And so, 365 days later, the last hours of 2019 are upon us. In a short while, the clock will strike midnight and we will begin the countdown on a new year and a new decade.

They say that understanding the past is key to predicting the future. So as we think about our hopes, goals, and aspirations for the year ahead, let’s take a moment to reflect on 2019.

Perhaps the conclusions we draw will help us live an even better, more prosperous 2020.

1. The Stock Market Continued Its Volatile, Yet Relentless Climb Upwards

This time last year, the investment world was in panic. The S&P had come off almost 20% off its high and was teetering on the brink of a bear market. It then recovered some of the losses heading into the year-end, albeit on thin volumes.

Fear was rife. Expert after expert took their turn pronouncing their predictions for 2019. For the most part, these predictions ranged somewhere between gloomy and self-serving.

“It’s a scary place out there”, they said. “Pull your money from the market”, they warned. “Or better still, let us manage your money for you”, they implied.

The stock market is indeed a volatile place. Predicting its next move is nothing but a fool’s errand. But predicting its long-term evolution is easy. Day after day, year after year, it continues its relentless climb upwards.

In many ways, it is like a rollercoaster. There are some steep drops and hairpin turns along the way. They aren’t everyone’s cup of tea. But just like a rollercoaster, getting off halfway through just because you are scared is a BAD idea.

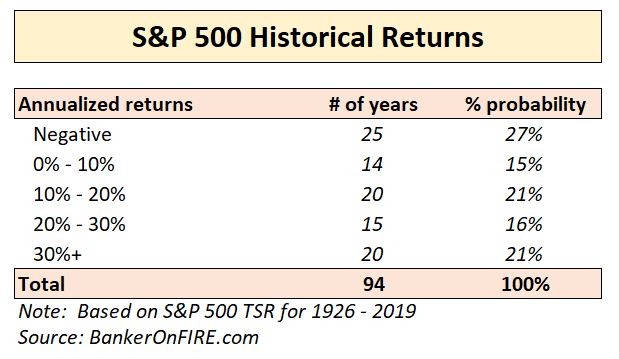

Had you listened to the so-called experts a year ago and pulled your money from the market, you would have missed out on one of the best years in recent history. 30%+ years aren’t rare – they happen on average once every five years. Still, it’s something to celebrate.

There will always be more good years than bad

Remember, it’s not timing the market, it’s time in the market.

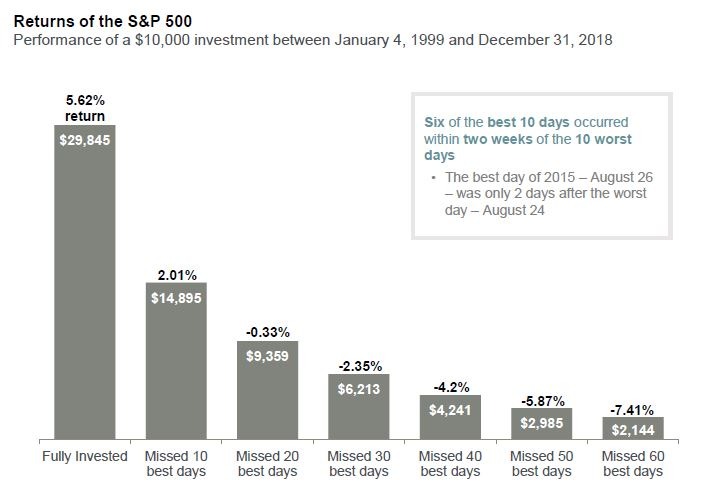

Trying to time the market is a sure-fire way of losing money. Selling after a correction is a sure-fire way of losing money.

We don’t like losing money.

The chart below shows what happens to investors who try to time the market:

Please don’t do this to yourself

2. A Silent Killer Kept Eroding Your Wealth

Imagine you had a $100k stock market portfolio, which you cashed out last year as you got nervous about the volatility.

If you sat on that cash all through 2019 (and many people did), you would miss out on one of the best years in recent history. But to make matters even worse, your net worth would erode by another 1.8% due to inflation.

That’s $1.8k, or about $5 per day.

Not many people pay attention to inflation – mostly because price rises don’t make for very catchy media headlines. But make no mistake, being cash-rich is one of the most effective ways to sabotage your path to financial independence.

