Of the many conceptual arguments playing out in the personal finance space, buying versus renting has got to be one of the longest-running ones.

Based on what I have seen over the past couple of years, the “buyers” represent a solid majority.

After all, most folks who have achieved financial independence own their own house. And for many who are currently on the journey, homeownership represents one of the core pillars of the strategy.

But is it really that simple?

Where Math Fails

In theory, there’s a straightforward and rational way to approach the buy vs. rent decision. All you need to do is run two scenarios:

Scenario 1: Buy A House

You put some money down and make thirty years’ worth of mortgage payments. You are also on the hook for a long list of other expenses, such as repairs, renovations, insurance, and so forth.

However, in three decades or so, you (hopefully) end up with an asset in the form of a paid-off house. Voila – you’ve arrived!

Scenario 2 – Rent

Instead of buying (and assuming you don’t already own a place), you just keep on renting.

No need to save up for a down payment. Hopefully, your rent is lower than the mortgage payment, and you also don’t need to worry about all those pesky expenses.

Instead, you take the money left over and invest it in the stock market.

In thirty years, you don’t end up owning a house – but you do own a portfolio of nicely diversified index funds.

You can go on to liquidate that asset at a minimal cost (take that, homeowners!) and live happily ever after.

It all sounds easy enough, doesn’t it? And yet, show me a person who performs this rational kind of analysis and I will show you a unicorn.

Garbage In, Garbage Out

The problem with running the kind of mathematical comparison outlined above is that it involves making numerous assumptions over long periods of time.

You need to take a view on the evolution of house prices and rents for the next couple of decades.

You also need to make an assumption about your housing needs going forward.

Are you going to buy a bigger house once you have a family? And once you do have little ones, will you try and move to be closer to a good school?

Or perhaps you will land that dream job in Tokyo and up selling your place, moving countries, and never coming back again. Who knows?

What about the cost of homeownership in the first place? As anyone who has ever owned a house will tell you, roofs leak, boilers break – and all these things tend to happen at the most inopportune moments.

And that’s before your wife decides she wants a new kitchen, or the hubby starts talking about a basement dig because he’d really like that man cave downstairs.

You can run your little excel spreadsheet for as long as you’d like, but it’s unlikely to improve the accuracy of your analysis. Kind of like some banking models I’ve come across in my career.

Ultimately, this is why most folks resort to what I call “emotional arguments”. And no one has more of those than the proponents of buying.

The Advantages Of Buying

I don’t necessarily subscribe to every word of the “buy your own house” sermon. That being said, I am a believer in real estate as an asset class and will be the first one to admit I see some very specific advantages in homeownership.

Below are my top 5 reasons for owning your home:

#1: Commitment To Asset Ownership

The time, effort, and complexities involved in selling your primary residence make it unlikely you will panic and sell your home if the real estate market wobbles.

Not so much for stocks, as many folks have realized back in March.

