If you are putting money to work with the objective of maximizing long-term investment returns, there’s only one right answer to the bonds vs stocks equation.

The data simply doesn’t lie: over extended periods of time, equities trump fixed income instruments by a wide margin. Go 100% equities, relax, and let them do the heavy lifting for you.

The issue with investing, however, is that there’s more to it than just pure data.

It’s not that easy to “relax” when you go 100% stocks. More often than not, there’s that pesky lizard brain of ours telling us to do things that we really shouldn’t be doing.

Not even the most impeccably constructed portfolio in the world will save you if you just can’t handle the volatility and sell at times of turmoil.

It’s like taking a Ferrari on a racetrack if you don’t know how to drive – you probably won’t clear the first tight corner. And that changes the whole equation.

Falling In Love With Bonds

There are a few scenarios when investing in bonds might make sense for you.

Perhaps you are approaching retirement and really don’t want the market dictating the timetable of when you get to kiss your cubicle goodbye.

Alternatively, you may be one of those people who are extremely bearish on the economy, think the whole world is going to implode, we’ll get hit with a Japan-like deflationary bazooka and nothing will save us.

My personal opinion is that such a scenario is wide out, but that doesn’t matter. If that’s what you are concerned about, bonds are the perfect vehicle for you (you may also want to pick up a few guns and read up on off-the-grid living along the way).

Finally, it may be that you simply cannot handle the stock market roller coaster.

This is the most common scenario – and adding bonds to the mix can definitely help you reduce the G-force without getting off the joyride.

But how do you figure out the optimal bonds vs stocks allocation for your portfolio? To answer that question, let’s look at some historical data.

Going Back In Time

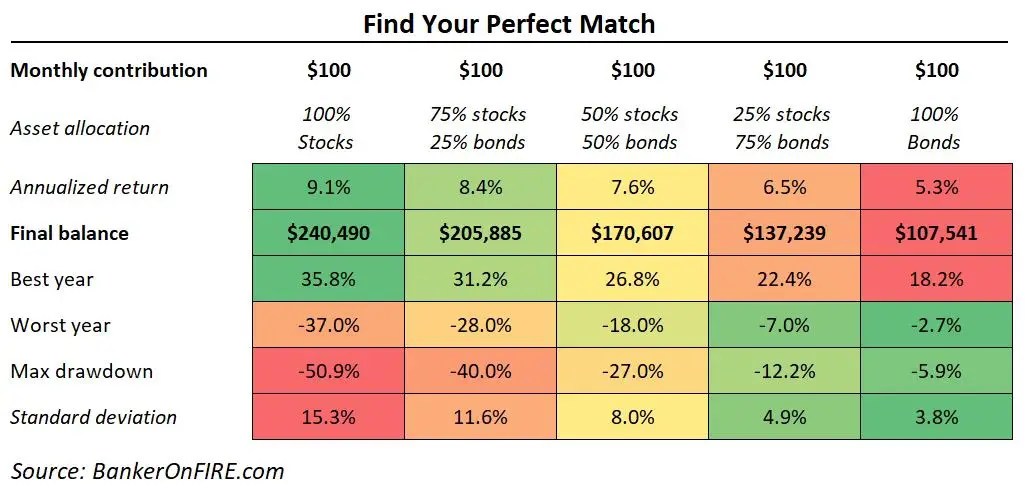

I’ve used Portfolio Visualizer to construct five different portfolios – and track their performance since 1987*.

- For all the risk-lovers out there, a 100% equity portfolio

- 75% stocks, 25% bonds

- 50% stocks and bonds

- 25% stocks, 75% bonds

- Finally, a 100% bond portfolio

All portfolios assume contributions of $100/month starting in January 1987 and going through April 2020.

For the mixed portfolios (i.e. #2, 3 and 4 on the list), I’ve assumed a monthly rebalancing exercise to achieve the desired bonds vs stocks allocation.

Let’s start with the two extremes.

All Hat No Cattle Stocks No Bonds

As expected, this one is a whopper.

