Say what you want about this wonderful government of ours, but when it comes to workplace pension schemes, it certainly has been on the ball.

The mandatory enrolment, minimum employer contributions and generous tax breaks make UK pension schemes an incredibly effective wealth-building tool. It certainly leaves its US sibling, the 401(k), in the dust.

The government has also done a decent job regulating workplace pension providers. There’s never been as much transparency on fees. And transferring your workplace pension to a new provider when you change jobs is relatively painless and straightforward.

However, relying on the government to be the best steward of your money is never a great idea. Since the interests of the workplace pension providers are rarely aligned with yours, you need to remain vigilant.

Want to make sure your money is working for you just as hard as you are? Then follow the five steps below to prevent your workplace pension provider from taking you to the cleaners:

1. Update Your Default Investment Allocation

When your employer enrols you in a workplace pension plan, the pension provider will select your investments on your behalf. While that’s awfully nice of them, this initial selection will not reflect your objectives and desired risk profile.

You may be defaulted into low-risk, low-return money market funds. Alternatively, you may end up with a portfolio of expensive, actively managed funds. Regardless, I can pretty much bet my right arm that your pension provider will not default you into a well-diversified, low-cost index tracker.

Instead, you will suffer years of sub-optimal performance at an above-average price. So if you haven’t yet done so, please check your pension plan investments to make sure they are right for you.

2. Take Ownership Of Your Asset Allocation

Instead of selecting your investments, your workplace pension provider may steer you towards “Lifestyle” options.

The naming conventions may differ, but the general idea stays the same. Basically, it means that your investment mix (usually between equities and bonds) will reflect your age and your planned retirement age.

While the idea itself makes a lot of sense, guess what pension providers usually do with it?

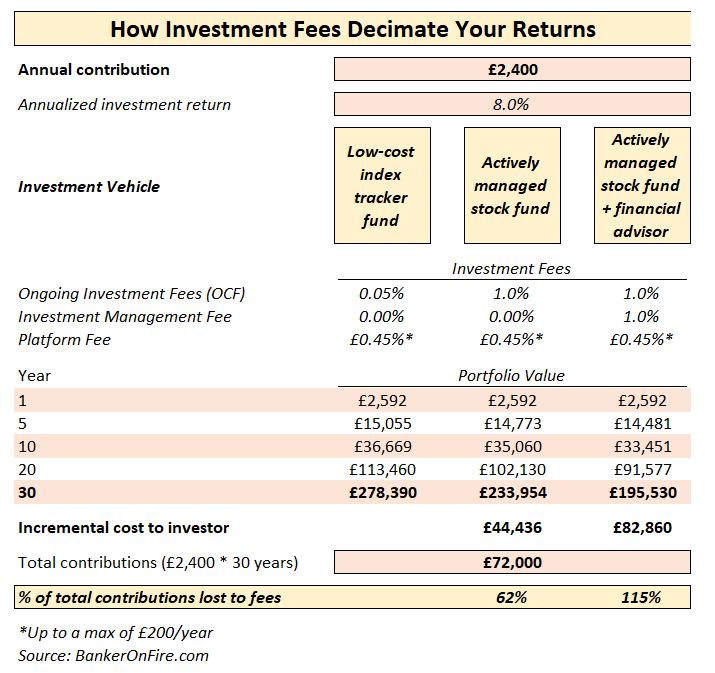

That’s right, they pack those “Lifestyle” plans full of expensive, actively managed funds. And there’s strong evidence that actively managed funds underperform their benchmark indexes.

That underperformance, however, doesn’t stop them from charging high fees (often in excess of 1%), which decimate your long-term investment returns.

Do yourself a favour and pick your own asset allocation. If you are a beginner, the general rule of thumb is to take a 100 and subtract your age from it. That is the proportion of your investments that should be in equities.

If you want to be even more aggressive, you can use 120 as a starting point. And if you know your way around investing and the 4% rule, you may want to keep your equities at 75% of your portfolio, even in retirement. Read this wonderful post to find out why.

3. Don’t Give Up Looking For Low-Cost, Passive Index Funds

Choice architecture matters. If you are like most people, you probably don’t enjoy managing your pension portfolio and just want it out of the way.

Guess what? Workplace pension providers know this. So they design their interfaces in a way that gently guides you towards the funds they want you to buy. Yes, the actively managed, expensive kind.

What it feels like to be looking for a low-cost tracker fund

However, the vast majority of providers do carry at least a small selection of passive index funds. They might be hidden well out of sight in the hopes that you will give up looking, but they are there.

Please don’t give up. Over the long run, investment fees can really kneecap your portfolio. Keep looking and you will be rewarded.

4. Consolidate Your Pensions

When you change employers, your workplace pension doesn’t automatically follow. It stays with the same pension provider until you choose to do something with it.

However, the fees you are paying are probably going to change, and not for the better.

Your old employer may have negotiated a discount on platform fees or preferential pricing on a selection of in-house funds. Once you move jobs, these discounts will disappear.

You should make a habit of transferring your workplace pension into a SIPP every time you change jobs*. In addition to giving your investments some extra oomph, it will also make them so much easier to manage.

*Unless we are talking about a defined benefit plan or one that comes with valuable benefits

5. Transfer Your Pension Out WHILE Employed

What if you tried to follow the advice above, but still feel you (and your pension) are getting a raw deal from your provider?

Well, there is a way out of that one-way, abusive relationship. Most people know that you can transfer your workplace pension to a SIPP after you leave your job.

But did you know that you can transfer your workplace pension to a SIPP before you leave your current employment?

That’s right. There’s nothing that can stop you from doing a partial transfer out of your workplace pension to a SIPP. Once you’ve taken advantage of your employer matching and the tax break, the money is yours to move around as you wish.

As a matter of fact, that’s exactly what my wife and I are doing at the moment with her workplace pension. The process is very similar to the one you would use to transfer an entire pension pot to a new provider. A few forms to fill out, a short period of time out of the market and you’re off to the races.

Pay Attention To Your Pension

Listen, don’t get me wrong – pensions can be boring as hell. But you know what isn’t boring? Being able to retire years ahead of others – and having the flexibility to do whatever the hell you want once you do.

There’s a reason why the rich love to use pensions to grow their wealth.

So do yourself a favour. Pay attention. Take a few hours to work through the five steps above. And don’t ever get a raw deal from your workplace pension provider again.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com