This post was first published in January 2020 and updated in May 2021

Clearing your first 100k is one of the most exciting milestones in your financial journey.

But it’s getting to your first million that makes you feel like you’ve finally arrived.

No, a million isn’t what it used to be back in the day.

In fact, some folks will argue that a million is not enough.

Perhaps. The question of how much is enough is one that only you can answer.

The good news, however, is getting to that first million is well within reach for most people.

I have previously written a post about my own journey from zero to one million:

It was anything but predictable, full of setbacks, tough stretches, and lucky breaks – but totally worth it in the end.

As I wrote about my experience, I cautioned readers against spending too much time forecasting their net worth.

Life is bound to throw a few curveballs at you.

You simply can’t create an Excel spreadsheet robust enough to accommodate them.

In addition, if you really want something, it’s much better to focus on the process instead of the outcome.

But that got me thinking – if I can’t give you a detailed roadmap, can I at least try and signpost the journey for you?

What would the road ahead look like for someone who is based here in the UK, starting from scratch and determined to become a millionaire?

Sure, you are bound to have some ups and downs along the way.

It might take a bit longer – or you may end up getting some wind in your sails and crossing the finish line ahead of schedule.

But the beauty of building wealth is that unlike many other things in life, it’s not binary.

As long as you do the right things, you will achieve your goals.

All it takes to win at life is consistent execution.

Do you want to know where your first million will come from – and how long it will take?

Then let’s dive in.

Establishing The Building Blocks

Building wealth may not be easy, but it sure is simple.

Let’s start by recapping the three fundamental principles:

- Spend less than you make

- Invest the difference

- Watch your wealth grow

The gap between your earnings and spending is also known as the savings rate.

The higher it is, the more you have to invest. The more money you invest, the faster you’ll achieve your goal.

Here in the UK (and many other countries with woefully underfunded public pension systems) the government finally realized that if you don’t save for retirement, it won’t have the money to help you down the road.

So to help you avoid a diet of fried wasabi in old age, it came up with a couple of nifty savings vehicles that reward you for saving money.

In practice, this means that the government will give your savings an extra boost – as long as you agree not to spend the money you save right away (which is kind of the whole idea of saving to begin with!)

The first such vehicle is called a workplace pension.

The “bad” news is that you are forced to put a percentage of your salary aside every month.

The really good news, however, is that your employer and the government will make a generous contribution as well.

As a result, you can double, or even triple the contributions you are making.

The higher your tax bracket, the bigger the benefit:

If this isn’t awesome then I don’t know what is

Then there’s the Lifetime ISA, in which the government will top up your contributions by another 25%.

It isn’t as attractive as the workplace pension.

You don’t get the employer match, the National Insurance break, or as much of a tax break if you are a higher earner.

However, it is tax-free on withdrawal. Thus, provided you’ve maxed out your workplace pension contributions, this can be a very good place to put your money.

Finally, there’s the regular ISA vehicle.

No, you don’t get an instant boost from putting money in your ISAs. However, any investment gains are shielded from future taxes.

With a hefty £20k individual allowance, it’s one of the most generous tax-efficient vehicles in the world.

This makes it a fantastic tool for folks who would like to access their savings ahead of retirement – or are solving a high-quality problem of bridging the gap in early retirement.

Depending on the nature of your employment, there are other savings plans you can participate in.

However, it is the three above that form the core building blocks of your wealth-building strategy.

Now that we have established the tools we’ll use to get you from zero to your first million, let’s get into the nitty-gritty.

First Million, Step 1: Pay Attention To Your Pension

If you think pensions are boring, then consider this: pensions are the number one tool used by the wealthy to grow their net worth.

That’s right – and there is a direct correlation between people’s net worth and the amount of money they’ve got stashed away in their pension vehicles:

The top two deciles have 50%+ of their net worth in pensions

The top two deciles have 50%+ of their net worth in pensions

In other words, if you are serious about building wealth, you need to pay attention to your pension.

Thanks to the government, this is something you don’t even need to worry about.

Provided you are 22 or older, your employer is obligated to enroll you into a workplace pension scheme.

