After real estate, consistent investment into the stock market over a long period of time is the second best way to build wealth.

Some bloggers out there will even argue that dividend investing beats index investing, but that’s a topic for another day.

My target portfolio allocation to stocks is about 45%. I keep the other 45% in real estate and 10% in cash or cash-like investments.

Stocks are relatively liquid and require little maintenance, but they do present one pesky problem.

The problem is called dividend reinvestment and it has bugged me so much that I finally decided to find a permanent solution.

The Dividend Problem

In an ideal world, your portfolio is fully allocated to low-cost index funds with an automatic dividend reinvestment program (aka DRIP).

The benefit of a DRIP is that it will take all the cash payments you receive and use them to buy more stocks / funds that you already own.

More often than not, it will do so without incurring a transaction charge.

But what to do if you invest in individual stocks (not me) or if your favourite index funds do not have a DRIP (yes, me)?

Optimizing Your Dividend Reinvestments

The problem you will run into is making sure your trading fees do not wipe out your investment gains.

In some situations, the trading fees may even erode your stock market portfolio – putting your net worth growth in reverse! So what’s a FIRE-aspiring investor to do?

As with many things in life, building an excel model can come in handy.

What I have therefore done is built up a simple model that allowed me to solve the situation once and for all. I am now sharing this model with all my readers to make sure that you too can optimize your dividend reinvestment strategy.

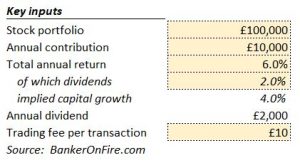

The key assumptions are as follows:

- Starting stock portfolio size of £100,000

- Annual additional contribution of £10,000

- Total annual return of 6%, of which 2% is paid as dividends while the other 4% represents capital (i.e. price) appreciation

- A trading fee of £10 per transaction. This should be easily achievable with a discount broker like Hargreaves Lansdown.

Comparing Various Dividend Reinvestment Strategies

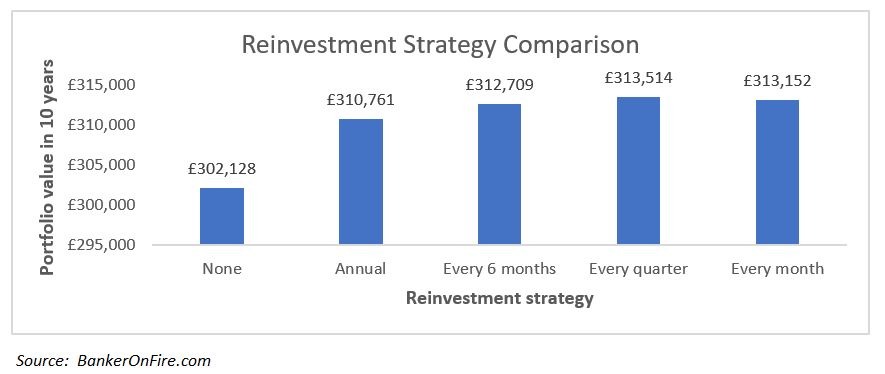

The results are summarized in the chart below:

As one would expect, reinvesting dividends over the course of 10 years has a striking effect on the portfolio, increasing its value by c.£8.5k.

This is really FIRE 101 and I wouldn’t want anyone reading this blog to be surprised by it.

If you are, I suggest you read up on compound interest and dividend reinvestment more broadly.

Moving from an annual to a biannual (i.e. every 6 months) dividend reinvestment juices your returns even more.

The reward from reinvesting dividends twice a year as opposed to once a year is about £2k over ten years.

Essentially, you get £200 for every extra time you log into your brokerage account.

As expected through the law of diminishing returns, your uplfit from moving from biannual to quarterly reinvestments is lower still.

You only get an extra £800 for the trouble of logging into your brokerage account on a quarterly basis and clicking on buy.

Then again, it only takes 10 minutes or so and your upside works out to be £40 a pop… I’ll take that any day of the week.

Let’s now take a look at what happens when you reinvest your dividends monthly.

As it happens, this is when your trading fees (despite being only £10 per transactio) actually more than offset your investment growth and therefore your portfolio value is about £360 lower than it would be if you were more patient (or less keen) and only reinvested once a quarter.

Quarterly Dividend Reinvestment Outperforms All Other Strategies

Or does it? It sure is the answer using the assumptions above.

That being said, if you were starting with a £1m portfolio what you would find is that monthly reinvestments would be the best strategy.

The same would apply if your annual contribution went from £10k to £50k. Incidentally, unless you start with a very small portfolio, quarterly reinvestment still makes the most sense.

I want all of my readers to make the best financial decisions and to reach financial independence as fast as possible.

Therefore, I am making this spreadsheet available for everyone to use.

Download it here, plug in your assumptions and rest at ease knowing you are not leaving any of your hard-earned money on the table!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Hi, just came about your blog and am reading through your posts now – why not buy an accumulation or a growth class where there are no dividends?

That’s the preferred option. That being said, the accumulation option isn’t always available and not all platforms offer an automatic dividend reinvestment option.