Financial independence can be confusing. Spend even a little time on a personal finance blog or Facebook group and you will soon get lost amongst all the novel concepts, acronyms, and alternatives.

You don’t have to be a genius to figure out that this rarely ends well.

Motivated to reach financial independence as quickly as possible, people try to do EVERYTHING. They take on too much, trying to re-engineer their lives from scratch. And more often than not, they fail.

It’s kind of like running a marathon. If you go full speed ahead in the first 5k, you quickly run out of steam. Good luck posting a good time – or finishing at all.

But what if there’s a better way? One that doesn’t involve trying to do a black diamond run the first time you put on a pair of skis?

The 80 – 20 Rule

If you have ever taken an economics class at university, you may have come across the 80 – 20 rule. Also known as the Pareto Principle, it’s a simple concept that boils down to the following statement:

In many areas of life, about 80% of outcomes can be attributed to 20% of the causes.

For example, many businesses find that 80% of their sales are often generated by 20% of clients. A negative interpretation may be that 80% of car accidents are caused by 20% of drivers (you know who you are!).

And inevitably, 80% of healthcare costs are incurred by about 20% of the population.

There are two possible applications of the 80 – 20 rule. The first one is the proverbial “if you throw enough cr*p at the wall and some of it will stick”.

It may be simplistic, but it works. When I think about personal experience, many of the things I’ve done in life have generated zero value for me. The two foreign languages. That accounting designation. The failed business venture in my 20s.

But then, I hit gold with my MBA degree and landed an awesome, well-paying job.

The more nuanced interpretation is not increasing your overall workload but rather focusing on the 20% of things that drive the vast majority of positive outcomes.

Nurturing your high-value clients. Getting the right advanced degree. Developing the soft skills that really move the needle in your profession.

The problem with the second approach is that while hindsight is 20/20, no one can predict the future.

You still need to do a hundred cold calls to find the 20 loyal clients. Ten job applicants will walk through the door before you find the right two.

In M&A, the majority of the deals go nowhere and it’s the few that do close that pay the bills.

The good news is that when it comes to building wealth, you can predict the future. After all, this is not like putting a man on the moon.

The path is well-trodden. Even better, it’s well-signposted. And when all is said and done, there are just three key ingredients that will get you from start to finish.

Start With The Basics

As I’ve said before, one of the fundamental truths in life is that people who don’t understand money rarely get wealthy.

The ones who do buck the trend, usually do it through pure luck – such as getting an inheritance or winning the lottery.

They are also the ones who typically squander their wealth in a short period of time and quickly end up back at ground zero.

Thankfully, the list of financial concepts you need to understand to become financially independent is very short.

You start by spending less than you make. Create a simple budget that tracks all your expenses for a month.

Once you understand where your money is going, look for ways to save anywhere between 25% and 50% of your income. Focus on the big items (housing / transportation / education / eating out).

