When it comes to personal finance, everyone gets to follow their own path.

It’s hardly surprising, given how many ways there are to get from point A (where you are today) to point B (aka some degree of financial independence, whether full or partial).

That, however, presents three problems for someone who hasn’t yet figured out their own blueprint for building wealth.

Problem #1: Sensibility

The spectrum of advice being dished out ranges from sensible to outlandish to plain dangerous.

At best, you’ll stumble on the right advice and end up wealthy.

At worst, you’ll lose both money AND time, leaving you far behind where you started.

Problem #2: Effectiveness

Not all “methods” do what they say on the tin. More on this below.

Problem #3: Fit

Just because a certain wealth-building strategy is effective doesn’t mean it’s right for you.

What some folks find intuitive and natural others will find highly uncomfortable.

Sure, you can suck it up for a week, month, or even a year. But that’s not enough in personal finance, where success is predicated on being consistent over multiple years and even decades.

In other words, it pays to follow a path that’s aligned with your money identity.

Let’s explore how the three problems above manifest themselves when it comes to the various ways of building wealth.

Lattes And Avocado Toast

We’ve all heard the mantra.

Skip the daily latte and boom – you’ve got a million bucks lining your pocket.

And if you gird your loins hard enough and say goodbye to avocado toast at the same time, even Bezos won’t be able to catch up.

Gazillionaire territory, here we come!

I love and hate this kind of thinking at the same time, but I hate it so much more.

What I love about it is the overarching theme of compounding and intentional spending.

Yes, saving a fiver a day adds up to eighteen hundred bucks or so in a year. Compounded over a long period of time, that can turn into a serious chunk of change.

And yes, you should never spend money mindlessly – or on things that you really don’t care for.

But you know all this already, and this is where all the good news ends.

Because first of all, you will NEVER save up a million bucks this way, unless good old Starbucks decides to double their prices every single year.

Just ain’t gonna happen.

On my numbers, it’s more like $465k by the time you are 60.

Second of all, have you ever met a person who actually saves and invests this way?

What do you do, buy five quid worth of VTSAX every single day?

However, even that’s not the biggest problem with lattes and avocado toast.

It’s the fact that you’ve got to look in the mirror every day for 40 years and say:

“This is the absolute best I could come up with”

I will never believe that the best way to utilize your energy, unique skills, talents, and passions is to grind your teeth as you drive past the local coffee shop every day.

Neither should you.

In other words, is the advice sensible? Yes.

Effective? Not really.

Does it have the right fit? Only you can answer.

An Early Start

They say that you start buying index funds when you are five, you can pretty much wrap up your investing career in grade 7.

By the time you are 75, you’ve got a few million quid rolling around in your brokerage account.

All hail the power of long-term compounding!

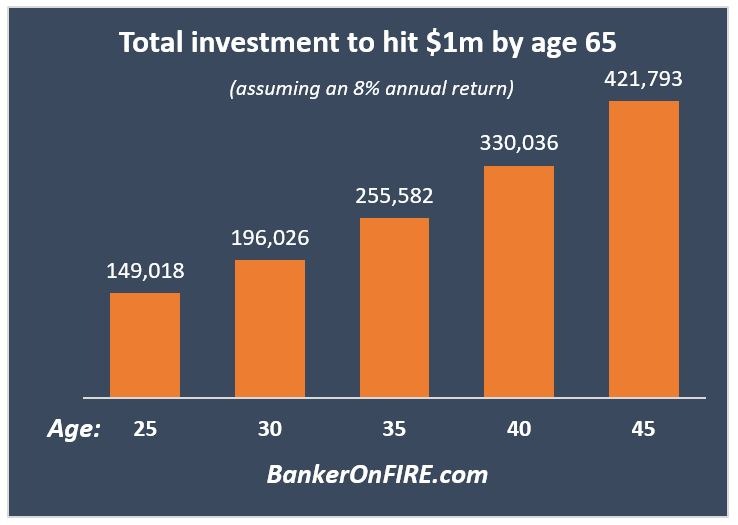

Objectively speaking, this is probably one of the easiest ways to break into millionaire territory.