Let’s look at what this could mean for someone making £30k/year, which happens to be the median salary in the UK.

You are required to make a minimum contribution of 4% of your salary. That will be £1,200/year.

Your employer then piles in with a 3% match, which works out to £900/year.

Finally, the government jumps in with a tax break.

That adds another £300/year (as at £30k/year you are in the basic tax bracket).

When all is said and done, your £1,200 contribution turned into £2,400.

Pretty neat – and that’s just the starting point.

Provided you don’t do anything silly with your investments and go for a low-cost, diversified index tracker instead, you can expect an annualized return of about 8%.

It won’t be a smooth ride.

Some years you’ll clear 30%+ and feel ecstatic.

In some others (remember Covid?), you’ll see the value of your investments decimated by an equivalent amount.

But if you stay the course, two things will happen

- You will not lose money

- The magic money machine will work for you day in, day out

Here’s a snapshot of how a $100 annual investment in the S&P 500 compounded over time:

Looks pretty magical, doesn’t it?

You will notice that while the market has delivered a 10%+ return historically, I’ve chosen to be conservative and picked 8% as the assumed return going forward.

And if you are worried about losing money, stare at this chart long and hard please:

Of course, life isn’t static.

I will assume that you’ll do well enough at work to at least get a pay rise equivalent to inflation (i.e. about 3%) every year.

That should be the absolute minimum because if you are young, smart, and motivated, you should find a way to grow your earnings much faster than that.

And if your existing employer doesn’t reward your hard work, just find a new job.

But assuming that your pay will increase by 3% per year, then so will your pension contribution.

At first, it won’t be very exciting.

As a matter of fact, once you’ve set your contribution level and investment mix, I’d encourage you to leave your pension on autopilot.

There won’t be much going on there for the first couple of years.

But after a while, thanks to the magic of compounding and minimizing your investment fees, things will get much more interesting.

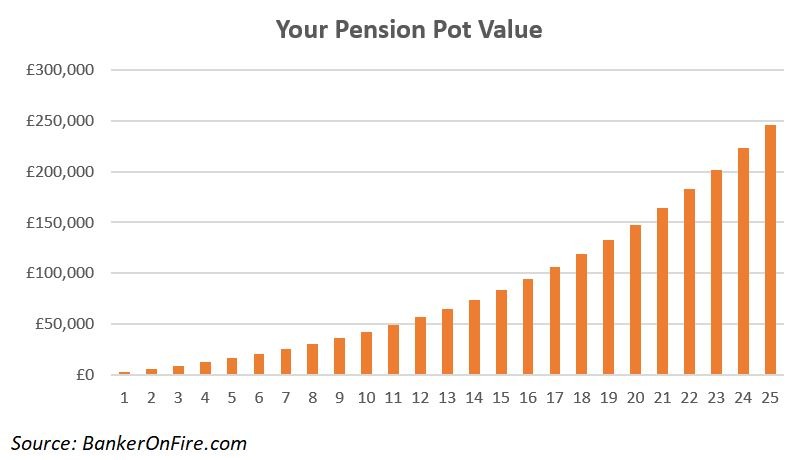

So interesting that in about 25 years, your pension pot value will reach about £250k.

Not too shabby, considering you’ve only contributed about £44k out of pocket over the years.

Boom. You are 25% of the way on the journey to your first million.

As an aside, you can still take advantage of pensions if you are self-employed.

Here’s how you can build wealth with a self-invested personal pension.

Back to regular programming now.

First Million, Step 2: Take Advantage Of Free Money

It’s time to turn to the Lifetime ISA.

The rules here are quite simple.

As long as you are between 18 and 39 years of age, you can open up an account.

Once an account is open, you can keep depositing money into it until you turn 50.

The maximum annual contribution is £4k, which the government will top up by 25%.

By now, you already know all that money should be invested in an index tracker.

Once you’ve got it all up and running and on autopilot, it’s time to step back and let this happen:

At the end of 25 years, you end up sitting on a cool £400k.

Add this up to the value of your workplace pension pot and you are 65% of the way to that coveted millionaire status.

Which means that it’s time for:

First Million, Step 3: Bring On The ISA

There’s a gap of £350k to bridge to get you to your goal of becoming a millionaire.

