The stats are in and the picture isn’t pretty. A recent NatWest study, which looked at the (thankfully anonymized) data of 750,000 customers drew some sobering conclusions.

Apparently, more than half of Brits aren’t saving ANY money.

It also seems that this inability to save cuts across income levels. Those with incomes of £90k+ were just as unlikely to put any money away as those way down on the distribution of income.

Let that sink in a bit.

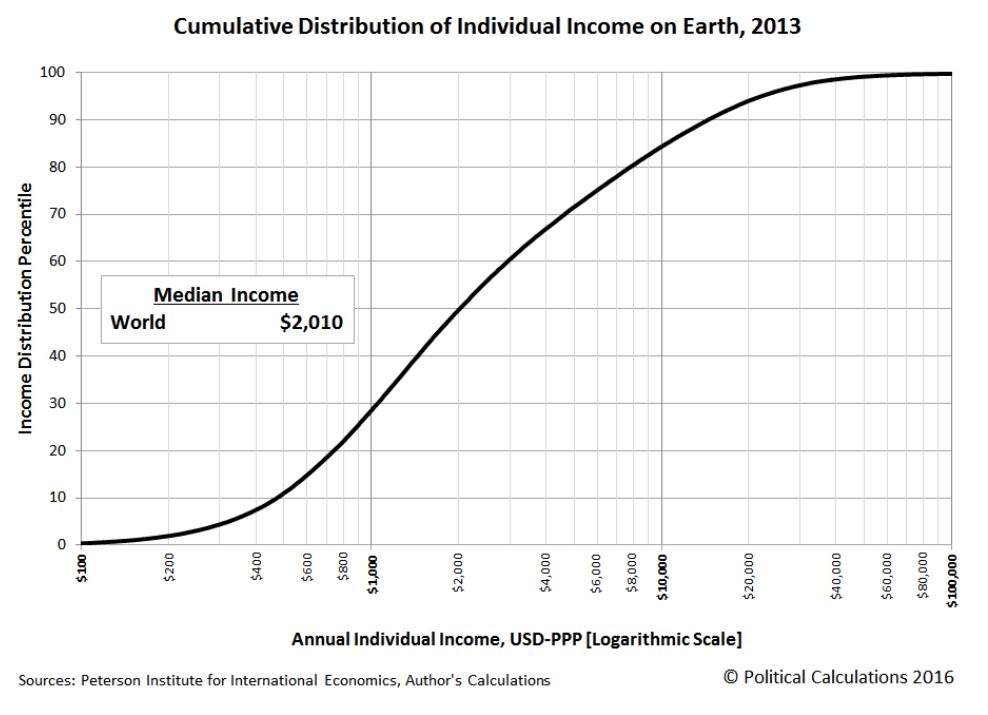

The average annual earnings in this country are about £30k. To contextualize that number, consider that it puts you straight in the top 3% of income earners in the world.

If you make £40k/year, you are squarely in the global top 1% by income.

And if you make £90k, you are in the top 4% of income earners in the UK and top 0.01% of the world.

But apparently that just isn’t enough to save any money. So what the hell is going on here? And why are we so bad at saving?

A Personal Perspective

Now, banker bashing is a popular sport these days so let’s clarify a couple of things here before you get those pitchforks out.

My family immigrated when I was 14. Six months after we landed, my father finally found a job. I don’t recall his pre-tax earnings (us immigrants don’t think that way) but I do remember that his take-home pay was the equivalent of £1,180.

Do you know how I remember that? Because the monthly budget for our family of four was £1,175. We had £5 left over every month. And we stuck to that budget, month in, month out.

Now you may say that we had an easier time sticking to a budget – because back in those days, immigrants simply didn’t qualify for loans, credit cards or overdrafts. But what we lacked in experience and language skills, we compensated for with math skills. And there was no way in hell we would ever pay someone 25% interest for the privilege of using their money.

So we kept going. And a year later, when my mother found a job, we still stuck to that budget of £1,175 and put all of her pay away. So when my dad got laid off a few years later, it wasn’t really a problem – because we were so used to living one income.

By this point in time, both my sister and I had part-time jobs and kicked in pretty much everything we made into the family pot.