However, it all depends on how old you are when you finally see the light.

If you are lucky smart enough to figure this out in your 20s or early 30s, pat yourself on the back and get to work.

Time is on your side.

However, for most young people, personal finance mostly consists of the blind leading the blind.

Thus, if you aren’t exactly a spring chicken anymore, there’s no need to wail over the missed opportunity.

Instead, just remind yourself that you aren’t getting any younger – and then get to work.

Time is always on your side, even if you haven’t got as much of it.

The “price of admission” to the millionaire club is only going to go up from here:

And so, is the advice sensible? Totally

Is it effective? Depends on how old you are.

Does it have the right fit? It better. Ain’t no other way to build wealth than to save and invest.

Flip The Bird To Your Bank

How do you get a 25% return on your money?

Easy – just pay off that credit card debt of yours.

Someone who carries a $20k balance on their credit cards will incur about $5k of interest charges a year.

But imagine if you just managed, somehow, to find a way to get rid of that debt.

Downsizing, moving in with your parents, taking on a part-time job, anything basically anything short of selling your soul your kidney on the black market.

That one, concentrated push would free up $5k of investable cash every single year – for the rest of your life.

Put $5k / year to work over the course of a 40-year period (which is sadly how long many people carry their debt) and you end up with a cool $1.3m.

You will hardly find advice out there that’s more sensible or effective.

The numbers simply don’t lie.

It’s more intriguing to look at it through the juicy prism of fit.

One can argue that it’s a bit like skimping on lattes. Living a miserable life and whatnot.

Except that it’s not.

Unlike skimping on lattes, paying off your debt requires zero mental or physical effort once you’ve gotten over the initial hump.

It simply doesn’t get any better than that.

Masters Of The Universe

There used to be a time when (at least in a Tom Wolfe novel), investment bankers were known as the masters of the universe.

Remember them?

Now, those days are clearly gone, but bankers, consultants, lawyers, and the like still do relatively well for themselves.

Elbow your way into one of these professions and amass untold riches as you rise up the ranks of the powerful corporate oligarchy.

As someone who followed this precise path, I can tell you straight up – it’s not easy.

Both in the US and in the UK, armies of smart, hard-working kids from non-target schools compete with their more privileged counterparts to get their foot in the door.

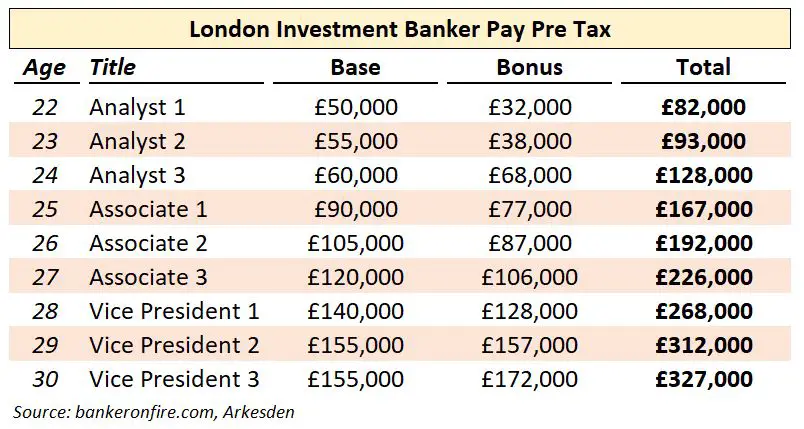

This is the monetary prize they are working towards, followed by even more lucrative stints in hedge funds or private equity:

Is the advice sensible? My (admittedly biased) opinion is an emphatic yes.

If you are going to spend a few decades working for someone else, maximizing the ROI on that time is a no-brainer.

Is it effective? Yes.

Objectively speaking, angling for a better-paid job is unlikely to leave you with a worse one.

Aim for the stars, reach the moon, and all that sort of stuff.

As ever, the fit question is tougher to answer.

High-pressure jobs aren’t for everyone. Many folks spend years trying to “break in”, only to churn out of their respective industries in the first few years.

But others persevere – and get the reap the rewards.

