Note: This post was first published in December 2020 and updated in April 2022.

Nothing in life is easy. But it’s fair to say that building wealth has got to be one of the most challenging tasks you can set for yourself.

A big underlying issue here is incentives.

Think about losing weight or learning a new language. Unless you are a naturally gifted athlete or a born polyglot, neither of those will be easy.

But if you were to set your sights on one of them, chances are you would find a host of cheerleaders to help you along the way.

For example, your gym’s incentives are aligned with your own here. They are keen for you to become a loyal member and keep coming back for years on end.

Similarly, your personal trainer would also want to help you along.

Yes, partially because he is getting paid for it. But also because (hopefully!) he actually cares about making a positive impact in your life.

Even strangers could act as unwitting allies, what with their subtle once-overs and not-so-subtle compliments. I’m sure it could get annoying as well, but sadly I’m not speaking from experience here.

Flying Solo

When it comes to building wealth, you’ve got no allies.

As a matter of fact, the only person who stands to benefit from your efforts is your future self.

Alas, that future self exists many years, if not decades, out. There’s only so much encouragement he or she can give you.

And in the meantime, everyone around you is actively disincentivized to help you.

Businesses large and small are constantly trying to sell you things you don’t really need. There’s also an army of savvy marketers helping them along – and taking a cut in the process.

Your employer certainly doesn’t want you to reach financial independence. God forbid you actually have options and become less motivated as a result!

Friends and acquaintances are quick to compliment you for that flashy car you shouldn’t have bought (on credit, no less). Tell them you’ve saved/invested the money and the most you’ll elicit is a yawn.

It might seem the government is aligned with you, given they provide perks like pensions and Lifetime ISAs.

Upon closer examination, it turns out to be an act of cold self-interest.

The more money you have, the less likely you are to need support in retirement.

The cynic in me argues that the government likes to reserve the option to raid your hard-earned savings to plug yet another budget hole.

In other words, building wealth is not a team sport. On the contrary, it feels like single-handed combat most (if not all) of the time.

Compare And Contrast

So why is it that some people are successful at building wealth – and (most) others aren’t?

One big difference separating the haves from the have-nots (or the still-to-haves, if you want to be optimistic), is the focus on process versus goals.

For example, anyone can set a goal to become a millionaire.

But let’s be honest with ourselves: the reason some people actually become millionaires (and most others don’t) isn’t that they have set a better goal for themselves.

Everyone starts out with the same objectives in mind.

What differentiates successful people is backing up their goals with the right processes, such as:

- Maximizing earnings

- Spending less than you earn

- Investing in low-cost index trackers

- Letting those investments compound

But even if you put the right process in place, your job is far from done.

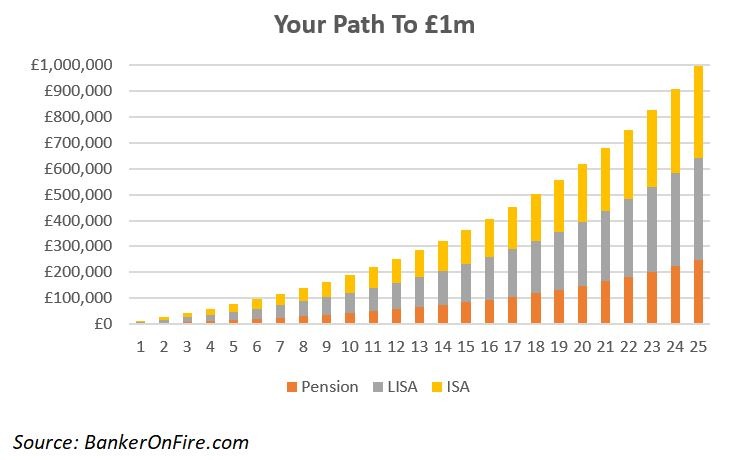

I’ve previously laid out a detailed step-by-step plan to get to £1m in net worth – on an average salary.

The wrinkle? It takes twenty-five years to get there – and a decade before you notice any meaningful momentum:

The only way you will ever make it to the finish line is if you enjoy the process.

And in this case, enjoying the process has very little to do with learning about index trackers. It’s not a particularly exciting subject, even for finance professionals like me.

Rather, enjoying the process has to do with your identity. And if your identity is at odds with the process you’ve put in, you’ll either give up – or have a very unhappy journey.

The Money Identity

For example, if you are constantly looking to make a quick buck, the long-term approach will not feel natural for you.

As a result, you’ll spend the next twenty years looking (and failing) to get rich quick – all while you could have been getting rich slowly.

The same goes for hard work. No, you don’t need to work a hundred hours a week to be successful.

Equally, you’ll rarely meet someone who got rich while lounging around on their couch all day. Success requires consistent effort.

You are also in for a struggle if you determine your self-worth by the things you own – or judge others by their spending habits.

Doing so is the perfect antithesis to building wealth. After all, real wealth is what you don’t see.

Most importantly, if you equate wealth with happiness, you are in for a shock. No, reaching financial independence won’t make you happy.

Content? Yes.

Secure? Sure.

Happy? Nope.

Give yourself permission to be happy today, not when you finally hit your number.