Based on that first-hand experience, I know that saving money is doable on much less than the median income.

Here’s another example.

Out of uni, I was absolutely stoked to land a job with a big corporate that paid £28k. As I quickly realized after moving out of my parents’ house, £28k isn’t bad – but it certainly isn’t enough to live in a big city (even with a roommate) and save up meanignful (40%+ savings rate) money.

So I sucked it up, moved back in with my parents, paid them £250/month in rent and saved the rest. I did that for four years until I saved up enough for a down payment on my first flat. This is way before I got my MBA and started working in the City.

So no, you don’t need to be an investment banker to save up for a down payment on a house. You just need to be willing to make the right choices. And it seems that Brits, while pretty damn good at most things, just aren’t as good at saving money.

What gives?

Our Convoluted Relationship With Money

Having lived both in the US and the UK, the one thing I’ve noticed is that we Brits have a REALLY shitty convoluted relationship with money.

We don’t talk about it. We pretend it doesn’t really matter. For the most part, we like to behave as if money is an afterthought to us. And yet it does. Guess what – money is important! And the sooner we acknowledge that fact, the better off we will be.

Now I am not saying we’ve got to walk around like this guy, suspenders and everything. Money won’t make us happy – but its absence will definitely make us unhappy. So let’s please stop lying to ourselves.

(A little bit of) greed is good?

We Underestimate The Power Of Compounding

Unsurprisingly for a personal finance geek, I am a fan of compounding. You put money away. It generates more money in form of interest. That money then goes to work for you, generating even more money. On and on it goes until one day you wake up a rich man.

Right?

Well, there’s a bit of a spanner in the works here. That spanner? Interest rates.

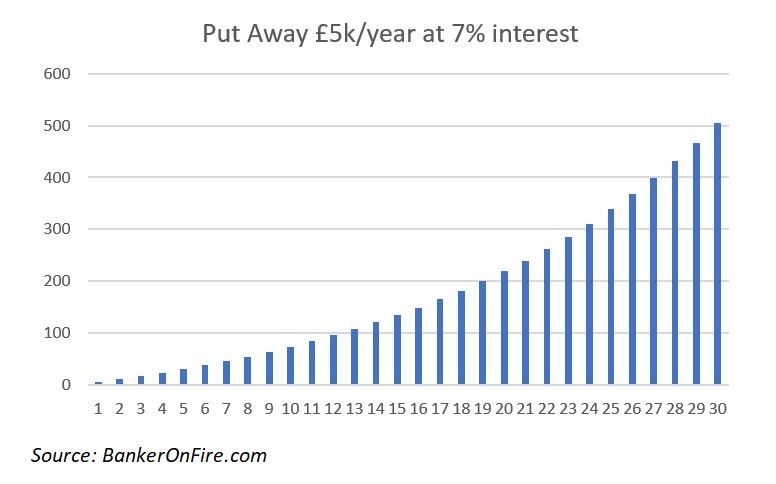

Compounding works very well when interest rates are north of 6-7%. It looks like this:

That looks kind of fun!

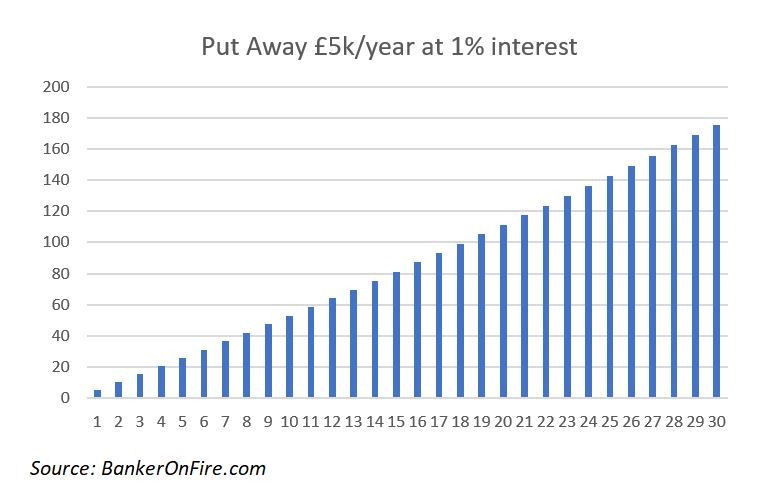

And when interest rates are where they have been for more than a decade (read ~1% if you are lucky), you might as well bury your cash in the backyard hoping it will grow into a money tree.

