And so, as it usually does every year, the Christmas fiesta has come to an end.

If anything, the unexpected lockdown here in London was a blessing in disguise. Yes, not being able to see friends and family was a bummer.

On the flip side, it sure helped with keeping food and alcohol intake at a minimum – all while freeing up enough time for sleeping, exercising, and catching up with the kids.

Talk about silver linings.

As a result, I’m entering 2021 with a lighter stomach, a clear head, and an even bigger spring in my step than usual.

No, we still aren’t out of the woods as far as the pandemic and the broader economy are concerned. But if you wait for an ideal time to build wealth, you’ll be waiting for a long time.

Thus, in what has now become an annual tradition, I sat down on Sunday afternoon to map out our family’s top money moves for the year ahead.

Here’s our family’s financial blueprint for the next 12 months.

2021 Money Moves: Real Estate

Continuing to grow our real estate portfolio will form the cornerstone of our wealth-building efforts over the next 12 months.

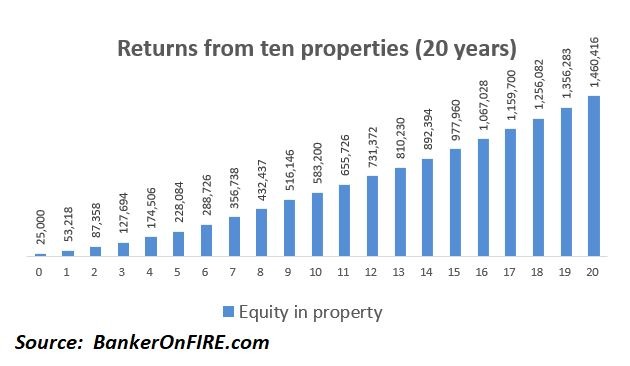

As a reminder, here’s why real estate is such a powerful tool for building wealth:

Other than the chart above, there are two reasons why I am so focused on property investing.

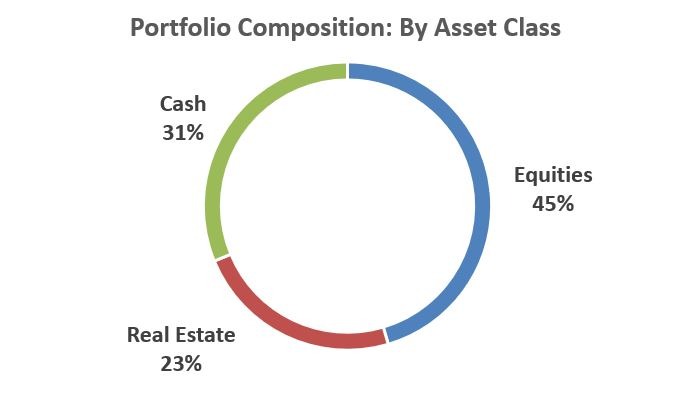

The first one is that we are currently underweight real estate in our portfolio. Hence, I would like to increase our allocation from 23% as of today to about 40-45%, broadly in line with our equity holdings.

The second one is that while I am a big believer in the magic money machine, I am also acutely cognizant that we can run into an extended period of stock market underperformance going forward.

This is especially true after the exceptional performance of the past 11+ years.

If I can find property investments that generate “base case” returns of 8-10% with upside potential, I’ll be happy to put a significant chunk of my money to work.

As far as specific 2021 goals go, I am aiming to buy two more properties:

- Another mixed-use residential-commercial building, similar to the one we bought at the height of Covid

- A detached, single-family home in the same metro area where my parents live. This would be both an investment as well as a hedge against rising property prices in case we ever decide to move back to our hometown

Given all the lockdowns that are being put back in place, I have a feeling that January – February may be an excellent time frame to find good bargains.

Hence, hence I’ve made all of the preparations leading up to Christmas. My real estate agent is on high alert.

In other words, watch this space.

2021 Money Moves: Stock Market

The beauty of stock market investing is that in the current world of index funds and online trading, it’s literally a matter of clicking a button on your screen.

As usual, tax considerations continue to drive our equity investment strategy.

In practice, that means that we will do the following four things in 2021:

(i) Max out our ISA limits of £20k for me and my wife.

(ii) Dial back our pension contributions.

While I love supercharging our returns through tax breaks and employer matching, I now need to manage the risk of exceeding the lifetime allowance.

More importantly, we’ve already got enough in our pensions to sustain us in our golden years. The focus is now on “working backward” and enabling retirement well before we hit our pension age.

(iii) Transfer our workplace pensions into our self-invested pension plans.

Back in 2019, I realized I am literally losing hundreds of thousands by sticking with my existing pension provider.

