A lot has been said about the tremendous run-up in the stock market since the global financial crisis.

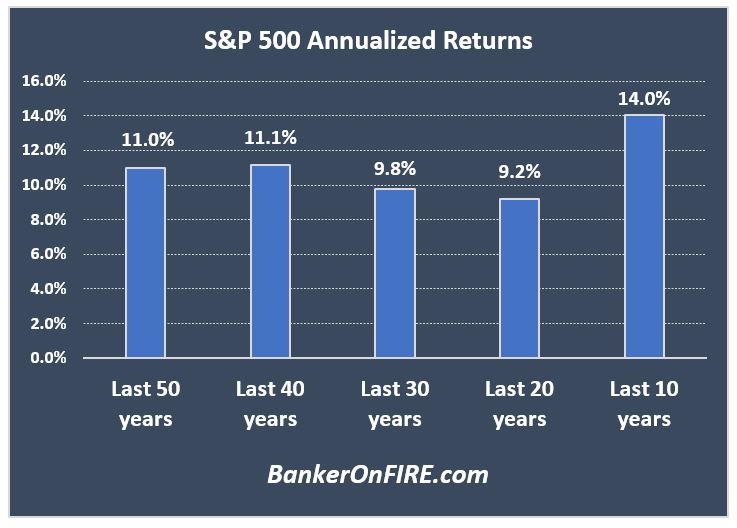

Historically, the S&P 500 returned about 10% a year (nominal, with dividends included). Over the past decade, however, the returns are well into double digits:

So far, that trend has continued in 2021.

S&P 500 now stands at 3,842 – about 4% up for the year. I think it’s fair to say not many people saw this coming back in March of last year.

To be fair, some of the tremendous returns can be explained by the fact that US equities have really gone nowhere between 2000 and 2010.

On a twenty-year basis, the annualized returns stand at just 9.2%, well below the historical average.

Still, we could very well be staring down the barrel of below-average returns, as valuation multiples normalize, interest rates rise, and earnings look to catch up with share prices.

Today, let’s run through a couple of different strategies to help you plan for a period of low market returns.

Strategy #1: Change Your Asset Allocation

Let’s start with the obvious one.

The easiest way to offset low market returns is to allocate a bigger chunk of your portfolio to higher-yielding assets.

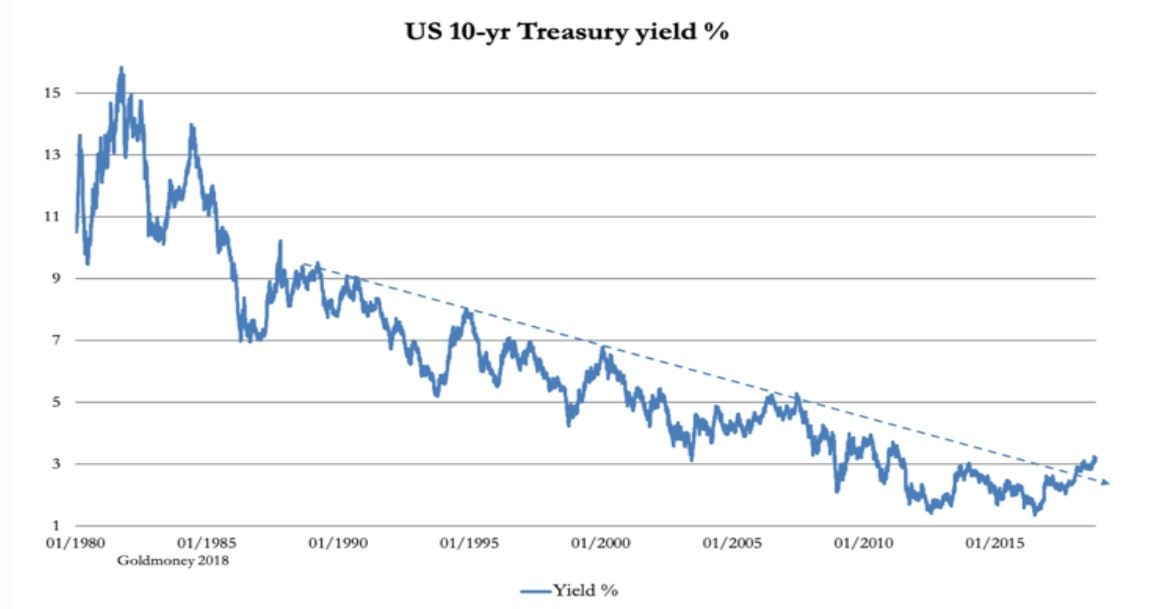

This is one of the biggest reasons why the stock market has done so well in recent years. As interest rates plummeted, investors piled into equities:

If you have a larger-than-needed cash buffer or bond allocation, you could juice your overall portfolio returns by allocating more capital to equities.

