Higher taxes are on the way.

Regardless of how you feel about it, it’s a fact.

A history of public deficits across the developed world, combined with a massive Covid-19 bill, means that governments will need to seek new sources of revenue.

Unfortunately, the increase in the tax burden will likely fall on individuals.

Let’s be honest with ourselves: taxation of real wealth is nearly impossible to enforce.

The same applies to large multinational corporations, who have an army of crafty accountants to help them take advantage of all the inter-jurisdictional tax loopholes.

And increasing taxes on small and medium businesses is just too risky.

They’ve taken an outsize hit from Covid, especially when compared to large enterprises. Increasing corporate taxes may well lead to yet another string of bankruptcies. It may ultimately increase unemployment and defeat the purpose of the whole exercise.

Which ultimately leaves folks like the readers of this blog to fill the budget hole.

The bad news is that most of us are salaried employees with very few options to mitigate the impact of higher taxes.

The good news is that we are not entirely out of options.

Ranging from the blindingly obvious to life-changing, here are eight things you can do when faced with an increase in taxes.

Blindingly Obvious

Option 1: Work Harder

As I said, blindingly obvious – and pretty damn effective.

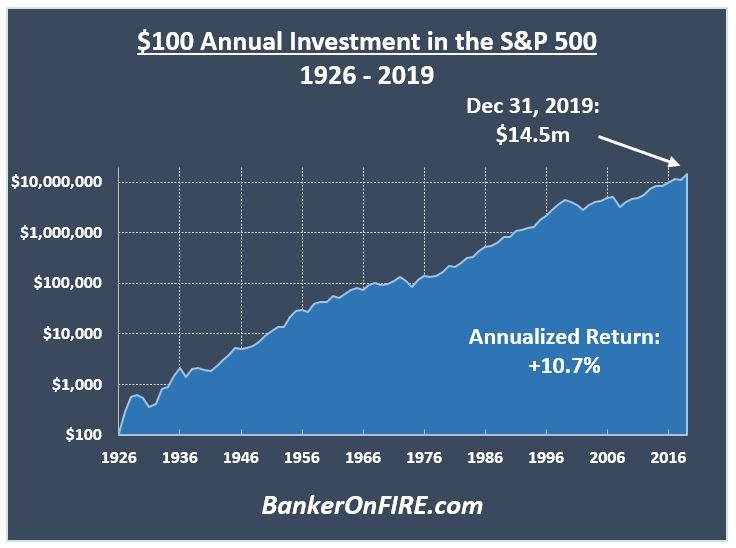

Even a bit of extra income can add up to very meaningful amounts over long periods of time:

But no matter how effective it can be, it also gets old quite quickly.

It’s one thing to forgo a Saturday with your kids knowing that the extra 10 hours you spend working will result in a direct economic benefit for them.

It’s quite another to realize that of those 10 hours, only 8, 6, or 5 (depending on the tax bracket) were actually spent working for your family – and that you’ve spent the remainder of time filling the government’s coffers.

Option 2: Spend Less

Another no-brainer, but one with interesting implications.

Clearly, the less you spend, the less you need to earn in the first place, which ultimately minimizes your tax bill.

Problem is, however, that past a certain point, reducing spending only gets you so far.

A second-order implication here is that as tax rates go up, there may be a further acceleration in people leaving high cost of living (HCOL) locations.

After all, the economic case for living in places like London or New York is predicated on earning a higher salary.

However, unless you are extremely careful, the cost of living (including big-ticket items like housing, childcare, and schooling) can more than offset the increase in earnings.

As most folks living in HCOL locations are already in a high tax bracket, an increase in their tax burden may well be the straw that breaks the camel’s back, especially given the uptake in working from home.

Food for thought – and suffice it to say that the BoF household sure won’t be sticking around Chelsea once I leave the investment banking industry behind.

Personal Finance Classics

Option 3: Utilize Tax-Efficient Investment Vehicles

No need to spend too much time on this point. As a matter of priority, any spare cash you are socking away every month should go into a tax-advantaged account.

Here in the UK, that means workplace pensions, self-invested pension plans, Lifetime ISAs, and regular ISAs.

In the US, that includes vehicles like the 401(k), 403(b), TSPs (for federal employees), and the various types of IRA plans.

Each has its own set of advantages and (some) disadvantages. That being said, they are pretty well-covered on this and other personal finance blogs, so no reason to get into the details here.

Bottom line – use them or lose them.

Let’s move on to some of the more interesting options.

Career Moves

Option 4: Become a contractor

Most popular in the IT industry, leaving salaried employee status behind and becoming a contractor used to be a fairly effective way to reduce your tax bill.

There are substantial tax benefits for both the “employee” and the employer in the form of reduced tax rates, eliminated NI contributions, expense write-offs, and so forth.

As it happens, HMRC caught on and revised the rules, meaning that only bona fide contractors can take advantage of all the perks.

Given that tax law is supposed to look at the substance, not the form, HMRC’s approach makes sense – and segways nicely into the next option:

Option 5: Start your own business

I am the first person to say that entrepreneurship is not for everyone.

That being said, there’s a big difference between entrepreneurship and self-employment. In reality, most folks who run their own business fall into the latter bucket.

Not everyone can be Elon or Jeff – and that’s okay.

But many more people can and do strike out on their own, incorporate a business, and reap the rewards in the form of better pay economics and improved work flexibility.

In the personal finance community, Indeedably is an inspiring example of someone who switched to self-employment as a way to design a better lifestyle.

In addition, the comments section of this post is quite revealing as to the multitude of tax optimization options business owners have at their disposal.

