It may not seem like it, but as of today, we are just four weeks away from Christmas. One of the most eventful years of the past few decades is beginning the countdown toward its logical conclusion.

It’s fair to say that 2020 has delivered more twists, turns, and unexpected outcomes than a John Grisham novel.

As we approach December, it’s hard not to feel jaded from being repeatedly blindsided by the events of the past 11 months.

And yet, for all its shortcomings, the year has also delivered some invaluable lessons. Taking the time to pause and learn from them will no doubt serve you well on your personal finance journey going forward.

Thus, with the promise of calmer waters just around the corner, I spent some time reflecting on what 2020 has taught us about investing.

Lesson #1: Don’t Panic. Ever.

I’ve been dabbling in the stock market ever since 2004. However, it wasn’t until 2011 that I finally started buying equities in meaningful amounts – and doing it the right way.

With the benefit of hindsight, stepping up my investing game post the global financial crisis was a no-brainer.

And yet, back in 2011, it still felt like I was walking on thin ice.

Memories of the crisis were fresh in people’s minds, and you could hardly go 5 minutes without yet another expert “proclaiming” that the markets were about to crash.

Few things sell as well as fear itself.

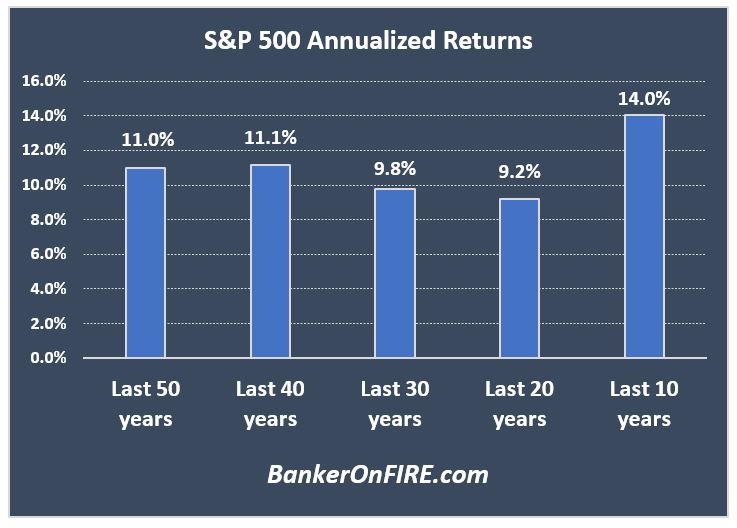

Of course, history had proven them all wrong. The prize for those who overcame their fear and ignored the noise was a knockout 14% annualized return between 2010 and 2019:

Compare that with the penalty for those who cashed out in September 2008:

- First, they crystallized a 40% loss on their investments when the market collapsed

- Then, they lost another 22% by sitting in cash, courtesy of a 2% inflation over 12 years

We’ve seen the same story playing out in 2020. Those who panicked, lost out. Those who didn’t are sitting on very respectable gains.

When I look back at the post I wrote at the very nadir, I am pleased to see the quote below:

You may be tempted to time the market. Don’t.

If you think you can anticipate the development of a global pandemic AND policy decisions of multiple central banks around the world, might as well skip the whole stock market thing and play the lottery instead.

If you held your nerve this year, well done to you.

If you didn’t, no need to beat yourself up. Chalk it up to experience – and don’t ever sell in a crisis again.

Lesson #2: This Time Is ALWAYS Different

“But we’ve never had a global pandemic before!”

“Sure, we had the financial crisis. But this is hitting the real economy! It will be MUCH worse!”

“The world is grinding to a halt. There’s no way we are going to recover from this one. I’m selling my stocks!”

When things get hairy, people get nervous. And when people get nervous, the natural instinct is to look for reassurance.

For the most part, statements like the ones above are really cries for help. For someone to hold your hand and tell you everything will be all right.

Unfortunately, all they do is amplify the anxiety.

The problem is that every crisis IS indeed different, and the solution isn’t immediately obvious.

Otherwise, it wouldn’t be a crisis – it would just be a problem we’ve experienced before and know how to resolve.

Now, what is not different is the ability of the human spirit to innovate its way out of any challenge it faces. That’s how we’ve managed to survive for millions of years.

Did anyone really think a virus would get in the way?

If there’s one thing I can guarantee you it’s that in your life, humanity experience a major crisis every five to ten years. More often than not, it will be accompanied by a massive stock market meltdown.

I can also guarantee you that every single time, the human race will persevere and find a way out.

And if we don’t, the value of your equity portfolio will be the last thing on your mind.

Lesson 3: The Fallacy Of Lump-Sum Investing

One of the most frequent questions in personal finance is whether lump-sum investing is superior to dollar-cost averaging (DCA – also known as “drip-feeding” money into the stock market).

Mathematically, the evidence is clear – the vast majority of the time, lump-sum investing trumps DCA.

If you don’t believe me, read this excellent post by Dollars and Data.

And yet, this is a great example of theory not standing up to real life.

Let’s say lump-sum investing beats DCA 99% of the time. Now imagine I offer you a game of Russian Roulette with a 99% chance of “success” – and a 1% chance of blowing your brains out.

Should you take it? Of course not! The absolute risk is far too great.

Well, the same applies to lump-sum investing. Yes, 99% of the time you will end up better off. But every once in a while, you’ll find yourself at a point in time like February 2020.