Since then, transferring the balance of our workplace pensions to a SIPP has become part of our annual financial routine.

Goodbye, expensive plans, and limited fund selection. Hello, low fees and well-diversified index trackers.

(iv) Cash out my vested share awards.

As I’ve admitted in this post, I am actually more of an active investor than I let on.

Thus, I’ve held on to my employer’s shares as they vested over the past 12 months – with more to come in the first quarter.

Given banking stock prices are finally rebounding, I will likely cash out the awards and use the proceeds to beef up our US equity holdings.

As you can see, there’s nothing groundbreaking here.

Once you’ve established a stock market investing strategy that works, it’s best to just leave it be.

Yes, you can tweak it on the margin to reduce fees and taxes. That being said, I probably won’t need more than a day to action all of the items above – and that’s just the way it should be.

The Biggest Money Move Of Them All

Real estate and stock market investing can be a lot of fun. That being said, we are not yet at a point where our investment income exceeds the income from my day job.

Thus, as boring as it may sound, my biggest focus area for 2021 by far is to continue doing well at work.

While 2020 was an intense year, I finished it with a ton of momentum and have a solid pipeline of deals into the next 12 months.

At a cost of significant time and intellectual investment, I’ve also expanded my coverage universe in a pretty meaningful way.

As a result, there’s much more ground to cover – and many more client relationships to nurture.

As in any client- and deal-driven industry, there is rarely a direct short–term correlation between effort and compensation.

Over the long-term, however, it’s all that matters. And if I am going to spend north of 70 hours a week working, I sure plan to make the most of it.

Sitting here in early January, it might seem that we have all the time in the world. That a year is a long time.

Perhaps. At the same time, there are only 52 weeks left to go – and the clock is ticking.

Might as well get started – and mapping out your own money moves is the perfect first step.

Good luck on your journey!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

What about the crypto allocation?

Btw, are you sticking to RE in US or looking for deals somewhere else? Logistically, do you deal with everything online without ever going there in person?

I’ve mulled over the crypto idea over the past few weeks.

Ultimately, I will stay on the sidelines for the time being. A variety of reasons such as:

– non-productive asset (i.e. gold)

– risk that your wallet provider will go under (remember Mt. Gox?)

– pure level of complexity to acquire crypto, which I cannot be bothered with at the moment

As far as property, it’s all across the pond and in / around the place I used to live. I know the area well and am there a few times a year anyway visiting family.

At other times, it’s a combination of a trusted real estate agent, lawyer, and a property management company.

Sounds reasonable. My NW is still such that a crypto allocation of 3% is small enough to tolerate keeping it in a wallet on a reputable exchange but I can definitely see the point if that’s something that would have you worried.

What would your view be on investing solely in the UK?

Property wise I mean

Tough to say. I make a point of only writing about things I have personal experience with, and I’ve not owned a single piece of property in the UK.

Based on comments on some of my other property posts, the regulations here can make the whole endeavour pretty unattractive.

That being said, am sure there are deals to be had – just much tougher to come by.

Hi BankerOnFire,

“I am also acutely cognizant that we can run into an extended period of stock market underperformance going forward.”

What makes you think we’ll be in a period of underperformance? Is it the level the stock market is at today?

Do you plan on changing your monthly DCA contributions as a result of this “fear” ? Similarly to you, I’m putting in an X amount each month, however, the likelihood of a long period of underperformance makes me think.

The way I see it, it’s best to keep going with the same monthly DCA, otherwise I would be trying to time the market. Underperformance may come tomorrow or in 5 years. Do you see it the same way?

It happened in the past and it might happen again. In the noughties, the US market has gone nowhere for a decade.

I don’t know when – or if at all – it will come. And I will definitely not be changing my DCA or cashing out any of my existing holdings. As you say, that would definitely be timing the market and I am not looking to do that.

The reality is that if the market is underperforming, the DCA works in your favour. Just like the folks who stayed the course between 2000 and 2010 – and were rewarded massively in the following decade.

For me personally, it’s more about tactical asset allocation. If I can increase my exposure to property at a 8-10% base case returns, I’m happy to take the option.

Thanks for your reply. I agree that when the market is underperforming DCA actually benefits you. (Unless you end-up in a Japan-like situation I guess).

One of the comments below (by Bankernotfired) made me think.

“My first decade of investing in the stock market was horrific. … after 8 years of going nowhere 1999 – 2008, I lost some enthusiasm.”

An “8 years of going nowhere” situation must be mentally challenging. You are very well aware that you should stay the course and these long periods of underperformance will even benefit you.

