrate the balance that may have gone MIA on us.

Which is exactly what I plan to do over the next few weeks.

I wish everyone a fun, relaxing, and happy August. And if you are looking for a thought-provoking summer read, Peter’s story may be a good choice.

My Favourite Quotes From “Not Fade Away”

On money:

“A problem that can be fixed by money … is not a problem.”

“Wealth is a great deal more enjoyable if you’ve already taught yourself that you can have a good time without it.”

On health:

“If you’ve got your health, you can always make some money. But all the dough in the world can’t buy back your health.”

“Everyone says that health is really important but if you look at how people actually live, they seem to believe the opposite.”

“Isn’t it clear that the person who compromises his health in the name of making money is cutting himself a really lousy deal?”

“Illness has always been a temporary setback… Nothing prepares us for that one illness that doesn’t go away.”

On life:

“Staying on a track can kill, one easy day at a time.”

“Nothing looks exactly the same once you truly understand that you are not exempt from death.”

PS: please read the disclaimer at the bottom of this page

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Great post, enjoy your holiday!

I’ve doubled my pension contributions during lockdown as I have a whole host of expenses that I’m no longer having to cover (mostly cancelled holidays replaced with camping trips within UK!)

Would love to leave pension contributions at higher level as would bring date I can retire by c10years, but equally don’t want to miss out on creating memories / fun with my family & young kids, so this post does strike a chord, will try to check out the book.

RIP Peter Barton

I think once you have kids, the clock really starts ticking.

As another personal finance blogger put it (can’t recall who it was): “We only have 15 summers with our children before they disengage. We want to make each a special one”

Sadly, few people will be able to retire at a stage where their kids are still young. Extending the journey to make sure you can enjoy it and create cherished memories along the way is the best alternative option.

Hope you have a good rest of summer too!

This is a great post with idea’s that have been on my mind recently. I’m still at the start of my journey, about to turn 24 and a year in to my first graduate job – and it’s really wearing down on me how much this might impact the new couple of years where I should be getting to go out and see the world. Plan on getting out there for a late summer holiday but it won’t be the same.

Somewhat similar to Pete’s thoughts on health is this one by Arnold:

“A well-built physique is a status symbol. It reflects you worked hard for it; no money can buy it. You cannot borrow it, you cannot inherit it, you cannot steal it.”

All the money in the world can buy you access to things that make it easier, and world-class healthcare, but at the end of the day you really have to put in the effort to look after yourself.

Thank you.

That’s a great quote. I’m a big fan of Arnold actually. Used to be quite into weightlifting when younger and still try to keep it up these days, but leaving that aside, I think Arnold’s life story is one of the most inspirational ones I’ve come across.

When I was in my 20s, I had a busy job (+ a stint in self-employment) but it was nowhere nearly as busy as investment banking in my 30s. In retrospect, I am happy I got to do many of the things I did – traveling around, volunteering abroad, and just having random but highly enjoyable experiences with my friends.

The folks who went into a real job grind right off the bat typically don’t get to enjoy their 20s like that. And despite making more money, they rarely use that money to make up for lost time in their 30s.

So I guess the message here is to try and keep the perspective. You can always make more money but you can’t make more time.

Hey BoF.

Interesting timing. Keeping it short, I lost my Nana this week, one of those expected but not expected situations. There’s nothing that focuses the mind on what’s really important in life than losing someone you care about.

The book sounds like it triggers the same kind of thoughts – tbh, it was always stories like these that were a big part of us retiring early to make the most of our lives, as you know. There was no way we were going to be another literal “work until you drop” case.

I’m really glad you are taking some time out with your family as I know you have been full on at work lately. Enjoy the break & look forwards to hearing more about your reflections.

Sorry to hear that Fire and Wide. I lost my grandmother (and the last living grandparent) a year ago. You are right, it brings on a degree of increased mental clarity and unfortunately it rarely lasts.

My condolences to you and your family. It will hurt for a while. As I’m sure you know, time is the only thing that can heal these wounds.

My health is something I need to work on again. I’ve put on a stone during lockdown but have started back indoor rock climbing now so hopefully will be able to get fit again. Need to work on my diet again.

I lost my cousin at 51 to a heart attack a couple of years ago. I think something like that sends you one way or another. He was your typical high earner high living but high stress

Drove 40 thousand miles a year .