That being said, do not forget that increasing your equity allocation also increases your risk.

Higher returns are great – as long as you don’t panic and sell after a downturn.

In other words, tread carefully.

Another option (which I am actively pursuing) is to allocate a bigger portion of your portfolio to real estate.

Unlike the stock market, which tends to be pretty efficient, real estate is much more fragmented, regional, and inefficient.

Most importantly, you can also use leverage – which is rarely a good idea when investing in equities.

In other words, there is an opportunity to find underpriced assets that will give you a return well above the 8%-10% that equities have delivered over the past 100 years.

That being said, real estate investing is not nearly as straightforward as some people would like you to believe. You’ve got to head in with your eyes wide open.

Once we get past bonds, equities, and real estate, we’ve pretty much exhausted the spectrum of investment options available to the general population.

The reality is that most people aren’t in a position to make venture capital, private equity, or private debt investments.

And while there’s seemingly a bunch of other assets you could pick (gold, crypto, individual stocks, Tesla call options, etc), all of these are speculative.

If you just can’t resist, it’s fine to allocate a smallish (<5%) portion of your portfolio to the above. But they should never be a cornerstone of your investment strategy.

Strategy #2: Offset Low Market Returns By Increasing Your Savings Rate

I realize this won’t be the most popular option.

However, realistically speaking, it is the most powerful tool you have in your arsenal.

The bottom line is that increasing your returns even by a single percentage point can be nigh on impossible. This is especially true once you’ve optimized your asset allocation.

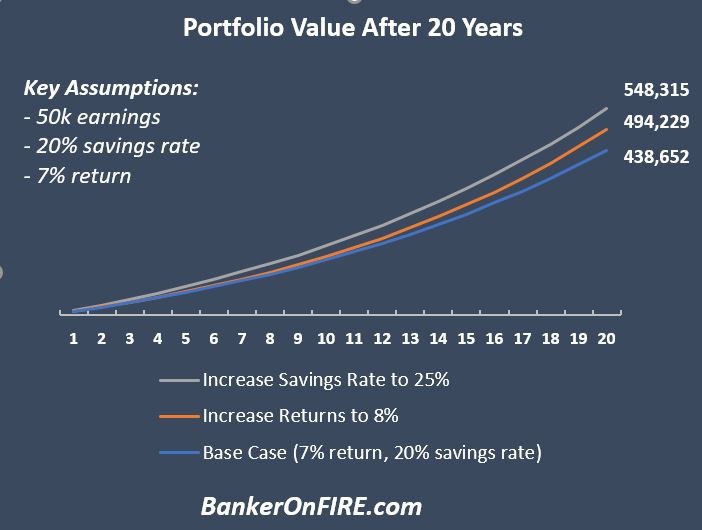

Increasing your savings rate by a few percentage points, however, is achievable for most people. And, as the chart below illustrates, it is also far more powerful:

In the example above, someone who makes 50k a year, saves 20% and invests it at a 7% return will walk away with 438k after 20 years.

Yes, increasing the returns to 8% would boost the portfolio value by about 55k, all the way up to 494k.

However, keeping the returns at 7% and increasing the savings rate from 20% to 25% leaves this very same person 110k ahead of the game, with a 548k portfolio after 20 years.

If that isn’t food for thought, I don’t know what is.

Strategy #3: Hedge Against Low Market Returns By Making More Money

Don’t want to save more? It doesn’t have to be a deal breaker.

The other way to increase your savings (in absolute terms) is to make more money.

The obvious way here is to work harder – by taking on more hours, getting a second job, or building up a side hustle.

Another one is to work longer.

