Debating the merits of active vs passive investing has got to be one of the favourite – and entertaining – pastimes in the FIRE community.

Clearly, the default stance is that passive beats active by a stretch.

At the same time, take a closer look at many “passive” portfolios and you will find more than a pinch of active investments inside.

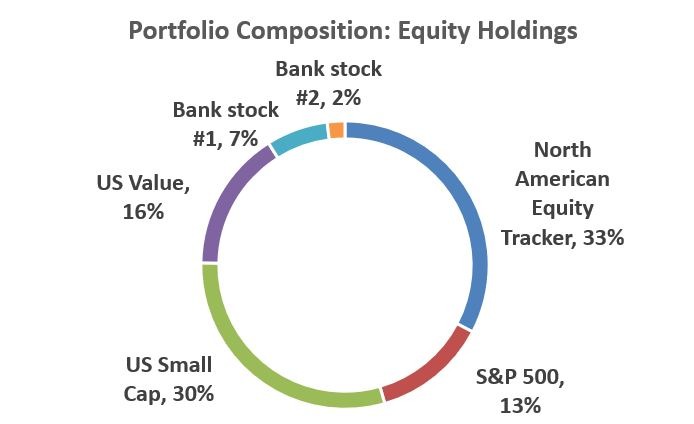

Certainly, my own portfolio is no exception.

That’s right.

10% in two single-name banking stocks (though a big chunk is soon to be liquidated).

Another 46% in small-cap and value stocks.

What gives?

Mission Impossible

One aspect I’ve always found fascinating about the active vs passive investing debate is that it’s nigh impossible to get to an objective answer.

Sure, empirical evidence suggests that passive will beat active.

But most active investors shoot right back and claim that they are the ones who bucked the trend.

Off the top of my head, I can think of at least six challenges in trying to determine which strategy is better.

There’s the issue of measuring returns. Not hard in principle – all you need is the timing of cash flows, an excel spreadsheet, and an XIRR formula.

And yet, if I was a betting man, I would wager that very few active investors have a proper system for tracking their returns.

The same applies to investing in funds. As Ben Carlson pointed out in this piece on Peter Lynch:

During his tenure Lynch trounced the market overall and beat it in most years, racking up a 29 percent annualized return.

But Lynch himself pointed out a fly in the ointment. He calculated that the average investor in his fund made only around 7 percent during the same period.

When he would have a setback, for example, the money would flow out of the fund through redemptions.

Then when he got back on track it would flow back in, having missed the recovery.

Assuming you’ve got the returns part figured out somehow, there’s also measuring risk.

In other words, what is the standard deviation of your returns? Did you take on more heartburn than needed?

Show me an individual active investor who calculates a Sharpe ratio for their portfolio and I’ll show you a unicorn.

Got the risk box ticked as well? Well, how about measuring luck?

Was your outperformance a result of skill, or an individual case of the infinite monkey theorem?

Who knows?

And that’s before you get into things like time horizons (i.e., will your outperformance persist) – or the fact that if the active money management sector keeps shrinking, generating alpha will get much easier.

A Better Way

If you can figure out a way to address all of the points above, I’d love to hear from you in the comments section.

But in the meantime, I would venture to say that agonizing over which strategy is better might well miss the point.

Instead of debating the merits of active vs passive investing, it’s far more productive to focus on actual investing.

Things like:

