Using a tax-efficient investment vehicle like a junior ISA can be one of the best ways to build wealth and grow your net worth.

The fact that the dividends and capital gains generated by your investments are tax-free makes a massive difference.

In addition, the government may even top up your contributions, as it does with pensions.

Other than pensions, Individual Savings Accounts (ISAs) are probably the most well-known tax-efficient savings and investment instruments. After all, we have all heard about cash, stocks-and-shares and Lifetime ISAs.

So isn’t it strange that the junior ISA isn’t getting as much airtime as some of its more famous siblings? And does it have a role to play in accelerating your path to financial independence?

Ever since I became a father, exploring the junior ISA has been on my to-do list. As it turns out, toddlers are demanding and life is busy – so it took me much longer to knock it off the list than I expected.

As I quickly realized, there is a way to utilize the junior ISA as part of my family’s journey to financial independence. However, simply opening an account and maxing out the contributions is not the way to go.

As a matter of fact, doing this will likely be detrimental to your family’s finances and net worth.

But first, let’s start with an overview.

Junior ISA – Six Things You Need To Know

A Junior ISA (also known as the JISA) is essentially an ISA that you open in your child’s name. It has all the same attributes as the cash or stocks-and-shares ISAs, barring a few key differences:

- You can only open a junior ISA if you have a child who is under 18 and resides in the UK*

- A junior ISA needs to be opened in your child’s name

- The annual contribution limit for a Junior ISA is £4,368** vs. £20,000 for a regular ISA

- A child can only have one cash and one stocks-and-shares Junior ISA at any given time

- When your child turns 16, he or she takes control of the Junior ISA account – but cannot withdraw funds

- Once your child turns 18, the junior ISA is rolled into an ISA. The ship has sailed – your child now has full control and can withdraw funds from the account

* With some very limited exceptions (i.e. if you are a Crown servant AND your child depends on you for care)

** For the 2019/2020 tax year

Just like with a regular ISA, you can have both a cash as well as a stocks-and-shares junior ISA. Only people with parental responsibilities (i.e. biological parents or legal guardians) can open junior ISA accounts. However, anyone can pay into a junior ISA.

In addition, from April 2015 any money in your child’s trust fund (CTF) can be transferred into their junior ISA.

Finally, just like with most other financial instruments, junior ISAs are protected by the FSCS (up to the £85k limit).

Why Should I Care About A Junior ISA?

As with a regular ISA, opening a junior ISA has a number of advantages:

1. It’s a tax-free way to save for your child

Have you and your spouse maxed out your individual ISA allowances? If that’s the case, opening a junior ISA allows you to invest another £4.4k/year and shield all the dividends and capital gains on that investment from tax.

2. You can get a higher interest rate on a Junior ISA

Most people are inert. They stick to jobs they don’t like, partners they don’t love and financial institutions that give them a raw deal.

While teenagers tend to be much about churning through jobs and boyfriends/girlfriends, they typically keep using the same bank account their parents opened for them ages ago, even if they can get a better deal elsewhere.

Of course, banks know this. That’s why they do everything they can to sign your children up as clients today before they grow up. This (and the fact that amounts involved are usually pretty low) is why the interest rates offered on junior ISAs are typically better than those offered on regular cash ISAs.

At the moment, the best junior cash ISA yields about 3.5%. This is 1.5% higher than the best regular cash ISA rates, which typically hover around 2%.

3. Encouraging cash presents from family and friends

Having been on both the giving and receiving side of children’s birthday presents, this is a massive attraction for me.

Research shows that receivers value presents on average at a 20% discount to what the givers have paid for them. For the givers, it’s much easier and faster to send £50 into little Sophie’s account as opposed to spending a day looking for the latest Peppa Pig toy – only to get the wrong one.

Cutting out the waste of time and money has got to be a win-win for everyone involved!

4. Junior ISA can be a great prop to teach your children the basics of saving and investing

One of the best things you can do to set your children on the right path in life is to teach them about the basics of personal finance. A junior ISA can serve as the perfect tool to help you do this.

You can set up both a cash and stocks-and-shares ISA and use them to teach your child the difference between building up a cash savings pot and stock market investing. If you start early enough, you may even get to demonstrate the advantages of stock market investing versus keeping your money in cash and having its value eroded by inflation.

Depending on how well your child gets on, you could also start exploring the topics of passive vs. active investments, taxes, risk/return – the possibilities are endless.

In addition, because neither you nor your child can withdraw money from a junior ISA, it can be a fantastic way to teach your children about delaying gratification and the value of taking a long-term approach.

5. Forced saving for the parents

Unlike the money in your own ISA, the government prohibits you from withdrawing the money in your child’s junior ISA account.

