To kick off today’s post, let me tell you a little story.

The story is about a good friend of mine from the MBA days. To preserve confidentiality, we can call him Mike.

Today, however, I will call him the Frustrated Consultant.

With that in mind, I present to you:

The Story Of The Frustrated Consultant

There are many parallels between Mike’s journey and my own.

It starts in the late noughties, when he also took out a $200k loan and moved halfway across the country to pursue an MBA.

We met at one of the recruiting functions at the very beginning of the program. Like me, Mike wanted to move abroad post MBA and experience living in Europe (because who knew this was going to happen?)

Unlike me, he was smart enough to avoid investment banking. Instead, he landed a coveted role with one of the Big 3 consultants, no easy feat.

We landed in London within months of each other – and went to work chipping away at our respective student loans.

Mike did well. Not too long ago, he made partner at his firm. We don’t talk numbers, but my sense is that he clears somewhere around £400k a year. Chump change it isn’t.

Mike is also quite good with his money. He isn’t flashy, has a good savings rate, and has been investing in the stock market.

In other words, I am sure his net worth is somewhere in the low seven figures.

So why is he frustrated?

Well, the thing is, Mike is from San Francisco. And if there’s one thing you’ve got to know about San Francisco is that housing prices have been on a tear for the past decade.

So Mike once ran the maths on what an alternative journey would look like.

To be specific, he figured out that had he used his $200k to buy a $1m house instead of funding an MBA, that $1m house would be worth around $2.5m today.

Correspondingly, Mike’s equity in his home alone would be around $1.9m (including some mortgage paydown).

His actual net worth?

Likely much higher, considering savings, investments, and all the money he could have made working in the tech sector out west.

Guess what? I’d be frustrated, too.

Years of risk and sacrifice, including going through the professional equivalent of hard labour. Despite what people may say, consultants bust their chops just as hard as bankers or lawyers.

All the maneuvering and stress related to making partner in an ultra-competitive environment.

More time on planes than can possibly be good for a human being.

All to end up well behind the “status quo”.

Risk And… Reward?

When Mike shared his frustration over a pre-lockdown dinner (remember those?), his wife stepped in with a very pragmatic observation.

That is, the fact that Mike was making a decision based on the best available information to him at the time.

Sure, you could build a case for San Francisco housing back in 2010. It’s even easier to do so today, with the benefit of hindsight.

Some people saw the light back then – and went all in. But many (if not most) didn’t.

They happened to have bought a house in SF because they needed a place to live in – and ended up beneficiaries of one massive property bull market.

Now, I don’t disagree with Mike’s wife here, though given that they met here in London, she was probably slightly miffed with the whole idea of this alternative journey.

But to me, there’s a broader argument here as well.

Wealth vs. Wealth

When I look at Mike’s net worth today, I see it as a function of many factors.

Sure, there’s the stock market, which forms the bulk of his portfolio.

But peel back the onion and there’s much more there.

The education credentials. The network. The industry knowledge and experience.

A fantastic (and rapidly growing) Rolodex of C-suite decision-makers.

The quality of life that comes from pursuing one’s dreams of taking chances and following a path less travelled.

The fact that as far as I know, Mike hated his pre-MBA job.

Some of these things are already in the net worth number, a monetary crystallization of all the efforts Mike’s put in over the years.

Many others are bound to be reflected in that number going forward.

And some, like the quality of life, will never be reflected – but that doesn’t make them any less important.

To me, the above components would mean far, far more than owning a great house with tons of equity in it.

A Dose Of Pragmatism

If all of the above sounds a bit too wishy-washy and impractical, we can add a quantitative component here.

First of all, there’s diversification.

Mike’s portfolio of “assets” is so broad that even if you were to take all his money away today, he’d be back up in millionaire territory in just a few years.

Can’t say that about someone sitting on an expensive piece of land (though I certainly hope no one has their house taken away!)

Then there’s future growth.

I am pretty confident that going forward, Mike’s combination of skill and network is likely to compound much faster than SF property.