Assuming you don’t overcomplicate things and put your savings in a good old stocks-and-shares ISA account, you’ll need to contribute about £4,500/year for 25 years until you build up a balance of £350k.

Boom.

You now have £250k in your workplace pension, £400k in your Lifetime ISA and £350k in your ISA.

Provided my math skills haven’t abandoned me just yet, that means you’ve just cleared your first million.

And not the boring, dollar kind either.

Nope, you’ve got one million pounds, which translates into about $1.4m if the current exchange rates happen to hold up.

Bringing It All Together

Let’s now take a step back and see how the three pieces of your millionaire equation come together.

It will take you about 10 years to go from absolute zero to £200k.

Make no mistake – this is the toughest bit, the place where most people falter.

The advantage that you have, however, is that this is the part of the journey where you are youngest, most energetic and highly motivated.

And things get rather easier from here onwards.

Because the next £200k will only take six years.

By this point, you will have found your pace, so you will add a further £200k in another four years.

And the last £200k will take just over two years – five times faster than the first £200k (which I’m sure felt like a total slog).

In other words, you’ll be like a runner smashing through the banner at the finish line, feeling mightly ecstatic that you didn’t give up when it felt like you are hitting the wall in the early years.

This is the magical road ahead of you

And the reason it gets easier with time? Well, take a look at the graph below.

Save for your pension contribution, the amount of money you are putting away isn’t growing over time. It’s denoted by the blue line in the graph.

But thanks to the magic of compounding, your investments grow faster every single year. That’s the orange line.

Another way to think about it is to conceptualize every £1 you put aside as a soldier in your wealth-building army.

As that £1 works for you, over time it creates another £1.

Now you’ve got two £1 “soldiers” busting their chops for you while you sleep. They create another two “soldiers”.

And if you give it enough time, you will go from a one-man squad to a whole army that is working tirelessly for you, day and night.

At some point, you get to that magical place where your money makes more money than you.

And this, my friends, is exactly how millionaires are created.

I Need To Save How Much?

I knew you were going to ask that.

If you are making £30k/year and contribute £1,200 in pre-tax earnings to your pension, your take-home pay works out to about £23k.

You then contribute another £4k to your LISA and £4.5k to your ISA.

This brings your savings rate (excluding pension) to about 37% (£8.5k divided by £23k take-home pay).

It may seem punchy at first. But consider this: as time goes on and your earnings go up, the savings rate will start declining.

It will go from 37% all the way to a very manageable 18% in your last pre-millionaire year.

And even at the outset, you are still left with £14.5k of disposable income per year.

If you are in your 20s, this is the perfect opportunity to continue living like a student for a few more years until your compensation catches up.

Otherwise, you can always consider getting a side hustle of some sort to help reduce your savings rate.

Working a regular 40 hour/week job leaves you with tons of free time.

So why not use some of that time to make money, instead of spending it?

If you can line up a gig making £10/hour, you only need to work 8.5 hours a week to cut your savings rate in half.

And if you find a way to work 17 hours a week (that’s one weekend day + two nights), the extra money you make will add up to exactly the £8.5k you are putting away each year.

To contextualize things, consider that doing 17 hours/week only gets your total workweek to 57 hours.

Not ideal, but equally very far from brutal.

But I Want It Now

The more attentive of you will also have picked up on the fact that it will take 25 years.

You may consider standing up and heading for the exits, unwilling to bear the thought of waiting that long before you reach your magic number.

Do you want it now? So do I. But let me make a couple of observations.

First of all, if you start upon graduation, you will get there by the time you are 47.

And while it may not seem that way now, but as most of your 47-year-old friends (if you have any) will attest: you are still young.

You’ve got at least 20 – 25 years of great health.

Considering you’ve spent the first 20-odd years of your life chilling out and partying, following that with 25 years of work to become a millionaire isn’t such a bad deal.

Secondly, my analysis ignores a bunch of factors, making the approach above rather conservative.

It ignores the probability of you getting married and forming a dual-income household.

It ignores the fact that statistically speaking, about 50% of the people reading this will have an above-average salary.