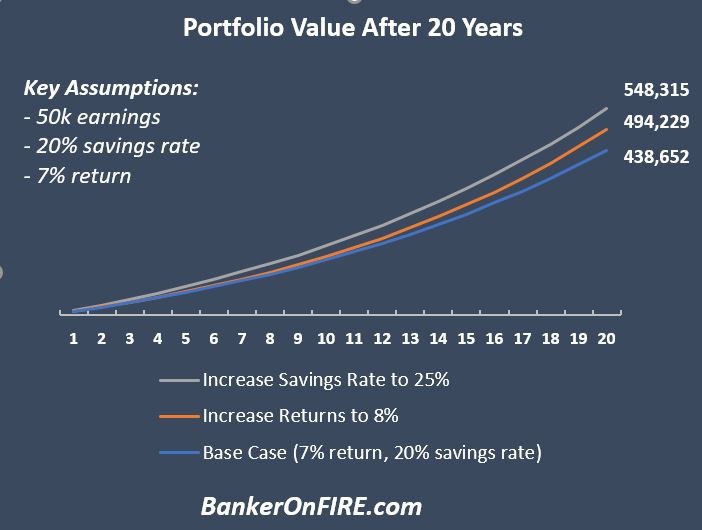

Your savings rate, which has a far greater impact on your portfolio than your returns:

Investing early and often.

Diversification – especially for active portfolios.

Minimizing fees. Returns come and go, but fees are always there.

Making some investments that pay you every month.

Most importantly, consistency. Once you’ve zeroed in on a strategy, give it sufficient time to compound.

It’s a bit like jumping on a flight to Hawaii.

You can go direct – or choose one with a layover. There may be tailwinds or headwinds along the way.

Heck, you might even find yourself on an unscheduled stop along the way.

But the most important thing is to board that flight in the first place.

The sooner you’ll do it, the faster you’ll arrive.

Happy investing!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

For something that “misses the point” you don’t half beat around this bush a lot !! I feel like I’ve been click-baited somewhat?!

I’ve said this before, but … although passive investing may beat an AVERAGE of active investments, the ABOVE AVERAGE funds, ITs etc are super easy to find and monitor. I’m not wholly advocating momentum investing as such, but the pandemic stopped me looking beyond 1-year performance as there doesn’t seem much point! Rightly or wrongly ?

Active isn’t not everyone’s cup of tea, it takes a little more confidence and a little more involvement and time.

But every time you diss it, I’ll be here ?

I’d be more worried about having all my investments in the US if I were you (!)

Those “ABOVE AVERAGE funds” that are easy to find quickly become average or below average as capital starts flowing into them. Research has showed that as AUM increases, most funds cannot consistently generate alpha.

Those who really beat the market (consistently) are not open to the public, e.g. Renaissance.

I would also argue with how “easy” it is to identify funds – the average person cannot do that.

What do you mean by “there doesn’t seem much point” to look beyond 1-year performance?

Phil,

Not dissing at all. The broader point I am making is that it’s nearly impossible to objectively prove whether an individual’s active investment strategy beats or underperforms the benchmark. Thus, the whole debate around “what’s better” is moot as folks will be wedded to their pre-existing points of view.

Now, I’ve got a strong preference for passive investing for reason that I’ve laid out on this blog in the past. But in my mind, it’s FAR better to be an active investor, especially with the right strategy, than to be sitting on the sidelines in the first place.

By the way, you are spot on re: US equities. I’m basing my allocation on their outperformance (on a risk-adjusted basis) over the past 100 years. But does that put me into active investing territory? Certainly does.

When we look back at things in a decade, perhaps your approach will beat mine by a few basis points. Perhaps mine will work out better. But both are guaranteed to outperform someone who just can’t get started.

@John – this reminds me I’m still mulling that post idea of yours over! Have got to say it’s a meaty one but think I’m slowly getting there 🙂

Ha – I loved this – cheers! It’s a bit like when I see people arguing for hours about the best instant access account. At some point you have to stop and realise the 0.1-0.2% diff you may be able to eek out on your emergency fund is really not going to move the needle if you are serious about FIRE.

Focus on what makes the biggest difference first, fiddle with the ‘details’ later.

I did laugh though – I actually calculated my Sharpe ratio the other day when testing out a mix of portfolio diversification blends I’m considering. Woohoo – I’m a unicorn! 😉

Wow, that’s next-level stuff!