Therefore, if your willpower isn’t yet as strong as you would like to be, opening a junior ISA can be a good way to save money you would otherwise be inclined to spend.

How Does A Junior ISA Compare To A Child Savings Account?

On a purely financial basis, a junior ISA will beat any other child savings account. This is because the investment income from a Junior ISA is entirely tax free.

In contrast, if you were to open a regular child savings account, any investment income from it that exceeds £100/year would be taxed at your marginal tax rate.

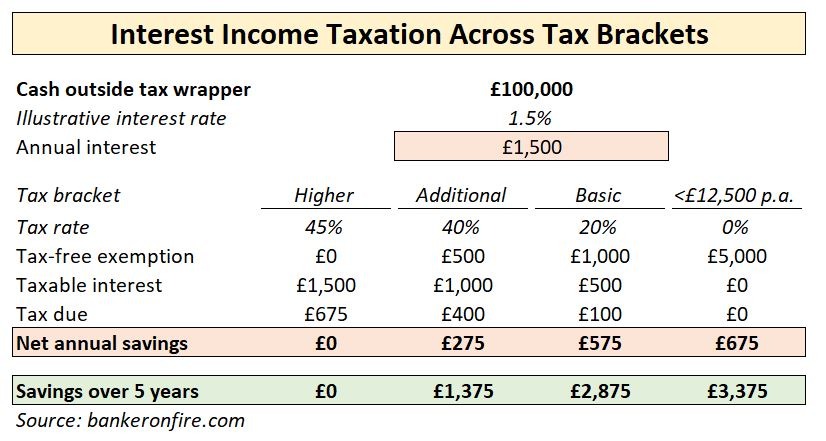

In case you have an unemployed spouse with a £5k/year tax-free exemption, that’s not a problem. But if the income on your child savings account is taxed at your marginal tax rate, you should probably look at other options. See below for a reminder of tax free exemptions by tax band.

Sounds Pretty Good – Should I Be Opening A Junior ISA Now?

Perhaps, but not for the reasons you may be thinking.

Unfortunately, despite the advantages outlined above, there are two significant drawbacks that make junior ISAs a highly suboptimal way to save:

1. You don’t get the same net worth uplift you would on a pension or a LISA

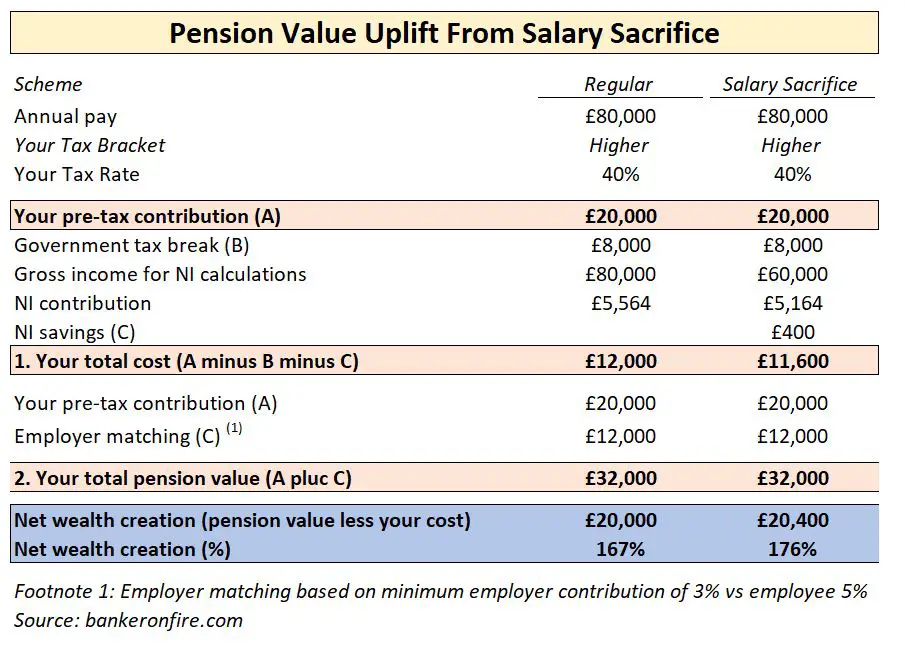

If you are in a higher tax bracket, making a £100 workplace pension contribution can instantly yield you between £167 – £176 in value.

Contribute £100 to a LISA and the government will top it up with another £25 the following month.

Unfortunately, ISAs don’t have this advantage. This doesn’t make a personal ISA a bad savings vehicle. However, if you and your spouse have already put £20k each into your personal ISAs, you are probably much better off topping up your pensions instead of putting another couple grand into a junior ISA.