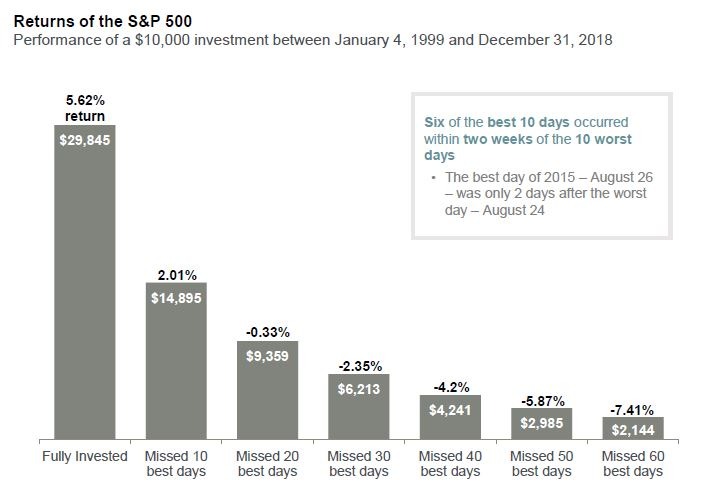

The longer you stay in employment, the more time your investments have to compound. To state the blindingly obvious, there’s also a shorter time frame during which you depend on your investments:

By the way, it doesn’t mean you have to work your fingers to the bone all the way into old age. But taking on a low-impact (and hopefully enjoyable) part-time job even for a couple hundred a month can make a massive difference here.

Finally, there’s my preferred option which is to work smarter.

That is – do the same work but be much more strategic about it to making sure you are financially recognized for it.

Strategy #4: Increase Your Time Horizon

You may think this one is out of your control, but the reality is that it isn’t.

Partially it relates to the “work longer” point above.

More important, however, is the point around getting started in the first place.

For those at the very beginning of the journey, it means the basics:

- Creating a budget – and sticking to it

- Paying off debt

- Learning the basics of investing

For those more advanced it’s about taking advantage of the full range of the wealth-building tools out there.

And even those who are well along the way always have scope to optimize their approach.

My personal money moves for 2021 involve rebalancing my investments towards my ISAs and transferring our workplace pension balances into self-invested pension plans.

I am sure others also have ways to make their money work even a little harder for them in 2021.

The bottom line, however, is that there’s no magic bullet that allows you overcome a period of below-average market returns.

The people who really know how to beat the market keep that knowledge for themselves.

And you should really stay away from the ones who promise you a magic solution of some kind. It simply doesn’t exist.

Happy investing!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Hi

Thanks for the post.

If you have sizeable equity in a second property which is rented out what would you do with the equity?

Hi Naz.

Tough to give advice without additional context. Really depends on whether you are in the UK, whether the property is held within a corporation, overall investment objectives etc.

What I do with my properties is re-finance every few years which keeps the mortgage payments high (and thus reduces my tax bill) and provides capital to buy additional properties.

The optimal strategy for you will be very situation-specific.

Thanks.

I’m in the UK. if I were to sell the rental property the equity which is about 100k would bit hit with 28% CGT which is likely to go higher in future there is speculation it may go up to 40% Just wondering what I can do with the equity. I’m thinking invest in index trackers but not sure.

I can’t really give advice on this blog – not least because I’m not certified but also because it’s all down to your objectives and risk profile.

That being said, another option you have is to refinance (i.e. take out a new mortgage with a higher LTV), releasing some of the equity tax-free and allowing you to hold on to the property while diversifying into stocks.

Strategy #2 is interesting, perhaps unintuitive as many people would presumably choose to increase returns rather than save 5% more. When you modelled it, did you do so whereby the portfolio didn’t start from zero? Because most people are unlikely to be thinking about these things at the get go. I wonder if you had an existing investment of (say) £50k or £100k – is the same still true? Does savings rate trump investment returns?

Mathematically, the bigger your portfolio, the more important the market returns become. At that point in time, it’s what your portfolio does for you, not what you do for your portfolio.

That being said, it’s probably also the point at which you’ve optimized your returns as much as possible, so increasing the returns is tougher.

Pingback: Friday FIRE Round Up #12 - Best FI Articles | FIRE Your Own Way