Note: This post was first published in June 2020 and updated in November 2021

A while ago, Peter Kim (a.k.a. Passive Income MD) published a post titled “Buy one property per year and retire early”, which I found to be fascinating reading.

Somewhat unfairly, Peter took a bit of flack in the comments for making assumptions that some people thought were too high level and others thought were unreasonable.

The bottom line is that real estate investing is an extensive and complicated topic. You simply can’t cover off all the angles in a single blog post.

That being said, I thought Peter touched on an intriguing topic and have long wanted to pick up on his good work and expand on the analysis.

Were his assumptions really so unrealistic? Having come across many people who created significant wealth through real estate, my gut feeling is no. In addition, I have extensive experience myself, with a couple of nice home runs in the real estate department.

At the same time, there’s nothing like solid, hard data to back up one’s intuition.

Today, I am going to deconstruct, step-by-step, the path to wealth through buying real estate.

To underpin the analysis, I have built up a detailed spreadsheet. You are welcome to download it here so that you can follow the maths along the way.

Note: if you are confused by some of the terminology below, I highly recommend reading this book. It’s one of the best primers for real estate investors I’ve ever come across.

Another important caveat to make is that all of my investments are stateside. Sadly, the UK government has made life pretty tough for retail landlords, though some people still find a way to make it work (scroll down to comments for more information).

With that in mind, let’s kick off.

The Assumptions

Let’s start with some basic parameters. To keep things simple, I am assuming the following.

- You buy a property for 100k with a down payment of 25%

- Your bank gives you a 25-year mortgage with a 4% interest rate

- The monthly rent on the property is 780. Note: this is designed to result in a 7% cap rate, addressing one of the questions readers had for Pete

- The property will be vacant one month every two years (which translates into a 4.2% vacancy rate)

- Your operating expenses are as follows:

- Property taxes (1,000/year)

- Insurance (200/year)

- Miscellaneous (500/year)

- Furthermore, you will spend 3% of your gross rental income on repairs and maintenance. Over the course of 10 years, this will add up to ~3k

- The rent, as well as expenses, increase by 2.5% per year, in line with long-term inflation (hopefully not wishful thinking post latest numbers!)

- Property value also increases in line with inflation at 2.5% per year

- You are in a 20% tax bracket

- …and I’ve kept things simple by ignoring depreciation

The Basic Maths

Let’s now run a simple profit and loss and a cash flow statement for the property above (you can play around with the numbers in the spreadsheet):

In the first year, the property will generate ~9k in net rental income and ~2k in operating expenses. This nets out to roughly 7k of net operating income, working out to the 7% cap rate I’ve referenced in the assumptions above.

Once you’ve accounted for the ~3k of interest on your mortgage, your operating income before taxes works out to ~4k.

Subtract 800 in taxes (20% tax rate) and you are left with ~3,200 of net income.

Of course, income and cash are not the same things. To determine how much cash you will have left over at the end of the month, you need to start with your net operating income and subtract the entire mortgage payment (principal + interest) as well as taxes.

So while your income is ~3,200, your cash flow in the first year of ownership will be roughly ~1,400. You can see it on lines 61 – 65 of the spreadsheet.

Now that we know what the first year looks like, let’s take a longer-term view.

Your First Property: A Long-Term Perspective

Broadly speaking, three things will happen over the coming years:

- Your property will appreciate while your rental income (and expenses) will also increase

- Your mortgage balance will decline, meaning the value of your equity will increase

- The amount of cash the property spins off will increase every single year

You can follow the detailed maths in the spreadsheet, but in summary, this is what the next decade will look like for you:

Having invested 25k at the start of year 1, you will have accumulated $92k of equity by the end of year 10.

The net increase is $67k. Roughly 21k of this will come from cash generation and the other $46k is from mortgage paydown.

And if you extend the holding horizon to 20 years, your initial 25k investment grows to almost $200k.

On an annualized basis, this represents a return of 15.3%. If there’s a perfect illustration of the power of leverage and compounding, this is it.

But what if you didn’t want to stop at just one property?