As much as I enjoy corporate finance, I’ve never done more than a back of the napkin calc on my Sharpe ratio 🙂

Ha – I did get some some help pulling the data from an awesome tool I found. It’s cool though – drop 1-2% returns & half the vol, yes, please for us FIRE’d lot 🙂

Just helps when playing with ideas!

An interesting discussion about passive vs active is the issue of when passive starts to outflow due to declining willingness to be invested. This could have an, unknown as yet, Very Negative effect on the whole market.

Let’s assume the all investors are 100% in passive funds.

If the market declines for any reason (market sell off, more retirees etc) Then the sell orders are selling into a market with no buyers and no liquidity.

The argument is the Active managers holding a few percent of cash act as the liquidity, to start buying when there is a sell off, stabilising the market.

In this extreme case 100% passive is bad.

However the trend is moving toward passive as has been proved time and time again, most active managers never beat the passive. And fewer still beat it year after year.

Where the change starts to become more serious is anyone’s guess.

**************

The one thing active I’ve had good success with has been With the Stockopedia

https://app.stockopedia.com/content/new-year-naps-top-stocks-for-2021-and-some-bold-bets-on-big-mo-733384?

Their NAPs portfolio has been doing 20% a year and 2020s hit 27% (after a January 2020 Portfolio purchase)

It’s the closest thing to the golden goose I’ve found anywhere.

Their founder has done some fantastic posts and I think their software is amazing. The theory and logic described for the NAPs (No Admin Portfolio) is genius.

I agree with your assessment of what might happen if the asset management community was 100% (or nearly 100%) passive.

That being said, I doubt we will ever get there. As the active management industry reduces in size (due to outflows), the remaining active managers will find it easier to generate alpha.

Thus, there will always be some kind of a balance. The real problem with active management is that the industry had gotten too large for its own good. That being said, active price discovery will always remain in demand.

Haven’t heard of Stockopedia – will have a gander.

Another corker BoF – always a pleasure and an interesting read!

Thanks Dalton, much appreciated!

Thanks for an interesting read. To answer your question I use Trustnet as one tool to track my portfolio. Like many others, my portfolio is a hybrid – mainly passive with some active to spice it up a bit! I have two portfolios on Trustnet – one is the complete holding and the other the complete holding less the active funds. By looking at the key ratios & performance analysis, you can see the Sharpe, alpha, volatility etc for each of the portfolios. It gives me some idea how much more return I am getting by adding the active component compared to a purely passive portfolio and at what level of increased risk and volatility.

Thank you! I’m aware of Trustnet but didn’t know they’ve got this kind of functionality. Very helpful.

I can’t see me winning any arguments on here about active investing! Jon, you probably already know that there are league tables of fund performance which, without having balls of crystal, is one way of tracking performance/momentum. It works well enough for me. In current conditions.

What strikes me is that these arguments are a bit like p!ssing in the wind. By which I mean it’s been difficult to lose money in such a long bull market… let’s see what happens in very different conditions. Active? Passive? Premium Bonds? Bitcoin? Who knows which will triumph ??

Over and out.

Pingback: Rich is having passive income greater than your burn - Apex Money

Good article. The key ingredients are saving, investing, reduce expenses, and time.

Pingback: Wednesday Reads: Drop? What drop? - Dr FIRE

Pingback: Saturday Linkage: – 39 Months

Great points here. Focus on saving/investing and you’ll be less reliant on the results or trying to beat the market. I recently threw some money at ARK funds pretty closer to the absolute top haha, enough to convince me to stick with VTSAX and not chase higher returns. We’ll see how that small (and getting smaller) portion of my portfolio performs over time, but a near 20% haircut within the first month, even of a planned long term investment, is hard to stomach. Intentional ignorance is bliss.

I like Cathie Wood a lot. I also find her investment papers very credible and insightful.

You are correct in saying that now that you’ve chucked the money in, might as well gear up for a long (and volatile) ride.

I suspect ARK will do okay, but keen to see what risk-adjusted returns look like in 5 or 10 years.