And, of course, Mike also has the optionality of going back home, landing a plum strategy role in Big Tech, and getting in on a piece of that West Coast action.

But most importantly, Mike’s story presents a crucial lesson for all of the investors out there.

It is the lesson of:

The Role Of Luck In Investing

There are hundreds of millions of investors in the world.

Perhaps even billions, if you consider all homeowners to be investors (Mike clearly does).

By virtue of pure math, some of them are bound to get lucky.

And those are the ones you hear about. The GME and Bitcoin success stories are all over the news.

Losers? Not so much.

It’s much more fun to hear, talk, (and imagine what it would feel like) about the 0.1% who make millions, not the masses who lose their houses.

When is the last time you read a story about homeowners in Detroit?

The unique thing about investing is that you can do everything right, and still come out behind.

If you work out twice as much as your friends, you are likely to end up with a better body.

Studying twice as hard as your classmates is a near-guarantee of blowing them out of the water when it comes to exams.

They even say that in blogging, the longer your blog has been around, the more successful it will be (note – I wouldn’t know).

In investing, that simply doesn’t matter.

You can have a perfectly constructed portfolio.

In the meantime, your golf buddy literally sleepwalks into an investment opportunity and makes more money in a year than you will in your entire life.

So what can you do about it?

Venn Diagrams

The good news of the day is that planning and luck are not mutually exclusive.

And yes, you can have the best of both worlds, without rolling the dice on your financial future.

First of all, success correlates to exposure.

Whether it’s building up an equity portfolio, accumulating real estate, going all-in on your career, or focusing on side hustles – something is bound to work. You just need to take enough shots at the goal.

It might even be that everything works.

Second of all, luck isn’t exponential – but compounding is.

Taking one wild punt after another doesn’t improve your chances of success. It only guarantees that at some point, you will run out of money.

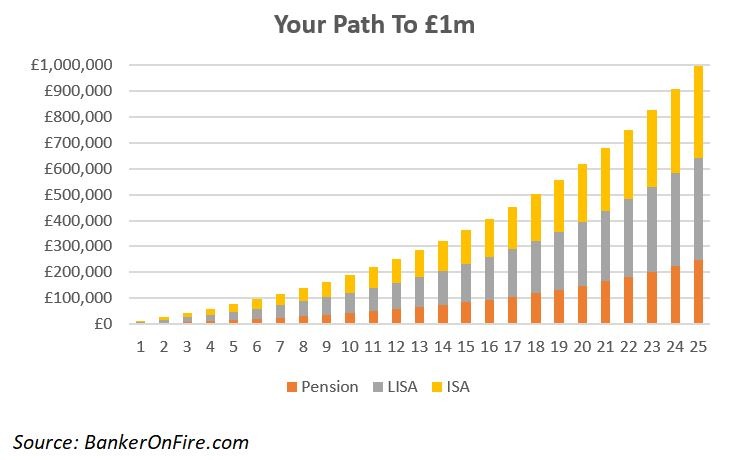

A proven investing strategy, on the other hand, is guaranteed to gain momentum over time. Kind of like this:

You simply need to stay the course long enough for your efforts to pay off.

Finally, you always have the option of allocating a portion of your portfolio to speculative bets.

Someone with a $500k net worth can easily put aside $50k as “play money”, without risking their future along the way.

If the bet pays off – great. If not, you are still on track financially. Have your cake and eat it too.

Yes, luck plays a crucial role in investing.

That being said, you are much better off making your own luck instead of relying on it.

Most importantly, don’t get frustrated if you feel that luck has somehow passed you by.

If there’s one thing that’s certain, it’s that your day in the sun is on its way.

Happy investing!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Good post thank you. Better lucky than smart as my old boss used to say. Early in my career I interviewed for 3 jobs – GE capital, BOFA and Lehman brothers. I would have certainly taken the Lehman job if I got it. Luckily I didn’t..

Indeed. I know a few ex-Lehman folks who got pretty much wiped out in 2008. Not that the rest of the industry was in a good place then, but Lehman and Bear really took the fall.