Building A Real Estate Empire

Imagine for a moment that you were able to buy one such property every two years.

A 25k down payment implies saving up just over 1k/month. The number isn’t inconsequential but equally, it isn’t unattainable.

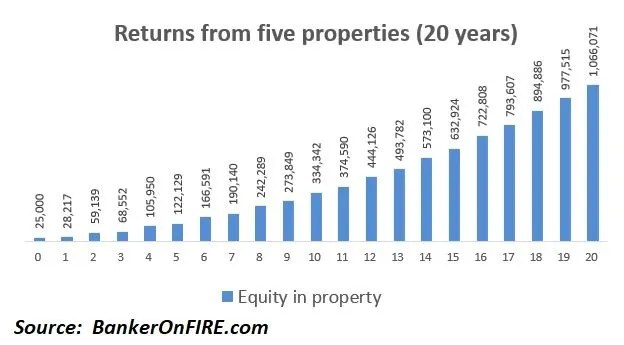

The graph below depicts one’s equity growth in this scenario:

Over a decade, you put 125k to work – and end up with 334k. You do need to keep in mind that the last couple of properties you acquire (in year 8 and year 10) will have very limited time to generate wealth.

But if we extend the time horizon to twenty years, those properties will have had sufficient time to appreciate in value, start throwing off more cash – and pay off substantial chunks of the mortgages along the way.

As a result, your journey now looks like this:

The 125k you put to work is now worth well over $1m.

Is twenty years a long time? Sure.

But crucially, it’s still short enough to allow you to get into the real estate game in your 30s – or even 40s – and still come out way ahead of where most people will end up in their 50s or 60s.

And for fun, let’s chuck in a graph of what life would look like if you bought one property every year for ten years.

Life just keeps getting better

But I Thought You Loved The Stock Market?

Of course I do. It’s one of the most democratic wealth-building tools there is.

For fun (and comprehensiveness), let’s compare what your returns would be had you invested your hard-earned dough in the stock market instead.

If you were to put 25k in the stock market every other year, in 20 years you would end up with just over 500k.

Seems like real estate blows the stock market out of the water. Or does it really?

Let’s now assume you are investing through a 401(k), a UK workplace pension, or a Lifetime ISA. All of these give you some form of a bonus on your contributions.

For a basic rate taxpayer here in the UK, employer matching and tax breaks mean you can easily double your money on the spot.

Put another way, that means that your actual returns are significantly higher than what the stock market is delivering:

Taking the above into account presents a very different picture:

A-ha!

After twenty years, you end up in pretty much the same spot! No wonder I love the stock market too.

But before we get too excited, let’s run through some crucial differences between the two alternatives:

#1. Returns

Long-term, 8% is probably where you will cap out on nominal stock market returns (assuming inflation in the 2-3% range).

In contrast, a 7% cap rate is probably on the conservative side in real estate, with many investors putting their money to work at significantly higher rates.

#2. Taxation

While it’s possible to defer taxes on stock market investments, real estate offers many more opportunities to do so.

You are essentially running a small business, which you can incorporate and use to write off eligible expenses. Over time, the incremental tax breaks can really add up.

#3. Leverage

This is the most important point. The analysis above assumes that whatever cash your properties spin off just sits on the sidelines. It also assumes you never re-finance any of your properties to release additional equity.

However, the true game of real estate investing is to use both the cash your properties generate and the equity you build up to buy more properties. So in reality, you don’t need to put nearly as much money to work to achieve the outcomes above.

The reason I didn’t reflect this in my analysis is that the modeling can get pretty hairy. But make no mistake – this is where the real magic happens in real estate.

#4. Flexibility

As great as workplace pensions may be, they come with a lot of restrictions on when and how you can access your cash.

With real estate, you don’t have to wait until you are in your late 50s to get your hands on the pot of gold.

#5. Upside

Once in a while, the government finds itself in a real bind – and looks to us to lend a helping hand, whether we want to or not.

Workplace pensions come with a cap on earnings – and total value. Real estate doesn’t.

Another one for real estate.

I have been very open and candid about views on real estate investing – including some of the challenges few people talk about.