The $100/month grows to $240k by April 2020, an annualized return of 9.14%.

That being said, it sure is a rocky ride:

In its best year, this portfolio went up 35%. In its worst – down 37%, with a maximum drawdown of 51%. Talk about the darkest hour.

But if you held on tight, the prize is worth it. Remember – there’s $240k sitting right at the end of the rainbow. Not bad considering you’ve only contributed $40k.

Let’s now look at the other end of the spectrum.

Chilling On The Lazy River

It’s fair to say that going 100% bonds back in 1987 would leave you with much less grey hair in 2020.

The best year would see your portfolio up a respectable 18.2%. In your worst year, you would only lose 2.6% and the maximum drawdown is less than 6%.

Not too shabby.

Or is it?

As it turns out, missing those best days, months, and years in the stock market really makes a difference in the long run.

Despite contributing religiously for 30 odd years, you would only end up with $107k. That’s less than half of the all-equity portfolio.

In absolute terms, you end up with $133k less money at the end of the journey.

Yes, you certainly had less stress along the way. But only you can answer the question of whether $133k is a fair price to pay for a less stressful life.

Last time I checked, putting away $133k through a day job, side hustle, or extra savings takes a lot of hustle, effort, and yes, grey hair. Even if you had three decades to do it.

Alternatively, you may have to continue working for much longer than that risk-loving alter ego of yours that went for 100% stocks.

Finding The Balance

As it often happens, the right answer may well lie somewhere in between.

The chart below summarizes what your investment returns and volatility would have looked like in all five scenarios:

As you can see, over long periods of time, the market is nothing but fair.

Want more money? Better strap yourself in.

Can’t handle the ride? You can still play – but it won’t be nearly as lucrative. Chances are, you’ll have to work that much harder, whether in your day job or a side hustle, to even out the equation.

An important caveat to make here is that interest rates have been on a secular downward trend for the best part of the three decades.

As a result, bond prices went up and so the bond-heavy portfolios performed better than they would otherwise. To an extent, that boosts the numbers on the right-hand side of the chart above.

You can bet that this trend will reverse going forward. Many people have done so over the past 15 years.

So far, they’ve lost.

When it comes to the stock market, history doesn’t repeat itself – but it surely rhymes. The beauty of it, however, is that you get to pick your favourite place on the risk-reward spectrum.

As for me, I’ll stay at 100% equities for a while longer. The returns are just too good to pass up.

You get to make up your own mind.

Happy investing!

*1987 is the first year for which Portfolio Visualizer has bond performance data. For our purposes here, a 33+ year investment horizon is largely sufficient.

I’ve also used the US stock market as a proxy given my predilection for US equities and the US bond market due to the availability of data.

Supporting data

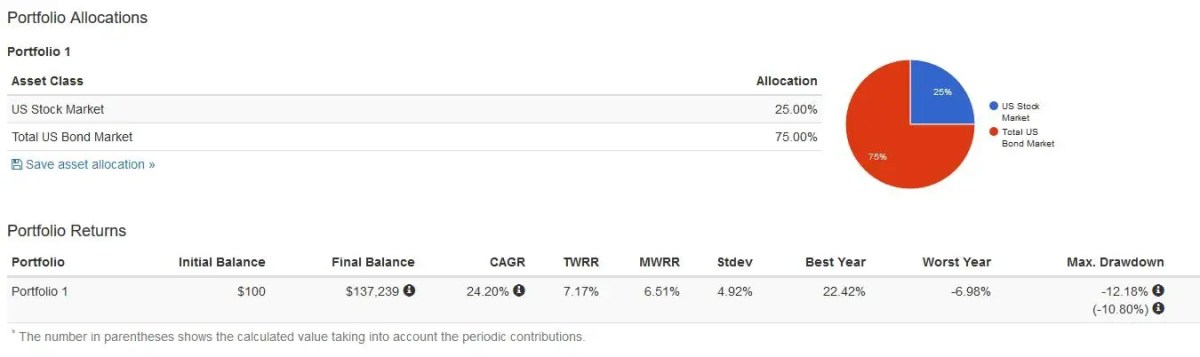

In case the summary table above doesn’t cut it for you, below is the detailed performance of the other three portfolios in this analysis.