It all starts with a simple question:

“If they can do it, why can’t I?”

Give it enough thought, back it up with some effort, and you might well be surprised at where you end up.

Side Hustle Nation

You know how this one goes.

Start a blog, buy a rental property, become a part-time math tutor, or try to build up a little property empire.

Soon enough, you’ve built up a nice little additional income stream. Invested properly, that extra cash takes you all the way into millionaire territory.

For full disclosure, I love this kind of advice – and not just for monetary reasons.

First of all, a side hustle is a great way to explore your passions.

Okay, driving for Uber might not exactly be your destiny – but what about teaching yoga on a Saturday morning?

For all you know, there might be a fitness studio owner in you – all because you’ve decided to challenge the status quo.

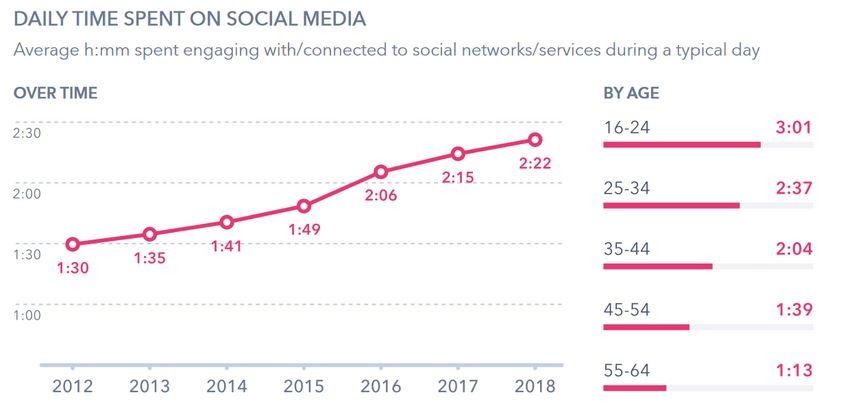

Secondly, it’s because the vast majority of people have tons of what I call “dead time”.

There’s the daily 8 pm Netflix binge. The aimless wobbling around on a Saturday morning.

And all the time we spend checking the news or social media:

You can trust me when I say that cutting all of these out of your schedule won’t impact your happiness levels (if anything, they will probably go up).

Replace them with a productive activity of some kind, and you’ll end up in a much better place.

Most importantly, there’s no downside – and unlimited upside.

Sure, you might cap out at a hundred bucks a month.

But many folks go on to build successful, thriving businesses that give them incredible autonomy from their day jobs – and it all starts with one little step.

Is it sensible to explore a side hustle of some kind? Yes.

Effective? You won’t know until you try.

Is it the right fit? Only you can tell.

Let’s be 100% clear: when it comes to building wealth, there are no shortcuts.

There are, however, multiple ways of achieving your financial aspirations.

Like it or not, all of them involve spending less than you make – and investing the difference.

Whether by choice or circumstance, some folks might go down a path that’s intense and somewhat unpleasant.

Others might be in a position to follow the scenic, leisurely route.

Only you can choose the path that’s right for you. But whatever you choose to do, do it with your eyes wide open – and don’t be afraid to question the advice being given.

Your life – and finances – depend on it.

Happy journey!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Interesting article. I am also interested in what is called “survivorship bias”. My friend had mentions funny “how there are so many millionaire on youtube” and people standing outside of there shinny sport car to give advice. Their advice is not for everyone.

I had mention to him following their advice can be like playing *Russian Roulette*. Remind me of the story mentioned in the book by Nassim Nicholas Telab in the book “Fooled by Randomness”. Someone ask the millionaire how do you get the millions. He reply was by playing Russian roulette with a gun. I put one bullet into the chamber spun the barrel and pointed the gun to my head. The mafia boss bet me one million and here I am today with one million.

He made the story clear to me. Some youtube’s are click bate and take a measurement of your strategy and be realistic. Stay anchored in reality. You only see the good and not the mistake and the hard work it took.

From Banker on Fire I learned to explore what is available to me and do the math.

Thanks as usual(and excuse my gramma)

regards Cleophas

Thanks Cleophas, nothing like Taleb to have a catchy story!