But the bottom line is that notwithstanding the complexities, it remains possibly the best way to build wealth.

You may choose to ignore it for a variety of valid reasons – but do so with your eyes open.

Thank you for reading – and happy (real estate) investing!

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Along with the ability to use leverage without the risk of margin calls, the other thing going for property is the ability to create value.

Extending, re-zoning, subdividing, and title consolidation are all examples of activities a property developer can pro-actively perform to create wealth for themselves.

There is no equivalent available for the passive index tracker investor. That said, they don’t have to get a plumber out on a bank holiday weekend to replace a faulty boiler either!

That’s right. With the stock market, the upside is capped – and there’s nothing you can do about it. In real estate, you can certainly move the dial on your returns if you are willing to roll up your sleeves.

I also like having exposure to an asset class that is (at least theoretically) uncorrelated with the stock market.

Hate the faulty boilers though…

Higher returns equal higher risk. There are no free lunches 🙂 I’m all for real estate but I’m just realistic. Comparing leveraged properties to an index fund is apples to oranges in my opinion. I think the bottom line is that if you are determined and work properly with real estate, you will probably blow past the passive returns of a stock index fund.

Cheers and great post!

Thank you.

Yes, two different asset classes with very different characteristics. However, most retail investors can only choose between the stock market and real estate, so the idea was to compare and contrast the two.

Really useful thanks banker I’ve realised I’m looking at the first year’s return only and stopping there. Schoolboy error. Is 7% what you should be aiming for as a return yield wise?

Thanks!

7% is a great starting point. In theory, you can go lower and still do very well given where interest rates are at the moment.

That being said, you don’t want to be flying too close to the ground as interest rates might go up eventually.

Also, you want to make sure that 7% is the real yield – post appropriate vacancy, collection and expense assumptions. Far too many people price properties for perfection – and end up disappointed.

Cheers for another great post.

Real estate investing was a decent chunk of our path to FIRE for sure. Back when we started (~2003) , it was a no-brainer – you could indeed get far better returns than the alternatives. We’d regularly see between 10-15%.

We’ve since sold out our portfolio over the last 5 years or so ( one a year, obviously, damn capital gains… ). Our experience was that margins were decreasing substantially. Longer empty periods ( your one month in two years assumption would have been bliss… ) , increased rent defaults, higher maintenance bills, especially with the ever more stringent regulations demanding some bizarre things that you’d never do for your own home! And as buy-to-let landlords continue to be seen as the scourge of the universe, the downside risks were only growing.

And, as indeedably mentions – when being called at midnight to change a lightbulb, you start appreciating the passive nature of investing more. It was just time for us to get out.

Absolutely, you can make good money from this strategy. We did. But you really have to be able to pick the right properties and know the market – it’s got much harder I think as more people jumped on this bandwagon.

So for us, it was another kind of diversification in our portfolio – not the entire strategy.

Glad you enjoyed it!

You are spot on. Unfortunately, real estate is an incredibly regional market in nature and certain areas/countries just become structurally less attractive with time.

The real trick is finding a property with an unlevered yield (cap rate) well above the cost of financing. If those aren’t available, the stock market represents the next best – and far more passive – option

I don’t know where you live where you can get insurance for $200 a year. In central Florida, your looking at $1200 min for a 100K property.

Very different depending on location. I pay $250 for a $450k property in a different location (but this is liability only, tenant needs to have their own content insurance).

The broader point is around the cap rate. As long as you get to 7% you are in a good place, doesn’t matter how you get there (higher rents / lower expenses etc.)

Specific to the UK but the buy to let opportunity has been squeezed by tax and regulatory changes over the past decade or so. From my own perspective BTL isn’t an attractive proposition to move into when coupled with the challenges of holding down full time employment, raising a family and generally wanting to have (some) spare time,

What are your thoughts around REITs or property related index trackers. Certainly an option to gain property exposure, diversify investments and minimal leverage or liquidity issues?

Agreed. To be very transparent (and I’ve written about this before) my own rental property investments are outside the UK but that’s for personal reasons.