Portfolio 2: 75% stocks, 25% bonds

Portfolio 3: 50% stocks and bonds

Portfolio 4: 25% stocks, 75% bonds

About Banker On Fire

Enjoyed this post?

Then you may want to sign up for our exclusive updates, delivered straight to your inbox.

You can also follow me on Twitter or Facebook, or share the post using the buttons above.

Banker On FIRE is an M&A (mergers and acquisitions) investment banker. I am passionate about capital markets, behavioural economics, financial independence, and living the best life possible.

Find out more about me and this blog here.

If you are new to investing, here is a good place to start.

For advertising opportunities, please send an email to bankeronfire at gmail dot com

Amazing, I’ve just forwarded this post to my risk-averse friend. For reluctant investors, starting with $100 could be a good idea, that way the risk isn’t huge for them and they can get used to the process. I started by investing 10% of my earnings, but soon got addicted to it! Always impressive to see the numbers though, you can gain so much even with a relatively low investment.

It’s amazing how much of a difference small amounts make over long periods of time.

The frustration is that most people (unlike you!) don’t start early enough.

It’s true, I did start early but I still think about where I would be now if I’d gotten into investing at 18. 6 extra years of even small contributions would’ve probably made a big difference. That’s why it’s so important that parents and schools talk about these things.

Indeed. It’s beyond me how budgeting and investing aren’t required material on the high school curriculum.

I think this is the biggest thing. It takes for ever to see anything really increasing. It’s only really I think when you get to 100k that there’s a meaningful momentum that’s what I’ve found. I took out 15k of my investment in August last year to pay for some house renovations. I was back up to the same level by Feb mostly with investment gains. It took forever to get to 100k in my pension but the second 100k didn’t take nearly as long and I could hit 300 k in maybe 2 to 4 years. It really gets moving when you join the 6 figure club

Yes – and it applies far beyond personal finance. It’s very tough to gain momentum in anything – but once you do, having the wind in your sails can be unstoppable.

Just to be a contrarian, the massive ramp in stock prices happens to coincide with a massive fall in bond yields.

Also since 1971 money printing started and took off at a rapid rate.

So going forward I’m even if bonds yield fall to zero and continue negative does that even make sense?

As a hedge against stocks I’ve gone very cool on bonds. I agree long term stocks will keep going up as money is printed.

With a bit of luck I might still be here in 30 yrs so we can check back then and see what was best!

I think the secular decline in interest rates could well be a spanner in the works, which is why I’ve highlighted it above. It essentially forces investors into equities as they hunt for yield.

I wouldn’t be surprised to see negative yields. The government is determined to avoid deflation and the best way to do that is to force people to spend money today and not tomorrow.

Let’s see if the BoF blog is still here in 30 years 🙂

Not strictly related but what do you think of my current arrangement of having 6 months money in a high bond low equity fund as part of my emergency fund? So 60 % bond 40 % equity

I know strictly your full emergency fund should be cash and I do carry 6 months worth in cash but for me a high bond low equity portfolio is a good idea as ‘the next rung’

Obv when retired ill probably carry 3 years cash and then another 3 years in this fund with the rest in a 60 /40 equity portfolio but while working and with major bandwidth it doesn’t seem a completely stupid idea

DO educate me!

Conceptually good idea, but why not just go with a 100% GILT fund and have 50% of the amount in there?

I don’t know much about gilts if I’m honest (edit I obviously know what they are but not necessarily where I’d hold them as part of my portfolio or why people hold them over cash) and I thought bonds gave a bit more return (yes I know that’s not why you have an emergency fund!)

Emergency fund is the wrong term I think more funds for shorter term spending

Thanks for the interesting and excellent work. A question: did this result include rebalancing of portions?

Glad you enjoyed it!

Yes it did – on an annual basis.

Great, thank you