And as it happens, the alignment between your goals, processes, and identity can be a major source of happiness in itself.

There’s nothing quite like the knowledge that the way you are going about your life is in line with your entire system of values, beliefs, and judgments.

Let’s go back to the example of losing weight for a moment.

The reason so many people manage to lose weight – only to gain all of it back isn’t because they have the wrong process. Ultimately, healthy eating and exercising will help you shed the pounds.

The problem is that the process is not aligned with their identity. Thus, it feels like a constant struggle and sacrifice – and they ultimately end up back at square one.

By definition, changing your money identity is not easy. But if you are truly serious about building wealth, it’s a pre-requisite.

As always, thank you for reading – and good luck on your journey!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Your spot on with this. The challenge for me will be to protect my money identity from the occasional negative comments I tend to receive from friends or colleagues who question why I’m not following suit with everyone else that’s signed up to the cycle of spending and upgrading.

Thanks for the great posts, I’ve enjoyed reading them all year!

Cheers, glad you enjoyed it!

Part of the solution is to stop associating with people who look down upon you (explicitly or implicitly) based on your spending habits. This is why fitness fans hang out with other healthy people, wealthy folks tend to cluster together etc.

However, that’s not always possible in life, which is where a strong sense of identity becomes crucial. Otherwise, it will always feel like a struggle.

I really like this style of post, BOF.

Don’t get me wrong, I like the nitty-gritty technical financial-wizardry too, but this kind of writing makes the reader take a step back and see the bigger picture.

It’s things like this that have helped me get bad habits and poor judgements out of my system; just as I’m about to gear up to a longer, faster, harder working week – along with a substantial increase in salary.

I’m grateful. Future me will be even more so.

Best,

TraineeRich

The technicalities can only get you so far. It’s not very hard to invest in index funds once a month.

Changing your mindset is quite different – but it can also make you happier in ways money never will.

Congrats on the promotion / new role and best of luck with it!

Nailed it. Choose carefully which Joneses you compare yourself to and try to keep up with.

Being a big fish in a comparatively small pond, filled with healthy and happy folks, makes a huge difference to our own contentment.

It also helps provide a sensible baseline for our kids, so they don’t come off the production line with a head full of inflated lifestyle expectations that only a career at Goldman could hope to satisfy!

Thanks for providing a tireless stream of thoughtful and well written stories this year. All the best to you and your family for 2021.

Goldman is the new baseline, partnership track at CVC is the only thing that will sate some people’s appetites these days.

Thanks for the kind words indeedably, goes a long way from someone whose writing I really enjoy and admire. Have an enjoyable break and a great start to the new year!

Another great and insightful post, thanks BoF.

If not for the friendly and helpful FIRE community, building wealth and aiming for FIRE would indeed be a very lonely path.

Thanks for the quality writing over the year and all the best for 2021.

You’ve got to have superhuman willpower to hack it alone. Sadly, few of us do (definitely not me).

Merry Xmas to you as well Weenie – and all the best for 2021!

Pingback: Wednesday Reads: Merry Christmas! - Dr FIRE

Another fantastic post, BOF. I’m not sure how you managed to do this being a senior investment banker! Hat off to you!

Stumbling on your blog is one of the great things happening in 2020 for me. Reading your articles was always a good pause from the intensity of live transactions. Hopefully you will keep this up and I look forward to reading your posts / thoughts on a weekly basis!

Merry Xmas and a very happy new year to you!

Thanks for the kind words AoF.

A banker in me would credit the day job for being so productive. The truth is, however, that having kids is the the best way to get your efficiency score from zero to hero 🙂

Glad I could be helpful/additive to your journey. Merry Christmas and a great start to 2021!

My hope is to really take things down in 2021 by going back to work. This way, I’ll have 10 hours a day to make money and take meetings instead of take care of my own kids.

It’s been looong days for so long. Need a break!

Sam

A 10 hour day doesn’t seem so bad once you compare it to 18+ hours a day taking care of the kids!

I think that after a decade in banking, my equivalent of a dream job would be 40 hours a week, no weekends and 4 weeks of undisturbed holiday.

I’ve been trying to build a bit of a FIRE culture with my closest friends and family, if only for the selfish reason that early retirement will be more fun if I have other early retirees to spend time with. Limited success so far though.

Same here frankly.

Despite being pretty successful professionals, my wife and I find it nuts to spend more time working than we have to.

However, most of our friends view that as a pre-determined outcome and it’s nigh impossible to convince them otherwise.

Yup. That’s how I got to FI by focussing on the process. In fact by focussing on one thing, getting that sorted, then moving on to the next thing, or working out what the next thing should be. With hindsight using the psychology of small changes on myself to become a different person over time where I was fully aligned with the goal, making willpower’s job easier.

Though it did make me happy when I discovered I was FI after flying solo for so long without a known end point.

What you describe, by the way, is the absolute best strategy for success in life.

The reason so many people fail at their NYE resolutions is that they try to do too much, too soon – and inevitably give up by the time February rolls around.

Those who start off slowly and focus on making one change only before moving on are the ones who succeed.

It took me a really long time to figure out the why of it. And I am fairly sure I have above average willpower, such that I suspect that all successful FIREes do.