The math holds regardless of tax regime – the real issue is that losing the tax breaks makes it harder to find properties with an appropriate cap rate. That being said, ultra-low mortgage interest rates here really help.

I’m not a fan of REITs or property ETFs. Lots of agency problems with those in my opinion. I did, however, look into US property crowdsourcing. Not straightforward from the UK but think could be a decent fallback option.

I maintain a policy of only writing about things I’ve tried myself so can’t give a detailed view though.

OK, I’m going to call this one out – Perhaps I’m missing something (and I’d really love it if I was!) But the location of the property doesn’t help you, does it? You’re UK tax resident, or at least I’ve always assumed you are. You’re an investment banker, I think it’s safe to assume you are a higher rate tax payer. So – you won’t get full tax relief on mortgage interest, if you hold property in your own name, regardless of where it is. This makes leveraging completely untenable, and w/o leverage property investment just doesn’t work. Yes, you can incorporate, but that has it’s own costs and issues, and mortgages are more expensive for a corporate.

The UK government have for all intents-and-purposes banned direct property investment for UK tax residents, regardless of where the property is.

Hey Finumus, great points (as always). There are a few nuances though.

HMRC does not dictate the deductibility of mortgage interest in other jurisdictions (I’ve had professional advice on this). If you own a property, let’s say in the US, you follow the local rules to determine your taxable income. You then pay local (US) taxes on that income – and make a top up payment to HMRC depending on the specifics of the tax treaty between the two countries.

The obvious way to defer your tax liability is to re-lever your property every few years, taking tax-free cash off the table while minimizing your ongoing income tax liability. This has the effect of deferring your tax bill until the property is eventually disposed, but you can time that according to your tax circumstances.

If you hold the property through a corporation, you pay local corporate tax due, but no personal income tax in the UK until you dividend the proceeds to yourself, the shareholder. Once again, the way to minimize your tax bill is to time your dividend payments to happen in years when you end up in a lower income tax bracket (sadly, 2020 may be one of those years for me!). Another way to do it is to have varying share classes for you and your spouse and pay a dividend to a specific share class only, depending on the circumstances. Finally, you can simply retain the cash within the corporate and use it to purchase additional properties through the same vehicle.

In the UK, the picture is indeed different. My post was intended to be more encompassing geographically though. In addition, you will have noticed I’m using pretty punchy assumptions for mortgage interest (4%). Even for a corporate your rates probably wouldn’t be as high. The real trick is finding properties with a high enough cap rate…

Thanks. I had no idea that the local tax rules applied, WRT mortgage interest deductibles. That’s very interesting, I had just assumed it was worst of both worlds, because it usually is! This certainly warrants some further investigation. Thanks again.

You are right, it usually is, but seems they’ve missed a trick on this one (for now).

Cheers 🙂

Great article. I am in the future looking to house hack and build a real estate portfolio along side an index fund portfolio. Best of both worlds.

Thanks Josh.

It takes a while to scale up in real estate, but the benefits are well worth the growing pains.

Pingback: The Full English Accompaniment – Gamble your COVID days away – The FIRE Shrink

Pingback: Sunday is for Sharing: Volume 156 – Collecting FI/RE Wisdom

I committed one of the all time greatest sins that Banker has said you should never do: I paid off the mortgage for my residential property. And Banker was right, I never should have done this.

My property is in the Greater London area and valued at about £600k today. All in all, I paid it off within 4 years of purchasing it, so including renovation my total cost was about £450k (about a 3% return p.a.).

I’ve been investing since 2005 mostly in index funds but also a tiny fraction directly in shares; but always 100% equities. My total portfolio value sits at £660k which represents a annualised return rate of 10.7%.

I would’ve been far, far better off making the minimum payments to my monthly mortgage and stuffing the rest into the markets. Quite significantly better off. In addition, COVID has resulted in my household income being reduced by approximately 50% (not taking into consideration returns from equities).

Listen to Banker, when he says that in this low-rate environment, you’re better off paying the minimum and investing the rest.

Curious to know what other people would do in my situation with so much equity in their residential property….

There’s a lot of comfort/utility in having your property paid off, especially if it happens to be your primary residence.

