Happy Saturday morning everyone!

Two specific things happened this week that will have a direct and quantifiable impact on our ability to build wealth – and our lives more broadly.

The first one is that, in the least shocking turn of events, the UK clocked its October inflation at a whopping 4.2%.

I would be surprised if anyone was surprised, given where US inflation numbers landed a week ago. But, for some folks, it doesn’t hit home until it has the national flag all over it.

So here we have it.

Incidentally, a few weeks ago, Cathie Wood (of Ark fame) published a thought-provoking Twitter thread with compelling reasons for why this inflation uptick will be, ahem, transitory:

In 2008-09, when the Fed started quantitative easing, I thought that inflation would take off. I was wrong. Instead, velocity – the rate at which money turns over per year – declined, taking away its inflationary sting. Velocity still is falling. https://t.co/tFaXSaCKqS

— Cathie Wood (@CathieDWood) October 25, 2021

Now, there’s absolutely no doubt in my mind that Cathy is a heck of a smart woman. She may well be right.

However, what I’ve learned over the years is that practice ALWAYS beats theory – even if that theory is delivered by the smartest people in the world.

And what we are seeing in practical terms, right now, is elevated inflation.

Sadly, Cathy (or anyone else) won’t come riding to the rescue once your cash holdings are decimated in value.

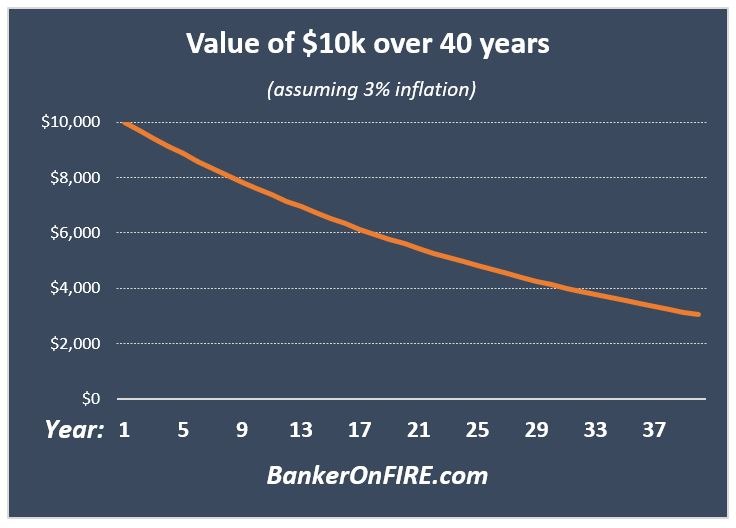

Thus, if you are sitting on a big chunk of cash and don’t have a good reason for it (like an emergency fund or an upcoming house purchase), please do yourself a favour and put that money to work now.

As it happens, both equities and real estate tend to be pretty good inflation hedges.

The other notable news event was the story of the Constitution DAO.

In a span of a week, thousands of people organized themselves into a democratic, decentralized, autonomous organization (with legal incorporation to boot) – and proceeded to pool their resources (to the tune of $40m) in order to try and buy a copy of the US Constitution.

One of the biggest rocks people throw at blockchain and crypto technology is the lack of real-life use cases. Well, this here is as good as it gets.

Throughout history, human progress has hinged on our ability to collaborate on complex projects – and do it better and faster than the generations before.

I have no idea whether Bitcoin or Ether will be around in 10 years.

But after I finally started paying attention earlier this year, I am firmly convinced that crypto technology is here to stay – and we will all be better off as a result.

Have a wonderful weekend all!

From Yours Truly

Building Wealth

They say that the most dangerous words in investing are “this time it’s different”.

Perhaps they are.

Equally, the world isn’t static. Some rules of making money haven’t changed in centuries – and others have.

The trick, of course, is to differentiate the former from the latter:

Experts From A World That No Longer Exists – Morgan Housel

You Don’t Live In The World You Were Born Into – The Irrelevant Investor

Web 3.0 Is Coming For Web 2.0 – The Escape Artist

Want To Get A Pay Rise? Here’s How – Financial Times

Early Retirement

FIRE Update: 6 Months In – Monevator. A great and candid look at early retirement, highly recommended

Also, here’s an alternative look at FIRE – one through the eyes of a child:

What I Learned Growing Up In A FIRE Family – Budgets Are Sexy

How I Planned My Early Retirement Withdrawal Strategy After I Retired Without A Plan – Accidentally Retired

Crypto Corner

10 Lessons From 5 Years Investing In Crypto – Mr. Stingy

I Got Scammed – The Irrelevant Investor (yep, it’s a double feature kind of day!)

Prime Time In Crypto – Marc Rubinstein @ Net Interest (technical but great for finance geeks like me)

Buying Crypto Assets – AVC

Lifestyle Design

The Nothingness of Money – More To That

Why Do We Work Too Much – The New Yorker

All Around

No One Cares! – Arthur C. Brooks

Recommended Books

As usual, some top-quality reads to cap it all off:

Exponential: How Accelerating Technology Is Leaving Us Behind And What To Do About It – Azeem Azhar

Make Time: How To Focus On What Matters Every Day – Jake Knapp

The Everything Store: Jeff Bezos And The Age Of Amazon – Brad Stone

Happy weekend all!

Note: the above post may contain affiliate links. You can read up about our affiliate policy here.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

I agree that crypto is simply here to stay–most likely BTC & ETH will be around but surely others will emerge (Solana?). I’m finally embracing it as a small part of my portfolio.

Same here

Have been a sceptic for very long but changed my mind after spending a fair bit of time in the crypto rabbit hole!

Pingback: State of Play – Q1’22 Market Update – Bankeronwheels.com

Pingback: What Does The Bond Rout Mean For the Stock Market? (Sunday Ride #14) – Bankeronwheels.com