Bonds or equities? US or international? Large cap or small cap? What about value?

Gold, commodities, crypto, individual stocks, sectors and subsectors, investing styles – the personal finance community is bursting at the seams with discussions on where to put your money.

And yet, over the past year, I have literally seen zero discussion on how to invest the most important asset you will ever have:

Your Time

It can be fun to play the investing game to try and squeeze out a few extra basis points of returns.

That is, until you realize that even if (and it’s a massive if) you are able to generate alpha, it doesn’t really move the needle.

Let’s say you’ve got net assets of $100k. In the unlikely event you are able to beat the market by 1%, you will have ended up with an extra $1k by the end of the year.

Hate to break it to you, but that’s less than three bucks a day.

Hardly a worthwhile trade-off for all the incremental effort, time, and most importantly, risk.

And in the meantime, you are slowly running out of time.

A Lifetime View

Sadly, all of us are bound to kick the dirt at some point.

In the meantime, we are likely to spend a big chunk of our lives working away.

Over a course of a standard 40-year career, you can expect to work roughly 80,000 hours.

To contextualize that number, recall that a year has 8,760 hours. In essence, you will spend roughly a full decade of your life working away.

The equivalent of walking into your job tomorrow – and working around the clock until 2031.

By an order of magnitude, this is the biggest investment you will ever make. And not trying to maximize the ROI on it is by far the worst money move you could ever make.

There are two other advantages to stepping back and taking a critical look at how you spend your working hours.

The first one is that it is essentially a risk-free proposition. In the workplace, tall grass does not get cut down first.

No boss will ever penalize an employee who is trying to do her best – and then asks to be rewarded appropriately.

In the worst (and unlikely) scenario, you’ll simply end up where you started.

The more important point, however, relates to protecting the downside. Because if there’s one takeaway from 2020, it’s that the world has changed.

If you want to stay ahead of the game, you’ve got to adapt – and that involves taking a cold, hard look at your career.

Post-Covid Realities

Regardless of how quickly the world is vaccinated (and how effective the vaccine is over the long run), it’s clear that a number of industries are far from being out of the woods.

Airlines and hospitality have a long, painful path ahead of them.

With demand for business travel unlikely to recover to pre-Covid levels (no CFO is going to give up those cost savings), the industry is in for a hard slog of rightsizing its capacity and pivoting back towards leisure travel.

Ditto for oil and gas, as illustrated by the wild ride in oil prices earlier this year.

And financial institutions, that permanent stomping ground of mine, aren’t much better off. Low (and possibly negative) interest rates pose an existential threat to banks’ net interest margins.

After a decade of near-zero interest rates, bankers were finally beginning to breathe a sigh of relief last year, when rates slowly started creeping up.

It’s now clear we are back to square one, with no reprieve in sight.

Bright Spots

But it’s not all doom and gloom. You can still make a fantastic living in all of the sectors above – as long as you pick your sweet spots.

Speaking from direct experience, investment banking remains a lucrative career notwithstanding the broader pressures facing the industry.

While no CEO will sign off on bumper banker bonuses in the foreseeable future, turns out we can still be pretty helpful to companies navigating stormy waters. The same goes for corporate lawyers and consultants.

In manufacturing, digitization will be the big story of the next decade.

If you have the right skill set to help create the factory of the future, you are well placed to command a premium in the labour market.

More broadly, there are a number of industries that will continue growing at above-GDP rates, thanks to powerful structural winds in their sails.