Which one did you end up going with?

BOFA. That turned out well in the end. What I didn’t realise until later was the GE capital guys morphed into Resolution – that would have been a home run…

Indeed, though a rocky one. The GE mothership has been unraveling for the past decade.

Great perspective. More folks get lucky in this market, but the investor base is rising as well. But then, we better focus on what’s in our control (incidentally, this also favors luck)

Thanks BoW. It also gives you peace of mind. No point stressing out about what could have or should have happened.

Much better to learn from your mistakes, move on, and make your own luck instead.

I think in general people are pretty good at respecting windfalls that came with conscious risk taking with the aim of a high payoff. I will personally not be bitter about the guy who bet his life savings in a crazy bet on Bitcoin because that came with a huge associated risk that they were willing to tolerate.

What’s harder to accept is, as in your example, someone whose house quintupled, or who wins the lottery with a startup that they joined only because they couldn’t get in a more established company (as opposed to the person who purposefully chose it).

But in the end I’ve learned something that has helped put my mind more at ease: when you’re jealous of someone, ask yourself if you’d be willing to swap your life 24/7, 100% with them. You can’t cherry-pick the lucky aspects and ignore the rest, you get the whole package. Maybe they had some hardships you didn’t go through, maybe they don’t have the same friends, healthy family, sense of accomplishment and so on. When I think of this, I’m instantly grateful and realize I wouldn’t swap my life with anyone.

That’s spot on. Everyone is fighting their own battle, and 99% of the time it’s invisible.

I’m not a very religious person but I find that the ritual of saying grace carries a lot of wisdom. It’s the best way to instantly shift your frame of perception and increase happiness.

I would take exception with being able to out study or out exercise your way to the head of the class. There is no way anyone of average intelligence could ever obtain a chemical engineering degree and find success in that field. Nor can someone with nonathletic genetics ever dunk a basketball without a trampoline. You can be the best you can be but if you are rational you have to admit that the best you can be is often constrained by forces you cannot influence. The trick is finding something you can monetize that you can also excel at. And thats hella hard for most people though it was pretty easy for you and me.

Yeah I agree. You’ve got to start at a similar point in terms of ability.

I’d flunk out of that chemistry class in a blink of an eye. But put me in a corporate finance class, and my ability to do well will be largely determined by the effort I put in.

This is especially true as people often self-select into groups of similar ability. Figuring out your edge goes a long way in determining what group that is.

I would argue that an inventor can create their own luck by reducing their investments in index funds and opt for stock-picking instead. Index funds will do well, but by definition, they won’t be better than average.

Granted there is a high chance that you won’t beat the market. Most professionals don’t. Everyone should at least have a large portion of their money in index funds. But it doesn’t have to be all of it.

Entrepreneur Bo Peabody once said, “The best way to ensure that lucky things happen is to make sure a lot of things happen.” If you want to do well, you have to put yourself in a position to do well.

Incidentally, I’ve got a post on active vs. passive investing coming up next week 🙂

That being said, I think what you are getting at is the “success correlates to exposure” point above.

The more things you try, the higher the chance of success – subject to you giving it a proper go.

I haven’t considered that. While it may not be the same as an MBA, I have contemplated so many times of not going to undergrad and spend the $50k for the 4 years. Instead, get a job making $30 – 50k per year so I would have potentially been ahead by $170 – $250k versus an undergraduate me.

It kinda makes you think but better to live in reality rather than an alternate universe that may or may not have happened.

Incidentally, I had the same argument with myself at 19.

I was working in the hospitality industry clearing $4-$5k/ month (post-tax). I had correctly calculated that post-undergrad, I would be making roughly the same amount of money in an $80k professional job. Thus, what’s the point?

My parents didn’t criticize but weren’t impressed. I double-clicked on uni as a result.

Two degrees later I couldn’t be more grateful for that decision. However, the payoff would have been far more uncertain had I stayed in my first job post graduation.