Unfortunately, as your experience shows, it’s also not a value-maximizing strategy, at least not in financial terms (though I wouldn’t discount the peace of mind that comes with it!)

In terms of options going forward, what I have previously done with one of my investment properties is to take out a new mortgage on it. It has the benefit of reducing taxable income (as mortgage interest is deductible across the pond) and freeing up a tax-free chunk of cash to invest in the stock market or buy additional properties.

Is this something that could be an option for you?

I

I’ve looked into residential property in the U.K. and I just can’t seem to make the numbers work. Once I take the hassle of a rented property into consideration it feels even less appealing.

Taking the £100k out of the house and placing into the stock market seems like maxing out a credit card to invest. However, if I had a £100k to invest and a £100k mortgage, then I wouldn’t have the reluctance to invest.

Behavioural biases are real.

The UK is a tough one. All of my investments are across the pond, but the comments on my subsequent post are quite informative:

https://bankeronfire.com/why-and-how-i-bought-more-real-estate-in-a-pandemic#comments

There’s inherent value in knowing that your principal residence is paid off. On a mathematical basis, however, stock market returns will trump unlevered (i.e. paid off) property returns over long periods of time.

Behavioural biases at work indeed.

Mate, I added the comment above (dated 26th Aug at 9:55am) using my real name. Can I please ask you to delete that comment or at least change the name? Thank you.

done

The assumption: “The property will be vacant one month every two years (which translates into a 4.2% vacancy rate)”

Are we so sure this holds up in a recession? In the USA, with the moratorium on evictions being lifted, I can see widespread vacancies in the near future. How does a real estate investor mitigate vacancy risk?

It will be higher in a recession and lower when the economy is doing well. The reality is that very few people move right after the end of their one-year lease term, and many people rent the same place for years at a time.

The very first property we bought had two months of vacancy in the 10 years that we’ve been renting it out.

The way you mitigate vacancy risk is:

1. Enforce your two months notice period to give you time to line up a new tenant, and

2. Credit check your tenants – those with good credit scores tend to make their payments or at least work with you to resolve a situation in case they lose their jobs

Pingback: 3 Reasons Financial Independence Is Easy In Hong Kong

Hi, i just discovered your blog and it’s a really good read and makes a lot of sense.

Regarding property though, I don’t see much mention of sales costs/taxes at the point of purchase or sale.

Clearly the amount this costs varies on where you are buying, but things such as stamp duty, legal fees etc add a real barrier to both entry and exit. Have you accounted for these in your figures?

I have dabbled with property, but the scaling up every 2 years that you mentioned doesn’t seem feasible when you factor in stamp duties, legal fees etc etc.

Keep up the great work!

Thanks for the kind words!

You are spot on. Agent fees / legal fees / stamp duty / appraisals / inspections etc – all of these add up to a meaningful chunk of cash. Then you’ve got the taxes on exit.

The way I account for fees in my numbers is by adding them to the down payment amount as they represent a part of the initial investment.

This is exactly why we look to buy properties with a 10+ year (ideally 20 or more) holding horizon. Much better to release some capital along the way through a property refinance than to see your returns eaten up by fees and taxes.

Hi BOF,

Could you please send me the excel sheet you used to get these numbers?

I did the calculatiins myself but the number came out different, i just want to see the reason.

For example, 75k mortgage balance for 25 years with 4% interest results in 4800 in payment compared to 4751 in your calculation.

First year total return ( equity + cash flow) my calculation shows 28,934 and yours 28,217.

My email is [email protected], that would be much appreciated, thank you very much 🙂

Hey Aaron, sure thing – you can actually download it here:

https://bankeronfire.com/wp-content/uploads/2020/02/Real-Estate.xlsx

Pingback: Eight Lessons From Building A Seven-Figure Real Estate Portfolio (And Adding $1M A Year) - Physician on FIRE

Hi thanks for this post!

Reminds me of BiggerPockets’ math way back when they say you can ‘make 7 figures in 7 years’ with real estate.