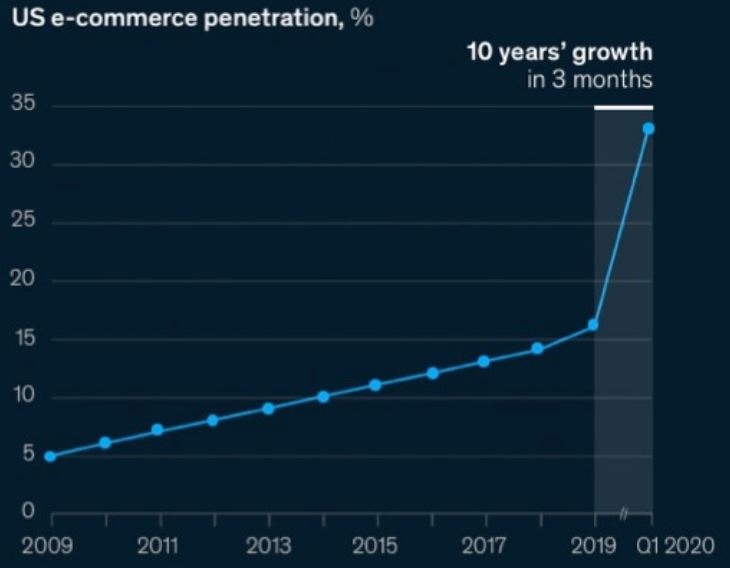

E-commerce is going to continue taking share from traditional retail. While most folks focus on the quantum leap in e-commerce penetration earlier this year, the reality is that online shopping is still a small part of the market:

Massive markets, in particular auto and real estate shopping, are still done in an old-fashioned, undigitized way.

Companies like Carvana are slowly changing that, but the opportunity set in front of them is absolutely immense. There’s a good reason Carvana’s share price has done this over the past 3 years:

A decade on, software continues eating the world, in particular when it comes to SaaS and cloud infrastructure.

The healthcare sector will benefit from multiple powerful tailwinds over the coming decades what with the rapidly ageing population and those pesky pandemics…

Fintech, while invisible to most, will continue disrupting the traditional payment paradigms (did you know that PayPal is now a $250bn company?)

I also suspect that luxury goods will continue to thrive as a sector. For what it’s worth, you can take it as my personal grim view on wealth inequality going forward.

You can (and should) have your personal view on all of the above. No one knows your industry and your business better than you do.

The bottom line, however, is that if you are stuck in a challenged industry, things aren’t nearly as bad as they seem.

Despite all the doom and gloom this year, there is a long list of industries and companies that continue to thrive.

Inevitably, they will need people to help them move forward – which is where you come in.

Switching Up

When I wrote a step-by-step guide to making more money at work, I had no idea it would become one of the most-read pieces of content on this blog.

That being said, most of the advice I gave at the time related to moving up the ranks in your current company.

Switching companies – and industries – is a far more challenging endeavour. With that in mind, below are a few observations that may help.

Tip #1: Maintain A Common Denominator

Changing both your industry AND your job type at the same time is incredibly hard. In other words, don’t try to go from an accountant in an airline to a sales rep in a fintech company in one step.

Instead, try to take the same job in a different (i.e., better) industry. At the end of the day, doing HR for a bank is similar to doing HR for an e-commerce company.

Then, once you’ve gotten your feet firmly under the table and have become an industry insider, you can explore changing job functions.

Tip #2: Bigger Is Better

If you are looking at AirBnB and thinking “what if?”, take a pause.

On a probability-weighted basis, unicorns are rare (hence the name). Chances of you working for one – and getting the right comp package – are even more so.

As a general rule of thumb, you are much better off working for a large, successful corporation. More structure, more runway, more lateral opportunities, more training.

Working for a start-up can be exciting. It can also be a colossal waste of time.

Tip #3: Look For Leverage

While I don’t necessarily advocate working for someone else’s start-up or launching your own, you do want to look for roles with leverage.

Law is a great example of a fantastic career with little leverage.

Even at a very senior (i.e., partner) level, lawyer compensation is still largely linked to their billable hours.

Sadly, this means they continue working 60, 70, and 80+ hour weeks despite reaching the pinnacle of professional success.

In other words, proceed with caution.