Incidentally, the self-employment joyride gets much easier to stomach when you’ve got a proper financial cushion in place.

So even if you are not ready for it today, I wouldn’t dismiss the option outright.

Lifestyle Design

Option 6: Work Longer

I know, this one is a downer. Isn’t the point of financial independence to sail into the sunset of funemployment?

It may well be – but look at it this way:

If you spend 20 years working an intense, additional rate (50%) tax bracket job, roughly speaking, you will have spent a decade working for yourself – and a decade to pay taxes.

Now imagine you spend 40 years working a much more leisurely job at half the pace, which lands you in the basic (20%) tax bracket.

Of the 40 years, you’ll have spent 32 years working for yourself – and just 8 years (40 * 20%) working to fill the government’s coffers.

You’ll also end up living a more balanced, less stressful, and likely a less expensive life.

Worth a reflection

Option 7: Work Together

This one is a big pet peeve of mine – big enough to become the topic for the very first post on this blog.

To this day, I cannot understand why a household with one working spouse making let’s say £160k should pay more in tax than a household where both spouses make £80k each.

And yet that is the world we live in:

I am probably unduly sensitive here, as this happens to be my situation. At the moment, my wife still works, though we would prefer that she becomes a stay-at-home mother once our kids are a bit older.

But if my tax rate goes up, that option may well be off the table. At some point, the disadvantages of working a highly-paid job start to add up.

Much better to split the workload with your spouse – and enjoy life together.

Option 8: Move Abroad

I’ll be the first to admit that this is nothing short of a life-changing decision and should not be taken lightly.

And yet, as someone who has moved countries three times in two decades, I can attest that this can be an incredibly effective way to reach your personal and financial goals.

The most obvious option is to move to a country with low or no taxes.

The Middle East is a popular option here. I have a number of close friends who have moved to Dubai, Abu Dhabi, and even Riyadh.

In most cases, their salaries are either equal to, or higher than, what they used to make here in the UK or the US. Combine that with no taxes – what’s not to like?

If you leave lifestyle considerations aside (as countries like Saudi Arabia may not be everyone’s cup of tea), it can be a very powerful financial move.

The real challenge, however, comes when you want to move back.

Relatively straightforward when you are in your twenties and early thirties. Progressively more complicated once you are decades into your career, much more dependent on a specialized skill set, local network, and client relationships.

The other option, which I think is underappreciated by most people, is to move to a country with equal or even higher taxes – but a much better social safety net.

Ultimately, having access to a better public education or healthcare system can more than compensate for the extra tax.

Executed well, either move can give a significant boost to your finances.

The bottom line is that while higher taxes are on the horizon, we certainly have a gamut of options to mitigate their impact.

In life, preparation is everything. Hence it’s more than worth your time to think through a strategy that works best for you.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Very timely article for me this one having recently discussed many of these options with my good wife.

I think the key positive is that by engineering the headroom between income and expenditure you give yourself options. The finer details of which levers you choose to pull then becomes dependant on the particulars of the changes implemented. These could be a very personal blend and could well change over time.

Personally I prioritise minimising my tax by contributing as much as possible to my pension through Sal Sac. I see this as a relatively short lived strategy, there’s only so many years you can contribute fully to a pension in your late 30’s and early 40’s without running the risk of busting well past the LTA in 20 years time – if there even is an LTA at that point. As a PAYE employee there’s little option but to pay the income tax on previous AVC’s once the pension is deemed to be full.

For me its about the 80/20 theory – getting as close to FI as possible through the more traditional earn more, spend less, make use of the tax benefits on offer. Once there the more unusual levers such as taking a lower paid less stressful job, working abroad or taking a risk setting up your own business can be used to glide out the last few years. You’ve got to bear in mind what your own end point is – is it to walk away from the office for good or to take your foot off the gas? If its the latter especially you don’t need to get all the way to FI before starting that process.

I agree. Even before reaching FI, more money equals more optionality.

I’ve set a goal of leaving the investment banking industry behind by 2022. There’s no way I want to stop working altogether, so the question becomes much more about designing a lifestyle that maximizes utility for a given level of effort.

While I have nothing against paying taxes, at some level the marginal benefit of working an extra hour (or ten) becomes too small to care. Losing salary sacrifice headroom is a big nail in that coffin.

Excellent. My timeline is a little longer but I totally agree on not wanting to stop working all entirely. Shifting down a few gears from a mentally and time demanding career would be very welcome for me though.

I have nothing against paying tax but I do think I have a problem with the stepped nature of the tax system and a few of the quirks you touched on in your article in point 7. My wife and I have a skewed income and the tax treatment of us as individuals rather than a couple also irks me.

Pingback: The Full English Accompaniment – Spectres of our past – The FIRE Shrink

Excellent post as always. London lawyer here, currently considering an offer to go in-house in tax-free Middle East. In terms maximizing tax efficiency beyond the tax free income, is there any additional tax advantage (on CGT or otherwise) for amounts outside tax efficient wrappers (after maxing out my and Mrs pensions, ISAs and even junior ISAs)? I guess any rental income from renting out the family home once we’re gonebwill be taxed at a lower marginal rate as well. Thanks.

Good question. I’ve not had to deal with a situation like that so might be best ringing up a tax accountant (or getting your future employer to pay for a session as part of relocation package).

Annother point you may want to consider is how easy it would be to come back to the UK. Think not a massive issue for in-house counsel but for bankers, the challenge is that local relationships and experience rarely transplant well abroad.

I.e. an American banker who comes to the UK and works on code transactions for 10 years will probably struggle to find a slot back in the US.