Can’t be bothered 🙁

So yes, the financial crisis kind of screwed us over when it comes to cash interest rates. Which leaves investing.

But here, we have another problem. Pretty much any mainstream financial article you see talks about “well-diversified portfolios of treasuries, bonds and funds” yielding 4%.

FOUR PERCENT?!?!?

No wonder people find it hard to get excited about investing! Now you run the risk of losing your principal and you only get one or two percent above inflation?

Back to the money tree it is. At least you’ll relieve some stress along the way.

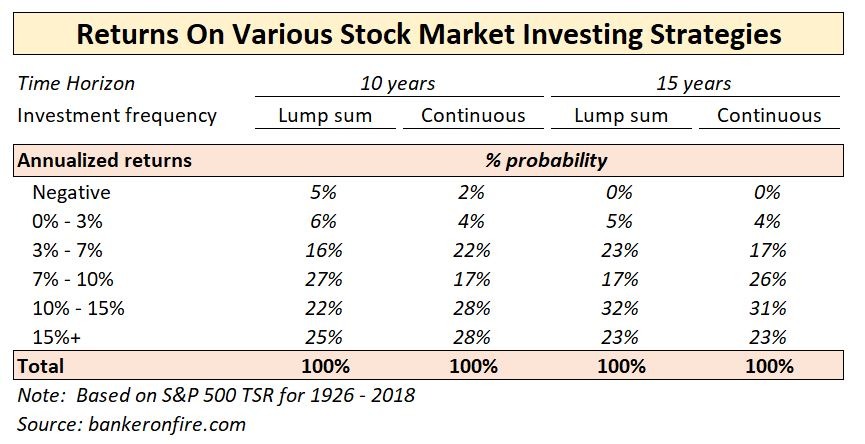

Unless, of course, you consider DIY stock market investing, especially that unglamorous, boring variety which is investing in low-cost, passive index trackers.

As it turns out, if you fire your financial advisor, put your money in an index tracker and ignore all the media talk about market crashes and bloodbaths you can actually do quite well for yourself.

And when I say quite well, I mean having a near-zero probability of loss – and a very high probability of making 7%+ on your money.

Now we are talking! But it does require some (not a lot of) effort to turn off the TV and take the time to open up a brokerage account and click “buy” on the right index fund.

Compound interest is a magical thing, not least because it allows our imagination to soar. Which brings me to my next point.

When Did You Stop Dreaming?

I’ve always been a dreamer. As the youngest child in a family of four living on £1,175/month, you don’t necessarily need a lot of inspiration.

Seeing a brand-new car on the street? Wow! Visiting a relative who lives on her own in a nice two-bedroom flat? Awesome! In other words, Instagram had nothing on this teen back in the 90s. And so I saved money – and learned about investing.

Later on, I dreamed of becoming one of those guys who get to fly around the world in business class, airport lounges and everything. Got to admit, that one wore off pretty quickly. Now that I have a family, I dream of working much less and seeing them much more.

And so I continue to save money and put it to work for me.

Who knows – perhaps all of the above will also wear thin quickly. I’ll tell you once I get there. After all, humans have a wonderful ability to self-sabotage our happiness. But I know one thing – dreaming makes all the sacrifices worth it. It also makes the journey a lot more fun.

So What Do You Dream About?

Is it kicking the commute? Not having to deal with unreasonable clients or backstabbing colleagues? Seeing the world? Or just being able to kick back with a book on a Monday morning instead of being stuck in your cubicle?

Reaching financial independence can make all of the things above come true. Not now. Not next year. But certainly years and perhaps decades before you turn 65.

But to get there, you have got to overcome your inability to save. Stare down that monster as if your life depended on it – because it does.

It won’t be easy – but it will be so worth it at the end.

Dream big. Save Money. Invest wisely. Live happily.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com