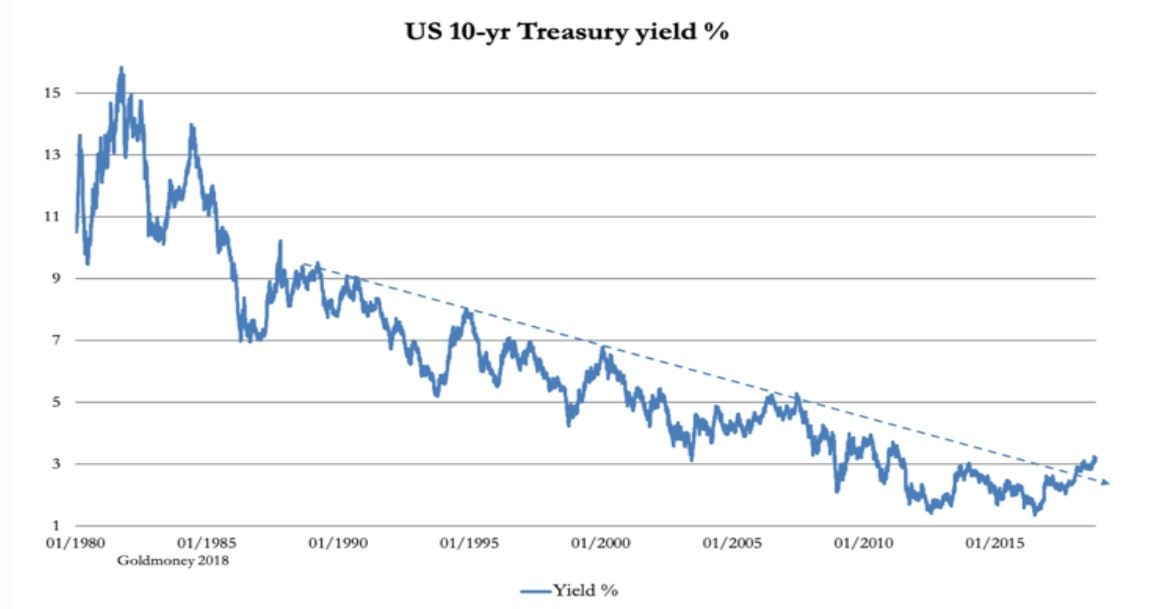

In addition, the ongoing decline in interest rates over the past three decades has resulted in a broad-based increase in asset prices. Real estate was no exception (save for some regional variations).

In other words, it’s been good to be a homeowner (recently).

#2: Alignment Of Incentives

Another advantage of owning is that it is often easier to convince your spouse to buy (and hold on to) a house than other investments.

Your significant other may feel nervous about equities or bonds, but they are unlikely to object to living in their own house. Most folks feel a sense of security when they own the roof over their heads.

In other words, buying a house may well be a way to combine marital AND financial harmony.

#3: Forced Savings

This is a big one.

Many arguments for renting are built on the premise that you will take the money you would have spent on a mortgage payment and invest it in the stock market.

Sounds good in theory but rarely plays out that way in practice. It takes some proper willpower and discipline to take that extra cash sloshing around in your bank account and put it to work.

A mortgage payment, on the other hand, is non-negotiable. Nothing like the Damocles sword of repossession hanging over your head to encourage some financial discipline.

#4: Tax Benefits

No, I don’t mean the US-type deductibility of mortgage interest for tax purposes.

Imagine you have decided that you need £20k of annual income to retire (before housing expenses).

If you already own a house, you are done. However, if you are renting, you need to increase that £20k by your annual rental expenditure.

The extra money isn’t the problem here – provided you’ve been diligent and have been “investing your mortgage” instead.

However, unless your entire investment pot is held in tax-efficient investment vehicles, you will likely end up with a higher tax bill. And given that taxes will probably go up over time (someone’s got to plug that deficit!), the financial impact may be meaningful.

#5: “Home-made LBO”

For those not familiar with the concept of a leveraged buy-out, it is essentially how private equity makes their money.

The recipe is simple – buy an asset, finance it with a ton of debt – and a sliver of equity. As long as the return on the asset exceeds the cost of debt, the difference will accrue to the equity holder.

And that is exactly what a mortgage is – especially in the early years, when you’ve got a very high LTV.

No, you cannot become an LP in CVC or Apax. But for many people, buying a home will be as close as they will ever get to a private equity-style money-making opportunity.

The Case For Renting

While advocates of renting may well be outnumbered, they sometimes put forth pretty convincing arguments in favour of forgoing homeownership.

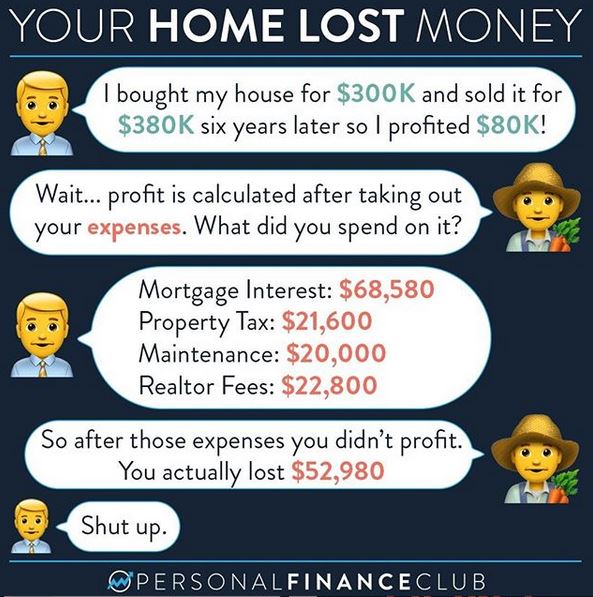

Jeremy Schneider of Personal Finance Club is probably one of the most credible proponents of renting. Jeremy runs a pretty good Instagram account and isn’t afraid to shine a light on some of the hidden costs of homeownership:

As someone who owns multiple rental properties, I am particularly attuned to his argument about the costs of buying and selling properties. In fact, that is one of the biggest reasons I never buy real estate unless I’ve got a 10+ year time horizon in mind.