If your pension is already maxed out because of the pension taper (or you think you will hit the LTA), take advantage of the LISA. If that’s also maxed out, turn to your workplace savings schemes such as the SAYE or the SIP.

In other words, you probably have a good number of savings and investment options which can give you a much better return. You should make sure to explore all of them before you contribute £4.4k into a junior ISA.

Have extra cash lying around after maximizing your pension, LISA, ISA, SAYE and SIP contributions? If that’s the case, you should probably look into real estate investing as a way to accelerate your journey to financial independence. All of the above investment vehicles offer some form of tax efficiency and can make an immense contribution to your net worth over the long run.

2. Lack of Control

As much as we all love our children, we must acknowledge that granting them control of a significant sum of money at the age of 16 (and withdrawal rights at 18) may not lead to the most rational decision-making.

Not-so-little Henry could well choose to spend his money paying for university. Equally, he might be tempted to buy a Jaguar, go to Ibiza or blow the cash on overpriced bottle service in a nightclub.

Of course, my kids are welcome to do all of the above. I just prefer them to do it with their own money as opposed to the cash I have been socking away in a junior ISA for the past 18 years.

I See – So Should I Forget About The Junior ISA?

Perhaps not yet. Let’s take another look at the list of advantages offered by the junior ISA and see how valuable they REALLY are:

1. Tax-free way to save for your child

Banker on FIRE view: plenty of other saving and investment opportunities (pension, LISA, SAYE, real estate) offering tax efficiency and greater upside

2. Higher interest rates

Banker on FIRE view: Meh. An extra 1.5% of interest doesn’t offset the tax breaks on pensions/LISAs or the returns on other asset classes (i.e. real estate). Besides, holding a junior ISA invested in cash for 18 years is pure madness

3. Encouraging cash presents from family and friends

Banker on FIRE view: YES!

4. A prop to teach your children the basics of saving and investing

Banker on FIRE view: YES!

5. Forced saving for the parents

Banker on FIRE view: If this applies to you, probably worth putting your junior ISA strategy to the side and reading this first

I will open a junior ISA for each of my children. However, I will only use it to encourage family and friends to contribute cash in case they struggle buying presents for capricious toddlers.

Then, when my children grow slightly older I will look to use their junior ISA as a practical aid in personal finance education. And if I am successful, perhaps my children will eventually put the money to good use. If not – it was worth a shot.

At the end of the day, it turns out there is a good way to utilize the junior ISA. However, I bet it is definitely not what most people have in mind when they first set out to explore the topic.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Hi, nice blog! picked up some really interesting points

I see where you’re coming from on in this one. Personally I’m taking a bit of a different line though and aiming to max out my child’s junior ISA every year assuming I can spare the £9k to do so. My thinking is that if I can get her up to a decent sum of capital early on in her life she will benefit from an entire lifetime of tax free compounding on that initial capital.

Super simplistically assuming a 5% real return:

With £9k added per year from ages 0-18 the Junior ISA compounds to £265k by age 18

Then assuming £20k is added per year from ages 19-65 the ISA compounds to £6.37m by 65.

Alternatively a 19 year old starting an ISA from scratch and adding the full £20k per year the ISA compounds to £3.74m by 65

So the £162,000 total I put into her Junior ISA means her ISA account is worth £2.63m more (in todays money) by the time she reaches 65

Of course it will never happen like this, ISA limits will change, she might spank the £265k on a vegas trip the day she turns 18, what 19 year old can save 20k into an ISA etc etc but the basic thesis around maximising the length of time compounding can do its works makes sense I think!

I think it makes total sense, as long as you are comfortable locking up the cash until your child turns 18 – and relinquishing control after that.

If I’m thinking long-term (which you are), I’d rather get the massive boost to my pension (subject to the lifetime allowance) and follow that up with maxing out my own ISA. Of course, there are inheritance tax issues to work through as well.

Ultimately, it’s down to a matter of preference. The one thing that applies regardless is the power of compounding over time, as illustrated by your calculations above.

I always thought a LISA was bad for high rate tax payers because the benefits of Salary Sacrifice is 40% savings, whereas LISA benefits are just 25% “return” of your post-tax salary. Isn’t it better to just Salary Sacrifice and not use LISA? unless I’m missing the step which is Salary Sac the first £40k for the year and then use LISA?

Correct.

Unless you are a higher or add’l rate taxpayer, always better to max out your pension before contributing to LISA. Possibly true for basic rate taxpayers as well given a break on NI.

I mention it in my Lifetime ISA Post: https://bankeronfire.com/give-your-lifetime-isa-all-the-love-free-money-can-buy