Most people can do that for months, 2-3 years, but waiting for the light at the end of the tunnel for 8 years (or potentially even much more in the future) – questioning yourself if the market will ever recover (amidst climate change risks) – is something I’m very curious if I could do.

I guess that’s what separates the best investors.

Is there any way you prepare for a 20+ year market underperformance? Should you prepare and Is there a way to prepare for that at all?

You can, of course, allocate a part of your portfolio to real estate, however, a significant part of your wealth will still be in equities (it’s just the most convenient).

Yeah all great points.

Automating your investments, so you never see the money coming out, is the “technical” solution.

Beyond that, it’s about recognizing that (i) you’ve got to put money aside in any event, (ii) you should have a meaningful allocation to equities, and (iii) you have to invest with a 10+ year time horizon in mind.

I also have a feeling that periods of underperformance relate to specific geographies, i.e. the “lost decade” in the US in the noughties or the more recent underperformance in Europe / EM.

Would think investing in world equities gives you more of a hedge (at a price of lower long-term returns). That being said, the world tracker data only goes back 30 years or so, thus I’ve never been able to substantiate my hunch with a proper data set.

Hi, nice post. I would love for you to do some detailed posts about how to start getting invested in RE, especially from abroad.

Thanks MSG.

Realistically, it’s very tough to pull off property investing from abroad. I do it because I know the particular metropolis area well, having lived there for 15+ years.

That being said, it takes having a very trusted network of individuals on the ground. I’ve also given my father a power of attorney so he can handle any specific issues for me locally.

If you haven’t got the “infrastructure” in place and still want to make a play on properties in North America, syndications may be the easiest way.

I’m not sure about holding off on the pension contributions. I’m getting close to breaching the limit already but still do the bare £4k maximum a higher earner is allowed. The only reason being by the time you reach pensionable age, which for you is a minimum of 18 years away, it’s very likely the rules may have changed for better or worse. In addition, there are still a few jurisdictions where you can execute a QROPS scheme (although these are highly highly limited) and pull out your entire pension tax free. Portugal was one but isn’t any more I believe. This a major health warning for anyone reading.

My first decade of investing in the stock market was horrific. it then negatively impacted my financial returns because what I should have been doing throughout was pumping money into the market but instead after 8 years of going nowhere 1999 – 2008, I lost some enthusiasm.

I find it so amusing to see many commentators blithely talking about the market being an ongoing compounding machine without the consummate risks or volatility. It is but it is quite feasible the equity market does nothing for twenty years and that would still mean the long term equity return was still just great. That’s not my central view at all but I’m prepared for it. What I’m saying is – I agree with diversification, real estate etc etc.

The trouble in the UK is residential real estate is so unattractive now due to regulation and low returns and commercial real estate outlook does not look good at all. I suspect a cautious amount of leverage is going to be a good idea to protect against paper devaluation over the next few years but who knows, that’s speculation.

I do keep thinking about topping up with gold now and again. I gift it immediately to the children having topped up the JISA etc.

Childrens pensions….I’ve not x the rubicon on that one yet but theoretically it’s a good idea.

I find it so amusing to see many commentators blithely talking about the market being an ongoing compounding machine without the consummate risks or volatility

Clearly I don’t think that’s you!

🙂

What will be very interesting to observe is the behavior of personal finance bloggers when we (inevitably) run into choppy waters that last years, not months / weeks.

As far as pensions go, I think I still do roughly £7k or so a year, which is the minimum I’ve been able to set with my employer. The £3k extra gets taxed but I’m not able to change the payroll scheme.

We are dialing my wife’s pension contributions significantly. She was at about 25% of her base for a while, which was ridiculous in % terms but allowed us to max out her full allowance and take advantage of employer matching. Taking that back to a much lower amount now.

Also not there on children’s pensions. To be frank there’s a meaningful chance we might move back stateside in the coming years so don’t want to create additional complexity (in addition to removing some of the motivation!)

Really insightful and a pleasure to read as always BoF.

Your portfolio is entirely North America when it comes to equity allocation. What’s your view on investing in say Emerging Markets for added diversification?

Cheers Rob.

In my mind, the only two credible investment options are (i) US equities and (ii) Global equities (i.e. owning the world)

I go with 100% US equities for reasons outlined here: https://bankeronfire.com/the-case-for-a-100-us-equity-portfolio

If I add EM exposure now that will be the equivalent of buying the world tracker, which isn’t something I want to do (but may be the right option for the majority of people)

Pingback: 100 Tips For A Better Life - Apex Money

Pingback: A Year Planned Out: 2021 Money Moves • A Chat With Kat