Sadly, real estate agents and lawyers don’t work for free.

The Road Less Travelled

There is, of course, a third option. It’s not one you come across very often, but I wanted to cover it off anyway, not least because I wouldn’t want anyone to accuse me of being hypocritical.

You can always rent the place you live in – and own rental properties at the same time. And that is exactly what our family does.

In a very non-FI way, we rent a townhouse in central London. It’s costing us a pretty penny every month. At the same time, we own multiple rental properties.

So why do we continue to do so? A few reasons, some of which I have touched upon above.

The most important one is uncertain housing needs.

Put bluntly, we don’t know where we are going to live in the near future. We may stay where we are. We may move outside London. And there’s always the option of leaving the UK behind.

The other one is transaction costs.

Over the past few years, we’ve come close to buying a house in London on a couple of occasions. However, the effective stamp duty on a £1.5m house (which doesn’t go very far in central London) works out to about 5%.

In other words, you need the house to appreciate by at least 5% to break even – and that’s before you consider other expenses.

Most importantly, it’s the fact that we are still long real estate. It’s just that instead of owning our primary residence, we own rental properties with better yields.

The bottom line here is that buying versus renting is as much of a lifestyle choice as it is a financial decision.

There’s a high risk that you won’t end up making the decision that maximizes your net worth. Thus, might as well make the one that maximizes your happiness.

Thank you for reading!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Interesting article BOF.

It is a question that I have toyed with for a long time. I am in a similar situation to you, I rent in London but have a tenanted apartment in Birmingham.

The only point I wouldn’t necessarily agree with, is that it is cheaper to rent than pay off a mortgage. Obviously alot depends on the terms of the mortgage. I would agree that renting is cheaper in London than a mortgage repayment, but that is due to the rediculously high property capital values and low yields. If you look outside of London there is a lot more parity. Therefore my view is that, in London it makes sense to rent (albeit there seems to be a mass exodus out of London), but for the majority of the country it makes sense to buy due to the ‘forced saving’.

Thanks for the article.

Alex

Glad you enjoyed it!

You are right, my take on the cost of renting vs buying is probably biased towards the perspective of someone living in London or another big/expensive city.

As you say, very market-specific and highly dependent on yields.

I agree with Alex above that renting is often more expensive than a mortgage repayment – some family members bought properties, putting good amounts down (30+%), and their repayments are a fraction of what I’m paying in rent.

The UK seems a very real estate-loving country. I was surprised at the perceived status difference between renters and homeowners here, as this doesn’t exist in Switzerland, where it is considered simply a lifestyle choice. It’s interesting how many people in the UK have told me to ‘just buy a house, it’s essential’, when this might not be the case in my situation.

Yes. I’ve got friends on the continent (in particular in Germany) who simply choose to rent their entire lives, notwithstanding the fact they can easily afford to buy.

That dynamic sometimes plays out in central London, where you’ve got a big proportion of expatriates like myself. However, it quickly disappears once you go beyond Zone 1 / 2.

That being said, I would say regulations are much more tenant-friendly in some of the European countries vs. the UK. In the meantime, the UK seems to have made being a landlord very painful, at little visible benefit to the tenants.

I completely agree with you that “the UK seems to have made …”.

Seems that screwing both sides is becoming something of a UK speciality or has it always been thus I wonder?

Seems to be my experience since I came to this country ten years ago!

Hi Katherine,

You are right it’s very British obsession with owning homes.

The rent is only one portion of it, the maintenance and transaction costs are not insignificant.

House prices only went up because interest rates fell from 15% to basically zero in the past 25 years.

My father had a large building in Manchester student area. He bought it in the late 70’s for £8k

He borrowed the money from a private individual. A lawyer with spare cash, as banks did not really do mortgages back then. It was very difficult to get credit.

Anyway the point is he rented the house out as bedsits. The Gross rental yield he got back then was about 7% to 8%

Scroll on to 2019. We sold the building. We got about £750k for it. The gross rental yield was about 7.5%

Nothing changed except the price of money.