Or September 2008.

Or July 2000.

In each of those situations, you would have been much better off dividing your pot into equal installments – and slowly buying up equities over the next 6 – 12 months.

In other words, lump-sum investing will likely give you greater upside. But dollar-cost averaging will protect the downside.

Remember this if you ever come into a meaningful chunk of money looking for a home.

Lesson #4: No, You Cannot Time The Market

It’s tempting. It looks so damn easy in retrospect. And there’s an endless line-up of people claiming to know what the stock market will do next.

Now, did anyone tell you the market was going to roar back starting on March 23rd?

That Softbank will spark a massive, artificial tech rally in August?

Or that markets will go up post the US election?

Or that Pfizer will come out with their vaccine announcement shortly thereafter?

Timing the market is impossible. Remember this – and don’t let it stand in the way of getting rich.

Lesson #5: Passive Beats Active

As indexing continued its relentless march upwards over the past decade, active investors would often resort to a trump card up their sleeve.

“Sure, passive investing works in a bull market. But wait until things get hairy and let’s see how well index investors do then!”

As it turns out, they will do just fine – because index investing implies you do just as well (or badly) as the stock market.

Sadly, you cannot say the same for active money managers – who underperformed this year yet again, even though 2020 was (supposedly) their time to shine.

According to S&P Global:

Most active fund managers in the US failed to beat the market over the past year, according to another dispiriting report on an industry that often claims it will come into its own during periods of volatility.

In a majority of the categories of US equity funds, the average active manager underperformed the benchmark index.

Sure, you can continue chasing the latest active management superstar. A few basis points of upside – at the risk of meaningful downside as their fees wipe out the alpha (to the extent it exists in the first place).

Or you can just accept market returns – but know you will never underperform the market.

Looking Forward

At this point in time, most of us are just looking forward to wiping the slate clean and getting off to a fresh start in 2021.

Hopefully, we are not in for another rollercoaster ride. But for all we know, the next market meltdown may well be just around the corner.

If you want to ride it out like a champion, don’t ignore the investing lessons of 2020.

Happy investing!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

“And if we don’t [find our way out of trouble], the value of your equity portfolio will be the last thing on your mind.”

Hands down the grounding mantra that has kept me safe from lack of self-control and impulsiveness – this year especially.

If humanity couldn’t find its way, we’d have bigger fish to fry. Keep a calm head while all those around you lose theirs.

Thanks for the read as always, BOF.

Cheers. It’s a bit like flying a plane.

Doesn’t matter what you do 99% of the time. What matters is how you behave when you hit turbulence.

Thanks for a good read, as always! Can you please comment about dollar-cost averaging vs fees if you are investing in ETFs? I am confused because everyone is touting passive investing plus dollar cost averaging but no clear data about the effect of fees with investing small amounts monthly in ETFs though there is always a brief warning.

Glad you enjoyed it!

Well, it really depends on the amounts you are investing, frequency, and your platform fees. In case the amounts are small, you probably want to start with a low-cost platform and invest every three months.

The point is to set a cadence and follow it. You can then “graduate” to more frequent investments and higher trade sizes.

Absolutely great read and time & again these 5 lessons have proven right … to come back and remind us that these lessons are there for eternity!

The 6th lesson if I could provide my 2 cents (pence 🙂 ) on would be- DO NOT UNDERESTIMATE THE POWER OF DEBT.

I meant that cushion to the swings of equity market will be provided by debt market, it could be risky to some extent but save us from all big swings. It is best to me a foundation stone on which my house (equity and returns) is built. I’d first allocate 20% on debt to go over to add 50% equity and rest others.

I got an eye opener when my debt money worked between Feb 2020 – May 2020. Just sheer brilliance basics of any portfolio management!

Indeed. The beauty of capital markets is you can find a perfect place on the risk-reward spectrum that suits your risk appetite.

I am 100% equities, and will be for a while, but it’s all down to personal preferences and investment horizons:

https://bankeronfire.com/bonds-vs-stocks-what-30-years-of-performance-means-for-your-portfolio

Thank you for your valuable insights as always!

Given you come from an M&A background yourself, would you think DCA is better even when you come into large sums of money every year due to the bonuses?

Given the low interest rate environment we are in and the opportunity cost of money arent we better off investing that money into the markets as a lump sum? Also your suggestion to account for that 1% scenario (DCA vs lump sum) sounds more like preparing for a black swan style unforeseen event which the general suggestion tends to be to not account for .

In theory, yes. In practice (and despite what many people think) bonuses are anything but guaranteed, so it’s not like you’re looking at a recurring stream of income every year.

As experience shows, any bonus can be your last.

And your 1% point is spot on – but do you really want to trade the marginal upside for a 1% likelihood of very meaningful downside? Theory says yes, the mind says no 🙂

‘In other words, lump-sum investing will likely give you greater upside. But dollar-cost averaging will protect the downside.’

Love how you’ve distilled this endless (and sometimes tiresome) debate into just one sentence. Downside not an issue because you don’t need the money for 30 years? Chuck it all in. Planning to buy a house with the money in 10 years? Drip feed.

Indeed. Sometimes we get too hung up on the maths and forget that most things can be boiled down to pretty simple concepts.

The lump sum investing point is interesting – I’ll be transferring a SIPP soon as cash and was debating on whether to lump the whole lot into investments in one go but I think I will drip feed, which is how I’ve always invested. Cheers!