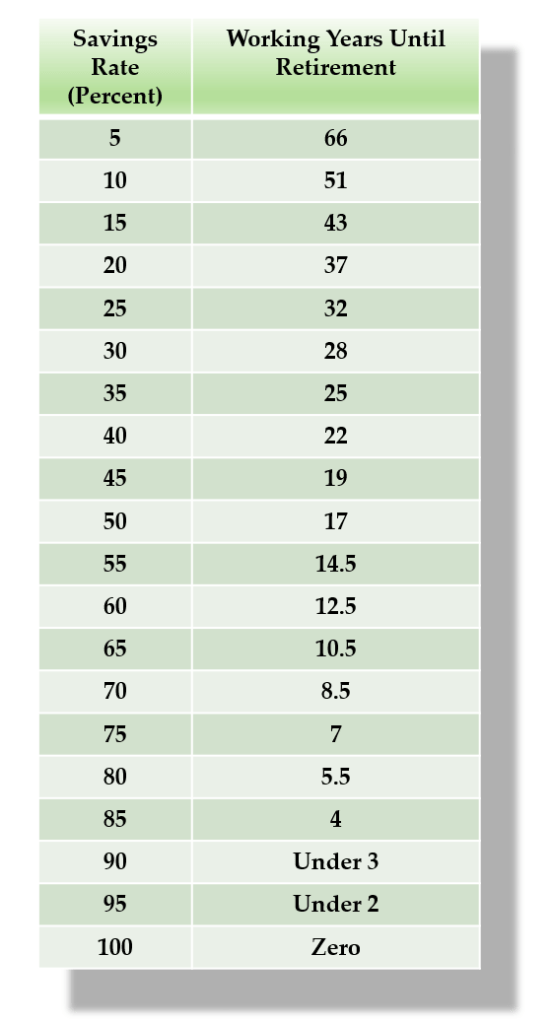

The reason I picked a savings rate of between 25% and 50% is that your savings rate is the only thing that determines how long it will take you to reach financial independence. If you manage to get to 50%, it’s just 17 years to financial independence.

No, it won’t be quick. But it’s better than a poke in the eye.

Once you’ve figured out how to put some money aside every month, it’s time to think about investing. Fundamentally, this one boils down to just two simple things.

There’s inflation, which means that the purchasing power of your money declines over time. Therefore, you shouldn’t keep your savings under your mattress – or in a bank account for that matter. Therefore investing is a must.

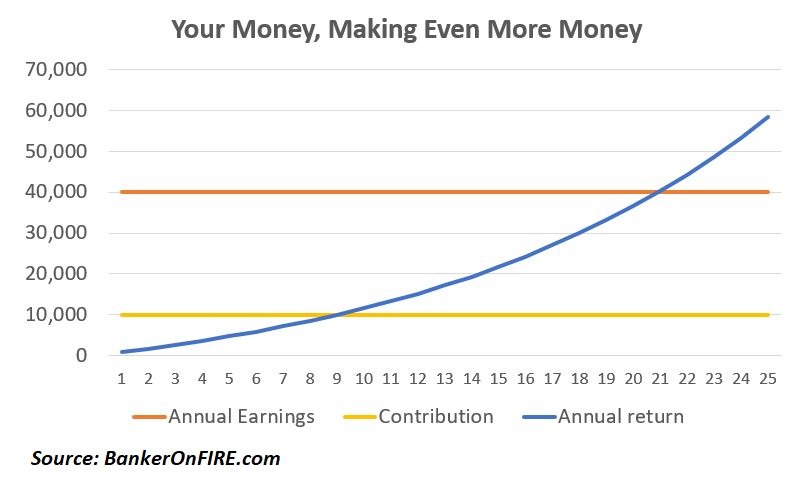

And then there’s compound interest. You can get very theoretical about it, but the bottom line is this: you put money to work. That money makes some more money. That additional money then goes to work for you as well.

As an aside, here’s a quick mental hack to help wrap your head around compounding.

It’s slow going at first but give it enough time and you’ll have a whole load of money working away for you. If you keep at it long enough, that money will start making more money than you do.

This is the magic of investing.

Now that you are convinced about the merits of investing, there’s one final pit stop we have to make before we dive in:

Taxation

No, it’s not the most exciting topic – but it’s a crucial one. Hopefully, you have figured out by now that giving a cut of your earnings to the taxman, while socially important, doesn’t exactly accelerate your path to FI.

Minimizing taxes is important, so we’ll come back to this one below.

Put Your Money To Work

For many people, this step takes far longer than it has to. There’s the eternal fear of being a loser. And then there are the perceived complexities of investing.

In reality, investing isn’t hard. There is an easy, cheap, and universally accessible way to do it. It’s called the stock market. And the sooner you start, the more time you have for compound interest to work its magic.

Don’t get distracted by the fancy lingo, the advanced concepts, and the empirical arguments. Instead, focus on the following:

Step 1: Investing in a tax-efficient manner.

As mentioned above, taxes make a MASSIVE difference to your net worth. There’s absolutely nothing wrong with legally minimizing the amount of taxes you pay. As a matter of fact, many governments put in place incentives that can help you do so.

Here in the UK, the easiest way to go about it is by using a workplace pension or an ISA. In the US, 401(k) is your best friend.

Step 2: Investing in a low-cost, diversified index tracker.