Personally having dove into rentals, the single family unit asset class is too much headache for me and stocks have been more profitable for me / less headaches due to the fact that:

– the 4.2% vacancy is a very aggressive assumption from what I’ve experienced, even in an A-/B+ class scenario.

– I would figuratively, not literally, kill to be in the 20% tax bracket.

– 3% on repairs is very aggressive from what I’ve experienced. Not sure if this accounts for capex, but 3% on just regular repairs has been very aggressive, so counting capex, 3% is extremely aggressive. Though my properties were built between 1970s to 1990s.

Anyway, maybe I’m just terrible at doing single family units so I’ve just been doing stocks + real estate syndications.

Was wondering if there’s similar math for those lazy investors like me that just want to buy into syndications, where there’s a rule of thumb of “a syndication a year” = retirement in 10 years.

Interesting. As you say, very location and asset specific.

So far, my actual vacancy rate has been below 2% (across many properties over a decade). Capex around 3-4% but then again, I buy pretty well-invested / renovated buildings

As far as the 20% tax bracket, you need to register a corporation for that 🙂

Another timely ref-fresh of previous posts BoF, a great, informative read. Ref your epic spreadsheet, do you have a version where the mortgage is interest only and not repayment please? All my BTL’s are interest only and I would love to use your spreadsheet to run the numbers.

Thanks

Cheers FI-F.

I haven’t got a spreadsheet for that BUT you can easily approximate it by entering a silly number (i.e. 250 years) into cell E6 of the “Mortgage Amortization” tab.

Will reduce your principal repayment to a de minimis amount, which should do the trick.

Let me know if that helps.

That worked a treat, cheers 🙂

Thank you for the brilliant article. My investment journey has gone from Gold, to the stock market and then to crypto, but never property (except for the house we live in). Property investing is something I have been considering for some time now.

What do would your response be to the following arguments against investing in property?

1) Why deal with the hassle of owning a real property when you can invest in real estate funds.

2) If you own a property (your home), then it makes sense to diversify into other assets rather than investing too heavily on one asset class (although this would depend on how much your total wealth adds up to).

Thanks Jud, glad you found it helpful and very good questions.

On #1, it’s really because the returns on direct property investment can be FAR higher than anything you’d ever accomplish with real estate funds. I usually bake in a conservative 10-12% return assumption but the first property I’ve ever bought generated a return of about 18% over 10 years (and that’s with price growth <5%).

The property I bought last year during Covid has doubled in value (update post to come soon), which means I will be able to refinance, take my entire down payment out AND hold on to the property, essentially getting it for free. Here are some posts I've previously done on the topic:

https://bankeronfire.com/infinite-returns

https://bankeronfire.com/real-estate-home-run

And on #2, you are right – need to view it in the context of overall portfolio allocation. I am in a slightly strange position of renting my primary residence while managing a pretty sizeable RE portfolio. That being said, I try to keep it <50% of my overall net worth

Hope this helps!

Need to take account capital gain tax. In 20 years what I bought increased in value 4 times. But CGT was huge when sold

Very true.

Except that instead of selling, you can also take out a new mortgage against the property, effectively crystallizing the gain while deferring the tax liability.

Great work. Really Amazing. Thanks for sharing

I’ve invested in 2 properties in Greece but I’m still learning.

I have a few questions.

1) Should the annual % growth of expenses be the same as inflation instead of 2%

2) Would it be better to calculate Property taxes on the latest value (considering appreciation)

3) Is only interest tax deductible?

4) since we have a payment for the principle why it’s considered in the Net income after taxes

5) Should we calculate cap rate considering current market value meaning appreciated value

6) When we calculate return based on purchase price is this the net yield instead of cap rate?

7)Does the equity in property represent the Increased equity from debt pay-down + Equity from Appreciation

8) Can we also consider Net cash flow as Net profit

) If we calculate ROI on our money is it going to be NOI/down payment

Sorry for all those questions and looking forward to read your answers and learn further.

Thanks in Advance!

Best,

Aga

How are you able to shield rental income from huge tax given you are a high earner? Are you using LTD and leaving money jn businesses? If not the tax implications (given high earner) would simply erode your earnings. Curious on your thoughts.