Note: this is a continuation of a previous post I did on maximizing the value of your pension pot. If you haven’t read it, it may be a good place to start. It covers off some easy pension hacks everyone should know.

If you are too lazy or busy to read the previous post, the one thing you should know is that this post is NOT about increasing the contributions into your workplace pension scheme.

It’s not because I think contributing a good amount into your workplace pension on a regular basis isn’t important.

Rather, it’s because I am sick and tired of seeing this as the only advice out given to people who want to maximize the value of their workplace pension pot.

In reality, there is so much more you can do to give your pension savings an extra boost.

Finally, I originally planned this as a post around tips specific to married couples. That being said, you will notice that you don’t have to be married (or common law) to take advantage of the last two tips.

Just don’t use that as an excuse to get divorced! Remember – one house, one spouse, be happy.

Grow Your Pension Pot Value With These Easy Hacks

1. Is One Spouse In A Higher Tax Bracket? Then Prioritize Their Contributions…

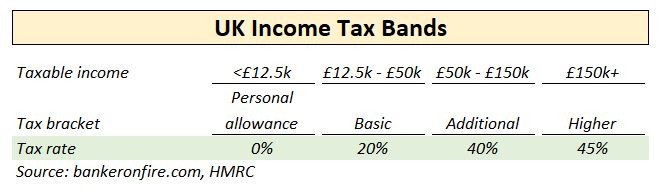

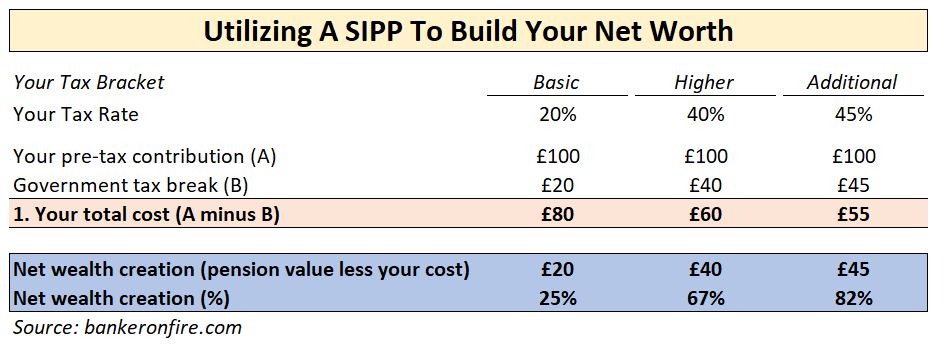

This one is a no-brainer, especially if there is a big difference between the tax bands of the two spouses. Remember that you get the maximum bang for your family’s buck by contributing into the pension of the highest earner:

That doesn’t mean doing anything silly like opting out of your own workplace pension to put all the money into your spouse’s. Rather, it’s something you should keep in mind when deciding where to put all the extra contributions you are (hopefully) thinking of making.

If you are in a basic tax bracket, an additional £100 contribution will double to £200 – thanks to employer matching and government tax breaks.

If your spouse happens to be in the additional tax bracket, the same £100 will almost triple to £291.

2. …But Keep Your Individual Future Tax Brackets In Mind

In a race to maximize the value of your pension pot to secure a great retirement, don’t overlook your future expected tax brackets. After all, 75% of your pension pot will be taxable when you withdraw it in retirement.

Ideally, both you and your spouse utilize your personal allowance to account for the bulk of your pension pot drawdown. The remainder will then get taxed at a basic 20% rate.

However, there may be scenarios where one of you ends up as an additional or higher rate taxpayer in retirement. This could be due to other income outside tax wrappers or even ongoing employment.

If you think there is a likelihood of that happening, then it may well be a reason to ignore tip #1 above. This scenario is quite unlikely but it’s worth to run the maths today to avoid a nasty surprise down the road.

3. Tame The Pension Taper With Spousal Tax Relief

Ahh, the pension taper. Love it or hate it, it’s a reality. Of course, just because you hit the pension taper doesn’t mean you need to stop taking advantage of this wonderful wealth-building tool

Just do what I did when I hit the taper a few years ago. My wife and I kept our family’s total pension contributions unchanged.

The only difference is that we directed the amount I “lost” from the taper into my wife’s workplace pension.

Yes, it feels strange to have ~25% of my wife’s pay go into her pension. You know what doesn’t feel strange? Seeing the value of our combined pension pots grow to >£250k in just seven years.

And remember – you can take advantage of this tip even if your wife is unemployed. Just open up a SIPP in your spouse’s name, start contributing, and you will get 20% tax relief.

You can contribute up to £2,880/year into the SIPP, which the government will top up to a cool £3,600.

4. Tame The LTA By… Getting Divorced?!?

Think you are on track to breach the lifetime allowance? Don’t despair – get divorced instead.

When assets get divided up between spouses in divorce proceedings, so do the pension pots. It’s also sometimes known as the pension sharing order.

Therefore, it is quite feasible for a couple with £2m sitting in one spouse’s pension pot to end up with two £1m pots, avoiding the penalty for exceeding your LTA.

Once that’s done, there’s nothing to stop this couple from continuing to cohabit together – or even remarry!

I won’t elaborate on what I think about doing this from a moral or philosophical perspective. If you plan to utilize this method, please do yourself a favour and get proper legal advice.

However, the reason I included this tip on the list is to illustrate the extent of the effort and the depth of creative thinking some people employ just to keep their money out of the reach of HMRC.

5. Don’t Consolidate Your Smaller (<£10k) Pension Pots

Consolidating your pension pots is usually a great idea. In fact, doing so can lead to some fantastic investment outcomes over the years.

There is, however, one exception. If you are at risk of breaching the LTA and have a couple of small (<£10k) pension pots lying around, it’s best to leave them be.

The reason for this is that cashing in a small pension pot does not trigger a lifetime allowance test by the HMRC.

Once again, make sure you get proper advice from an accountant before you proceed to make sure you have done it properly.

6. Don’t Forget To Update Your Planned Retirement Age

Contributing to a workplace pension and not bothering to update your retirement age is like driving a Porsche with a handbrake on.

This is because most pension providers will adjust your risk profile according to the number of years you have before retirement. So if you are 54 and your retirement age has been set to 55, all of your investments will be held in low risk, low return instruments.

I don’t have to tell you that this is bad news in case your actual retirement age is 65 because you will miss out on nearly a decade of stock market returns.

Vice versa, setting your retirement age to 65 if you plan to stop working at 55 can lead to a major boo-boo if you retire right before a major market meltdown.

Do yourself a favour NOW and get that retirement age updated. You can thank me later.

Readers, are there any other hacks you are using to increase the value of your pension pots? If so, please share them in the comments below.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com