Don’t fall into the trap of skipping the proverbial latte but bleeding wealth elsewhere at the same time.

It’s a problem I felt acutely this year as I am sitting on a big chunk of cash which I hope to funnel into my next property purchase. Unfortunately, three of the deals I looked at fell through – and the opportunity cost of not being in the stock market hurt.

You should never let cash burn a hole in your pocket. At the same time, do remember – if your cash isn’t working for you, it’s probably working against you.

If you must be cash-rich, some financial housekeeping can help keep inflation at bay. Make this a core part of your financial strategy for 2020.

3. The Economy Is Actually In Great Shape

As it happens, having some inflation isn’t a bad thing. It encourages investment which in turn helps propel the economy forward.

And so when you look at the 1.8% inflation figure above, you should take it as good news. It’s just another sign that the economy is humming along just fine. As a matter of fact, the economy hasn’t been this good in a long time.

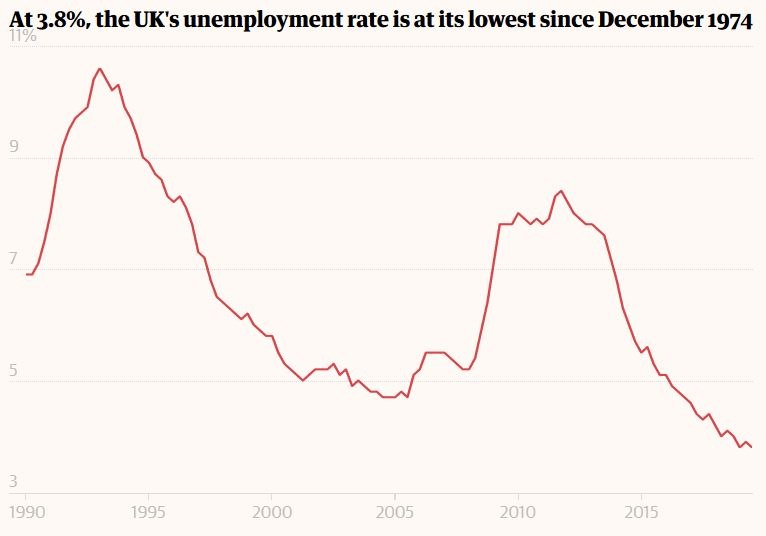

US unemployment is now below the pre-crisis levels, with hundreds of thousands of new jobs being added every month. And at 3.8%, UK unemployment is at its lowest level since 1974.

Low unemployment and reasonable inflation levels are the two most important ingredients in a healthy economy.

There has never been a better time to build wealth. Take advantage of it as the good times will not last forever.