Kind of like the story of a lottery winner who claims that his secret was not giving up in the face of adversity.

I have my own views on youtube / Instagram influencers and the quality of their products. You can tell pretty quickly who knows their stuff and actually wants to help people, and that’s a tiny minority.

I think the easiest path for those with the aptitude to excel in a highly technical field is to work a 9 to 5 for a mega corp. Promotions, bonuses and stock awards will allow you to earn multiple millions during your career. You can manage a 25% plus savings rate (on gross income) which will build a multi million dollar portfolio while still living a pretty plush lifestyle. It worked for me and many of my peers. The work was fun and the saving was effortless.

I agree. While I found that Entrepreneurship was my ticket, it still took 10 years and hours of hard work for it to pay off. Frankly, it would be a lot easier and less stressful to work for a mega corp, max out your 401 (k), invest in yourself first, etc.

There’s also the uncertainty of it.

Got to have nerves of steel to navigate your business all the way to an eventual sale when there are so many things (competition, regulation, technological disintermediation) that can trip you up every single day)

I agree. Having tried entrepreneurship, I can say from experience it’s not for everyone.

The “day job” path comes with its own challenges but provided you navigate them well (and are always ready to move on to greener pastures), it’s a great path for the majority of people. Sure beats skimping on lattes your entire life!

It’s also a more social path than running a business – folks underestimate how lonely being an entrepreneur can get.

That is an amazing story. Wish this was the case filled most 9-5 workers.

Speaking as a lawyer, I would recommend not going into that profession for anyone looking to FIRE. The hours don’t justify the reward and forget trying to start any side hustle (yes I may be biased and bitter).

Law has got to be one of the toughest gigs out there.

I’ve worked with hundreds of lawyers in my career. Most were highly intelligent and hard-working, but very few looked happy.

The other challenge is that the billable hours model just doesn’t scale…

Pingback: Saturday Linkage: – 39 Months

Hi BOF,

The article is a great read but have you thought about the side hustle advice from a different perspective?

When you said the advice about skimping on latte is not subtantially helpful, the reason is you can’t really buy $5 of VTSAX everyday, the principle here is, the money from latte savings is not a meaningful amount for investing, especially when you have dealings fee to pay, it is just not a big enough amount to justify the cost of investing. I totally agree with you on this one.

And then on to starting side hustle from the free time on a spare sunday or the 2 hour on netflix at night, i think this idea would also have the same issue as the latte. The spare time there is not enough to really build a working side hustle. Spending 1.5 hours everyday on building a business is like savings $5 on lattes to buy vtsax everyday. With pretty much every activity, there will be the “warm-up stage” where you open the computer and then try to remember what needs to be done, and progress to “actually getting work done”, and then “downtime”.

When you have like 2 hours free each night, by the time you get past the warm up stage, it’s nearly time to sleep already. Don’t get me wrong, this advice of you is totally “sensible”, but the “effectiveness” and “fit” will be a hard one to answer.

I know a lot of successful startups was started that way, Instagram for example, but i’m sure these guys spent a lot more than 2 hours each night on the project. Similarly, savings on latte to invest is probably still a very effective advice, if you are one of those addicts who spend like $25 to drink 5 cups of Starbucks everyday.

It’s a sensible comment to make but in my experience, there’s quite a bit you can accomplish in 2 hours, especially if you don’t take the entire time to warm up and cool down 🙂

5 days x 2 hours is 10 hours. In a year, that’s 520 hours – equivalent to 13 workweeks. There’s a TON you can get done in that time.

Add another 10 hours over the weekend (totally doable if you do 8am – 1pm both days) and you are up to 1,040 hours a year.

Most importantly, you don’t need to build the next Instagram. Lots of folks become part-time fitness instructors, zoom yoga teachers, maths tutors etc etc etc. Plenty of options to monetize that spare time in a way that compounds and makes a difference.

If you create a side hustle that brings in $2,000 a month extra and then invest $1000 a month or ($250 a week) you would be set!

Even if you made and additional $1,000 and invested $500 of it a month would be a huge impact to your future finances.