What people can afford to pay for the money they borrow to buy the house.

The price of money cannot fall much further.

Capital values of houses cannot / will not go up anywhere as much as they have.

The only way to make money rent is is to make use of tax advantages (BOF properties seem to all be in the USA where it has good tax rules.)

Here in the UK it’s much more difficult.

I agree with you that price appreciation is unlikely to be as strong as it has been in the past. That is, unless we move into negative rate territory, which could well happen in the bizarre environment we live in.

My properties are all stateside and I’m usually assuming no more than a 2-3% price growth in my projections.

The dynamics change substantially with the arrival of a young family. Having the ability for a landlord to be able to ask you to move at relatively short notice is not conducive to stable living or the building of childhood memories. That for me is the emotional reason for buying. Alongside the FI hedge against rental increases etc. Having dealt with the mortgage, it’s comforting to know if everything goes wrong the roof is always over our head. That level of safety is a considerable factor preventing us from upgrading – along with the points you make above that a house inevitably sucks up cash. We completely gutted our place when we bought and having done so there is limited expenditure required a decade on. A great article though as for many people renting is forced anyway. We have thought about keeping the house, renting it out and checking out to a much cheaper area out of London commuting territory but being a landlord in the UK is becoming a major major pain (I already have a few).

That’s right. If we didn’t face the prospect of moving cities / countries over the next few years, we probably would have tipped towards buying. There’s something innate about being able to guarantee a roof over your head, especially once kids arrive as you say.

I toyed around with the idea of buying a rental property in London but having read some of the reader comments on this blog, opted against it. The risk – reward just isn’t attractive enough.

Great post! Unless you are going to live in your home for 5 years or so, I don’t think it makes financial sense to buy. The transaction costs are simply too high. It costs 6-7% of the home value to sell in the US!

As you rightly mention above, taxes are a good reason to own a home outright when retired. If you own a fully paid for home in retirement, you decrease your expenses and thus the income you have to pay taxes on. Health care subsidies also come into play here in the States. I wrote about this here: https://themodernmindfulness.com/dont-pay-off-your-mortgage-until-retirement/

Keep up the great posts! I’m almost through with reading the entirety of your Writings.

Yes. I hope that the real estate agency market is going to get disrupted much like many others and the fees will come down from the egregious levels they are at today.

Key benefit that is not touched on here (and which may well change soon) is that there is no CGT on any gains on the main residential home. So buying with max leverage and holding can be v effective over eg a 30 yr horizon. Trying to diffuse typical gains on equities over the same horizon with the CGT allowance (even x2) is not easy…

Good point though I would think you can offset a big chunk if you utilise your ISAs? Really depends on the quantum.

Yes good point. Thinking aloud as fill Isa each year. But after that it must then be attractive to buy a main residence, then GIA.

Yes that’s the sequence, subject to relative cost of renting vs owning in the location where you live.

And as you point out, the criteria will change if the ISA allowance happens to come down.

“Hopefully, your rent is lower than the mortgage payment,”

That is the key part. If the mortgage payment is LOWER than the rent (which it was in our case) then there is no ‘extra’ money to invest in stocks (OK possible maintanance, but that hasn’t been particularly high in our case).

I also like the idea that once you are living off your assets, if you are required to reduce spending due to a downturn, it is easier to do if you don’t have a required rent payment making up a big chuck of monthly expenses.

Indeed. Tough to build a case for renting if it’s more expensive than owning.

The second point is one that’s often overlooked in the buy vs rent debate but I think will become much more relevant as tax rates go up (which unfortunately seems to be the direction of travel)

I’ve been personally struggling with this for a while – thanks for the post.

Even coming from a country where no one rents, I was still surprised by the British obsession for owning property. People will go out on a limb for the elusive “deposit” and will pay it with no second thoughts as the price to get on the mythical “ladder”. I’ve become sick of how often I’ve seen these terms regurgitated.

What will probably end up tipping the balance for us is that we are really missing the freedom to do the small things: decorate freely, get some of our furniture rather than cheapest possible items a letting agent found in a day. The reasonable places are those that were formerly refurbished by owners for themselves, but those are usually going on sale.

As someone with a family that needs stability and to make the house feel like a home, how have you gone about that? Are you willing to invest your own money for some improvements, have you negotiated any special terms, do you have a long term contract?