In addition, I’ve assumed the absolute minimum employer match when it comes to your pension scheme.

The majority of employers out there are far more generous – which means you can take some of the cash destined for your ISA and put it into your pension instead.

It’s exactly how these three people become pension millionaires.

Thirdly, I’ve ignored real estate.

While buying a property will reduce the amount of money you can sock away in your pensions and ISAs, the accretion of wealth from mortgage paydown and price appreciation can more than offset the impact.

Most importantly, remember this – no one owes you your first million.

As of today, only about 5% of individuals (or 10% of households) in the UK have a net worth that high.

It’s a high bar to clear. Achieving ambitious financial goals is never easy.

Doing so on ordinary incomes is even tougher.

Despite what some people may want you to believe, get rich quick schemes don’t exist.

If they did, no one would be trying to sell you that proven method to go from zero to gazillionaire in 12 hours.

The sooner you stop trying to get rich quickly, the sooner you will start getting rich slowly.

Happy investing – and don’t forget to enjoy the journey!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Hey BoF,

Question for you on your index fund of choice. Mine has been a broadbased tracker world fund with low fees – rather than over exposing myself to the UK economy. Is this what you would do?

My slight issue is that this effectively locks in my sterling : dollar FX rate as these funds are generally denominated in dollars (albeit you can buy a GBP version which is converted from USD). If Sterling strengthens, then the value of my investments in GBP will drop to compensate for the fx movement. So the USD value of my investments is effectively set as soon as I buy a world fund.

Or am I missing something simple

On your first question, yes – get a low fee world tracker fund, set and forget. My portfolio is much more US-focused but that’s because (i) I’m a massive believer in the long-term outperformance of the US market and (ii) I might end up living in the US again at some point so want a local currency hedge.

Bottom line is that the world tracker is a fine choice.

On your second question, the nuance is that it’s more about the other currencies. If you hold a world fund, you are invested in euro, rouble, yen, peso etc-denominated stocks. So if I’m reading your question right, it’s really about how those currencies perform vs the GBP/USD FX rate. In the long run, i’d expect it to be a wash.

Wow I loved this article! It’s great to see someone break down this information for a British audience. I personally am not a fan of the Lifetime ISA because of how restrictive it can be – but there are some definite perks. I should perhaps give it another go in 5+ years time when it matches my finances better. I also love how you’ve broken this down to an attainable salary – lots of people think that to retire well you need £100k+ as a salary, and that’s totally not true!

Yes, things get much easier if you have a roadmap you are working towards. But because we aren’t that great at talking about money here in the UK, many people are missing that roadmap.

Agree with you on the Lifetime ISA. As with any deferred savings plans, there are bells and whistles. Just make sure to open one before it’s too late to maintain optinality.

PS: I’ve tried to check out your blog but the domain won’t open for me

I definitely think that you’re right about learning to talk about money! I’m very lucky in that my parents introduced me to investing whilst I was young and talked to me regularly about how their decisions worked.

The Lifetime ISA is a great idea, but as somebody who has a decent chance of living abroad, the idea of my money not being able to buy a house etc. in another country is a real turn-off – particularly as you get penalised!

I would guess that the majority of your readers earn more than average, as higher earners are more likely to be interested in personal finance. But I love how attainable you make this goal for an average or slightly above average person, earning mid 5 figures.

I recently started a new side hustle, content writing, and it‘s likely to pay £12+k a year if I work at it consistently. According to your post, this alone could make me a millionaire over time! Definitely a motivating thought.

Thanks Kat.

For what it’s worth, I have full confidence in the fact that you will one day become a millionaire (should you choose to).

On a broader note, I’ve always found it perplexing how many people rule themselves out of the running just because someone else said their goal was too challenging.

This isn’t just money – though I find that in Europe, unlike the US, many folks believe getting rich is out of their reach.

However, also has to do with relationships, health, jobs, where a lot of people settle for outcomes that are significantly below where they could possibly end up.

No point in setting unattainable goals, but setting the bar too low is much worse!

