These days, I am facing a fairly serious conundrum in my capacity as an investor.

Sure, the last ten years have been good to us.

On the property side in particular, we initially became landlords by accident. However, we subsequently went on to accumulate a reasonably sized portfolio of investment properties.

Objectively speaking, rising prices have played a big role here.

The mathematical effect is straightforward. Interest rates and yields compress, the value of our properties goes up. Nothing more to it.

However, it is the psychological benefit that is far more important here.

Rising prices validate our strategy – and give us the confidence to continue allocating a significant chunk of capital to real estate:

At the same time, the continued growth in prices is making our job increasingly harder.

Gone are the days when folks were scared to get into real estate – and banks were stingy with financing.

Nowadays, the market is on fire, buying property seems like a total no-brainer – and banks are bending over backwards to give you a mortgage.

The animal spirits are spilling over beyond the single-family home segment, too.

There’s been an influx of “retail” investors in the $1m – $3m commercial / multi-family segment (which is where I focus my attention these days).

It’s tough to compete with investors who price properties at cap rates 40-50% below market.

Or assume they can get away with paying zero in taxes.

Or buy properties across the street from a gas station / right next to dry cleaners without even thinking about an environmental inspection.

The list goes on and on. And so, I just can’t help but wish for a correction.

Sure, when the market gets a collective kick in the nuts it will hurt me as well. It will become much harder to secure mortgages at attractive rates – and refinance them once the property has been stabilized.

But as a long-term net buyer of real estate, the upside from being able to acquire on the cheap FAR outweighs the near-term turbulence.

Parallels

A similar phenomenon is playing out in the stock market.

Everyone (except for the people who hate the stock market) is happy with the way equities have rallied post-Covid.

Last week, the S&P 500 has reached the milestone of doubling off those March 2020 lows:

Sure, it’s encouraging when all you see in your brokerage account is a sea of green.

But for any long-term net buyer of equities, this is absolutely terrible news.

The magic money machine can only do so much – as illustrated by Vanguard’s most recent take on equity returns going forward:

Now, things may or may not work out according to the chart above. But if you ask me, lower returns going forward are a near certainty.

It will take time for valuation multiples to normalize after a long stretch of multiple expansion.

Thus, if you have been investing for a while, it’s pretty much a guarantee that the money you’ve put to work a decade ago will generate a far higher return than the equities you are buying today.

Now, this doesn’t mean that you should go all cash and wait for the inevitable correction.

Data shows that to be a far inferior approach to good old-fashioned, regular investing.

Besides, what if the correction never comes? What if the stock market just goes nowhere for a couple of years while earnings catch up?

Next thing you know, it’s 2025 and you are still waiting to buy the dip.

The broader point here is that if and when volatility does come, you want to embrace it, not shy away from it.

The FIRE community agonizes over the unpredictability of the stock market, because it messes with those SWR numbers.

But the irony is that it’s the very unpredictability of the stock market that gives rise to an SWR in the first place.

If the stock market was as safe as the bond market, investors wouldn’t require a 6 – 8% return on their money.

Instead, they would be perfectly happy with 0.5%. Good luck getting to financial independence on that return.

In a similar vein, if the property market didn’t crash every decade or so, flushing out a bunch of unlucky overlevered investors along the way, there would be no way to make 10%+ returns in real estate.

Poof – say goodbye to the asset class that created hundreds of thousands of millionaires over the past 50 years.

Even the job market functions in a similar way.

Being an accountant means you are unlikely to ever be unemployed. This is why a bunch of risk-averse people become accountants in the first place, creating a solid supply of talent – and keeping wages down.

Contrast that with being an entrepreneur.

After a few years, you are virtually unemployable. But, to compensate for that risk, entrepreneurship offers upside potential that good old accounting could never match.

In both investing and life, the idea of accepting and embracing volatility is not an intuitive one. But at the end of the day, it might well be the most important skill to develop.

Thank you for reading.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Great perspective as always BoF

A risk averse accountant

I’ve been both an entrepreneur and an accountant.

A gauge of my “success” is that I am now neither of those!

Great article.

The exuberance for property does not translate very well to the UK though. Too much regulation for tenants, slowing capital growth, and taxation. Such a shame. I’m 35 and would dearly love to get into property. I’m also a lawyer specialising in property, landlord/tenant, general chancery work so would be able to navigate the legal issues fairly well but even then am concerned that it is all too time consuming. At the moment, I have just decided to build/extend my primary residence and take the capital growth when I choose, if ever, to upscale. The rest goes into the stock market

Thank you. And yes, I am with you on this one.

As a matter of fact, we own zero property in the UK (we even rent our primary residence here, though that’s more due to the fact that we are likely to move back at some point).