This one is real simple. Fees decimate your investment returns over time. Diversification reduces the risk (i.e. the variability) of your returns. And passive investing beats active.

So keep it simple. Open up a Vanguard account. Put your money into their global index tracker fund. Keep adding every single month. Done.

Leverage Real Estate

This is the third and final building block in your future financial empire.

Once again, people in the FI community often spend too much time arguing about it. Some have true religion on the fact that renting is the way to go.

Many others treat home ownership as a pre-requisite for financial independence. So which one is it?

As with many things in life, an evidence-based approach may be the way to go. If you look at the universe of people who have achieved FI, you will find that the majority of them own their own houses.

There are good reasons for that. Owning a house eliminates one of the biggest expense items in your budget. Taking out a mortgage helps you supercharge your returns.

And if you want to move into real estate investing down the road, owning your first property is the ideal springboard for it.

The bottom line is that it is very hard to go wrong with real estate, provided the following apply:

- You buy a house in an area with a growing population

- It has a good economic backdrop (i.e. it is attracting new businesses as opposed to being full of factories that are slowly going bankrupt)

- You plan to stay there for at least five years, which will minimize selling costs and impact of short-term price changes

- The housing market regulations aren’t punitive (the UK is a great case study)

This is it. Yes, you can build a case for renting over owning. But the fact pattern suggests that if you want to reach FI, owning your home is the way to go.

And with those three components, you are 80% there. Will it take time? Sure it will. Is there more you can do to get there faster? Absolutely.

Just don’t lose sight of the fact that life needs to be lived, not spent fretting about getting to financial independence as quickly as possible.

Putting the above building blocks in place leaves you well ahead of the game. What you do with the rest of your free time is up to you.

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Hi BoF – another great article, thank you. Can you elaborate on which Global index tracker fund specifically? Do you mean their Lifestrategy funds (0.22% fees)? The only Global Balanced Fund appears to be actively managed with 0.48% in fees?

many thanks

Raj

Lifestrategy has too much UK bias. What makes me think I know more than the market when it comes to allocating capital…

BoF is probably referring to this:

https://www.vanguardinvestor.co.uk/investments/vanguard-ftse-global-all-cap-index-fund-gbp-acc

I use it for my son’s JISA as it’s v easy and needs to maintenance.

For my own and wife’s investments, we use a combination of VEVE and VFEM, using the effective split from VWRL, updated on a monthly basis.

Spot on Genghis, I had actually forgotten about the UK bias of Lifestrategy.

Raj – it’s either the one Genghis suggested or this one (VWRL):

https://www.vanguardinvestor.co.uk/investments/vanguard-ftse-all-world-ucits-etf-usd-distributing?intcmpgn=equityglobal_ftseallworlducitsetf_fund_link

Raj, I would assume he means the FTSE All Cap tracker, think it’s 0.23% and passive

That’s right. Either this one or the FTSE all world ETF

An Interesting Article and great blog.

I started my journey around the age of 26 saving for a house. I made a lot of sacrifices, no holidays, cheap accomodation, structured savings plan and high interest regular savings accounts (5% best available back then).

I am now 36 and having purchased my first house at the age of 30 am speeding along my FI hourney. The first property was a four bedroom new build in Birmingham. I lived there alone and rented out 3 rooms to lodgers. This income paid for the mortgage and bills, allowing me to start to dabble with monthly investments with my wages. I brought the house for £145k in 2013 with a £25k total outlay (deposit and fees). In 2018, having paid nothing towards the property out of my salary I sold the property for £175k with £85k remaining on the mortgage taking £90k from my initial investment of £25k over a period fo five years.

I now own a much nicer detached four bed property in a fantastic area which was £465k to purchase in 2018 with just over £300k remaining on the mortgage. My wife and I joint own the property and still have a regular lodger paying monthly rent to go towards overpaying the mortgage.

I save 67% of my wages each month into my work pension, lifetime ISA, ISA and standard share account. I have also pushed in my career, constantly promoting up from £15k a year in 2009 to now being on circa £65k including all my benefits. During this I trained as a personal trainer after havign one help me become fitter and now train clients part time to earn an extra income though something I enjoy more than my regular job. The whole thing is a process you need to switch your mind into.