4. Staying Optimistic Paid Off

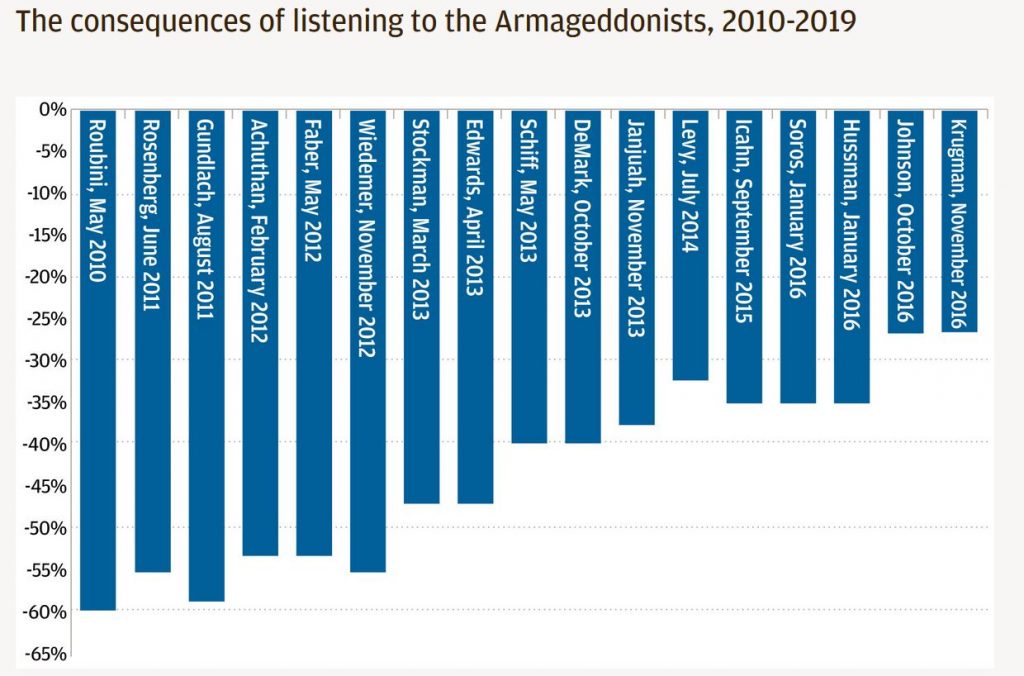

As it turns out, predicting doom and gloom in the stock market is a profitable affair. If it wasn’t, there wouldn’t be nearly as many people out there crying wolf.

This is how much money you’d lose if you listened to the “experts” and pulled your money out of the market

It is profitable for the media, who prey on our negativity bias to attract viewers and generate advertising dollars.

It is profitable for the money managers, who use every trick in the book to seek attention and get you to invest in their actively managed, expensive funds.

Finally, it is profitable for a whole bunch of other individuals who have long realized that making sensational claims is an effective way to build their own personal brand.

The bad news, of course, is that it simply isn’t profitable for you.

Stock market corrections are like winters. They will come – and they will go. Sometimes you get snow in October. Sometimes in February. Occasionally, you get a really nasty winter – or an abnormally warm one. But as long as you are prepared and don’t do anything rash, it doesn’t matter.

No, it won’t be this bad…

The next big, prolonged stock market correction may well define your life in a bigger way than you think. There will be those who will persevere through the stressful times and add to their portfolio at rock-bottom prices. They will come out ahead and prosper.

And there will be those who haven’t prepared for the proverbial winter. They won’t have an emergency cash reserve and may be forced into a fire sale of their investments. Or they may simply succumb to the general panic as masses rush for the door. As a result, their journey to FI will take years, if not decades longer.

Ignore the doomsayers. Stay positive. Prepare now.

5. Life Just Kept Getting Better

That’s right. Lost in the deluge of negative news is the simple fact that our quality of life has never been better.

In just twenty years, the internet has revolutionized the way we live and work. If you are old enough to remember the 90s (I unfortunately am), you will know that the things we take for granted today simply did not exist as recently as 20 years ago.

Smartphones, video calling, instant messaging, Google maps, online payments, ride-sharing, Air BnB, instant delivery, the Banker On FIRE blog… we can keep going for hours.

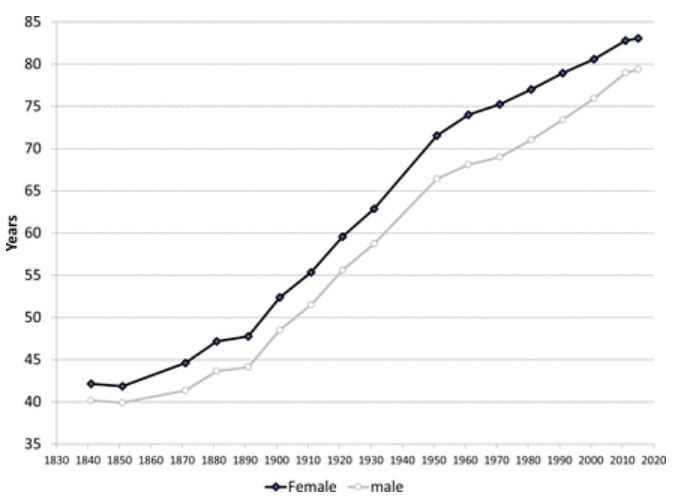

And the great news is that we get to enjoy these things for longer. As a result of fewer armed conflicts, better nutrition, and medical breakthroughs, our life expectancy keeps going up:

We won’t be kicking the bucket anytime soon!

If you are reading this post, the odds of you being around in a years’ time are stacked massively in your favour. If that isn’t absolutely awesome, then I don’t know what is.

It’s a truly amazing time to be alive. So when you break out the bubbly in a few hours, be thankful for an incredible 2019 – and get ready for an even better 2020.

Happy New Year!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com