Tip #4: Consider Going Back To School

I’ve previously written a candid post on the pros and cons of going back to school. At the end of the day, it can be a very effective way of switching careers AND supercharging your income (it was for me).

That being said, it’s far from a magic bullet. Once again, tread carefully.

Tip #5: Don’t Be Afraid

By definition, humans are inert creatures. Change requires effort – and is uncertain to boot. Why bother?

If you are just a few years away from retiring, I can see why you might not want to rock the boat.

But if you’ve got a decade or more to go, you should also consider the risks of being stuck in a stagnant or declining industry.

Sooner or later, things will come to a head. If you’re on the Titanic, it doesn’t matter whether you are in first-class or all the way down in the engine room.

As a former colleague of mine once put it: “A job is like a girlfriend. You don’t leave one until you find another one.”

This was a long time ago, and things may well have changed in the post-Tinder era, at least as far as boyfriends and girlfriends are concerned.

What remains true to this day, however, is that it’s MUCH easier to look for a new job while you are still employed.

Retiring early is one thing. Being put out to pasture before your time – or before you are ready – is quite another. Don’t let it happen to you.

Good luck – and thank you for reading.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Something I’ve been wrestling with alot recently. The problem being in my field (insurance) is any job change would involve retraining completely. I’ve thought of retraining as an ifa due to my interest in this field (and ifas have said I’d likely be good at it) but can’t quite get motivated to do it yet

Also looking at a significant haircut on salary. Similarly alot of jobs even in my own current field would be lower paid or come with the risk of my clients not following me

So for me it’s doubling down on the fire idea and least getting most of the way there (likely 3 years) when the salary won’t be quite so important.

I suspect though I’ll be unwilling to give up the income despite not being particularly motivated at present

I have too much of my self worth wrapped up in my earnings which isn’t healthy really but struggling with the idea of ‘going backwards’

I’m in a similar boat in banking. The reality is, any alternative will come with a significant “price cut” – though there will be a lifestyle improvement as well.

That being said, this career is highly precarious and the longer one leaves it to find an alternative, the greater the chances of being thrown overboard – which will make lining up a new gig that much more challenging.

FI is the game-changer here, being able to sit on the sidelines until the right new gig comes along makes a big difference. This is why I keep an emergency fund of 12+ months.

Yes my emergency fund is probably smaller than it should be currently (about 3 months) but about 5 years worth of basic expenses in an isa so feel OK with that balance and my job isn’t (touch wood) precarious

As always very thought provoking comments and well written BOF…I suppose the only thing is that if you can consistently (admittedly not easy to do) achieve a 1% over performance on investments the rewards over the long term are quite juicy. Assuming one could achieve a 1% out performance versus buying a standard passive ETF and lets say we could achieve a slightly higher dividend yield (not too onerous given the yield on S&P 500 stands at 1.62%) and you would have limited costs except dealing costs so say you could get 1.5% above the benchmark in total over a savings lifetime of 30 years (assuming deposits of £1,000 per month would be:

Total Interest earned of £3,298,616 versus £2,133,868 ie a £1,164,748 increase…

Thanks – and fully agree.

But if one was able to do that consistently, he / she would easily make hundreds of millions as an active money manager.

Sadly, and as you correctly point out, outperforming the market by 1% a year is a rare skill: https://bankeronfire.com/the-people-who-beat-the-stock-market

As a lawyer I fully agree with tip 3. Law can be a TERRIBLE career option if you want to leverage up.

The hours are brutal and the reward is normally quite limited.

Also it is getting harder and harder to hit the holy grail of equity.

Don’t get me wrong, some people love the law and becoming transactional lawyers. They will do well and some of them will become very rich, but based on my experience these are the few and far between.

Also another thing, law is a TERRIBLE choice to learn about financial freedom or good financial management of your own money.

I think the top 1% of lawyers will do very well for themselves, especially now that the traditional lockstep system is being done away with.

However, unless you really love law, there are much easier – and enjoyable – ways to build wealth.