The amount of people who tell me im lucky to be in my position amazes me. Many people have no idea how to slowly build wealth though at its core it is very simplistic and just requires that you take an interest in your finances and situation and become responsible for your spend. Monevator was the site that first taught me about investing, attitudes to debt and saving. I really think these things should be part of our national ciriculum.

Thanks Tom – appreciate the kind words and you taking the time to share your story. Very inspiring trajectory and an impressive savings rate to boot!

The first couple of years can be v. tough but once you’ve gained some momentum, things get easier and at a certain point it just snowballs. All about clearing that initial hurdle.

I’m not holding my breath for personal finance to be included as part of the curriculum, but thankfully a lot of good information online for people who want it. I’m also spending a lot of time educating my children and nephews about money and investing.

Challenge is that clearly not everyone benefits from a move into passives / decline in consumer spending, so I don’t expect the government to pick up the FIRE baton anytime soon!

I’ve said it before I get really irritated when someone calls me ‘lucky’. Yes there’s a bit of luck involved in everything but predominantly it’s good habits pretty much since being 18 and working hard at my career

Bought my first place at 21 a shared ownership 1 bed flat 132k sold 3 years later for 150k

Moved to a 2 bed house at 200k sold 7 years later during the gfc for 197k (should have kept it)

Bought my current property for 315k current value 500k. Got divorced and ended up with a mortgage nearly 6 times my salary

Lived with lodgers and paid 40k off the mortgage in 2 years and with salary increases down to less than 3 times salary

Have always contributed at least 10 to 15% of my salary to my pension no matter what I earned

The missing link for me was long term investing outside of my pension which I’m now doing since being about 33. I’d done Saye schemes but they went on the house.

I totally accept there’s people who can’t do this but most of the people who say I’m ‘lucky’ are earning well above the average salary. They’re just not willing to be patient

As you say, there’s a degree of luck in everything.

That being said, over long periods of time it does average out. Hard to find a person who has been extremely unlucky or extremely lucky their entire lives (they exist, but rare). This obviously leaves aside folks with structural disadvantages such as being born in poor countries or with severe health issues.

Hence, after a certain point it’s all down to consistently making good decisions over long periods of time.

spot on bof – would the pareto optimality make a case for specialization as opposed to spreading thin? Or in the case of someone pursuing FIRE, focusing on a career as opposed to side hustling as well?

I have a liberal arts background, and I wonder how different it would’ve been if I’d taken a more focused approach. I don’t regret it, but I sometimes wonder.

I think being good at your job is one of the most effective ways to move the needle in terms of your pay, which should ultimately help savings.

There are two reasons I advocate side hustles:

1. Diminishing marginal returns. With most “regular” (i.e. 40 hours/week) jobs, you can probably knock it out of the park by spending an extra 10 – 12 hours a week. Going beyond that is unlikely to result in higher pay

2. Diversification. Always good to have a fallback plan in case your employer falls on hard times or you happen to rub people the wrong way.

As far as your education background – who knows. Everyone has a different journey, having no regrets is the right approach.

> The housing market regulations aren’t punitive (the UK is a great case study)

Can you dive in deeper on why the UK is a great case study?

On a more general thought, I’ve always found it easier to invest in the stock market than in the real estate market. While for stocks you have the 99% agreed principles (passive funds, global market, 90/10 shares/bond fund) for real estate you have all these extra factors: is London too expensive, will the area be okay, will the neighbours be okay, is the house good, what about the nearby school. Renting provides this big optionality where if I dislike one of the factors, I can send my notice and then move out.

When it comes to UK property investing, the reader comments on the post below are quite illuminating:

https://bankeronfire.com/why-and-how-i-bought-more-real-estate-in-a-pandemic#comments

All of our properties are in North America, where the regulations aren’t nearly as punitive.

Your point on complexities of real estate investing is spot on. That’s why you should always target a return on property investing that’s at least 3-4% north of what you would get in the stock market. Otherwise the extra risk (and hassle) simply don’t make sense.

Pingback: The Full English Accompaniment – Negative interest rates – The FIRE Shrink