It’s so true about the first 100k to 200k being the toughest. You feel like you’re never ever going to get there

As it goes along you don’t even notice except in hindsight. I checked my net worth in Jan compared to a year ago and it had increased by over 120k in a year (not signalling! I genuinely nearly fell off my chair) about half of that was new contributions of various types but the other half was returns. During a pandemic! Mad.

Also true that nowadays a million isn’t enough. When you think a relatively modest family home in the south will set up back minimum 400 to 600k most of us are going to need to be millionaires when we retire to have a basic standard of living.

I do wonder how many people will ever retire. I think my neighbours may be shocked if they knew my income level but its because I don’t want ‘too much house’ leaving me free to build wealth outside of this.

I know often people plan to downsize (and have considered myself buying my dream home and simply running a large mortgage for a few years before downsizing ) but even cheaper areas you’re going to probably need 300k for a house. On a million that leaves you 700k to live on. Won’t be eating rice and beans but equally won’t be flying round in private jets

There’s a temporal aspect here too.

The first 200k takes 10 years – that’s a whopper of a time chunk.

The next 200k, however, only takes 6 years. The one after that – 4 years.

So objectively speaking, it does get much easier.

The thing about £1m is that if you start early enough, you can get there in your mid-forties (and that’s on a regular income). That leaves A LOT of time to push the pedal a bit more, if private jets is your thing (good old business class will do for me!)

probably one of the best articles ive read!

Thank you!

A great article, but you miss out on the fact that many people start off with student loan debt, pushing all the numbers lower as this is a drag on any income and takes an average of 10 years to clear 🙁

Thank you and you are right.

Everyone starts at a different point.

But many others will also experience windfalls along the way, such as above average incomes, dual income households or even inheritances.

Bigger point is that £1m is absolutely achievable, even on median incomes.

Controversial idea for your comments. A young person at 20 should just contribute to a LISA and an ISA. A £5k initial deposit and £500 per month in an isa for 40 years will give you ~£3.7 million with a 100% equities portfolio @ 10% returns pa. There will be more control over his access to the money and there is no lifetime limit on the money. With pensions you cannot access the money until your 57, there are limits and tax to pay.

I don’t think that’s a bad idea, insofar that it gives you MUCH better control over your money.

However, from an absolute return perspective, a pension will always blow an ISA out of the water due to the tax breaks on the way in, the employer match, the lump sum on the way out, and the fact that one’s tax rate in retirement is likely to be lower than during working years.

Assuming an 8% return, all the breaks add up to give you an actual return well into double digits. I quantified it here: https://bankeronfire.com/zeroing-in-on-your-workplace-pension-returns

Hence, I think makes sense to max out pensions first, then move over to ISAs and GIAs.

I know how great being a millionaire is and I always knew that I would get there. If I stay at my current job and continue working, I have no doubt that I would get there in the next five to seven years. However, I’ve been thinking more lately that I just kinda want to give it all up to live one year without having to work for a company…

Your story about Kelly who couldn’t find a job easily after taking an 18 month sabbatical does scare me into submission to keep giving value to my employer…

One way to de-risk it is to actually take a sabbatical as opposed to quit your job altogether.

Worth exploring if your company is offering one or perhaps lining up a job where you have that option (though you need to be in situ for a bit of time before you can take advantage of it)

That way, you are guaranteed to have a job when you come back which makes “re-entry” much easier.

I think the biggest mistake the 25-year-old me made was not contributing enough to my workplace pension. 55 seemed a long way away. Now, 15 years later, it somehow doesn’t seem so far off!

I think the tax savings on the way in and the potential for 25% tax-free on the way out makes pensions an absolutely fantastic vehicle in the UK, especially for higher and additional rate taxpayers (as long as not caught by the annual/lifetime allowance).

Great content as always, keep it coming!

Cheers David.

I found out about workplace pensions not long after I had moved to the UK – was in my early 30s at the time.

Having had a basis for comparison vs the far less generous US 401(k) plans, I knew just how much of a steal it was (and it was well before the taper was introduced).

As a result, both my wife and I went in guns blazing and pretty much fully funded our pensions over the next decade. Probably won’t hit the LTA but might get close.

Very grateful we did that and that’s why I spend so much time on this blog preaching the pension gospel!