At 51 he had less in his pension than I do at 39. For some it would encourage that live for today lifestyle. For me it crystallised that I don’t want to work forever and also the stress of trying to earn more isn’t worth it. It encouraged me to redouble my efforts to reach fi. A million and a paid off house is plenty for me. A couple of holidays a year. Business class flights for long hall. How much do you really need? 40k to 50 k a year seems plenty

I’m sorry to hear that. A sad turn of events, 51 is just far, far too young.

There’s a balance to be struck here. If you enjoy the day to day, you simply don’t need that many holidays as there’s no need to “escape the grind”.

For flights, I always do economy unless its more than 8 hours and flying East. Even then, I’ve always used my miles to upgrade. There’s something about paying an extra grand for a business class flight that offends my immigrant mentality 🙂

It’s interesting, you hear a lot of anti-FIRE commentary about how you shouldn’t pursue FIRE as you may drop dead pre-retirement. Well I did drop dead last year (at 43) when I had an out-if-the-blue cardiac arrest on the treadmill at home. I was very lucky to have an NHS wife and some excellent paramedics/doctors who ‘brought me back’.

Whilst I’m 100% fine now, the experience is what drew me to FIRE, as I’m committed to ensuring that my kids (and wife) have financial freedom should something happen down the line.

Enjoy your holiday and ensure you enjoy the time with the family!

Wow, that’s nuts. Great to hear you’ve made it through with no issues. Must be an absolutely crazy experience to go through.

Yes, securing my family’s future is an important part of my reasoning for FI as well. I have a very hefty insurance policy which I’ve increased further once the kids were born. Between our assets and the insurance proceeds, it should hopefully see the kids through their 20s and my wife into old age. Isn’t cheap but the peace of mind is worth it.

Thank you and hope you get to have a break over August as well!

Great post BoF!

Lots of things in life are about finding the right balance – and its different for different people.

For us, our balance in pursuit of FI is to take a little longer in exchange for having more time with our kids on the journey.

Thanks Paul. That’s right – just imagine being an absentee parent for the first decade of your kids’ lives because you are so focused on achieving FI to spend more time with them.

Then you get sideswiped by a health issue like that and realize you would have been far better off taking your time but actually enjoying the journey. Thankfully, the risk of experiencing something like Peter did is (thankfully) quite low for most people, but is it really worth taking chances?

This is one of the reasons I’ve set myself a deadline of leaving banking in the next two years. I do manage a reasonable amount of time with the family right now, but the balance is not where I want it to be. Keen to change that while the kids are still young (ours will be 6 and 3 then).

Even worse would be missing the first decade of your kids’ lives in a pressurised job just so that you can maintain a certain lifestyle.

Great that you’ve set yourself a deadline – and your kids will still be really young by the time you hang up the calculator! Have you got someone holding you accountable to that deadline?

Hah, nothing like burning that old abacus of mine!

It’s really just my wife and I executing on our plan. More broadly speaking, us bankers don’t have a very long shelf life, so if I don’t hold myself accountable, the next round of cost cuts might well do it for me 🙂

Hi BoF,

I am also in banking – front office quant in square mile. I have recently started thinking about what to do beyond 45 (currently 40). I expect that is when I will struggle to find front office jobs, rampant ageism – some justified and some not. Any ideas on career after 45? I’m not a managing director or in sales or trading, so will have to work for another 10 years though salary of half my current should be enough.

Cheers.

It’s a tough one. I’ve not walked in those shoes before, having just crossed into the 4-0 territory myself, but I do agree there’s quite a bit of ageism in both the finance and IT sector.

To me, the only real hedge against being “disintermediated” is to develop unique skills and network.

As far as technical skills go, it’s increasingly tough to keep up with the younger generation, notwithstanding any efforts one puts in.

Easier to differentiate yourself on softer skills. Things like influencing people, building consensus, navigating a political environment in an organization – basically all the stuff that actually helps things get done in a corporate setting. This isn’t something you come out with after a four year graduate degree.

Finally, there’s developing – and monetizing – your network. This is how senior banking MDs earn their bread (because it’s certainly not their excel or powerpoint skills!)

Hope this helps!

Heavy stuff, but great perspective. Taking two weeks off every August sounds like a family tradition I need to start for myself.

I often work during our holidays, but as they say – better a bad day on the beach than a great day in the office!