I ran my ruler over the local market a few years ago and figured I can get a better risk adjusted return elsewhere. Luckily I’ve got family and a network of lawyers / agents / property managers back home which makes overseas investing feasible. Would be very hard to do otherwise.

Re Tiffany vs Brittany vs Sarah …

Unfortunately, I am not sure that I have 41 years remaining!

Sadly, neither am I

But hopefully some other readers have a few years (or decades) on you and me!

Hi BOF,

Discovered your blog site a few months back and it has been a great read for a beginner investor like myself.

I have only really been taking investing seriously for maybe around the last 15 months or so since COVID struck – So it is interesting to read the thoughts of much more experienced investors like yourself.

I am 31 years old (aiming for retirement somewhere between 55 and 60 currently but who knows what will happen!) and currently able to put away between 1600-2000 a month between my pension and S&S ISA each month so I am reasonably confident that even with below average market conditions I should still have a decent pot within the next 25-30 years.

Your post above highlights the risk of lower equity returns for the next 10 years, but when planning so far ahead, do you feel it would make more sense to use the average market return for my long term horizon during the accumulation phase? My current plans have 5% growth (including inflation figures) but not sure if this is too pessimistic or not.

For reference, I am fully invested within VWRP, and will likely remain so (or equivalent global tracker if something better comes along) until I hit 50/55 when I plan on dialling back the equity exposure.

Thanks,

Dan

Thanks for the kind words Dan. Congrats on beginning your journey – that’s quite a bit of cash you are putting aside each month, well done.

My personal preference is to plan conservatively and enjoy the upside (if any).

I’ve got a c.20 year time horizon for my tax-sheltered investments, and I assume a return of 7% or thereabouts (including inflation). The way I look at it, long term returns are 10%, and even if there’s a decade-long stretch of underperformance, I have many years beyond that to hopefully compensate for it.

The only caveat is that I’m 100% US equities, which have historically delivered a superior long-term return:

https://bankeronfire.com/us-equities

That being said, I think your 5% assumption is prudent enough, especially in light of your time horizon.

Good luck – and don’t forget to enjoy the journey!

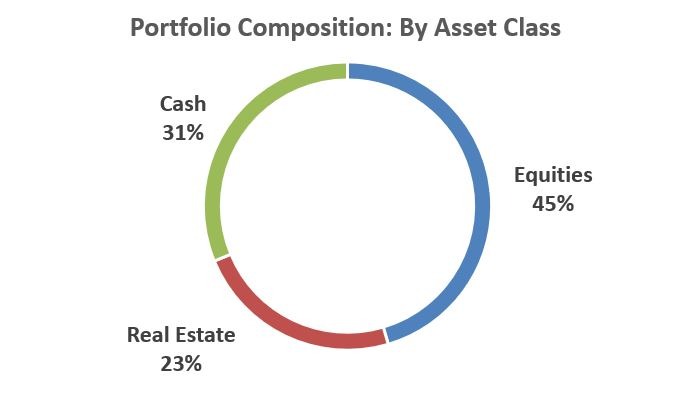

Another interesting post. Can I ask about your cash allocation? It seems high. Are you waiting to deploy this to another real estate deal maybe?

Correct.

I’d like to buy another commercial property within the next 9 months and will need a significant chunk of cash for a down payment. I’m aiming for 30% down so will need anywhere between $300 – $600k, possibly higher if I go north of $2m + closing costs.

The other reason is to maintain appropriate liquidity. We’ve got two kids + a number of properties that are reasonably (50 – 70% LTV) levered. Having a decent chunk of cash on hand means I don’t lose any sleep when I get a vacancy / unforeseen capital repairs etc.

I’ve been a long time reader of your blog.

Just out of curiosity, did you change your monthly DCA amount that you put into S&P 500 in light of recent valuations? Or no matter what you just keep putting in the same amount?

Thanks & have a good weekend!

No. All fully automated – I make an allocation decision once a year depending on where our portfolio stands and then just let it roll.

In 20 years, it really won’t matter whether you bought at 4,500 or 4,000

What will matter, however, is that you bought as opposed to waiting around on the sidelines for a correction.

Good luck!

So I guess in the long run, once per year DCA will yield returns that are roughly equivalent to once per week DCA?

If so, I probably will just go with what you’re doing then because deciding how much to DCA each week can get stressful (but also allows me to YOLO a bunch of the stock market dips 20-30% all of a sudden).

Or would it be prudent to just do a once-per-year DCA and *if* the market dips just put a bunch of cash into it on top of the annual DCA?

Not quite. I think the value-maximizing option over long-term is to invest as much as early as possible.

You do want to be mindful of transaction fees – the $10 / £10 trade fee doesn’t really matter if you are contributing a grand a month but starts to hurt if you are operating with smaller numbers.