I can now (almost) speak from experience that the path you describe will get you there. When I take my monthly snapshot of my ‘retirement’ funds at the end of May I should have passed through that 7 figure mark for the first time at the age of ~46. For a northern lad of working class stock that is something I could never dreamed of.

~70% of that is in Pensions with the balance in emergency cash, ISAs, and company shares that I am locked in to (i sell and diversify as soon as I can).

No doubts I got lucky on the way. A 1:1 company match on pension contributions upto 10% meant it was a no brainer to put 20% in my pension (at a 6% of take home pay) cost to me. This started at the age of 25 and I am certain I would not have done this without the company match.

I was also lucky over the past 5 year that the effective 60% marginal rate of tax from erosion of personal allowance effectively capped my taxable income at £100k and I was loading anything above that into my pension at 38% cost to me as salary sacrifice. Combined with strong market growth over the past 5 year enabled me to double my retirement fund; I had ~£450k at the start of 2016. With another 4-5 years of pension contributions, with the 60% marginal rate hopefully remaining, I should be complete with pension contributions and then can worry about managing the LTA.

The final lucky turn was company share schemes, either SAYE (no downside risk as can cash in contributions if shares are below option price) or parternship shares (upto £1,800/year pre tax contribution – again at 60% marginal rate in recent years).

On reflection, I have to thank my company for the position I am in, but i have many colleagues in similar positions who didn’t take the 121 match, invest in the company share schemes, and happily pay the 60% marginal rate of tax today …….

I honestly don’t know what I love most about your story as it appeals to me on so many different levels.

First, it’s the foresight and discipline to enroll in all of the schemes at a young age – and stay invested throughout.

Second, it’s the focus on really understanding and managing your tax rate (mention taxes and most people’s eyes just glaze over, including your colleagues)

And third, it’s the fact that the first 10 years of your investing “career” were some of the hardest. Not easy to stay the course after the dot-com meltdown, followed by the GFC a few years later. Many people capitulated in the noughties.

To be clearing a £1m in investments in mid-forties is beyond impressive! True inspiration for those who think becoming a millionaire is unachievable.

I’m sure I’m missing something obvious here, but what’s the advantage of a LISA rather than just increasing my workplace pension instead?

No, you are not. Unless you are a basic rate self-employed taxpayer, you will always be better off using a pension vehicle.

The one advantage of the LISA is that you actually can tap your savings early at a “charge” of 6.25% which isn’t something you can do with a pension.

However, the reason I included the LISA in the post above is just to illustrate the gamut of savings vehicles possible as some folks might not have access to a company pension scheme.

A little mental accounting trick that I wanted to share.

I basically worked out that if I give up £17,500 in net take home pay then, between tax relief and company contributions, I will end-up with £40,000 in my pension at the end of the tax year. That’s a “return” of £22,500 p.a.

People may say that you’re not comparing apples to apples here as you’re going to have to pay tax on the £40k when you withdraw and you’re comparing it to a present after-tax figure. To which I say, use whatever tricks incentivise you to save more.

This is exactly the way to think about it.

There’s a chart on this page that summarises the massive boost you get from your pension contributions. Anywhere from double to triple your money on the spot – and that’s assuming a minimal employer match and no NI breaks.

I don’t think most folks truly appreciate how glorious of a savings vehicle it really is…

This is quite interesting to read about pensions in other countries. I think where I am in the States, employers have transitioned over to a 401(K) where most employees put their own money in, tax free, and allow it to grow over time.

The limits in contribution seems different though – ours is $19K USD annual and it seems like there’s a cap at 4K + 25% (5K sterling) total savings per year in the UK?

The tradeoff here is that a lot of companies don’t have matching, so all $19K is generally out of pocket from the employee. Though some companies do offer up to 100% match so the employee would only need to put in half of the $19K and the other half is free money.

So the actual pension system here might be the most generous in the world. Mandatory employer match and a £40k (c.$56k USD) annual contribution allowance.

Sadly, that allowance starts reducing once you make > £240k a year and goes all the way down to £4k.

It’s a high-quality problem to have, but it’s still a problem – especially for people who have incurred significant student loans in order to secure highly-paid jobs.