I’m neutral on RE as an asset class but as I saw it nicely put in another blog, owning your primary residence is being neutral and renting in the long term is shorting it unless you own other property (like you do). I don’t like B2L in the UK, so might eventually do it in my home country where yields are higher but I’m generally more of an index fund guy.

Given these circumstances, we’re looking to buy a place at the edge of Z2/Z3 but I definitely don’t want to overstretch the budget and we’ve found the market super inflated due to SDLT holiday so staying put for now.

Cheers A. By the way, this post was inspired by a comment you’ve left on the blog earlier in the summer – thanks for that!

We have been lucky that our landlords have always been professional ones. Our first landlord owned the entire building we lived in, so when we had our first child we simply moved to a bigger flat within the same building. Altogether, we stayed with him for about six years and were very happy.

The current place we live in is owned by a chap who splits his time between the UK (Midlands) and Asia. We’ve negotiated a long term lease with an early break clause (but only for us, not for him). Fair trade all around, the place is unfurnished so we can adapt it to our own needs and tastes.

Are we overpaying in the traditional sense of the word? Perhaps, we could probably buy a place in Z2 where our mortgage payment would be the same as our rents. That is, of course, until you consider the £100k or so in stamp duty which changes the equation pretty quickly (if we were to leave the country in a few years, as we well might).

Best of luck with your own house strategy. Ultimately, you will find a construct that works for you, so I wouldn’t stress about it in the meantime.

What in particular attracted you to a long-term lease – and, if I may be so nosy: how long is the term, what does your break clause look like, and what, if anything, is agreed re rent increases or otherwise?

I ask because whilst the UK media, etc is forever banging on about tenants seeking such a deal – I have never met/read about anybody how has in reality gone that way!

Without getting into too much detail, it’s a multi-year lease and we have a unilateral break option after 18 months. Rent increases can be in line with CPI (though one was not proposed this year and we didn’t proactively offer!)

What we had found is that for properties at the higher end of the range in central London landlords can be a bit more accomodating as it’s a less “liquid” part of the market. That being said, perhaps we just got lucky!

Guess this is why a lot of people just rent even some married couples do

Yeah – and despite what many folks believe, renting might actually be a value-maximizing strategy, especially if you live in an expensive city or move around a lot.

Great article and I completely agree with pretty much all of what you have said; particularly when it comes to high cost of living cities.

I would counter however with more Northern regions; particularly suburban regions where there’s just not the same ‘high quality’ rental housing stock.

We live in a beautiful Suburb of Yorkshire and there’s very rarely ‘high quality’ rentals on the market. They are typically out of the suburb or are few and far between in that competition is incredibly high.

When having a family it makes sense to buy as you can provide your family a high quality home.

Of course If i lived in an area with a higher level of rental properties then I am very much certain that id be a long term renter however Geography plays a huge part in the decision process.

Thanks again for writing.

Another angle against renting is – You are paying off someone else’s mortgage, you may as well benefit by paying your own.

I guess its a ratio of rent to mortgage payment calculation versus the investment/growth.

Something like that, yes. If your rental payment is higher than what the mortgage would be, might as well pay the mortgage.

However, if your rental payment is less than the mortgage, you’ve got to think through whether you’d be better off investing the difference.

And then you layer on some of the other considerations I’ve listed above.

Completely agree in a similar position to you. We rent a 2br flat in Zone 1 25 minutes walk from work for 2k pm, if we were going to buy it would be 700-800k around here for an equivalent place. The stamp duty + 2nd home penalty will be more than a years rent even with the stamp duty holiday.

There is also so much uncertainty now about the future of work w/ covid / brexit / career – so we are in no rush to buy to live.

Nice to be our landlord who bought the flat for 200k… good return for him.

Good article. I think the main negative you overlook with home ownership is its a often a jointly-owned asset and we live in a society with a large number of divorces and separations.

You can’t split a house as easily as you can a stock portfolio, and can therefore be forced sellers (perhaps during periods where there market is depressed, locking in losses). I also know of a few couples who – though they won’t admit it – are basically staying together to the detriment of their own happiness because of the big dumb house they’ve poured almost all of their savings into.

Yes, sad but true. It’s the flip side of the liquidity argument.

You cannot really “panic sell” the house like you can with stocks, but equally, it can be tough to monetize it when you need to.

If you are buying (for investment) outside of the country you live in, how do you go about doing your DD, etc?